Daryl Wee

Senior Content Writer

Many consumers have been anticipating a round of interest rate cut since its increase to over five percent between March 2022 and July 2023. Interest rates have gone up 11 times during that period and held steady until the recent round of 50 point cut by the US Federal Reserve. While the rate cut was anticipated, the amount that was cut came as a surprise. There are also planned rate cuts over the next two years that will bring interest rates down to a much more manageable level. If you want to know more about the latest rate cut, read here.

For those of you who are unfamiliar with the Fed, they are the United States central banking system that manages interest rates, money supplies and regulating financial markets. In a more local context, it is a little like the Monetary Authority of Singapore (MAS), except the MAS does not control interest rates.The US Fed is one of, if not, the most powerful economic institution in the world as America is the world's largest economy and any economic move has immediate effects on the global markets.

The bank interest rates offered by Singapore banks are largely influenced by global rates, and we tend to follow the US interest rates. You should definitely care about the falling rates as it affects the interest you incur when taking out a loan with the banks.

While most homebuyers are over the moon with the recent rate cut announcement and are ready to make a splash in the market, what if the interest rates aren't the only indicating factor when buying a home. Should you wait for the interest rates to drop further before entering the market?

While many would think that a further drop in interest rate would be a better timing to purchase their homes, there are also other factors to consider as to if you want to potentially reap bigger and better profits.

The header might sound absolutely absurd to the common man, how can higher interest rates possibly lead to higher profits? Would I have to pay more for a mortgage with a higher interest rate? Look below, the proof is in the pudding.

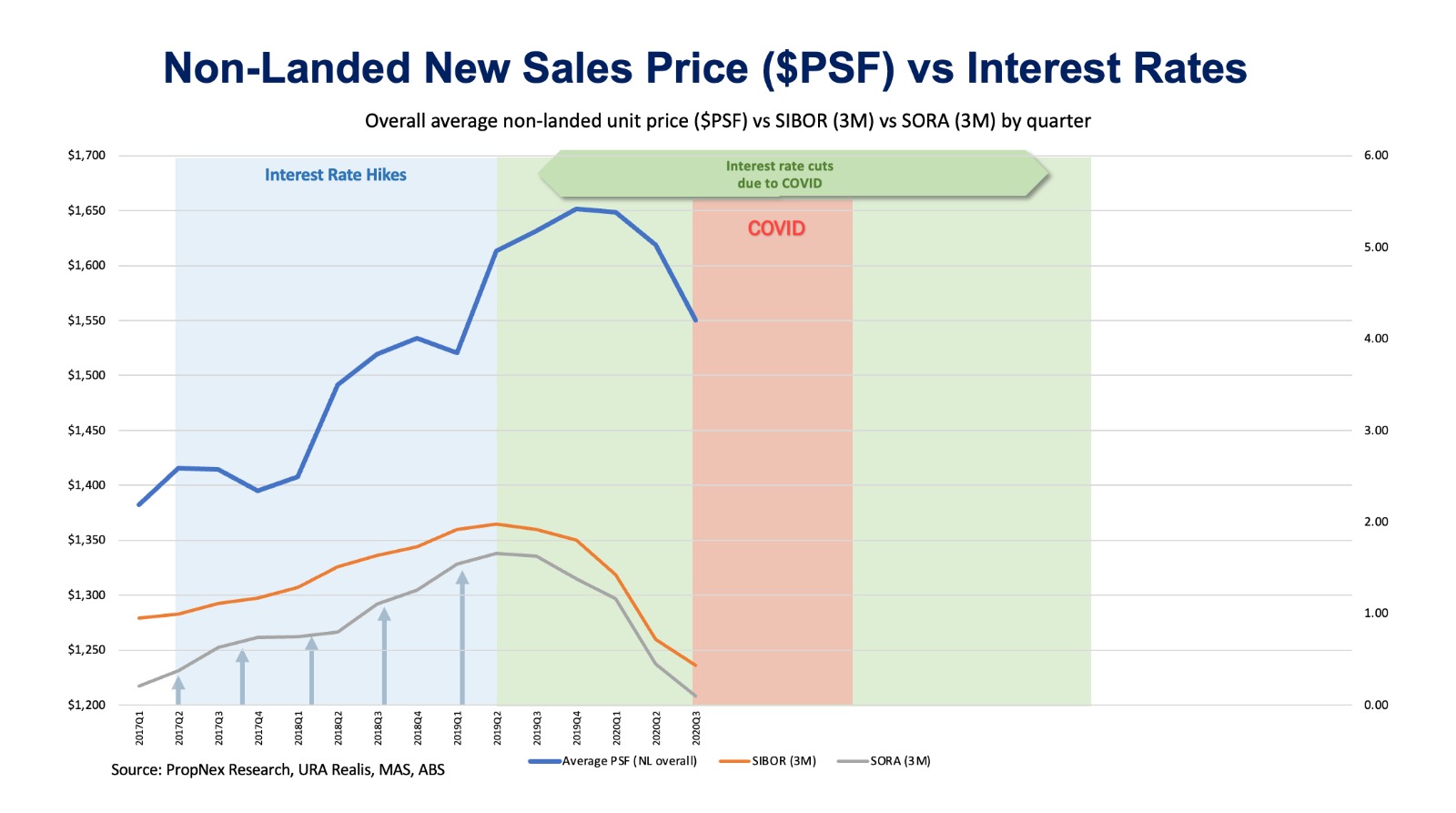

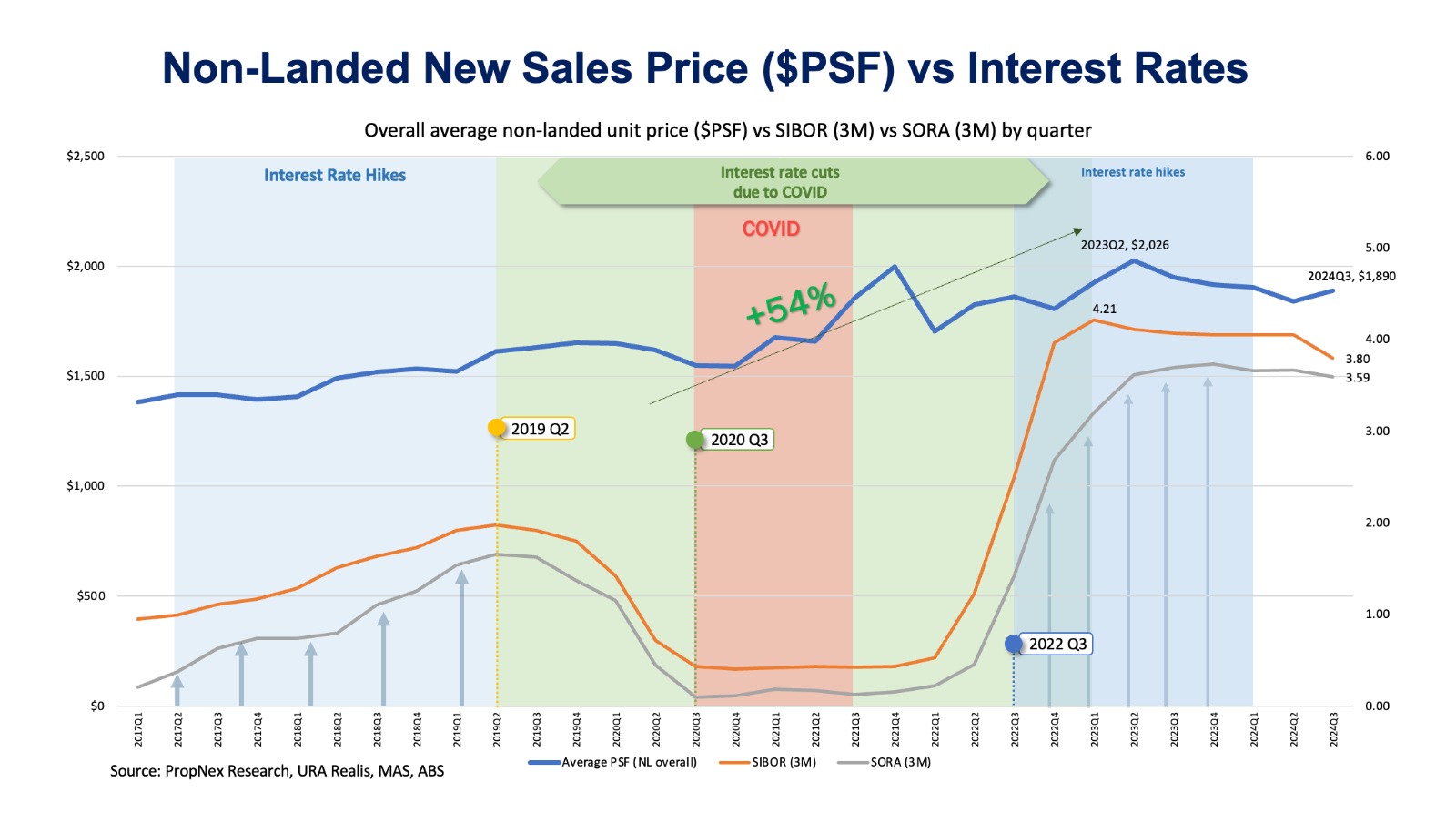

Looking at the interest rates over the years, you can see that in 2019, it was actually relatively higher. It reached a peak in 2Q 2019 and then you see the interest rate dropping. What do you think will happen to the average price of a new launch as the interest rate moves towards a downward trend?

You would think those who bought homes during the last peak probably made less than those who bought when the interest rates were almost zero. You could be quite wrong. Prices of new launches actually increased by 54% when the interest rates were near zero.

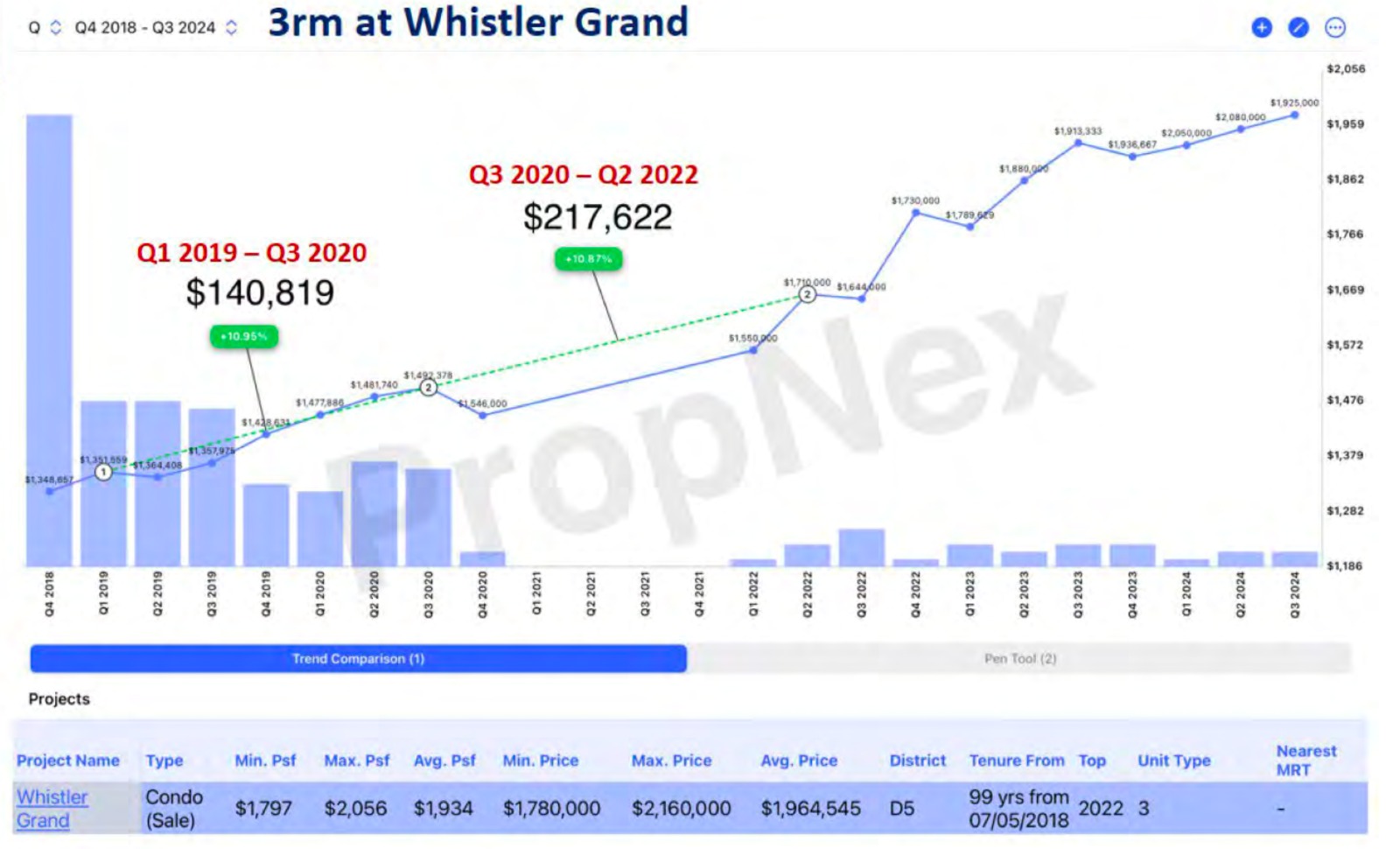

When interest rates were falling, people started rushing in to buy homes. This created a demand in the market which caused the prices to spike. During the period from 1Q 2019 to 3Q 2020 the price of a 3-room at Whistler Grand actually went up by more than $140,000 and when the interest rates were hovering around zero during 3Q 2020 to 2Q 2022, the price spiked further by another $217,000. Based on the demand over this period, the price of this property actually increased close to $360,000. Put this into perspective, do you think it is good to enter the market when the interest rates are starting to fall or when the interest rates have already fallen?

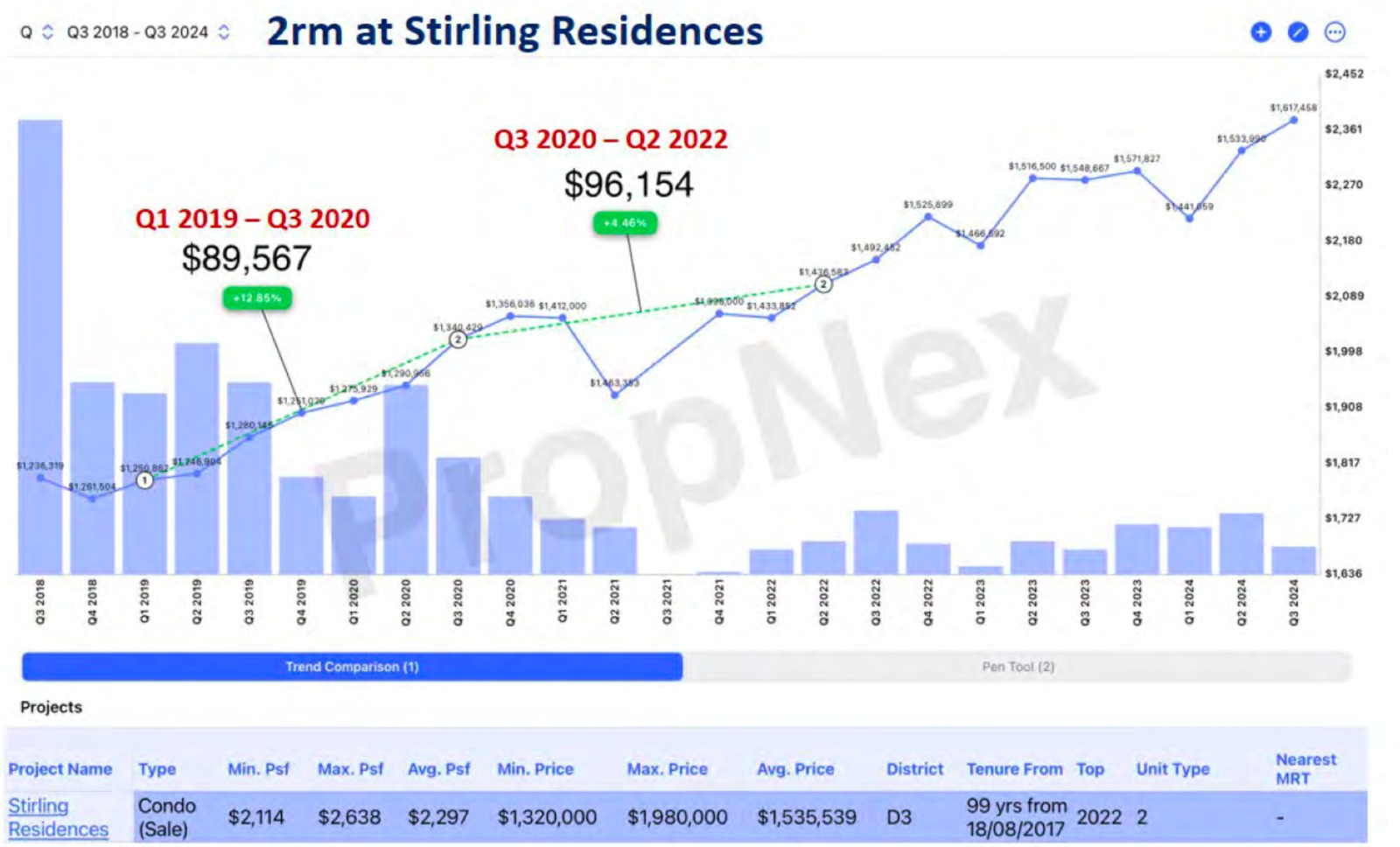

Another example of a 2-room unit at Stirling Residences. When interest rates were falling during 1Q 2019 to 3Q 2020, the price went up more than $89,000. And when the interest rates were hovering around the zero per cent point, prices went up by another $96,000. It is evidential and also the plain theory that with a spike in demand, the scarcity of supply pushed up the prices.

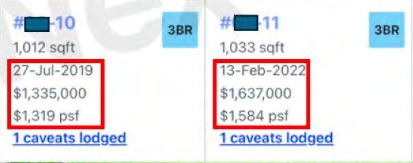

Now let's take a look at this very interesting example of these two units at Treasure @ Tampines. Zoomin into stack 10 and 11, we can see that stack 10 is a pool facing unit and stack 11 faces the bin centre (BC). If we did not have any information about the price, we would easily assume that the pool facing unit would be more expensive.

Yet the reality is, depending on when you enter the market, the unit facing the bin centre is actually more expensive by over $300,000. Shocking isn't it?

Clearly, this underscores the importance of understanding the relationship between interest rates and the timing of your market entry. So, I'll pose this question to you: Is it wiser to enter the market when a significant interest rate cut is on the horizon, or when rates are already low? Food for thought.

Apart from interest rates, there are also additional TWO factors that are important in determining the best time to enter the market. If you'd like to find out the what these two other factors are and gain an even more clearer view on how will interest rates shake up the property market, join us at our event with industry's movers and shakers as they discuss and address all these critical topics to ensure you make discerning choices in your property journey.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position.