Private Home Prices Dipped In Q3 2024 But Skies Are Clearing For New Home Sales; Hdb Resale Market Continued To Strengthen

25 October 2024, Singapore - Private residential property prices dipped marginally in Q3 2024, but brisk primary market activity presents potential price upside in Q4 2024. Meanwhile, the HDB resale flat prices continued to march upwards during the quarter, boosted by stronger demand. In August 2024, the loan-to-value limit was cut from 80% to 75% for home loans granted by the HDB in a bid to cool the HDB resale market.

Q3 2024 URA Private Residential Property Index

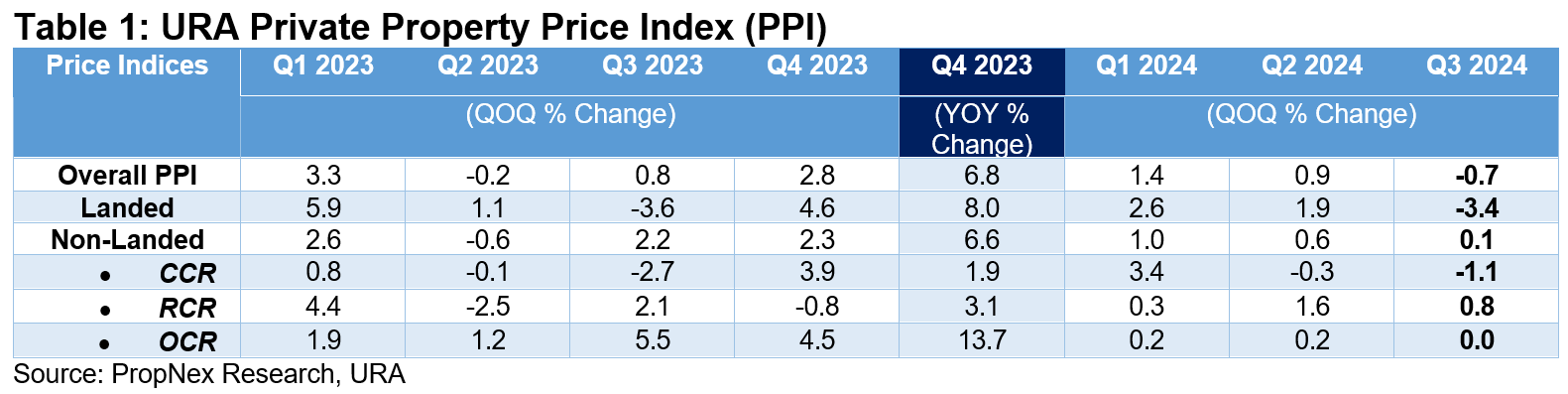

The final real estate data from the URA showed that overall private home prices fell marginally by 0.7% QOQ in Q3 2024, compared with the 0.9% QOQ increase in Q2 2024 - marking the first quarterly decline since Q2 2023 where prices dipped by 0.2% QOQ (see Table 1). The final print is an improvement from the 1.1% QOQ decline recorded as per the flash estimates released earlier this month.

Prices

Cumulatively, overall private home prices increased by 1.6% in the first nine months of 2024, lower than the 3.9% increase in the same period in 2023. PropNex expects overall private home prices to rise by 2.5% to 3% for the whole of 2024 - which would be the slowest year of price growth since the 2.2% increase in 2020.

In Q3 2024, landed homes prices fell by 3.4% QOQ due to the lower sales volume in the quarter. Non-landed private home prices, meanwhile, inched up by 0.1% QOQ, as the Rest of Central Region (RCR) helped to pull up prices with steady sales at several projects in the city fringe, including the new launch, 8@BT. Home prices in the RCR rose by 0.8% QOQ in Q3 2024, while prices in the Outside Central Region (OCR) were unchanged from Q2 2024.

PropNex expects prices in the OCR and RCR may see a lift in Q4 2024, as new launches come up in these sub-markets (e.g. Nava Grove and Union Square Residences in the RCR). Notably, the robust sales at 348-unit Norwood Grand recently - 84% of units sold at an average price of $2,067 psf at launch - will help to prop up OCR prices in Q4 2024. Meanwhile, Meyer Blue in the RCR transacted 50% of its 226 units at an average price of $3,260 psf when it hit the market in October.

In the Core Central Region (CCR), non-landed home prices remained subdued, posting a 1.1% QOQ fall in Q3 2024, following the 0.3% QOQ decline in the previous quarter. Home prices in the CCR have been measured as there have been limited new launches in this segment following the tightening of the additional buyer's stamp duty (ABSD) rates in April 2023.

Transactions

Based on the URA data, developers sold 1,160 new homes (ex. EC) in Q3 2024, representing a 60% increase from the 725 units sold in Q2 2024, but sales were down by 40% year-on-year from the 1,946 new units sold in Q3 2023. The top selling new project in Q3 2024 was Kassia which sold 164 units in the quarter at an average price of $2,017 psf, according to caveats lodged. In the first nine months of 2024, private new home sales stood at 3,049 units (ex. EC). For the whole of 2024, PropNex projects that developers' sales may hover at around 5,500 to 6,000 units (ex. EC) in view of new launches to come and an uptick in buying sentiment. The URA said that as at the end of Q3 2024, there were 19,940 units (ex. EC) of unsold uncompleted private homes in the supply pipeline - down by 3% from the 20,566 in Q2 2024.

Meanwhile, there were 3,860 private homes sold on the resale market in Q3 2024 - up by 1.5% QOQ from the 3,802 units resold in the previous quarter. The resale volume accounted for 71.9% of the total private residential transactions in Q3 2024. Limited suitable units in the new launch market, and the still sizable price gap between new homes and resale units could have drawn buyers to the resale segment. A total of 10,351 resale private homes have been sold in the first nine months of 2024. For the full year, PropNex expects private resale transactions may come in at around 13,000 to 14,000 units.

Private residential leasing

In the private home leasing market, rentals ticked up by 0.8% QOQ in Q3 2024, snapping three quarters of decline. In the first nine months of 2024, rentals fell by 1.9% compared with the 11.1% in the corresponding period in 2023. The more measured movement in rents could have appealed to some tenants, as the number of private home rental contracts rose by about 24% to 25,731 transactions in Q3 2024 compared with 20,676 contracts in Q2.

According to the URA, 3,953 new private homes (including ECs) were completed in Q3 2024, and 3,727 units are expected to be ready in Q4 2024. Meanwhile, 6,603 units (incl. ECs) are slated to be completed in 2025. With the steady pipeline of private home completions, tenants will have options, and the oncoming supply may keep rental growth in check as the rental price expectations between landlords and tenants may be more aligned.

Please attribute the comments below to Ismail Gafoor, CEO of PropNex Realty.

"Despite the muted price trends in Q3 2024, we think there are some bright spots and reasons for optimism. First, we sense that the new home sales market is turning and buying sentiment has recovered, as evidenced by the healthy take-up rates at new launches recently, namely Kassia and 8@BT in Q3 2024, as well as Meyer Blue and Norwood Grand which were launched in October. In particular, Norwood Grand sold 84% of its units at launch, making it the top performing project at launch this year. Apart from fresh projects, sales are also moving at previously-launched developments, such as Pinetree Hill, Hillhaven, and Tembusu Grand.

Meanwhile, the private resale market continues to be a bright spot with 3,860 units resold in Q3 2024; this is the second straight quarter where private resale volume exceeded 3,800 units. We think the price difference between non-landed new and resale private homes (median unit price gap at 34% in Q3 2024), and the relatively limited number of launches in the past two quarters have channeled some demand to the resale market.

Overall, we find some encouragement in the improving sales, as they reflect the resilient underlying demand for private housing and that household liquidity remains strong. Some factors that have sparked a recovery buying sentiment include the jumbo rate cut by the US Federal Reserve in September and prospects of further cuts to come, better economic growth in Singapore, the tight labour market, and a boost in the Singapore stock market recently. Following the US Fed rate cut announcement, the STI hit its highest level since November 2007. Taken together, we think buyer confidence has strengthened, and there is a more positive vibe in the market of late. We think the more upbeat sentiment will likely persist in Q4 and carry over into the new year, barring any unforeseen events.

Generally, we expect overall private home prices to stay firm with potential price upside, as new launches come on the market. Given the high land price, high financing cost and construction costs, as well as rules on the harmonisation of gross floor area definitions, we anticipate that developers will hold on to prices, with projects in choice locations near to an MRT station or close to amenities potentially commanding higher selling prices.

Prospective buyers are expected to remain price conscious and selective, with price quantum being a key deciding factor. We think many buyers are waiting for new projects to be launched since there have been limited number of launches this year. Based on URA data, there were 19,940 units (ex. EC) of uncompleted unsold units in the pipeline as at Q3 2024, which in our view is a manageable supply; taking a measured annual sales level of 6,000 units, that inventory can be cleared in just over 3 years."

Q3 2024 HDB Resale Price Index

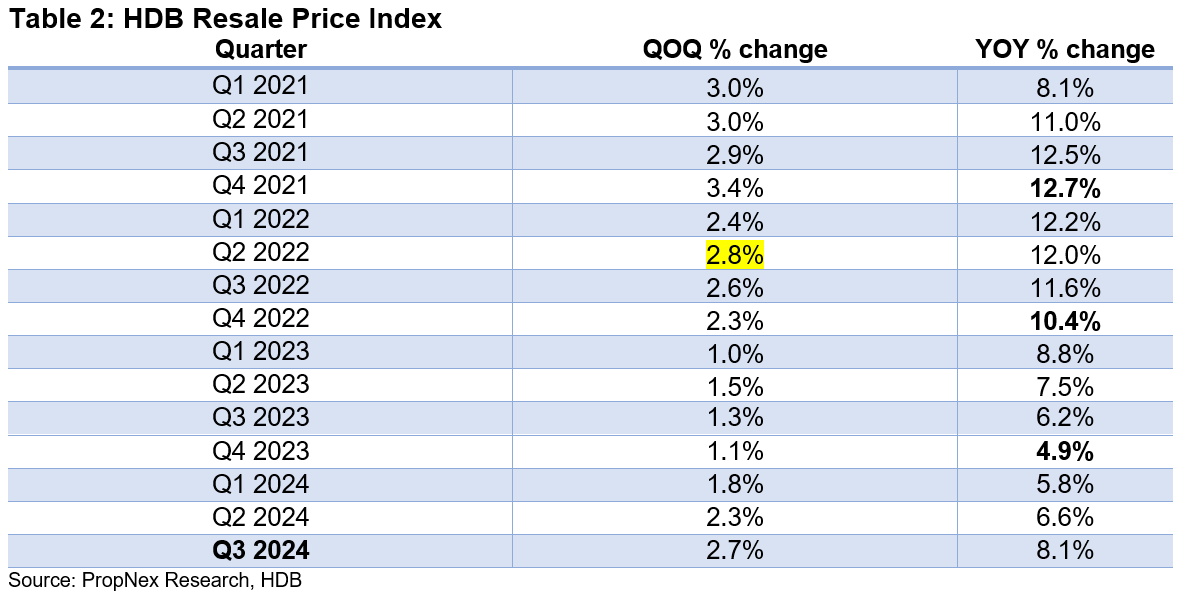

Data released by the Housing and Development Board (HDB) showed that prices of resale flats rose by 2.7% QOQ in Q3 2024, accelerating from the 2.3% QOQ growth in the previous quarter. This is the third straight quarter where HDB resale prices have climbed at a faster pace on a quarterly basis, and it is also the steepest increase since the 2.8% growth recorded in Q2 2022 (see Table 2). The final print came in higher than the flash estimates of a 2.5% QOQ increase.

Cumulatively, the HDB resale price index has risen by a 6.9% in the first nine months of 2024, compared with 3.8% increase observed in the same period in 2023. For whole of 2024, PropNex expects HDB resale prices to climb by 8% to 9% - outpacing the 4.9% price growth in 2023.

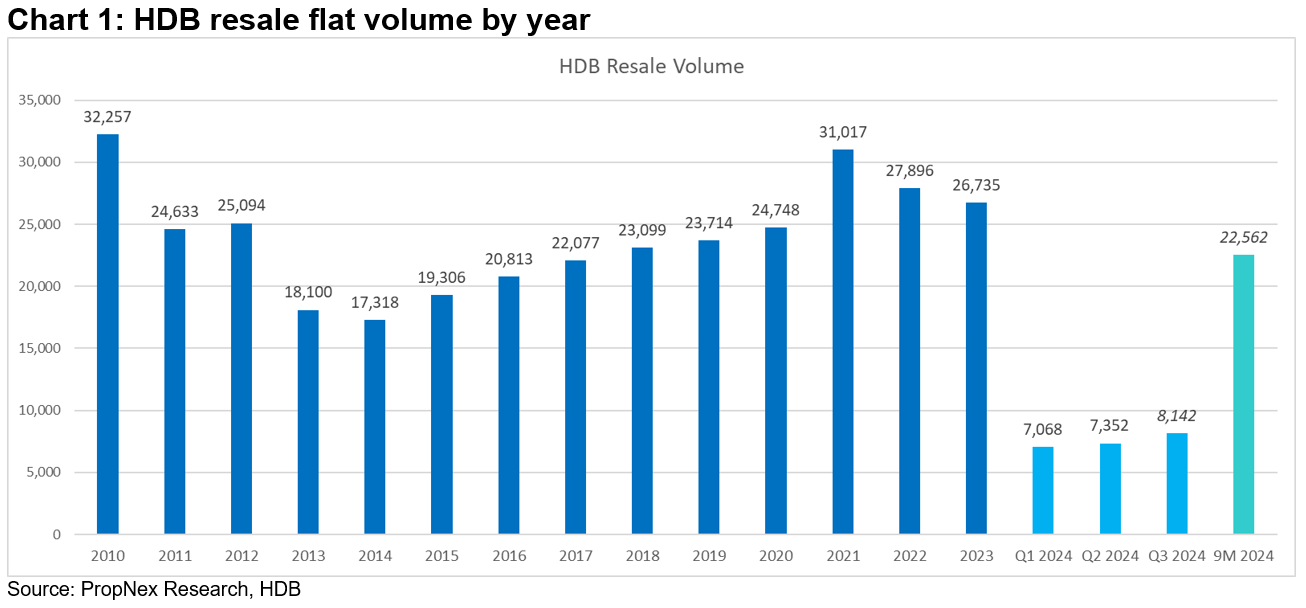

The price growth can be attributed to the stronger demand for HDB resale flats. HDB said that 8,142 flats have been resold in Q3 2024 - up by 10.7% from the 7,352 units transacted in Q2 2024 (see Chart 1). This is the highest quarterly resale volume since Q3 2021 where 8,433 flats were resold. In the first nine months of 2024, HDB resale volume has reached 22,562 units. PropNex expects the HDB resale volume could potentially come in at 28,500 to 29,500 units for the whole of 2024, outperforming the 26,735 flats resold in 2023.

In August 2024, the government introduced further cooling measures - a 5 percentage-point reduction in the loan-to-value (LTV) limit for HDB loans to 75% - to tame rising resale flat prices.

Please attribute the comments below to Wong Siew Ying, Head of Research and Content, PropNex Realty.

"Demand for HDB resale flats has been resilient, with transaction volume gaining traction over the first three quarters of the year. The resale volume in Q3 2024 is the highest quarterly sales in 3 years, while HDB resale transactions exceeded 7,000 flats in each of the first two quarters of 2024 (see Chart 1). We have not seen such vibrant HDB resale market activity since 2021, where demand surged amid COVID-recovery optimism, and delays in completion times driving buyers to the secondary market then.

With the higher resale flat volume, resale flat prices also got a lift, and the HDB resale price index rose for the 18th straight quarter in Q3 2024. This is now the longest period of consecutive price growth - topping the 17 quarters of back-to-back increase in the HDB resale price index from Q2 2009 to Q2 2013. In the first nine months of 2024, HDB resale prices have climbed by 6.9%, and we project that resale flat prices could rise by 8% to 9% for the whole of 2024.

Some of the factors that may have contributed to the HDB price growth this year include demand likely outpacing the resale stock, with fewer HDB flats reaching the 5-year minimum occupation period (MOP), as well as sellers generally holding on to their asking price, particularly for choice units. Meanwhile, some buyers may be willing to pay a slight premium for well-located flats, which may be seen to offer good value compared with a much pricier private home in the same area.

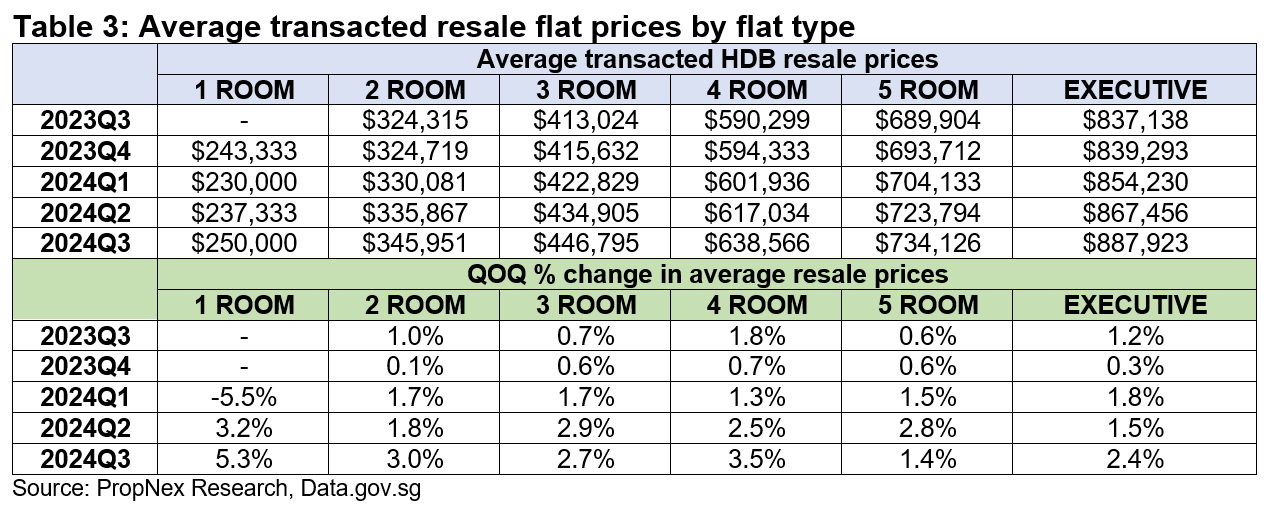

Based on the transaction data, the average resale price rose across the flat types, from 1-room flats to executive flats in Q3 2024 (see Table 3). Going by historical price trends from 1990, the average resale prices of 2-room to executive flats have touched a new high in Q3 2024.

Given the time lag - usually about two months or so - between sales and the transaction data being reflected, we could probably get a clearer picture on the effects of the 20 August 2024 cooling measures (LTV cut for HDB loans) in the coming months. That being said, we are not anticipating a significant market-wide impact as the tighter LTV limit is expected to affect a small group of buyers.

However, what may potentially influence the HDB resale market could be the HDB's build-to-order (BTO) exercise in October, where more than 8,500 new flats have been offered for application under a new flat classification framework. The October BTO exercise attracted more than 35,000 applicants, in what is the strongest applicant turnout since the August 2022 BTO launch. A large BTO supply, the attractive location of several BTO projects, singles being allowed to buy a 2-room Flexi flat in any location, and flats with shorter waiting times of around two years, are factors that may draw some prospective buyers from the HDB resale market to BTO flats.

The number of million-dollar resale flats sold in Q3 2024 came in at record 331 units, up by 40% from the 236 units that changed hands in the previous quarter. In the first nine months of 2024, 750 flats have been resold for at least $1 million, and transaction data showed that 82 such flats were sold in October (based on updated figures on 24 October). We project that the number of such flats sold in the whole of 2024 could potentially hit 1,000 units - smashing the previous record of 469 units of million-dollar flats resold in 2023."

Suggested Reads

Upcoming Events

View moreYou may like

Developers' Sales Plunged By 87% MOM In November Amid Limited New Launches; City Fringe Projects Dominate Sales

December 15, 2025

Sustained Private Housing Supply Planned For 1H 2026, Amid Stabilisation In The Property Market

December 02, 2025

A Rare Bukit Timah Freehold Hilltop Estate Enters the Market for the First Time in 70 Years

November 21, 2025

Developers' Sales Surged To 11-month High In October, Propelled By Robust Demand For New Launches; Monthly Sales In The Core Central Region Are Highest In Over 18 Years

November 17, 2025