Developers' Sales Surged In October 2024 Amid New Projects Being Launched And A Bounce In Market Confidence

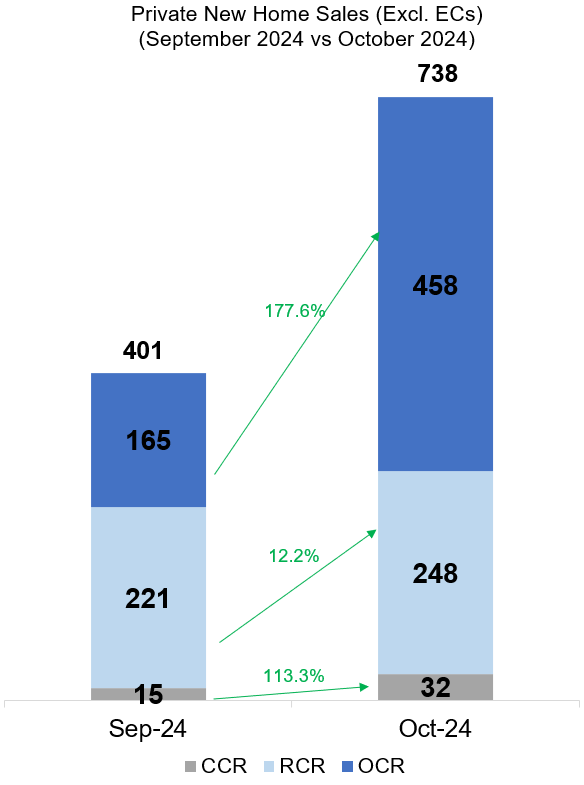

New private home sales rebounded strongly for the second-month running, with developers shifting 738 new units (ex. EC) in October. This marks an 84% month-on-month jump in sales from the 401 units in September, which had itself been a 90% MOM increase from August. October's sales figure is the highest monthly tally in nearly a year, since 784 units were transacted in November 2023. On a year-on-year basis, developers' sales were up by more than 3.5 times from 204 units in October 2023.

PropNex expects home sales in November to be turbocharged by a deluge of attractive project launches which will collectively offer some 3,550 units (including an EC project) - providing tailwinds for the primary market sales across all segments. In the first 10 months of 2024, developers have sold 3,787 new private homes (ex. EC). PropNex projects that developers' sales may hit 6,000 units for the whole of 2024, with stronger numbers coming in for Q4 2024.

The two fresh project launches in the month - Norwood Grand in Woodlands, and Meyer Blue in Tanjong Katong - accounted for around 56% of October's sales. Boosted by sales at Norwood Grand, the Outside Central Region (OCR) led private new home sales in October.

There were 458 new units sold in the OCR in October - up significantly from 165 units sold in the previous month. The best-selling project in the OCR and overall was Norwood Grand, which transacted 292 out of its 348 (84% take-up) at a median price of $2,081 psf in October (see Table 2). Several previously-launched projects also propped up sales in the sub-market, including Hillock Green that sold 36 units at a median price of $2,236 psf, and Lentor Mansion where 29 units changed hands at a median price of $2,241 psf. Sales in the OCR will spike in November, since Chuan Park sold 76% of its 916 units during its launch on Sunday (10 Nov).

In the Rest of Central Region (RCR), new home sales came in at 248 units in October, up by 12% from the 221 units sold in September. Transactions were mainly boosted by new launch Meyer Blue which sold 124 units at a median price of $3,240 psf, and existing project Pinetree Hill which moved 71 units at a median price of $2,541 psf. Tembusu Grand also kept up with a steady pace of sale, selling 26 units at a median price of $2,388 psf. Similarly, RCR sales is expected to jump sharply in November, with Union Square Residences, Emerald of Katong, and Nava Grove all hitting the market. Over the weekend, Union Square Residences sold 75 out of its 366 units during its launch.

Meanwhile, developers sold 32 new units in the Core Central Region (CCR) - more than double the 15 units transacted in September. This is the first monthly growth in CCR new home sales in seven months. Klimt Cairnhill accounted for about 41% of the sub-market's sales, selling 13 units at a median price of $3,302 psf. This is followed by One Bernam which sold 7 units at a median price of $2,876 psf. Notably, 32 Gilstead in the Novena area sold 4 units (all to foreign buyers) at prices ranging from about $12.8 million to $14.5 million - making them the priciest new homes transacted in October. Like the two other sub-markets, the CCR will see a lift in sales in November. The Collective at One Sophia, which will be officially launched in January 2025 has sold 39 out of its 367 units following the start of its private preview sales earlier this month.

In the EC segment, developers sold 28 new units in October, down by about 13% from the 32 new EC units transacted in September. North Gaia was the top-selling EC project with 13 units sold at a median price of $1,310 psf. As at the end of October, there are only 146 unsold new EC units on the market. The limited supply bodes well for the 504-unit Novo Place EC project in Tengah which will be launched this weekend (16 Nov).

In October, developers launched 534 new units for sale, up by 22% from the 437 units that were put on the market in September.

Ms Wong Siew Ying, Head of Research & Content, PropNex Realty said:

"At 738 units, developers' sales in October posted the highest monthly figure since November 2023. New home sales have been languid for most part of 2024 amid limited major launches on the market and cautious sentiment. However, the dour mood has started to shift, and the market sentiment appears to be brightening, particularly after the US Federal Reserve's jumbo rate cut (0.5%-pt) in September. Earlier this month, the Fed announced another quarter-point cut which was music to the ears of home owners, prospective buyers, and property investors.

October's home sales were mainly driven by two new launches, Norwood Grand and Meyer Blue. Meanwhile, previously-launched Pinetree Hill also continued to pare down on its unsold inventory ahead of the sales launch of adjacent project, the 552-unit Nava Grove. Pinetree Hill sold 71 units in October, following the 63 units transacted in September - marking two of the strongest monthly sales since the project hit the market in July 2023.

Norwood Grand is the best-performing new project in 2024 by take-up rate, having sold 84% of its units at launch. It is the first private condo launch in Woodlands since 2012, when Parc Rosewood came on. The dearth of new launches for more than a decade has generated pent-up demand, while Norwood Grand's attractive locational attributes near to the Woodlands South MRT station also drew buyers in. Sales at Meyer Blue were also laudable; the project - which is near the Katong Park MRT station - sold more than half of its 226 units despite its higher price point, and several other projects being launched in District 15 in recent years.

Table 1: Transacted price range of non-landed new private homes (ex. EC) in 2024 by month

| Price range | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct |

| Below $1.5 mil | 15.9% | 10.8% | 28.0% | 9.5% | 8.1% | 6.2% | 41.0% | 5.6% | 12.2% | 21.5% |

| $1.5 mil to < $2 mil | 33.2% | 25.0% | 31.9% | 23.0% | 25.2% | 24.8% | 22.0% | 23.1% | 30.4% | 20.8% |

| $2 mil to < $2.5 mil | 27.9% | 24.3% | 21.1% | 33.2% | 36.7% | 31.4% | 15.9% | 25.6% | 24.9% | 25.5% |

| $2.5 mil to < $3 mil | 11.3% | 14.9% | 9.2% | 17.9% | 17.1% | 21.9% | 10.2% | 19.5% | 18.3% | 13.4% |

| $3 mil to < $3.5 mil | 4.9% | 10.1% | 5.4% | 8.8% | 4.8% | 7.1% | 5.4% | 11.3% | 8.2% | 7.4% |

| $3.5 mil to < $4 mil | 2.5% | 8.8% | 2.6% | 1.8% | 2.4% | 2.4% | 3.0% | 7.2% | 2.9% | 4.2% |

| $4 mil to < $5 mil | 1.8% | 1.4% | 0.7% | 1.1% | 1.9% | 2.9% | 2.2% | 4.1% | 0.5% | 2.9% |

| $5 mil to < $10 min | 2.1% | 4.7% | 1.0% | 3.3% | 3.3% | 3.3% | 0.4% | 3.1% | 2.1% | 3.4% |

| $10 mil and over | 0.4% | 0.0% | 0.1% | 1.5% | 0.5% | 0.0% | 0.0% | 0.5% | 0.5% | 0.8% |

| Total | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% |

By price quantum, we note that a good proportion of non-landed private new homes (ex. EC) continues to be sold at below $2 million over the months (see Table 1). In October, such transactions made up 42.3% of the sales, relatively on par with the 42.6% proportion in September. The highest proportion this year was seen in July where 63% of the non-landed new home sales were priced at below $2 million - boosted by deals at Kassia and SORA. Generally, developers are pricing new launches sensitively as buyers remain price conscious, and a price quantum of below $2 million typically sits well with many prospective buyers.

Meanwhile, the portion of non-landed new private home sales to foreign buyers (non-PR) remains low at 2.7% in October. In absolute terms, there were 20 transactions to foreigners (non-PR) for units at 32 Gilstead, 8@BT, Canninghill Piers, Klimt Cairnhill, Lentor Mansion, Meyer Blue, Norwood Grand, Pinetree Hill, The Arden, and The Lakegarden Residences.

With a flood of launches in November, we expect home sales to surge this month, giving a much-needed boost to the primary market. It is possible that some 6,000 new private homes (ex. EC) may be sold in the entire 2024 - slightly short of the 6,421 units in 2023. The improved sentiment and new home sales momentum could carry into 2025, where we anticipate a slate of attractive projects to be launched. In 1H 2025, there may potentially be 20 new projects on tap, including The Orie in Lorong 1 Toa Payoh, ELTA in Clementi Avenue 1, Parktown Residence (mixed-use development), and a couple of new EC projects, among others."

Table 2: Top-Selling Private Residential Projects (ex. EC) in October 2024

S/N | Project | Region | Units sold in Oct 2024 | Median price in Oct 2024 ($PSF) |

1 | NORWOOD GRAND | OCR | 292 | $2,081 |

2 | MEYER BLUE | RCR | 124 | $3,240 |

3 | PINETREE HILL | RCR | 71 | $2,541 |

4 | HILLOCK GREEN | OCR | 36 | $2,236 |

5 | LENTOR MANSION | OCR | 29 | $2,241 |

6 | TEMBUSU GRAND | RCR | 26 | $2,388 |

7 | LENTORIA | OCR | 22 | $2,253 |

8 | HILLHAVEN | OCR | 16 | $2,168 |

9 | THE MYST | OCR | 15 | $2,126 |

10 | KLIMT CAIRNHILL | CCR | 13 | $3,302 |

Suggested Reads

Upcoming Events

View moreYou may like

January's New Private Home Sales Signal Steady Start to 2026; Demand for New Executive Condominiums Holds Up

February 16, 2026

Growth In Private Home And HDB Resale Flat Prices Touched Multi-Year Low In 2025, While Housing Demand Stayed Resilient, Settling Into A Goldilocks Market

January 23, 2026

Developers' Sales Fell To The Lowest In Nearly Two Years In December 2025, As A Lack Of Major Launches And The Seasonal Lull Curtailed Market Activity

January 15, 2026

Propnex's Singapore Budget 2026 Wish List: Targeted Policy Recalibration To Further Promote Market Stability, Improve Affordability, And to Encourage Urban Renewal

January 06, 2026