Resale Market Watch: Astrid Hill GCB Nets $36 Million In Resale Gains In July 2024

Based on URA Realis caveat data, about 150 landed homes were transacted on the resale market in July 2024; the combined transaction value came up to $824.6 million - up from June (136 deals valued at nearly $661.8 million). Upon an analysis of each transaction and their respective gains, most landed deals were profitable. With the exception of the top gainer, the remaining top 10 landed home transactions in July booked gains ranging from about $4.16 million to $9.18 million. The top gainers were scattered across the island; four out of the top 10 landed transactions are located in the Core Central Region (CCR); another three in the Outside Central Region (OCR) and Rest of Central Region (RCR) respectively during the month.

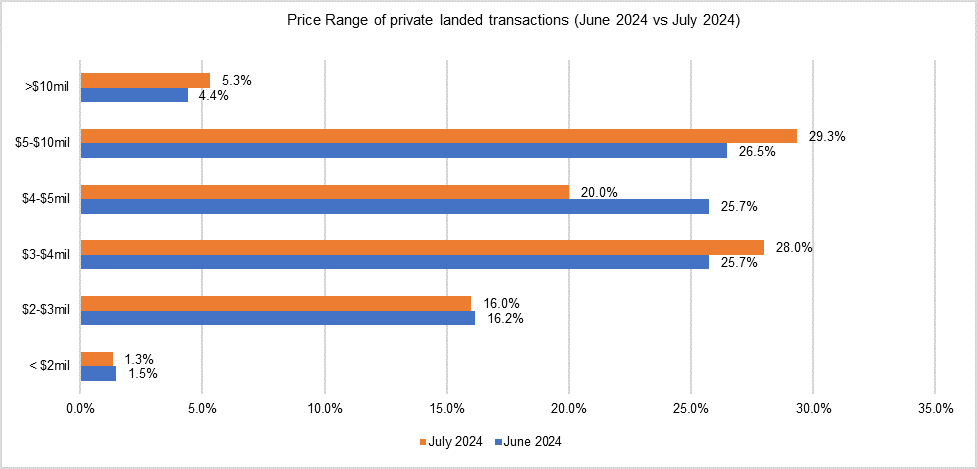

The landed home resale activity in July built up following a quiet June. Amidst the higher sales in July, there was a higher proportion of higher priced landed homes being sold compared with the previous month. Based on URA Realis caveat data, about 34.7% of resale landed homes sold in July were priced at $5 million and above, compared with about 30.9% in June. Meanwhile, 65.3% of the resale landed transactions were priced at below $5 million in July - lower than the 69.1% proportion in the previous month.

Chart 1: Price range of private resale landed transactions in June 2024 vs July 2024

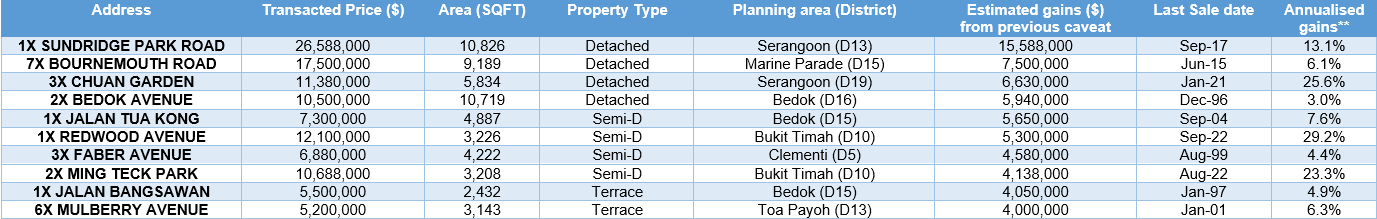

Top 10 resale landed transactions in terms of estimated gains*

Top landed transaction with highest gains (overall)

The top landed transaction in the month was for a Good-Class Bungalow property in the CCR, along Astrid Hill in District 10. The property is situated within the prestigious Queen Astrid Park GCB estate. The GCB was sold for $49 million in July and achieved an eye-watering gross profit of $36 million from the last caveated price lodged in May 2009 - booking an annualised gain of 9.2% over 15 years. This freehold property sits on a sprawling plot with a land area of over 21,000 sq ft; reflecting a unit price of $2,321 psf on land area. The property is within walking distance to the Botanic Gardens MRT station on the circle line and downtown line. The property is located close to several amenities the vicinity, including the Holland Village lifestyle cluster, Botanic Gardens, and just a short drive to the Orchard Road Shopping Belt. According to various media reports, the buyers of the Astrid Hill GCB are relatives of billionaire, Kuok Khoon Hong, the CEO of Singapore-headquartered agribusiness group Wilmar International.

Top landed transaction with highest gains (Core Central Region)

The second-best performing transaction in the city was for a semi-detached house in River Valley (District 10) along Lengkok Merak, within Kin Lin Park. The freehold property is a short walking distance from the Orchard Boulevard MRT station on the Thomson East Coast Line, which take residents to the city in less than 15 minutes. It is also just a stone's throw distance from the Orchard shopping district. It was sold for $9.9 million in July, with its last caveat being lodged in April 2010. The sale price is up by about $5.1 million from the previous caveated price, marking an annualised profit of 5.2% over 14 years. Based on a land area of 3,209 sq ft, the sale price reflects a unit price of $3,805 psf on land area.

The third best-performing landed transaction in the city was for a terrace house along Shelford Road in Watten Estate (District 11). The property was sold for $6.55 million in July and achieved a gross profit of $4.95 million from the last caveated price lodged in November 2006 - booking an annualised gain of 8.3%. This freehold property sits on a plot with a land area of nearly 1,800 sq ft, with the sale price reflecting a unit price of $3,644 psf on land area. The property is within walking distance to the Tan Kah Kee MRT station on the downtown line. The property is also a short walk from the quaint cafes and amenities in the Coronation Road neighbourhood, including Crown Centre, King's Arcade, and Coronation Plaza. It is also near the National Junior College, Raffles Girls' School, and Nanyang Girls' School.

Top landed transaction with highest gains (Rest of Central Region)

The best performing landed home transaction in the RCR was for a detached house along Goodman Road in the Marine Parade planning area (District 15). The property was sold for nearly $13.7 million, reflecting an estimated gain of $5.4 million, representing an annualised gain of 8.7% per year from its last caveat lodged in July 2018 - with a holding period of 6 years. The property is situated close to two MRT stations - Dakota MRT station on the circle line and the Katong Park MRT station on the Thomson-East Coast Line, which take residents to the city centre within 20 minutes. The property is just situated behind Chung Cheng High School.

The second-best performing transaction in the city fringe was for the sale of a semi-detached house in Cheng Soon Crescent in Bukit Timah (District 21). It was sold for nearly $7.4 million in July, with its last caveat being lodged in February 2008. The sale price is up by nearly $4.8 million from the previous caveated price, representing an annualised gain of 6.6% per year over 16 years. The property is located near the Beauty World commercial node and within walking distance to the cluster of amenities at Beauty World Centre, Bukit Timah Plaza, Bukit Timah Food centre and more.

Top landed transaction with highest gains (Outside Central Region)

The most profitable deal in the suburbs in July was the sale of a bungalow in Chestnut Crescent located within the Greenhill GCB estate in Bukit Panjang (District 23). The property was sold for $12.68 million, up by $9.18 million from the last caveat lodged in May 2000. This reflects an annualised profit of 5.5% over a holding period of more than 24 years. The project is situated near the Dairy Farm Nature Reserve, Chestnut Nature Park, and a stone's throw from the commercial amenities in Hillview and Bukit Panjang.

The second best-performing landed home transaction in the OCR was for a 2-storey semi-detached house along Wolskel Road in the Serangoon planning area (District 13). The property was sold for about $8.85 million, reflecting an estimated gain of some $4.53 million, marking a whooping annualised profit of 32% less than 3 years, from its last caveat lodged in December 2021. The property is a 10-minute walk from the Serangoon MRT station and bus interchange, as well as the NEX shopping mall.

If you are looking for high-end homes or good class bungalows in Singapore, contact PropNex's GCB and Prestige Landed department for buying opportunities and insights on the landed residential property market.

For more property research insights, join PropNex Friends today.

Read the latest PropNex Research report on the GCB and Prestige Landed homes market.