Deciphering Residential Market Opportunities For 2025

It has been a year of two halves in 2024, and to be more precise, a year where the fourth quarter almost single-handedly propped up new private home sales, with more than 3,000 private homes (ex. EC) sold in Q4 (till 26 November). This takes new home sales to 6,256 units (ex. EC) in roughly the first 11 months of 2024, and overall sales should exceed the 6,421 units shifted in 2023.

Over in the HDB resale market, flat prices continued the upward march in 2024, supported by resilient demand from flat buyers. The HDB resale flat prices rose by a cumulative 6.9% in the first nine months of the year, and look set to outdo the 4.9% price growth in the whole of 2023. In August 2024, the government intervened by cutting the loan-to-value limit for HDB housing loans from 80% to 75% in a bid to cool prices.

Undoubtedly, prospective buyers and investors will be wondering what lies ahead in 2025. PropNex Picks put some burning questions to Deputy CEO Kelvin Fong, and KEO Lim Yong Hock for their take on the real estate opportunities and segments to watch for in the new year.

1. Where do you think are the bright spots/opportunities for the property market in 2025?

We have ended 2024 on a high note, with record-breaking sales at some new launches in November. I think the first half of 2025 could be crucial, and prospective buyers will be watching interest rates to see if they will come off a bit more. The thing is, when interest rates fall, housing demand will rise, this could in turn influence home prices. So, this is something consumers should note.

Some of the opportunities in 2025, I would say given the bump-up in OCR new launch prices, executive condos (EC) could look very attractive to eligible buyers. In addition, we could see some buyers shifting their attention to RCR properties, due to a narrower price gap between RCR and OCR homes. Based on URA Realis caveat data up till 26 November, the average unit price gap between new private non-landed homes in the RCR and OCR was 12% in Q4 2024 (see Table 1) - some buyers may opt to take the leap to purchase homes in the city fringe.

Table 1: Average unit price of non-landed new private homes & EC by Region, and price gap (%)

Price comparison | New sale non-landed private/EC average $PSF price | Price gap (%) | |||||

CCR | RCR | OCR | EC | CCR vs RCR | RCR vs OCR | OCR vs EC | |

Q1 2023 | $2,966 | $2,605 | $2,076 | $1,383 | 14% | 25% | 50% |

Q2 2023 | $2,963 | $2,506 | $2,002 | $1,300 | 18% | 25% | 54% |

Q3 2023 | $2,993 | $2,527 | $2,077 | $1,439 | 18% | 22% | 44% |

Q4 2023 | $3,154 | $2,496 | $2,289 | $1,346 | 26% | 9% | 70% |

Q1 2024 | $3,127 | $2,561 | $2,192 | $1,490 | 22% | 17% | 47% |

Q2 2024 | $3,274 | $2,603 | $2,110 | $1,414 | 26% | 23% | 49% |

Q3 2024 | $3,169 | $2,597 | $2,119 | $1,404 | 22% | 23% | 51% |

Q4 2024* | $2,941 | $2,672 | $2,382 | $1,616 | 10% | 12% | 47% |

Source: PropNex Research, URA Realis (*data till 26 Nov 2024)

Another point to consider is that residential land prices in Singapore are not likely to fall substantially - the government has in 2024 decided not to award three government land sales sites because the bids were too low. In a way, this helps to uphold land values, and with rising costs and confidence returning among developers for land acquisition, it is unlikely for home prices to see a sharp drop in the coming years, barring unforeseen events.

2. The CCR market has been muted since the hiking of additional buyer's stamp duty (ABSD) rates in April 2023, what's your outlook for this segment in the year ahead?

The CCR new home sales market has been relatively quiet, partly due to the ABSD rate hike since April 2023, as well as fewer major launches in this segment in 2024. With new launch prices staying firm across the other sub-markets, prospective buyers may want to explore the existing unsold stock in previously-launched projects - they could potentially buy a CCR property at close to RCR prices.

For instance, the average unit price of new units sold at One Bernam in the city centre was $2,784 psf in 2024 (till 26 Nov) based on URA Realis caveat data. This is only 5% higher than the average unit price of RCR new homes at $2,645 psf over the same period. Generally, CCR homes tend to command higher rentals than RCR units because they are in the city and they have more convenient access to various amenities. Therefore, value-buys in the CCR coupled with and firm rentals may translate to good rental yield for the investor.

The reasons why some existing CCR projects are priced competitively may be that the developers had bought the land at a more moderate price previously, and also to drive market activity, since there haven't been that many launches in this segment in the past year. Those who are keen on getting into the CCR market can connect with any of the PropNex agents, who will be able to make recommendations that are customised to clients' needs.

3.An estimated 14,000 new homes (including ECs) may potentially be launched in 2025 - doubling the number of units launched in 2024. With more launches, it could promote competition among developers, how do you see private home prices trending in 2025?

Private home prices in Singapore have been rising for seven years since 2017, and on track for an eighth straight year of increase in 2024. Barring any hiccups, I believe 2025 will be a positive year for the housing market, in view of the easing interest rates, sales momentum from launches, and the favourable economic outlook. As for how prices will trend next year, prospective buyers will do well to consider these factors: 1) robust sales at launches in November; 2) an OCR project's average price has crossed $2,500 psf; 3) strong interest for well-located projects; and 4) firm land price, high construction cost, and effects of GFA harmonisation. Do you think prices will fall next year?

4.What is your advice for first-timer homebuyers and property investors in 2025?

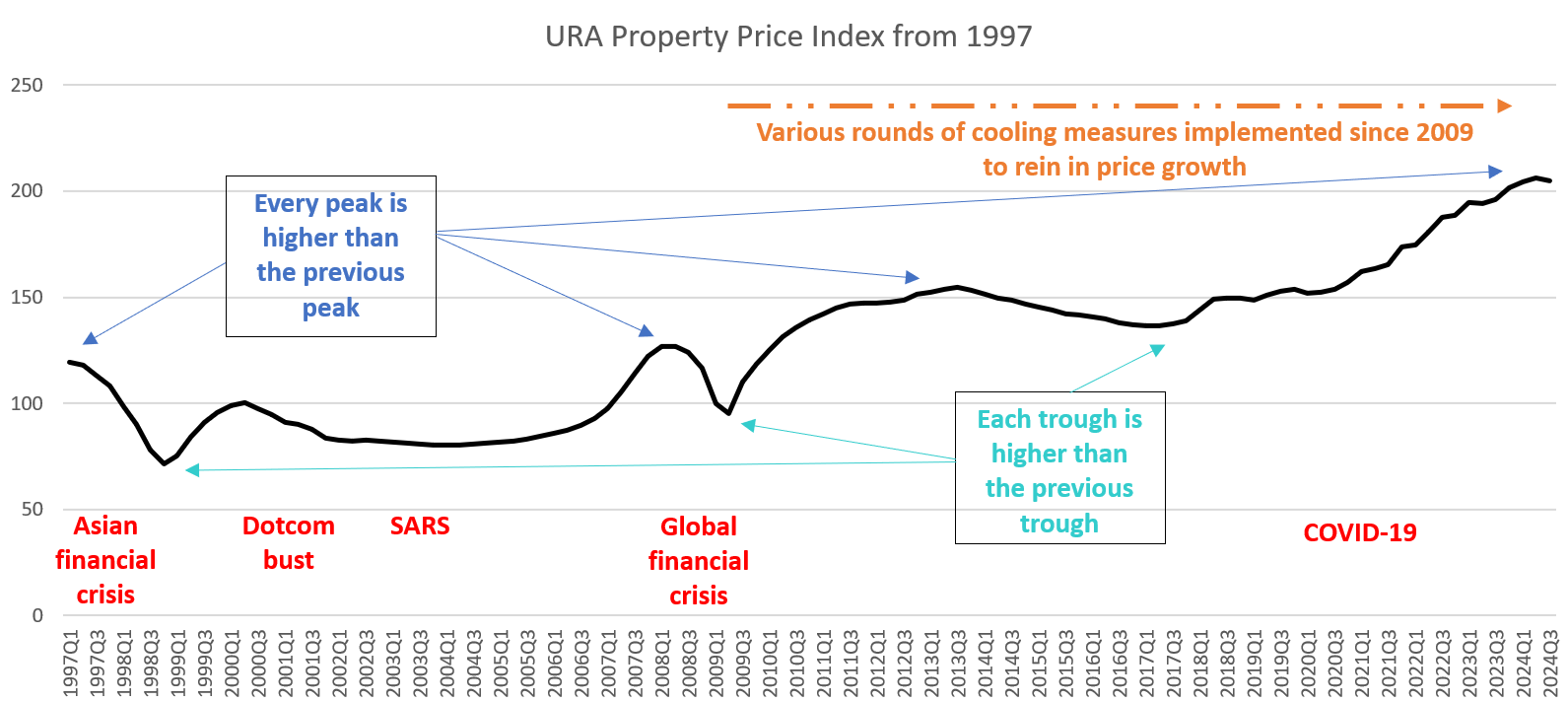

The burning questions among many first-timer homebuyers and investors include, 'are prices too high to enter the market now', and 'will I be able to exit in the future if I buy at today's prices?'. In my view, they will have to look at purchasing a property as a long-term commitment. While prices may fluctuate over the short-term - perhaps due to cooling measures, or various uncertainties/events - what has been the price trend over the longer-term? Has it been positive?

Generally, I would say Singapore private residential properties have a good track record. The URA PPI has its ups and downs naturally, but each high point has been higher than the previous highs, and even the dips have been higher than previous troughs (see Chart).

Chart: URA Property Price Index - good track record of private home prices weathering crises through the decades

Source: PropNex Research, URA

Another point to consider is that residential land prices in Singapore are not likely to fall substantially - the government has in 2024 decided not to award three government land sales sites because the bids were too low. In a way, this helps to uphold land values, and with rising costs and confidence returning among developers for land acquisition, it is unlikely for home prices to see a sharp drop in the coming years, barring unforeseen events.

As for concerns about whether there would be buyers for their property in the future, I believe our housing eco-system is such that there will be a certain demand pool that will be fed to the next property segment (see Diagram), and this is an ongoing cycle. For instance, at the base, the government will ensure that the masses will have access to affordable public housing, some of these flat owners may subsequently sell and upgrade to private home, then to a landed home, and so forth. These will be some of the discussion points in our Property Wealth System (PWS) masterclass in May 2025 - do sign up to learn more. Our PWS sessions have been well-attended and many consumers have benefited from it.

Diagram: Three stages of property investing

Source: PropNex Property Wealth System

5.The ABSD hike in April 2023 remains prohibitive for Singaporeans looking to invest in a second, and subsequent residential property here. Are there good buys in overseas markets, and where can they explore?

In my PWS sessions, I have shared about the three stages of property investing: first, wealth accumulation when you are younger; second, value growth when one hits 40 years old; followed by garnering cashflow in the retirement years. Having one or multiple investment properties will help to generate cashflow via rental income, but this is not easy to do in Singapore, given the ASBD and total debt servicing ratio (TDSR) measures.

Hence, some investors decide to capitalise on the strong Singdollar and purchase a property overseas, such as in Manchester, UK or Australia. To give an example, one can buy a decent 2-bedroom unit in Manchester with a downpayment of $200,000, and get a rental yield of 6% to 8% which form part of their cashflow.

1. What is your outlook for the HDB resale market next year in terms of resale volume and pricing?

Based on the strong application rates in the HDB's October 2024 build-to-order (BTO) exercise, I think the HDB resale market will remain strong going into 2025. That's because many of the applicants who are unable to secure a queue number or their desired BTO flat may likely seek out other available options in the resale market. The 8,573 BTO flats launched for sale in October had attracted 35,678 applicants, reflecting an application rate of 4.2 times.

By flat types, the median application rate for 3-room or larger BTO flats in October was about 2.6 times for first-timer families and 29.9 times for second-timer families, while the median application rate for 2-room flexi flats was 26.3 times for first-timer singles. This reflects a robust demand for HDB flats across a wide spectrum of home buyers, be it singles, or first-timer/second-timer families. With a large number of applicants vying for the BTO flats, inevitably many of them will not be able to secure a unit. They could either wait for the next BTO exercise in February, or explore more plentiful options in the resale market. Thus, I believe HDB resale volume and prices will potentially see strong upside in 2025.

2. What will be the key demand drivers and factors affecting the HDB resale market in 2025? Do you think interest rate cuts will affect HDB resale demand?

Generally, HDB flats cater to a broad section of the population and hence demand will remain supported in the new year. Notably, I think the high demand for BTO flats remains a key driver for the HDB resale market in 2025 from two perspective: one, those who did not get a flat could tap the resale market; and second, families who want to move in sooner will prefer resale flats.

Although the HDB has put out projects with shorter waiting time of less than 3 years, a number of BTO projects still have relatively longer waiting time of between 3 and 5 years. Those who cannot wait will certainly be looking at more immediately accessible options such as resale flats. In addition, with mass market private home prices staying firm, some owner occupiers may decide to go for more affordable HDB resale flats in the same area.

Meanwhile, factors like interest rates may affect a small portion of buyers, but they generally do not have a significant impact on HDB transactions, as buyers have a choice between taking an HDB loan or a bank loan.

3. In addition to the 5,000 new BTO flats to be launched in February 2025, HDB will hold the largest-ever SBF exercise in February 2025, to offer more than 5,500 flats across various towns/estates. How do you think this will impact the HDB resale market?

Although some flats in the SBF exercises have shorter waiting periods, these flats are predominantly balance units or made available due to applicants dropping out of the BTO exercise. Hence, the units may have less-than-ideal locational attributes, and may not be as well-received by prospective buyers. Despite this, we expect the number of buyers eyeing flats in the SBF exercise to remain high, and the chances of securing a flat might be slim. Nonetheless, it is still too early to predict the impact of the February 2025 BTO/SBF exercise on the HDB resale market at the moment.

4. HDB launched its resale property listing portal in May this year, have you observed any significant impact to the agency business since its launch? Why? (Can focus on value add by agents)

While the HDB resale portal provides another platform for homeowners to list their resale flats for sale, the majority of buyers may still choose to browse potential listings via more popular, and established property portals instead.

Listings on the HDB resale portal can only be viewed by buyers with a valid HDB Flat Eligibility (HFE) Letter, and many buyers who are still awaiting their HFE letter will likely start looking around for flats on other property portals. As such, homeowners who only depend on the HDB resale portal may not be reaching out to the largest pool of buyers.

We believe real estate salespersons will continue to have a crucial role to play in HDB resale transactions, as they offer value-add services which a seller or buyer acting on their own may not have access to. These include the ability to quickly mobilise their network of ready buyers and sellers, the access to sophisticated tech tools to analyse property data, their deep experience in conducting deals and avoiding potential pitfalls, as well as their expertise in managing home viewings and price negotiations, among others.

5. Million-dollar HDB resale flats are continuing to gain in numbers, and looking to potentially cross 1,000 of such flats in 2024. In your view, do you think this is sustainable? Are HDB resale flats still affordable?

In the first 11 months of 2024, there were 940 flats that were resold for at least $1 million - already doubling the record 469 units transacted in the whole of 2023. Despite the sharp increase in such sales, they still made up a small portion of the total HDB resale transactions at 3.7%.

Overall, we think the majority HDB resale flats are still relatively affordable, with eligible buyers able to receive grants and subsidies from the government to help with the flat purchase. As million-dollar HDB flats only take up a small percentage of total HDB resale transactions, it is not accurate to merely focus on them to determine the affordability of HDB resale flats for homebuyers. Most million-dollar HDB flats often share some unique characteristics, including but not limited to:

Newer flats with longer remaining leases

Central location or a location with a limited supply of HDB resale flats

Near to an MRT station and/or amenities

Higher floor level

Spacious (e.g. jumbo flats, terrace flats, maisonettes)

Well-renovated unit

I believe the number of million-dollar HDB resale flats transacted will remain strong in the short term, but numbers are likely to slow down and stabilise due to the limited availability of flats that fulfil these specific criteria.

For more insights and advice on how to navigate the property market in 2025, join the Property Wealth System (PWS) masterclass in May 2025 where Kelvin, Yong Hock and a team of experienced real estate veterans, including Ismail Gafoor will be conducting classes to guide first-time homebuyers and investors on how to take advantage of current market conditions and build their wealth using real estate.