HDB Resale Volume Rebounded In July; Million-Dollar Resale Flats Set New High

The HDB resale flat volume rebounded in July, overturning two straight months of decline in resale market activity. The number of resale flat deals in July 2025 was the highest in 11 months, ever since the reduction in the loan-to-value (LTV) limit for HDB home loans to 75% in late-August 2024.

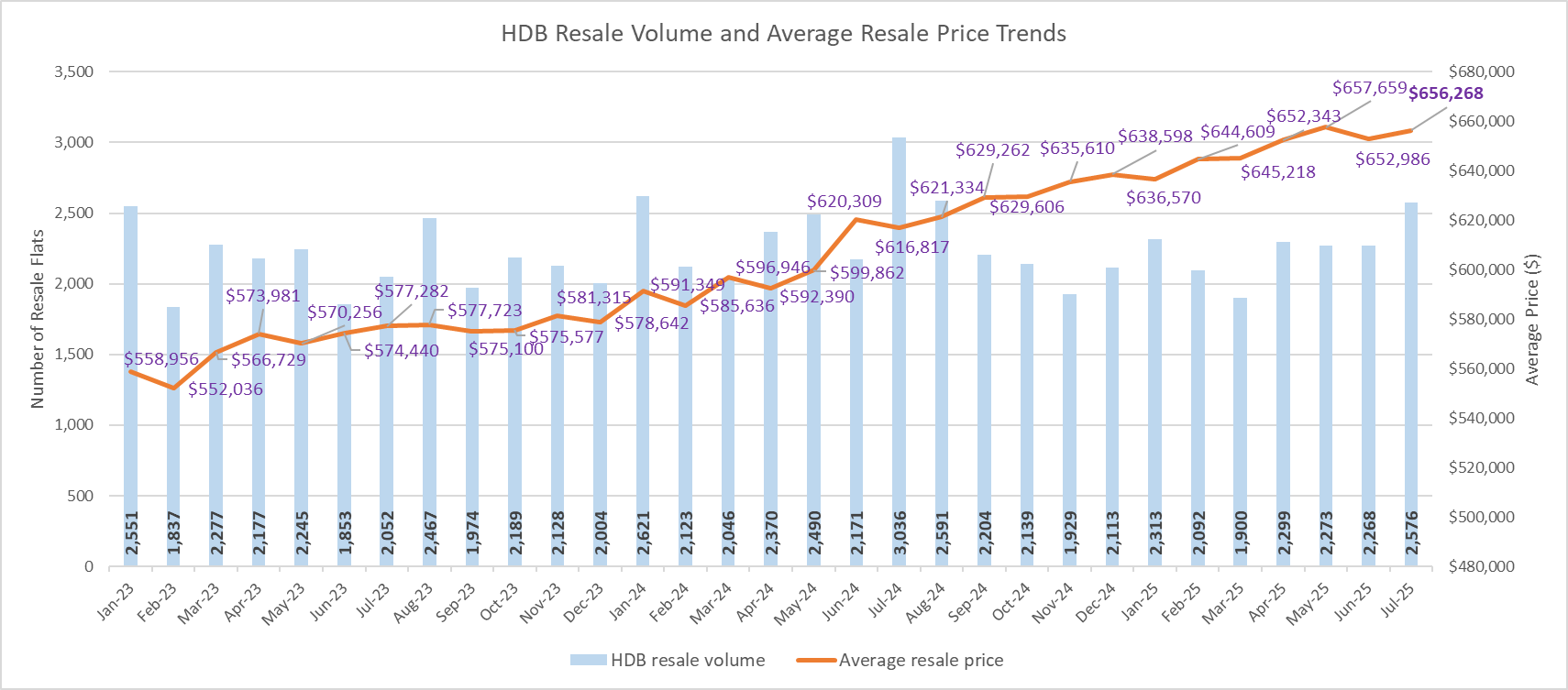

Based on transaction data, 2,576 resale flats were sold in July 2025 - up by 13.6% from the 2,268 units transacted in the previous month (see Chart 1). The most popular towns which led sales in July were Sengkang, Punggol, Yishun and Tampines. However, on a year-on-year basis, the resale volume was down by about 15% from July 2024.

It appears that the HDB's Build-to-Order (BTO) exercise in July has not dampened the interest in the resale flat segment. In July 2025, HDB has rolled out over 5,500 BTO flats in Bukit Merah, Bukit Panjang, Clementi, Sembawang, Tampines, Toa Payoh, and Woodlands. In addition, it also offered more than 4,600 balance flats for sale during the month.

Chart 1: HDB resale volume and average resale price

In tandem with the recovery in sales activity, the average price of HDB resale flats held up in July, inching up by 0.5% to over $656,000 from about $653,000 in June (see Chart 1). The month-on-month price increase in July had reversed the slight dip in the average resale price in the previous month. Moving forward, resale flat prices are expected to see moderate gains amid price resistance among buyers, prevailing cooling measures, and completing supply of BTO and SBF flats which have shorter completion times, or are already completed in the case of some balance flats.

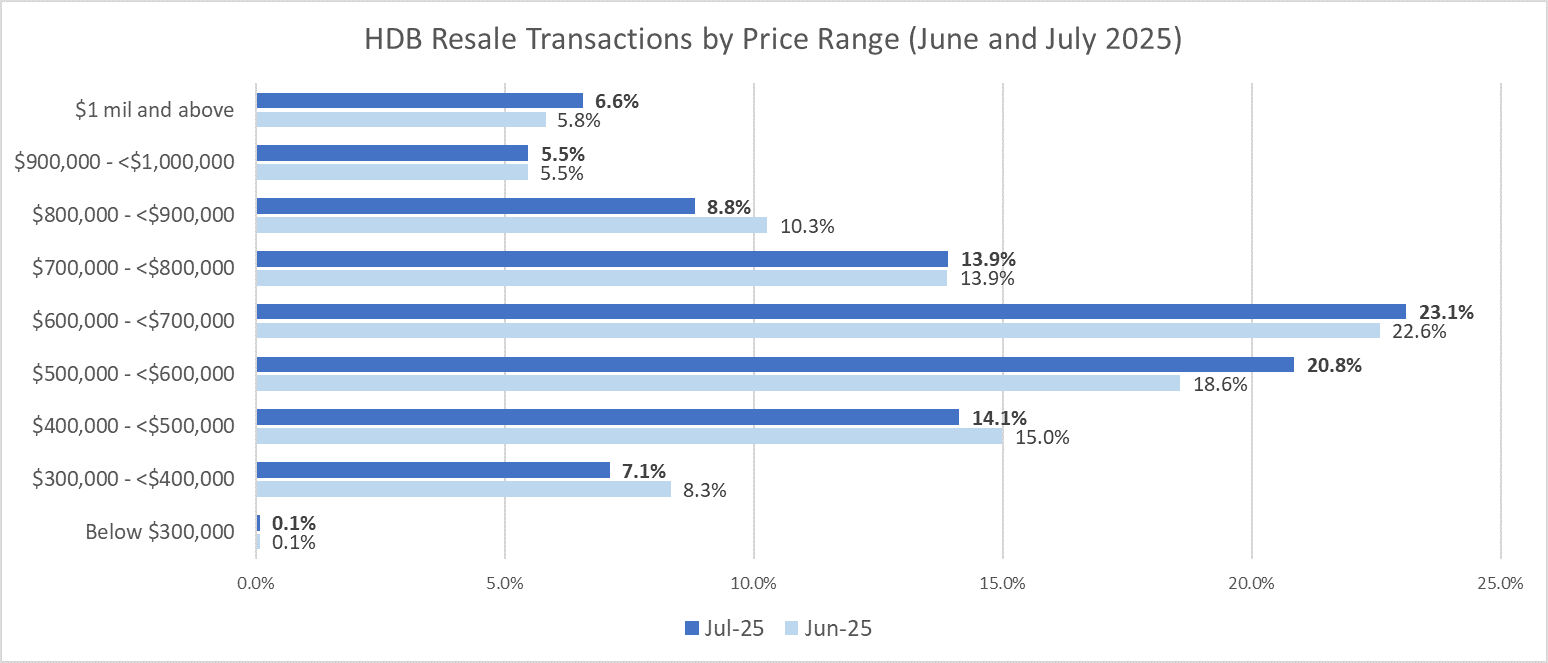

According to the sales data, about 21.3% of the resale flats sold were priced at below $500,000 in July 2025, compared with 23.4% in the previous month. Meanwhile, about 43.9% of the transactions fetched between $500,000 and $700,000 each in July - higher than 41.1% in June. The proportion of flats resold at $700,000 to just under $1 million was 28.2% in July, down from 29.6% in June. However, the million-dollar resale flats made up 6.6% of the transactions in July, compared with 5.8% in the previous month (see Chart 2).

Chart 2: HDB resale flat transactions by price range

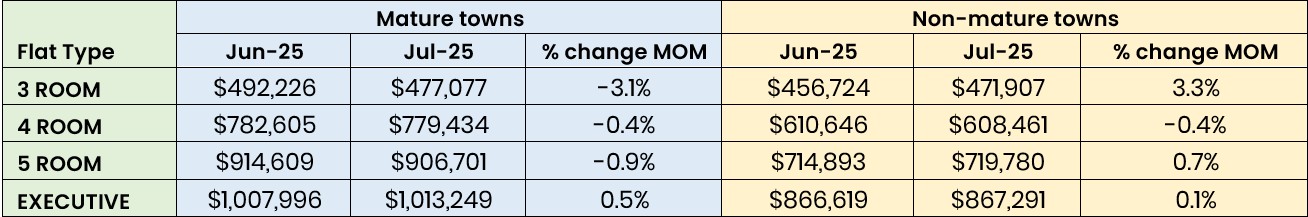

By flat type and town classification, sales data showed price declines for several flat types, particularly in mature estates where the average resale price of 3- to 5-room flats all posted MOM declines. Of note, 3-room flats in mature towns saw the average resale price fall by 3.1% MOM in July (see Table 1). Meanwhile, prices in non-mature towns were mostly up, with the exception of 4-room flat which saw a 0.4% MOM fall in the average resale price.

Table 1: Average HDB resale flat prices by flat type, by town classification

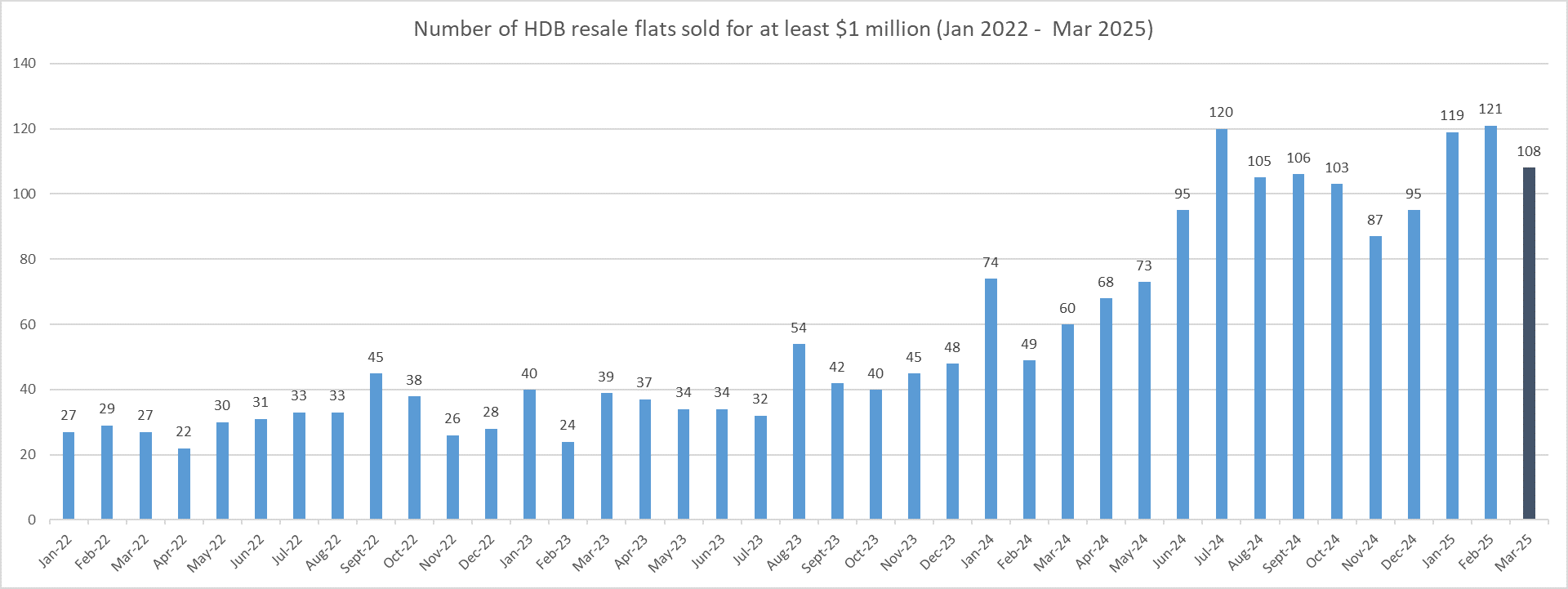

The demand for well-located resale flats with sought-after attributes, and larger units that are limited in supply remains healthy. In July 2025, the number of HDB resale flats transacted for at least $1 million touched a new monthly high at 169 units - smashing the record 142 units resold in May 2025 (see Chart 3). This takes the total number of such flats sold in the first seven months of the year to 932 units, on track to beating the all-time high of 1,035 units of million-dollar flats transacted in the whole of 2024 by possibly end-August.

Some possible reasons why the number of million-dollar resale flats has remained elevated include stable demand for such units from buyers including, former private home owners who are entering to purchase such flats after completing their 15-month wait-out period, Singapore PR families who are eligible to buy resale flats, and buyers who like the unique attributes of such HDB flats (e.g. located near the city, or a unit on very higher floor etc.).

Furthermore, such attractive flats may also appeal to HDB upgraders who desire to move to another flat in a better location or a more spacious home. Like for like, such resale flats are also more affordability priced than a private condo of the same size in the same location.

For sellers of million-dollar flats, they may seek to re-channel the proceeds from the sale to purchase a private home, particularly with more attractive new launches coming up. By first selling their flat, these households will avoid having to pay the additional buyer's stamp duty (ABSD) when they buy a private home later.

Chart 3: Number of HDB flats resold for at least $1 million by month

The 169 units of million-dollar flats resold in July comprised 76 units of 4-room flats, 50 units of 5-room flats, 42 executive flats and a multi-gen flat. In particular, the 76 units of million-dollar 4-room resale flats sold marked a new monthly high of such sales for the flat type.

Among the 169 units, 18 of the million-dollar flats (also a monthly high of such sales for non-mature estates) are located in non-mature towns Bukit Batok, Bukit Panjang, Hougang, Jurong East, Punggol, Sengkang, Woodlands, and Yishun. The estates with the highest number of such sales in July were Toa Payoh with 33 units, Bukit Merah with 19 units, and Kallang Whampoa with 17 transactions.

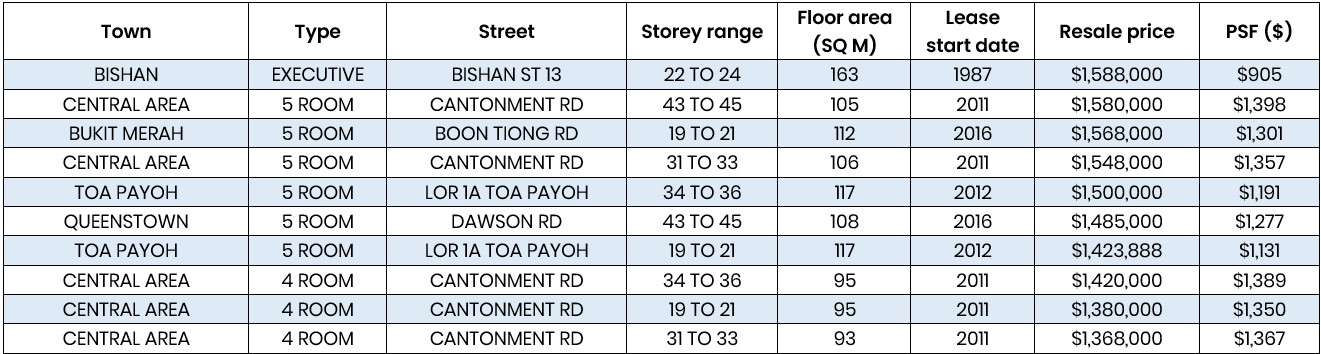

The priciest flat resold in July was a large 163-sq m executive flat (maisonette) in Bishan Street 13, a stone's throw from the Bishan MRT interchange station, bus interchange and the Junction 8 mall. The unit which is located between the 22nd and 24th storey fetched $1.588 million (see Table 2).

Table 2: Top 10 HDB resale flats sold in July 2025 by Transacted Price

Contact a PropNex salesperson to find out more about resale HDB market trends.