Exploring the Allure of Freehold Titles Among Singaporeans

In my previous article, we uncovered and addressed the prevailing conflict between choosing a freehold or leasehold property. If you haven't seen that article, I suggest you head over there to read it before reading this one.

Since the release of the article, it's clear that many of you continue to express a preference for freehold properties - a sentiment that seems to resonate deeply within the "Singaporean culture". In light of this, I'll be highlighting three crucial points about freehold properties that you should take note of.

1. Leaving a Lasting Legacy

Picture a scenario where a buyer invests in a new property, making a 25% down payment and securing a 20-year loan for the rest. If they opt to rent out the property, the rental income would cover the mortgage payments, with the buyer covering any shortfall. Once the loan is fully repaid over the 20-year period, the rental income would then transition into passive income for the buyer.

This strategic approach allows property investors to leverage tenant rent to cover mortgage payments. Once the property is fully paid off, the owner can enjoy limitless rental income. Furthermore, with the property being freehold, the opportunity exists to pass it down to future generations, ensuring ongoing monthly payouts.

2. Location is key

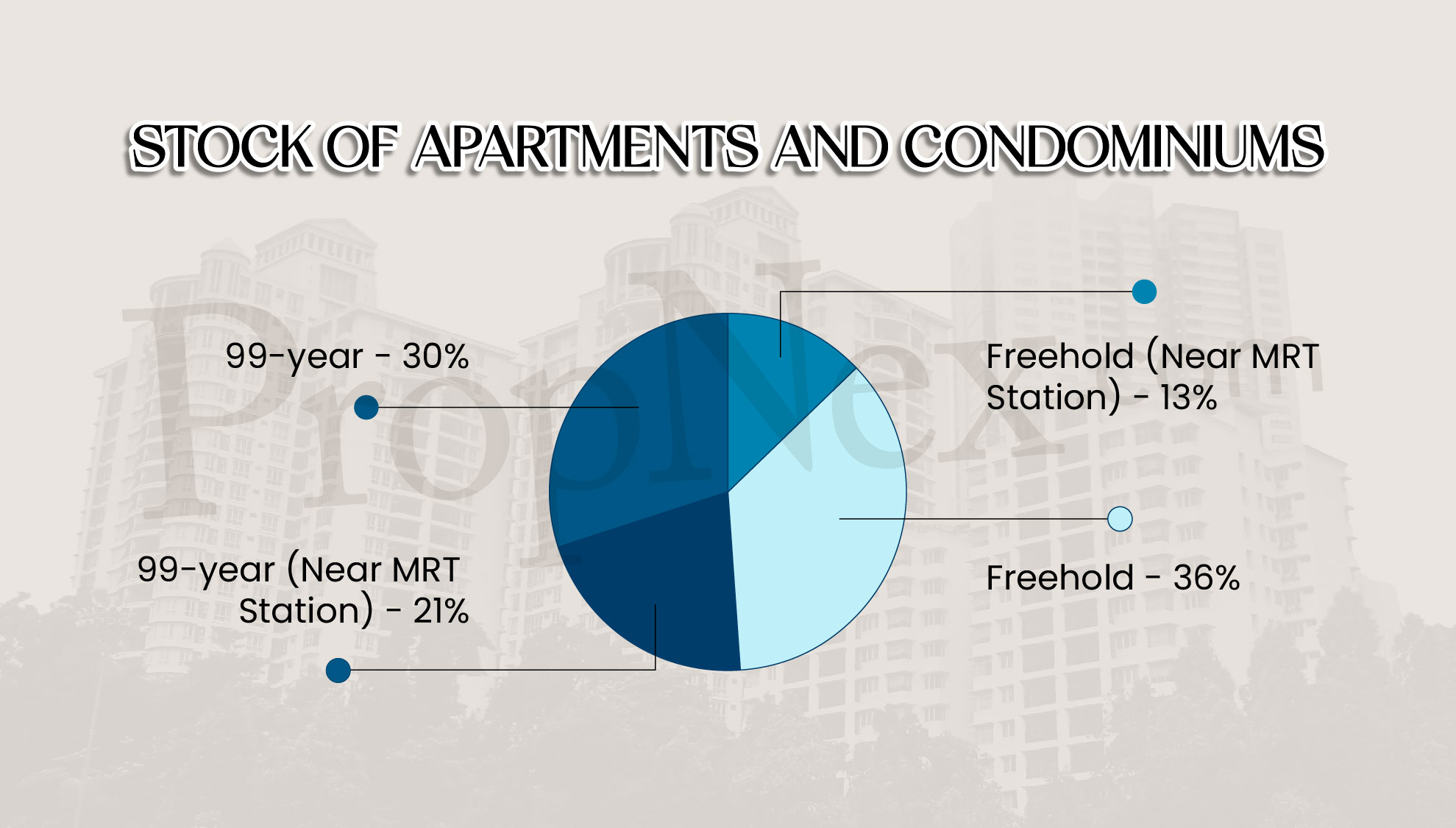

This is definitely something that many already know, going beyond the debate of freehold or leasehold, the price of a property is largely determined by its location. Developments that are near transportation nodes, especially an MRT station, are a huge advantage for residents. Freehold properties that are near an MRT station only make up 13% of the properties in Singapore. A freehold property that is near an MRT station always holds its value and may even appreciate over time - given its demand in both ownership and rental.

3. Near Reputable Schools

I suppose this is an important factor for most parents, trying to get their kids into reputable schools, feels like you're giving them a better head start in life. Some parents would go to the extent of moving house just to secure a spot for their children in their dream schools. Let's take a look at a freehold development, 8 Eden Grove, which is within 1km of two such reputable schools.

Just by looking at the top 20 most profitable transactions, we can see that people make as much as close to $900,000 holding the property for just slightly more than 13 years.

Won't everyone want to own properties like these? A property that appreciates nicely over time and with a freehold status that can be passed onto the next generation.

But then again with every successful property investor, there's also ones that make a loss over their purchase. So the important thing is still to consult with a professional when it comes to making such moves. The data above provided in this article is powered by our proprietary app Investment Suite. Should you need help in any property analysis, do hit us up to see how our data can help you make discerning choices in your next property move.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.