Renewed Buying Interest And A Fresh City Fringe Project Launch Helped To Rev Up Developers' Sales In September

15 October 2024, Singapore - New private home sales jumped in September on renewed buying interest and healthy take-up of units at a newly launch project in the city fringe. Developers sold 401 new private homes (excluding executive condos) during the month, marking a 90% increase from the 211 units shifted in August. When compared with September 2023, sales were up by about 85% on a year-on-year basis.

Factoring the latest sales, developers have sold an estimated 1,188 new units (ex. EC) in Q3 2024 - taking the total new private home sales for the first nine months of the year to 3,077 units (Q1 2024: 1,164 units; Q2 2024: 725 units). PropNex's forecast for new home sale volume for the whole of 2024 ranges from 4,500 to 5,000 units (ex. EC).

Source: PropNex Research, URA

The new project that hit the market in September was 8@BT in Beauty World, which sold 53% of its 158 units during its launch weekend. All in, developers launched 437 units for sale during the month, including units at previously-launched projects. The number of units launched in September was up by 60.7% month-on-month, compared with the 272 units placed for sale by developers in August.

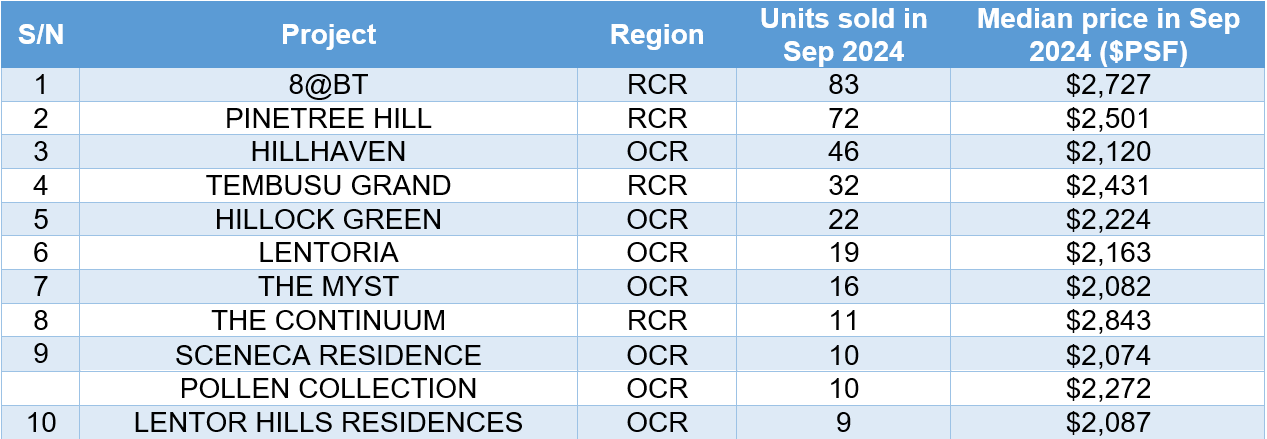

Thanks to 8@BT, the Rest of Central Region (RCR) led new home sales in September, where developers transacted 221 new units, reflecting a more than three times jump in sales from the 66 units moved in August. The RCR accounted for about 55% of the private new home sales in September. 8@BT was the top-selling RCR project during the month, selling 83 units at a median price of $2,727 psf. Meanwhile, Pinetree Hill in Pine Grove saw a sales spike in September, following a Phase 2 project launch; it saw 72 units transacted at a median price of $2,501 psf. This is the best monthly sales at Pinetree Hill so far this year.

The Outside Central Region (OCR) also witnessed higher sales during the month. In September, there were 165 units of new private homes sold, about 32% more than the 125 units that changed hands in the previous month. The most popular OCR project was Hillhaven which sold 46 units at a median price of $2,120 psf. A clutch of OCR projects also saw sales perked up in September, including at Hilllock Green, Lentoria, The Myst, and Pollen Collection.

Over in the Core Central Region (CCR), developers sold 15 new units in September, down from the 20 units transacted in August. This is lowest monthly new home sales in the CCR since 13 units were sold in January 2009. The sluggish sales in the CCR can be attributed to the limited new launches in this sub-market since the government tightened the additional buyer's stamp duty (ABSD) rates in April 2023. The joint top-sellers in the CCR in September were 19 Nassim and Klimt Cairnhill where each sold three units at median prices of $3,608 psf and $3,517 psf, respectively.

In the EC segment, developers sold 32 new units in September, down by 11% from the 36 new EC units transacted in August. Lumina Grand EC was the best-selling project, with 11 units sold at a median price of $1,486 psf. Based on URA's data, there are about 170 units of new ECs that are still unsold on the market, as at end-September. In November, eligible EC buyers will have more choices when the 504-unit Novo Place in Tengah is put on the market.

Please attribute the comments below to Wong Siew Ying, Head of Research & Content, PropNex Realty.

"The uplift in new private home sales in September is encouraging and we think it may be reflective of renewed buying interest in the market, seeing that 8@BT was well-received, and that several existing launches have sold more units in September compared with prior months. Some buyers may decide to purchase now after monitoring the market for a period of time. With prices holding relatively stable and with the recent US Federal Reserve rate cut possibly lifting sentiment, it could have motivated some buyers to act sooner rather than later - perhaps mulling over the prospect of prices potentially creeping up should demand start to improve.

Following on from September's sales, we expect further upside to transactions in October and November - it seems likely that new private home sales, which have been fairly muted this year could turn a corner in these last few months of 2024. In October, Meyer Blue transacted 50% of its 226 units at launch, and there could be pent-up demand for the upcoming 348-unit Norwood Grand, being the first private condo project to be launched in Woodlands since 2012. Notably, Meyer Blue is the third consecutive new project that have achieved at least a 50% take-up rate at the launch weekend since July (Kassia 52%; 8@BT 53%).

Meanwhile, in November, we are anticipating a bumper slate of new launches, namely Emerald of Katong, Chuan Park, Nava Grove, Union Square Residences, and Novo Place (EC) - all set to come on before the start of the year-end school holidays. These projects have attractive attributes and will likely tap different segments of demand in the market, including first-time homebuyers, HDB upgraders, and investors.

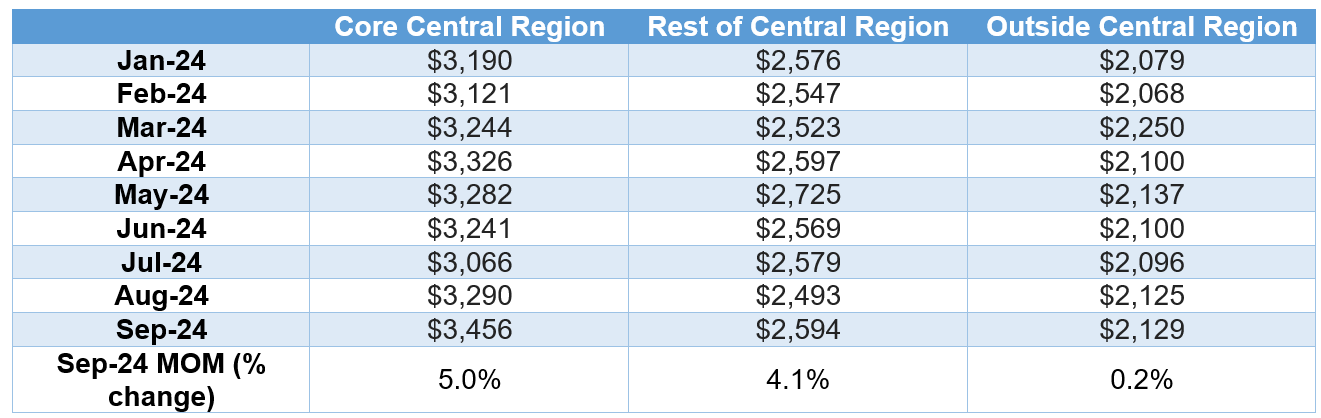

Based on URA Realis caveat data, the median unit price of non-landed private homes ticked up across all three sub-markets in September from August, with a 5% MOM growth in the CCR, 4.1% MOM price increase in the RCR, and 0.2% MOM uptick in the OCR (see Table 1). Generally, we expect prices of new private homes to remain resilient, with slight upside potential particularly in the RCR in view of the several new launches to come in this segment.

Table 1: Median transacted unit price ($PSF) of non-landed private new homes sold (ex. EC) by Region, by Month

Source: PropNex Research, URA Realis (retrieved on 15 October 2024)

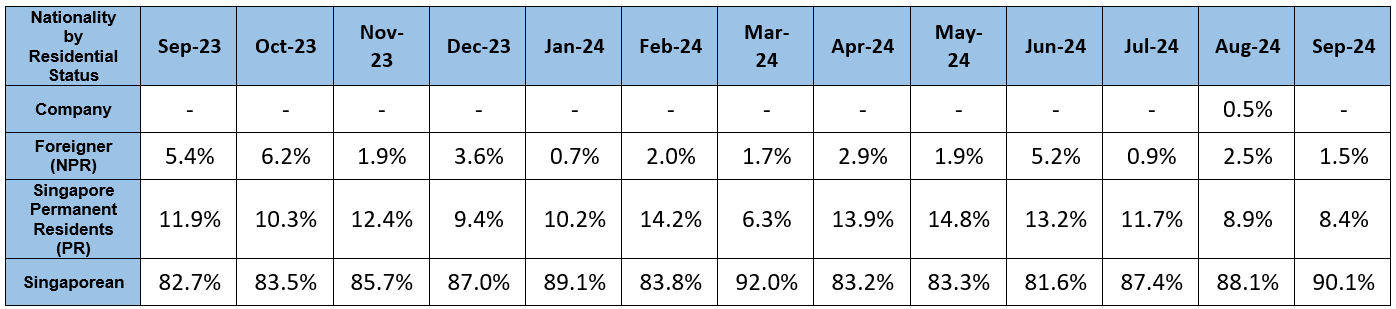

Table 2: Proportion of non-landed new private home sales (ex. EC) by nationality by residential status by month

Source: PropNex Research, URA Realis (retrieved on 15 October 2024)

We think another encouraging aspect of September's sales is the stronger presence of Singaporean buyers. As per caveats lodged, 90% of the non-landed new private homes sold in September were purchased by Singaporeans - the highest proportion since March 2024 (see Table 2). By contrast, the proportion of foreign buyers (non-PR) remained low at 1.5% in September, while the portion of new non-landed private homes purchased by Singapore PRs came in at 8.4% in the month.

With a varied pipeline of new launches to come, and buyers returning to pick up units at previously-launched projects, we are optimistic that developers' sales could finish the year on a brighter note, compared with the sluggish performance we have observed earlier in 2024. For the full-year, PropNex expects the new home sales volume could come in at around 4,500 to 5,000 units (ex. EC)."

Table 3: Top-Selling Private Residential Projects (ex. EC) in September 2024

Source: PropNex Research, URA (15 October 2024)

Suggested Reads

Upcoming Events

View moreYou may like

Developers' Sales Plunged By 87% MOM In November Amid Limited New Launches; City Fringe Projects Dominate Sales

December 15, 2025

Sustained Private Housing Supply Planned For 1H 2026, Amid Stabilisation In The Property Market

December 02, 2025

A Rare Bukit Timah Freehold Hilltop Estate Enters the Market for the First Time in 70 Years

November 21, 2025

Developers' Sales Surged To 11-month High In October, Propelled By Robust Demand For New Launches; Monthly Sales In The Core Central Region Are Highest In Over 18 Years

November 17, 2025