Strategic Departures: Unveiling the Art of Exit Strategies

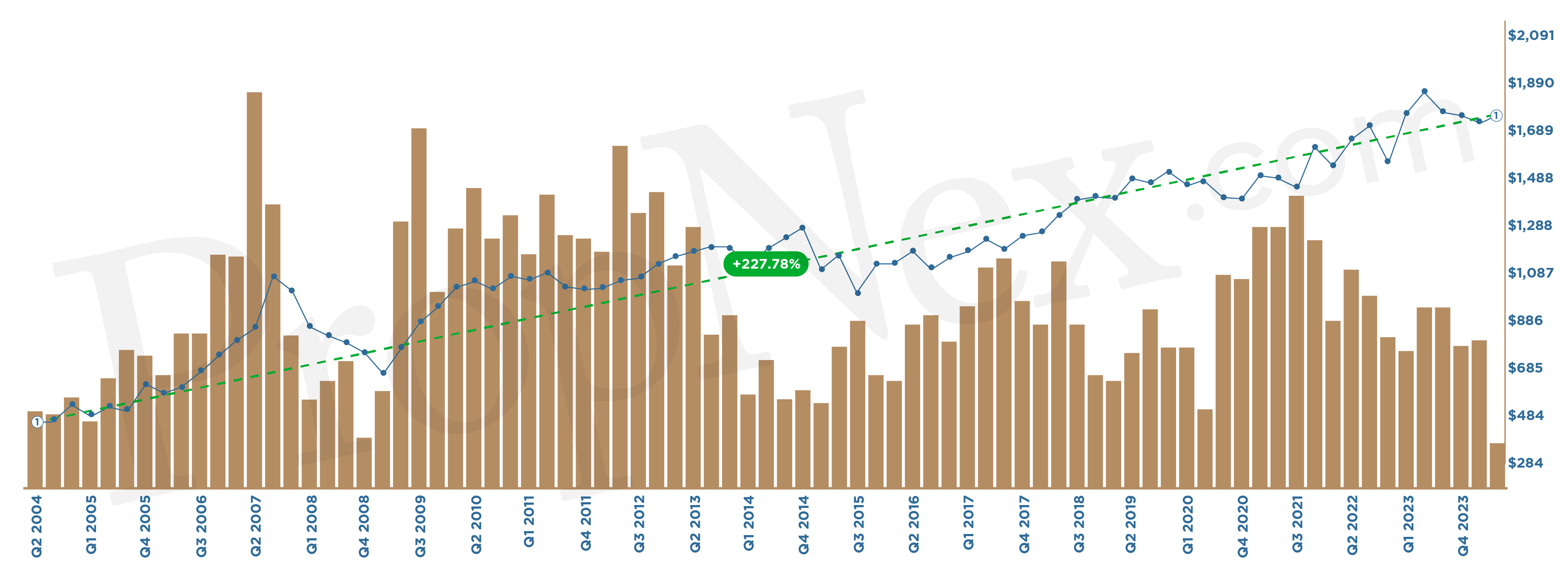

It is a privilege to be living in Singapore or even own a property here because our real estate market is one of the most robust and resilient markets in the world, and more than ever we don't usually see red with our property purchases. Looking at the private property market (without ECs & landed) over the span of the last 20 years, we see an increase of a whopping 277.8%.

Average price of private property market (without ECs & landed) over 20 years

However, I am pretty sure that this might not be a common notion to many, but every property, be it for own-stay or investment, should be bought with an exit strategy in place. Fact is, if you fail to make plans for your property purchase, chances are, you are potentially setting yourself up for failure.

As the saying goes, "You enter strong and you exit strong", in an ideal world we would love to buy a property for the lowest cost possible and sell it for the highest possible price. But is getting a property at the lowest possible price a guaranteed win for you in terms of making profits? This might not be necessarily true if you don't have an exit strategy, you are not even sure what important milestones to look out for or actions you need to take. Most people are just purely blindsided by mere gains without planning for a post-sale strategy or a fail safe backup plan if the value of your property goes south.

Before jumping into some common exit strategies, there are some points to establish especially for those who are new to Singapore's real estate. There are some policies pertaining to selling off your properties that you would have to take into consideration of:

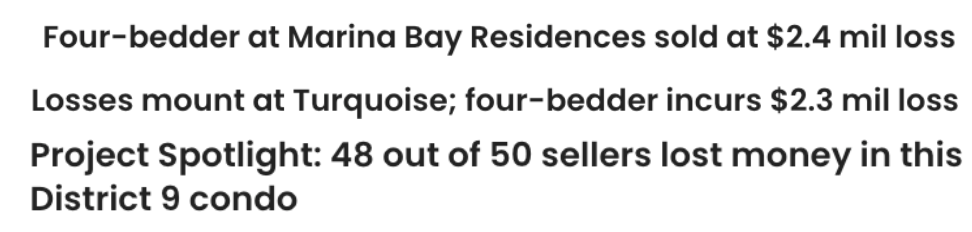

Seller's Stamp Duty (SSD)

Sellers are required to pay duty for the sale of private residential properties if it is disposed of during its holding period.The first cooling measure ever implemented in 2010, continue reading below to see its implications to formulating an exit strategy. Here's a table for reference:

SSD is one of three stamp duties in Singapore, head over here to read more about the other stamp duties.

Minimum Occupancy Period (MOP)

Applied to only HDBs and ECs, homeowners of these property types will have to occupy and live in their homes for at least five years before being allowed to sell them.

Types of Exit Strategy

Jumping straight into the crux of the topics, there are FOUR main exit strategies for property buyers in Singapore.

The Flipper

Once prevalent in earlier times, this approach involved identifying undervalued homes, renovating them, and swiftly reselling for profit. However, in today's landscape governed by SSD and MOP regulations, executing such a strategy has become considerably more challenging. Now, success in this realm necessitates a longer-term perspective and investment horizon.

The Asset Builder

For these homeowners, the primary focus is always on "upgrading". Whether starting with an HDB, EC, or private property, their goal remains consistent: enhancing the value of their assets through strategic upgrades. Typically, they hold onto properties for shorter periods, continually seeking opportunities for higher returns and capital appreciation. Their strategy revolves around identifying properties with favourable entry prices and strong potential for appreciation, crucial for funding their progression to larger, more valuable homes.

Lord of the Land

The game of being a landlord and finding tenants for your property has been a popular mode of passive income for many real estate investors. This is a long-term strategy that guarantees you passive income once the mortgage has been paid off. But the good thing about such a model is that your monthly mortgages can be defrayed by the rental coming in monthly, ideally if the rental covers your mortgage fully.

But little did many know, this would be best executed at the last part of your property journey when you want to take things slow and receive passive income. While we are able to work, we should ideally be building and accumulating capital. With our capital snowballed, it would be way more effective being a landlord at that point. It's a tested and proven framework taught at our Property Wealth System Masterclass.

Appreciating the Capital

The capital-appreciating method is one that is popular amongst the savvy homebuyers. In a nutshell, this entails finding a property with a safe entry price and waiting for the price to increase with different developments and transformations in the region.

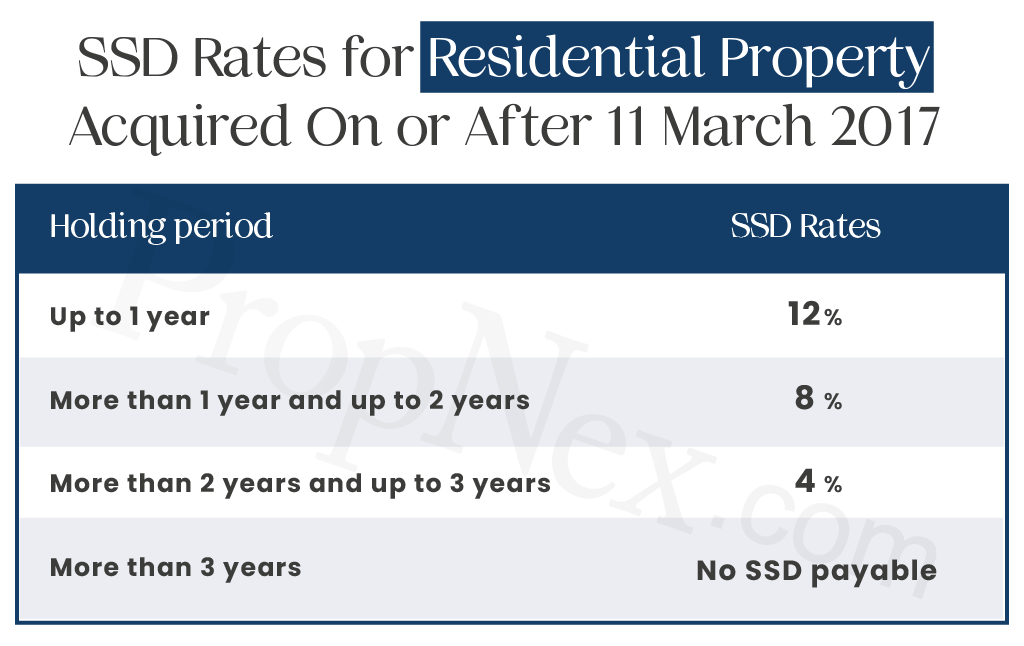

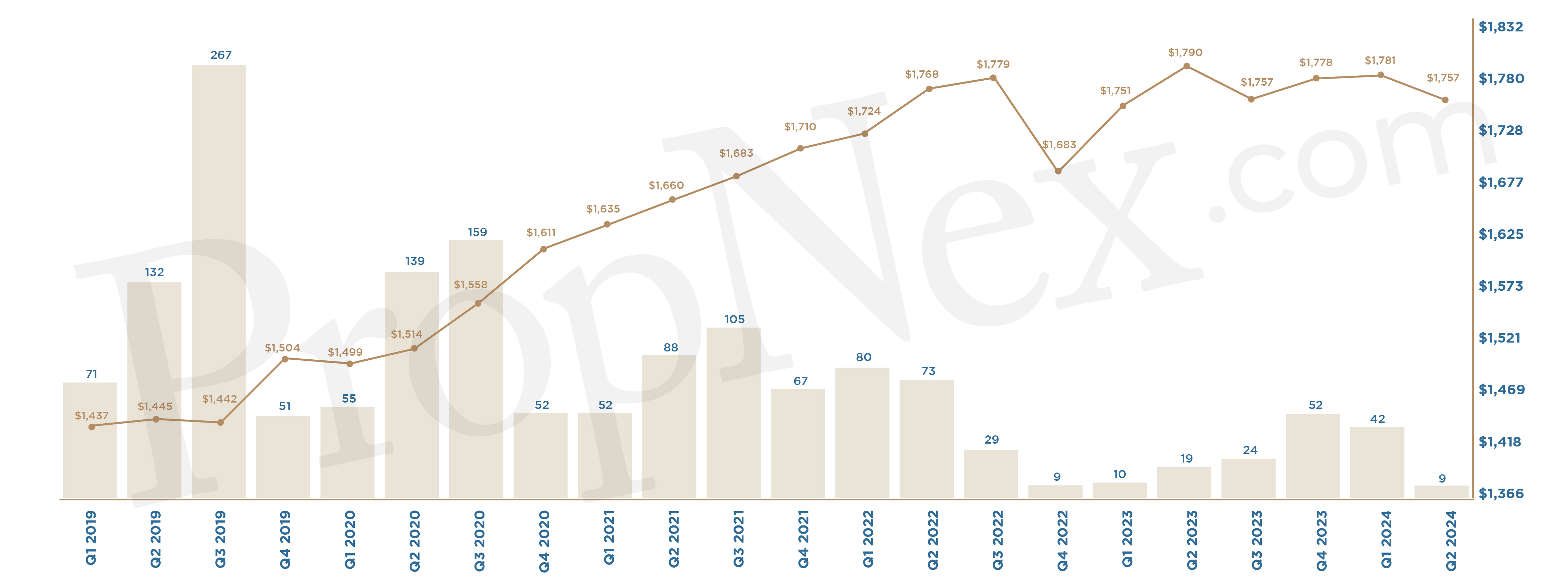

A good example is The Florence Residences with its growth trajectory. The Florence Residences launched amidst market uncertainties, coming out of the backdrop of a then-recent cooling measure, high interest rate climate, only 54 units were sold on the day of launch - despite developers selling it at a breakeven price.

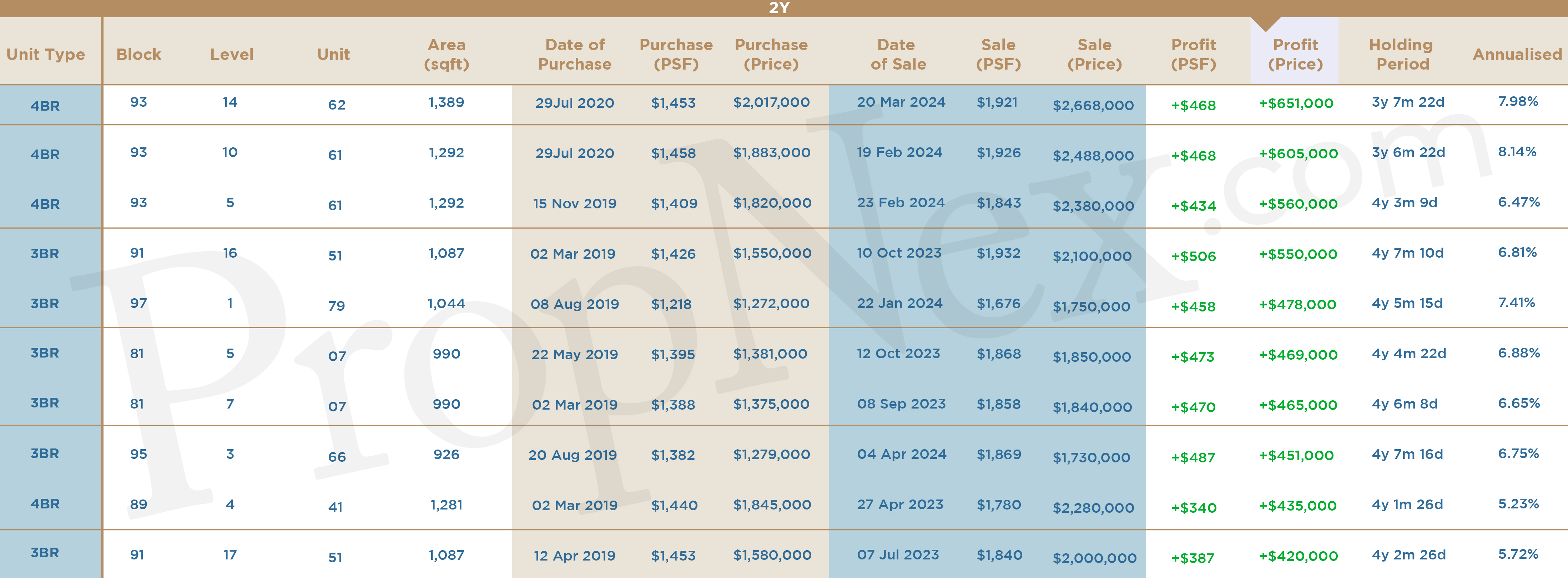

Of course, this didn't deter the savvy buyers who saw the upside of this project, with the highest profits standing at more than $650,000. Below are the top 10 most profitable transactions at The Florence Residences till date (1 May 2024).

An additional catalyst for development was the revelation that Hougang MRT station would become an interchange as part of the Cross Island Line (CRL), transforming the single-line station into a pivotal transit hub. This upgrade facilitates seamless connections to key districts such as Changi, Punggol, and Jurong, enhancing accessibility for residents. Coinciding with residents of neighbouring BTOs in Hougang and Buangkok reaching their MOP and realising significant profits, the timing was opportune for residents of The Florence Residences to capitalise on the heightened demand and strategically exit their properties.

Which exit strategy is best for you?

This boils down to your financial capabilities and ultimately your goals in life. Do you want an early retirement? Do you want passive income? There are still many factors to consider when choosing the best exit strategy for your property journey. Just like the example of savvy buyers spotting great value properties like The Florence Residences, you must also learn the art of finding such properties, which we would cover in another article soon!

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.