October's HDB Resale Volume Dipped As BTO Supply Wooed Buyers

The resale volume of HDB resale flats dipped slightly in October 2024, possibly affected by the large supply of build-to-order (BTO) flats launched for sale by the HDB in the same month. More than 8,500 BTO flats were launched in the sales exercise, and they drew over 35,600 flat applicants - the strongest turnout since August 2022.

The BTO effect on resale market

Applicants were likely attracted to the BTO projects as many of them are conveniently located near an MRT station. In addition, first-timer singles are also able to apply for a 2-room Flexi flat in any location, while some projects with shorter waiting times of around two years also caught the eye of flat applicants.

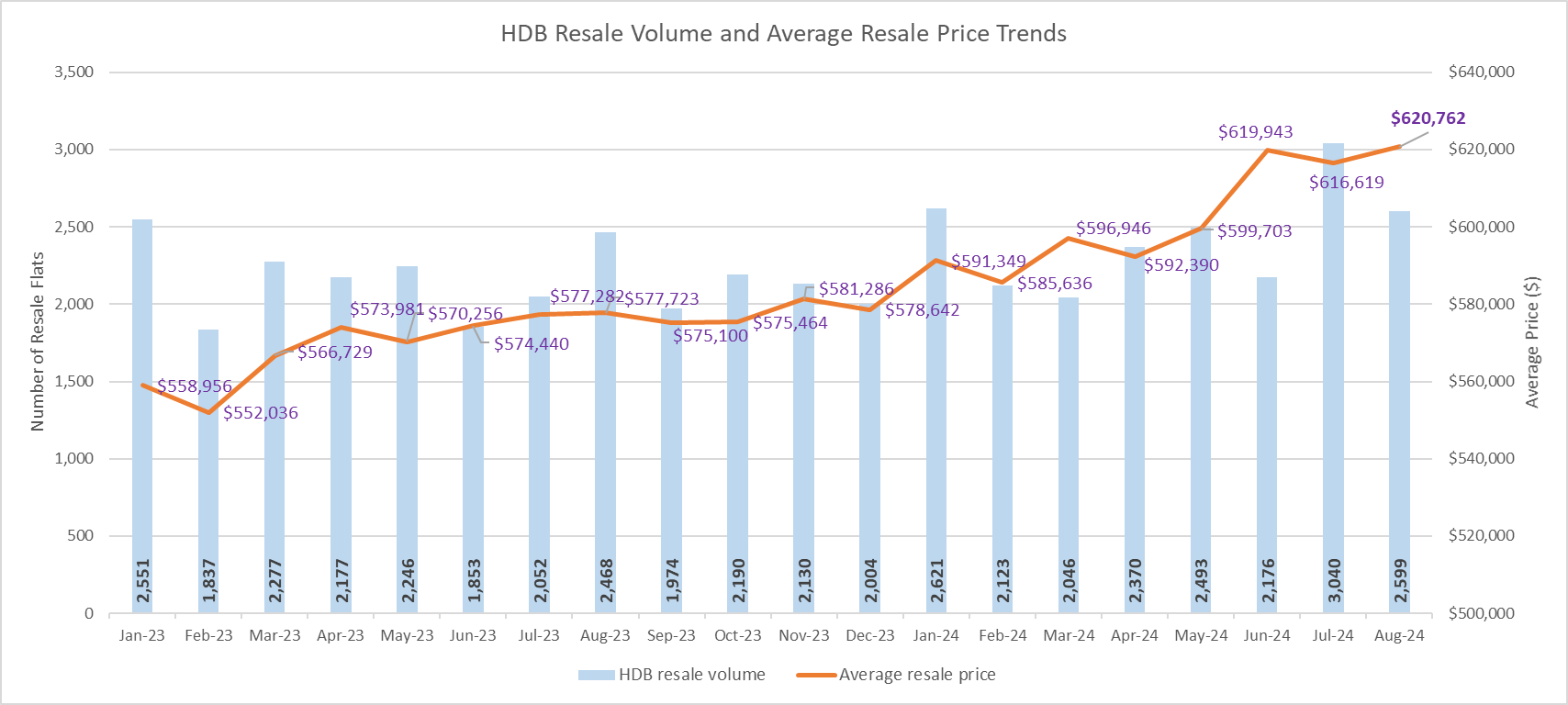

To this end, the strong interest garnered by the BTO launch could have siphoned some demand from the resale market. According to transaction data, 2,155 flats were resold in October, down slightly by 2.4% from the 2,209 resale flats that changed hands in September. This also marked the third straight month since August 2024 where the resale flat volume fell. Sales were also lower on a year-on-year basis, declining by 1.6% from 2,190 units in September 2023 (see Chart 1).

Apart from the Lunar Seventh Month (Ghost Month) which straddled August and September, another reason for the slower sales could be due to some prospective buyers holding back on transacting while waiting for more clarity on interest rate movements, seeing that the US Federal Reserve is expected to cut rates then. The US Fed delivered a jumbo rate cut of 0.5%-points in September, and signalled that rates could fall further in 2024 and 2025.

Chart 1: HDB resale flat transaction volume and average resale price by month

Resale prices stable

Despite the softer sales volume, the average resale price of HDB flats held up - almost unchanged in October from September at about $628,000. Meanwhile, the average price rose by 9.2% YOY from around $575,400 in October 2023 (see Chart 1).

Since there is typically a lag time of about 2 months or so before sales are captured in the transaction data, the impact of the cooling measures implemented from 20 August 2024 - the reduction in loan-to-value limit from 80% to 75% for housing loans granted by HDB - may not be fully reflected yet.

By flat types, the average price of 4- and 5-room, and executive flats posted an increase in October from September, with resale executive flats chalking up a 3.3% MOM growth (see Table 1). Meanwhile, the average price of 3-room resale flats moderated by 1.1% MOM in October, possibly due to the higher base in September following months of price increase.

Several flat types in mature towns witnessed a decline in their average resale price, with 3- and 4-room flats posting a 1.6% MOM and 1.7% MOM price drop respectively, while 5-room flats saw a 1.5% MOM average price decline in October (see Table 2). The priciest flat resold in mature estates in October was a 5-room flat at Pinnacle @ Duxton in Cantonment Road which fetched $1.54 million.

Over in non-mature towns, the average resale prices rose across the various flat types, with executive flats booking the steepest price growth at 1.9% MOM in October. The most expensive resale flat transacted in non-mature estates during the month is located in Hougang Street 31, where a 141-sq m executive flat was resold for $1.098 million.

Table 1: Average transacted HDB resale flat prices by Flat Type in last six months

Flat Type | May-24 | Jun-24 | Jul-24 | Aug-24 | Sep-24 | Oct-24 | MOM % change |

3-ROOM | $432,522 | $442,301 | $443,827 | $445,674 | $452,100 | $447,267 | -1.1% |

4-ROOM | $613,105 | $635,020 | $638,906 | $628,910 | $649,464 | $652,449 | 0.5% |

5-ROOM | $718,076 | $743,971 | $728,213 | $734,080 | $742,569 | $745,018 | 0.3% |

EXECUTIVE | $857,144 | $876,113 | $882,217 | $897,892 | $881,356 | $910,201 | 3.3% |

Table 2: Average transacted HDB resale flat prices in Mature and Non-mature towns

| Mature towns | Non-mature towns | |||||

Flat Type | Sep-24 | Oct-24 | % change MOM | Sep-24 | Oct-24 | % change MOM |

3 ROOM | $459,714 | $452,392 | -1.6% | $440,274 | $441,094 | 0.2% |

4 ROOM | $755,956 | $743,252 | -1.7% | $589,382 | $598,580 | 1.6% |

5 ROOM | $892,513 | $882,501 | -1.1% | $684,564 | $690,799 | 0.9% |

EXECUTIVE | $961,474 | $996,645 | 3.7% | $849,938 | $866,039 | 1.9% |

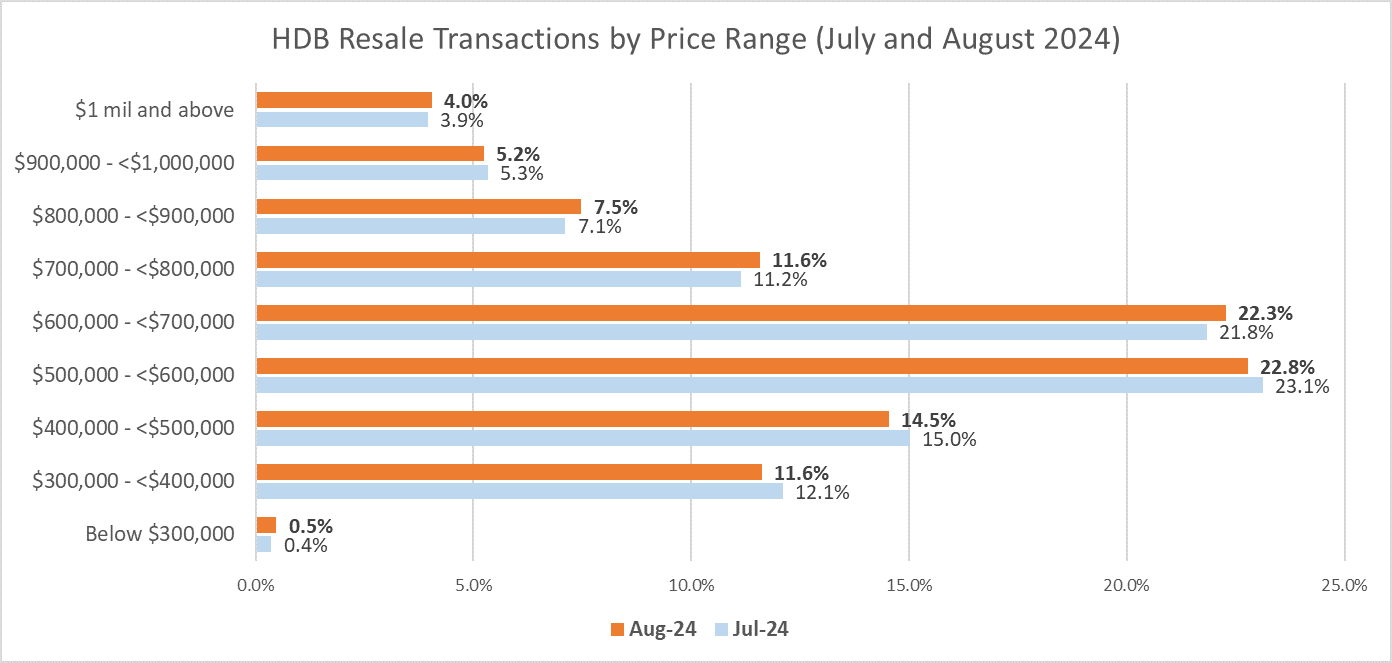

Chart 2: Proportion of HDB resale transactions by price range

In October, the proportion of flats resold for less than $500,000 rose to 26.9% from the 25.4% in the previous month (see Chart 2), while the portion of flats transacted at pricier levels of $500,000 to just below $1 million accounted for 68.3% of October's sales - down from 69.8% in September. Meanwhile, million-dollar resale flats made up 4.8% of October's resale volume, unchanged from the previous month. These may be early signs of the August 2024 reduction in LTV limit having an influence on the prices in the secondary market.

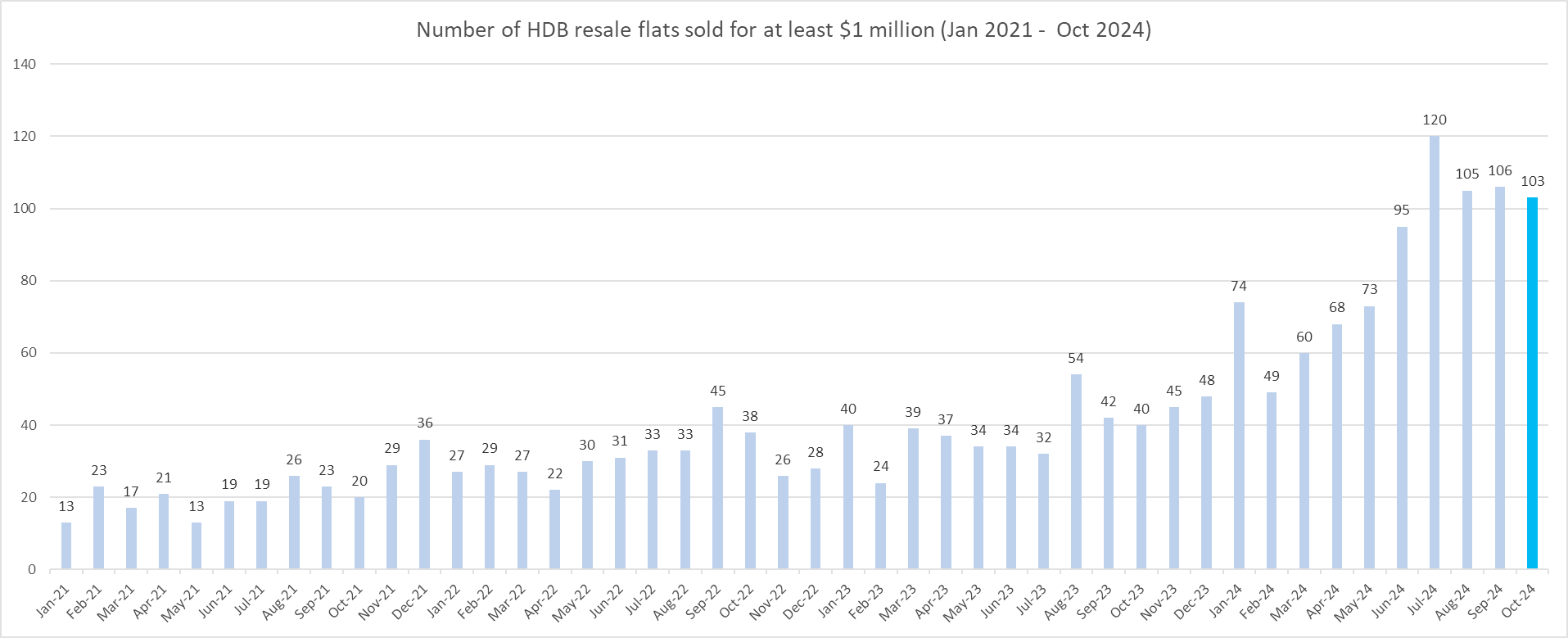

Easing number of million-dollar flats

According to HDB's sales data, the number of million-dollar resale flats sold in October slipped to 103 units, from 106 units in September (see Chart 3). In the first 10 months of 2024, there were 853 flats that have been resold for at least $1 million - already far exceeded the record 469 such units resold in the whole of 2023.

Of the 103 units of million-dollar resale flats transacted, nine flats are located in non-mature towns, namely in Bukit Panjang, Hougang, Woodlands, and Yishun. The rest of the units are in mature estates, led by Toa Payoh with 18 such deals each, followed by Kallang Whampoa and Bukit Merah with 15 and 13 transactions, respectively.

In Toa Payoh, some of the million-dollar flats are from projects that have recently met their 5-year minimum occupation period (MOP), such as in Bidadari Park Drive where six such deals were done. Meanwhile, in Kallang Whampoa, the St. George's Towers project in St. George's Lane continued to chalk up million-dollar resale flat deals, with seven such units being transacted in October.

Overall, the 103 million-dollar flats sold in October comprised 41 units of 4-room flats - boosted by transactions at Kallang Whampoa - 33 units of 5-room flats, and 29 executive flats.

Chart 3: Number of resale flats sold for at least $1 million

The top resale transaction in October was a 5-room flat at Pinnacle @ Duxton which was resold for $1.54 million. The 107-sq m unit is located on a high floor ranging between the 43rd and 45th storey (see Table 3). This is a new record resale price for a 5-room flat transacted at Pinnacle @ Duxton - besting the $1.515 million garnered by two 5-room units in May and September this year.

Although the number of million-dollar resale flats has climbed steadily, they still accounted for a small proportion of the total resale flat volume. In the first 10 months of 2024, the 853 units sold represent about 3.6% of the total transactions, based on sales data. PropNex anticipates that the number of million-dollar resale flats sold may potentially hit 1,000 units this year, going by recent the transaction trend.

Table 3: Top 10 HDB resale flats sold in October 2024 by Transacted Price

Town | Type | Street | Storey range | Floor area SQM | Lease start date | Price | PSF ($) |

| CENTRAL AREA | 5 ROOM | CANTONMENT RD | 43 TO 45 | 107 | 2011 | $1,540,000 | $1,337 |

| TOA PAYOH | 5 ROOM | LOR 1A TOA PAYOH | 31 TO 33 | 114 | 2012 | $1,500,000 | $1,222 |

| CENTRAL AREA | 5 ROOM | CANTONMENT RD | 37 TO 39 | 106 | 2011 | $1,480,000 | $1,297 |

| CENTRAL AREA | 5 ROOM | CANTONMENT RD | 40 TO 42 | 107 | 2011 | $1,466,000 | $1,273 |

| BISHAN | EXECUTIVE | BISHAN ST 12 | 22 TO 24 | 163 | 1986 | $1,410,000 | $804 |

| QUEENSTOWN | 5 ROOM | DAWSON RD | 16 TO 18 | 108 | 2016 | $1,400,000 | $1,204 |

| KALLANG/WHAMPOA | 5 ROOM | BOON KENG RD | 37 TO 39 | 117 | 2011 | $1,390,000 | $1,104 |

| CENTRAL AREA | 4 ROOM | CANTONMENT RD | 34 TO 36 | 93 | 2011 | $1,388,888 | $1,387 |

| BUKIT MERAH | 5 ROOM | HENDERSON RD | 16 TO 18 | 113 | 2019 | $1,360,000 | $1,118 |

| CENTRAL AREA | 4 ROOM | CANTONMENT RD | 34 TO 36 | 93 | 2011 | $1,350,000 | $1,349 |

| KALLANG/WHAMPOA | 5 ROOM | BOON KENG RD | 31 TO 33 | 109 | 2011 | $1,350,000 | $1,151 |