From Pit Stop to Profit: How F1 Affects Singapore's Real Estate

The Grand Prix is coming back to Singapore later this month. Many people have been anticipating this upcoming event, and not just racing enthusiasts but also property owners! Yup, that's right. You might think of it as a mere sporting event, but this race is actually also a major economic driver that has a significant impact on various sectors, including real estate.

As one of the biggest events on the global F1 calendar, the race attracts hundreds of thousands of tourists, literally. Last year alone, over 260,000 people attended the Grand Prix, and tourists typically make up around 40% of that number. This directly translates to an increased demand for accommodation, influencing property prices and rental trends, especially in areas close to the Marina Bay Street Circuit. Additionally, the increased consumer spending during this period boosts commerce in general, indirectly supporting growth in the real estate market. So, if you own a property or want to buy one, it might be worth your time to read the rest of the article.

Naturally, accommodation rates tend to spike during the race weekend and the days leading up to it because there's a heightened demand from tourists seeking a front-row seat to the action. For example, during last year's Grand Prix in September 2023, hotel prices experienced a sharp rise due to the influx of tourists.

Source: Singapore Tourism Analytics Network

With hotel rates climbing so steeply, many people may find them unaffordable. That, or they've become unavailable because everyone and their mothers are visiting at the same time. This leads people to seek out alternatives such as short-term property rentals... which are unfortunately restricted. Under Singaporean law, the minimum rental duration is three months for private properties and six months for HDB. This leaves tourists with very limited options: hotels (no minimum stay duration) and serviced apartments (minimum stay duration of seven days).

Despite that, some landlords find ways to work around this regulation by offering longer leases during the F1 season or engaging in more discreet rental arrangements (which I do not recommend). As a result, rental rates in these areas can increase significantly, creating a seasonal spike. Do note that landlords who partake in this can be fined and visitors can be kicked to the curb.

However, there are still indirect benefits in terms of long-term rentals. For instance, the workers, teams, or event staff at F1 may require extended stays and seek out rentals for several months. And as these expats or temporary workers relocate to the city, rental demands and occupancy rates go up. As a result, property owners can boost their rental income.

The annual Grand Prix definitely puts a spotlight on the Marina Bay area, which no doubt enhances its appeal to investors, many of whom are attracted to the idea of continuing to benefit from the attention and enhancements associated with F1. And being such a magnet for the rich and famous, the race has firmly placed Singapore on the global map as a prime destination for the wealthy.

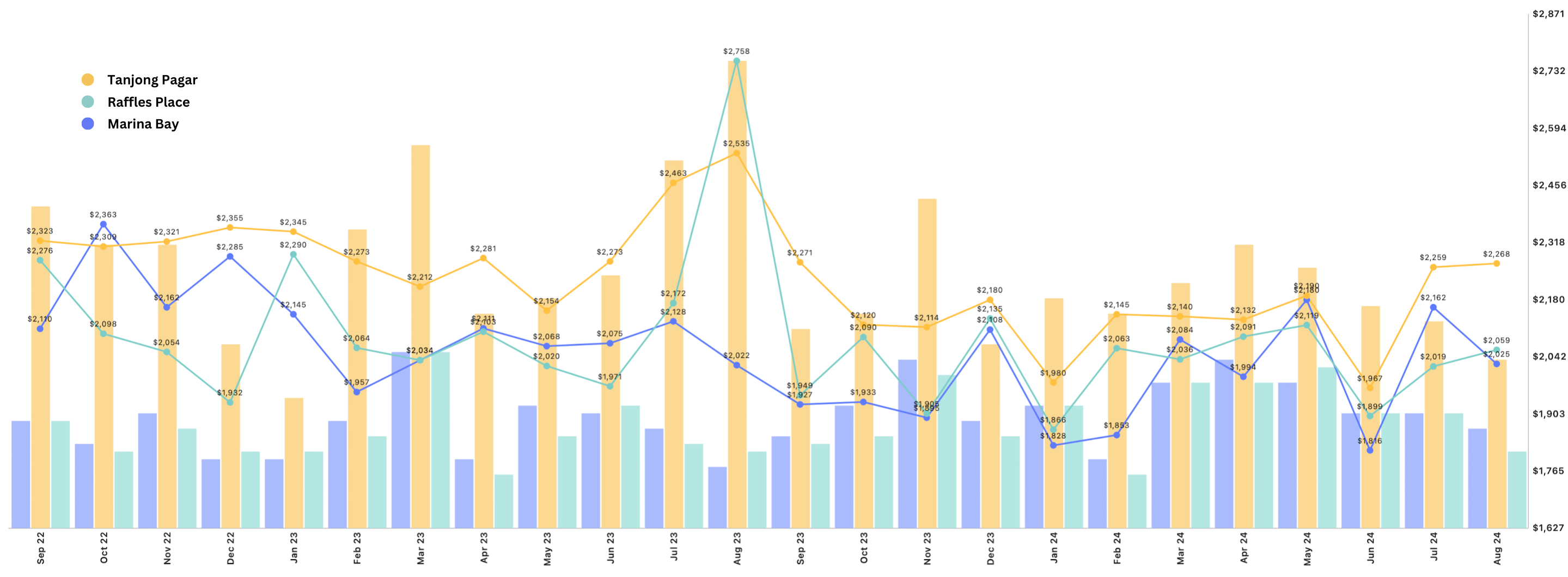

That being said, there's no solid evidence that the Grand Prix contributes to rising property prices per se. If you look at the chart below, you'll see that property prices in the Marina Bay area don't look much different from other comparable areas like Raffles Place and Tanjong Pagar. The fluctuations are almost parallel!

Source: PropNex Investment Suite

So it does not seem that the circuit plays a big role in property values at all, even near the circuit. Rather, other factors like economic growth, infrastructure developments, market sentiment, and cooling measures are more responsible for driving the price trend. Even if, let's say, the race does hike up property prices, it's not like owners can easily sell their units during peak seasons. It would take more than sheer luck for that to happen, you'd need the guidance of professionally trained agents!

The F1 Grand Prix may give Singapore an adrenaline rush for a weekend, but its impact on real estate is not as prominent as one would imagine. While it brings short-term boosts in rental demand and attracts high-net-worth investors, its long-term influence on the property market is subtle and multifaceted. So, while the race may spark interest and add a little glamour, the true value of Singapore's real estate is built on a much more stable foundation such as economic conditions, infrastructure upgrades, and market trends. These are what you should really pay attention to before buying a unit. In any case, if you're interested in learning more about how to create wealth through property investment, do check out this workshop directly led by our leaders.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.