Government Keeps Foot On Pedal In Boosting Housing Land Supply In 1H 2025; Offering Three Executive Condo Plots On The Confirmed List

The government has kept up with efforts in boosting private housing land supply in the first half of 2025 (1H 2025) by offering 8,505 units on its upcoming Government Land Sales (GLS) programme under the Confirmed List and Reserve List.

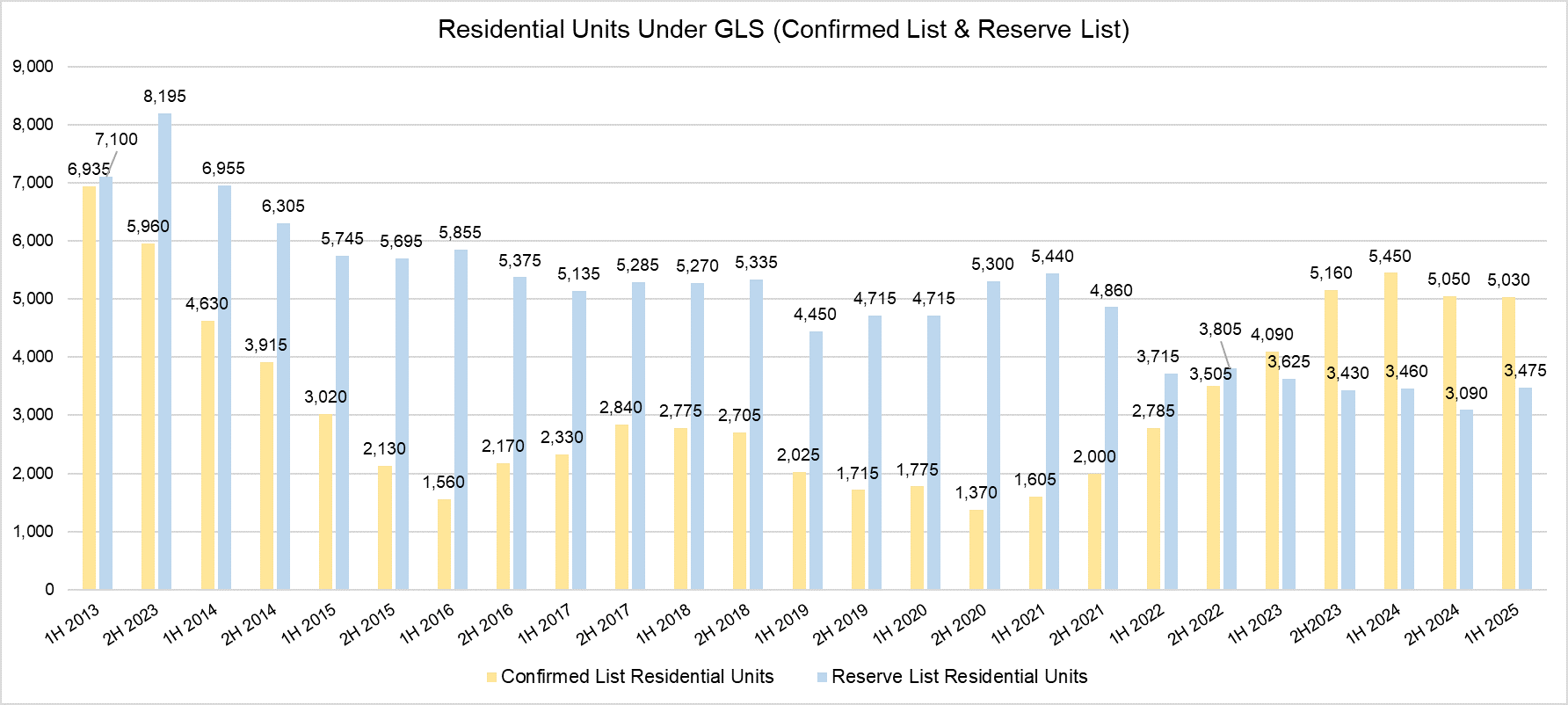

For the 1H 2025 GLS Confirmed List, it will offer 10 sites, comprising nine residential sites (including three executive condo (EC) plots), and one residential cum commercial site. All in, the 10 Confirmed List sites can yield an estimated 5,030 residential units (including 980 EC units) - relatively on par with the 5,050 units offered in the Confirmed List of the 2H 2024 GLS programme (see Chart 1).

Chart 1: Residential units offered under the GLS programme (CL and RL)

Source: PropNex Research, MND

In view of the stiff competition for EC sites among developers and rising EC land prices, PropNex notes that the government has ramped up the supply of executive condo (EC) sites, with three such plots - potentially yielding 980 EC units - parked under the Confirmed List in 1H 2025. This is a shift from previous GLS programmes since 2018, where only one EC site was offered in each of the half-yearly land sales programme. The last time that three EC plots were launched for sale in a single GLS programme was in 2H 2014, where EC sites in Sembawang Road/Canberra Link, Anchorvale Crescent, and Woodlands Avenue 12 had been placed for tender. In addition, in 1H 2014, the HDB launched four EC sites (two in Yishun, one each in Sembawang and Choa Chu Kang) for sale via the GLS.

Meanwhile, the government has placed another nine sites on the Reserve List of the 1H 2025 GLS slate which can be triggered for sale by developers should there be market demand for them. The Reserve List comprises four residential plots, one commercial site, three white sites, and a hotel site; they can collectively offer 3,475 residential units, 199,900 sq m gross floor area of commercial space, and 530 hotel rooms.

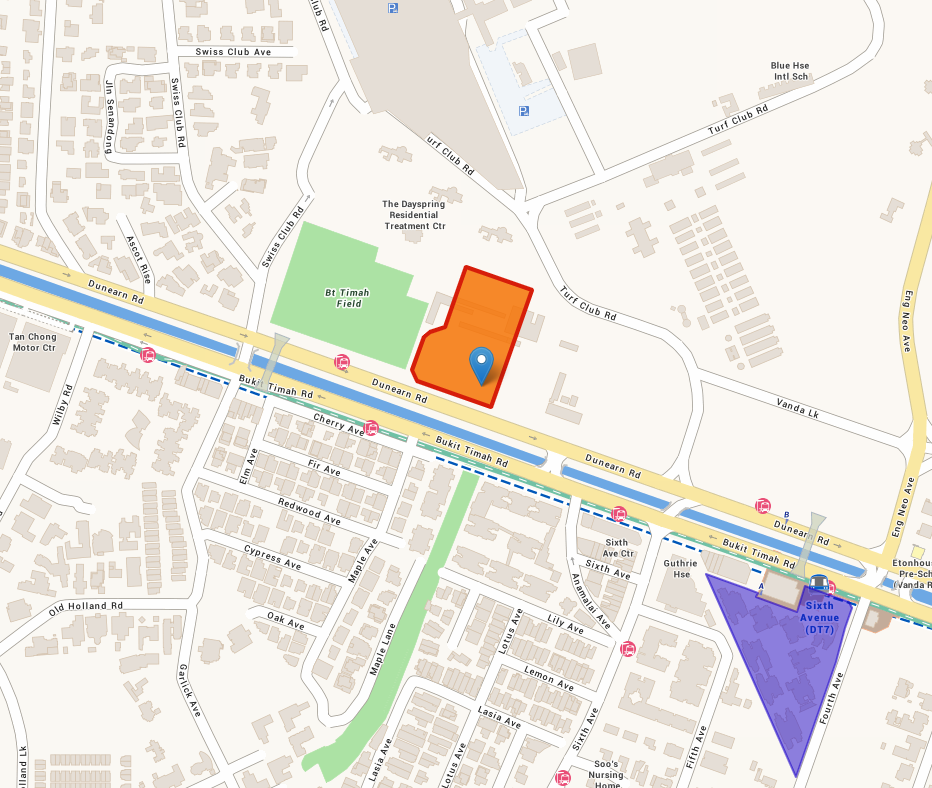

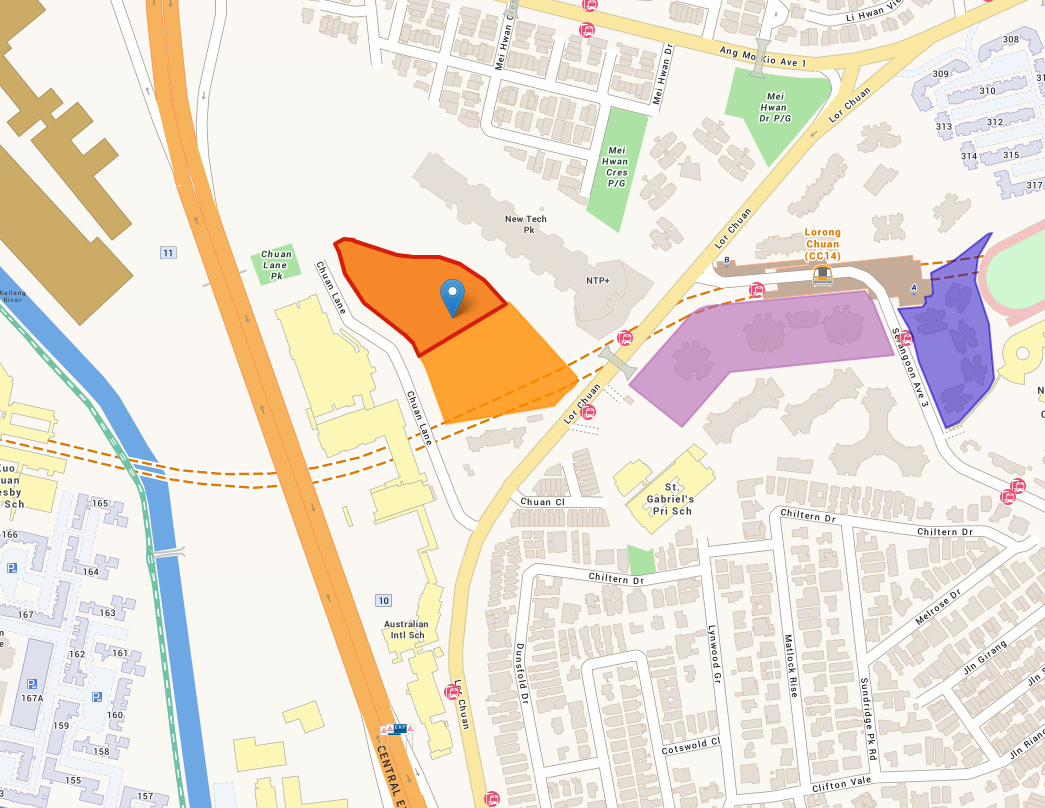

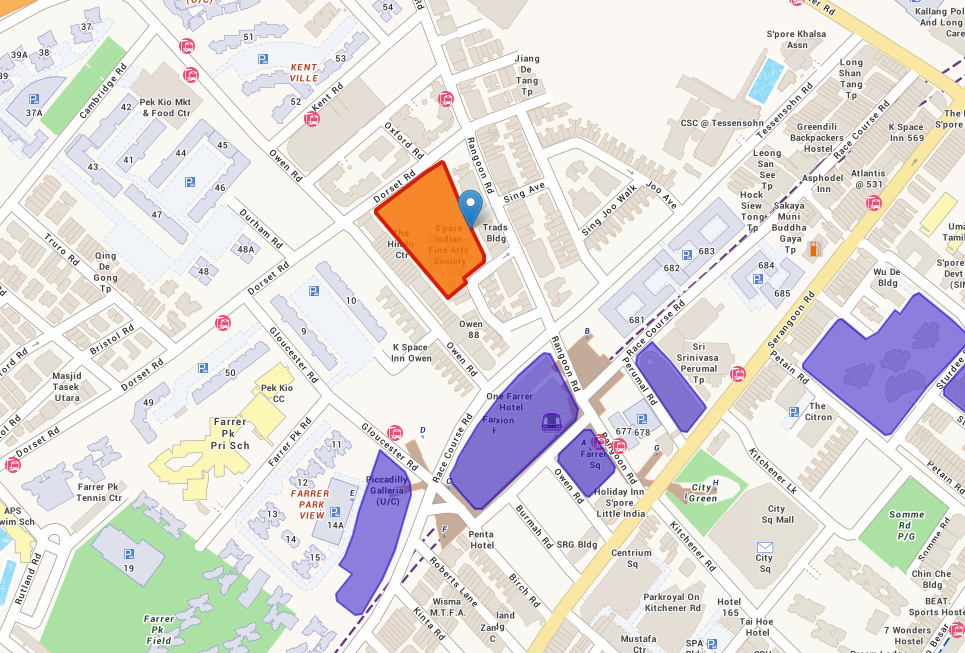

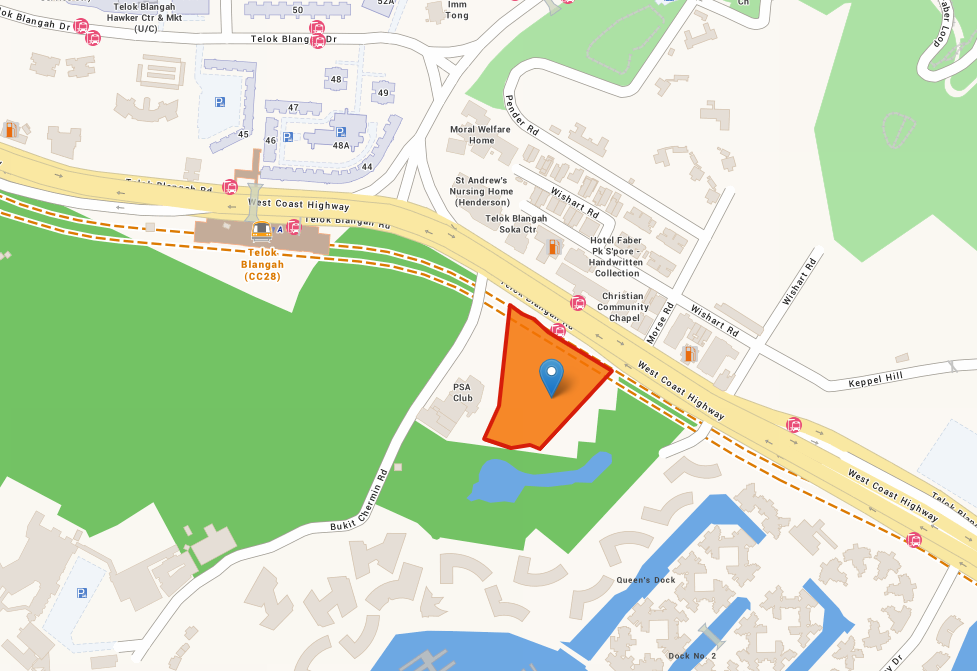

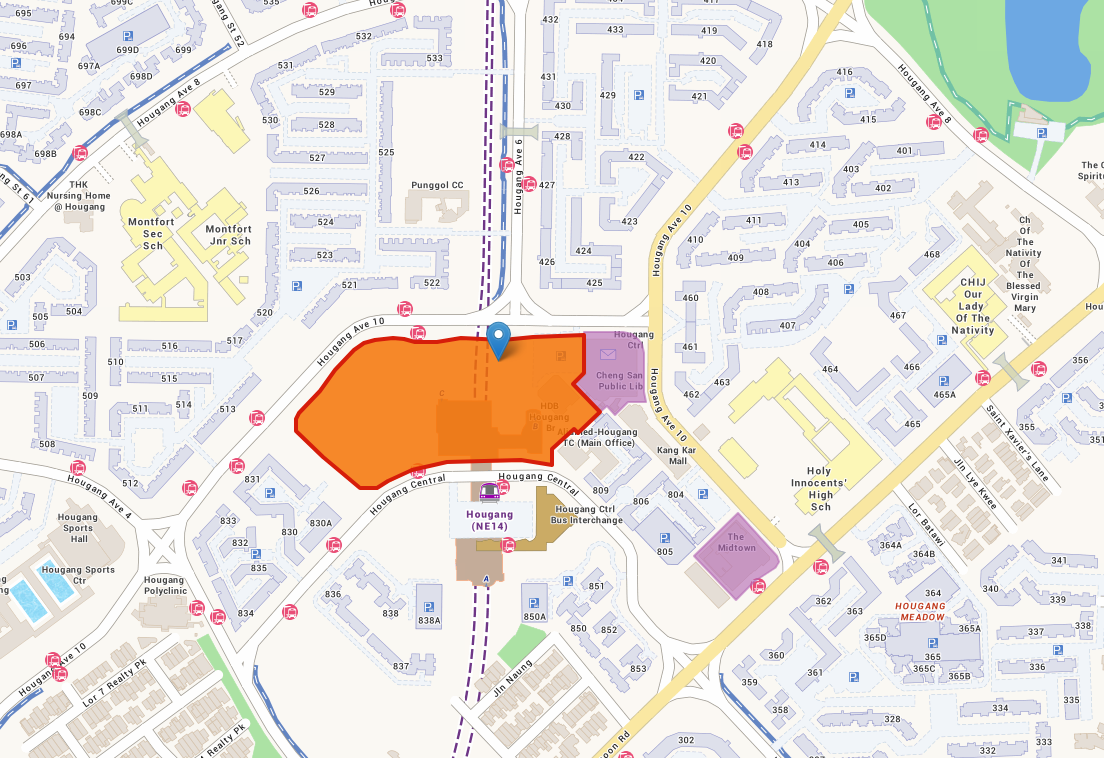

There are seven brand-new sites introduced to the GLS in 1H 2025, with all of them under the Confirmed List. The newly added plots are: Lakeside Drive; Dunearn Road; Chuan Grove; Sembawang Road (EC); Dorset Road; Telok Blangah Road; and Hougang Central. In particular, the Dunearn Road site is located in the new housing precinct in Bukit Timah Turf City, while the Telok Blangah plot is situated in the former Keppel Golf Course site.

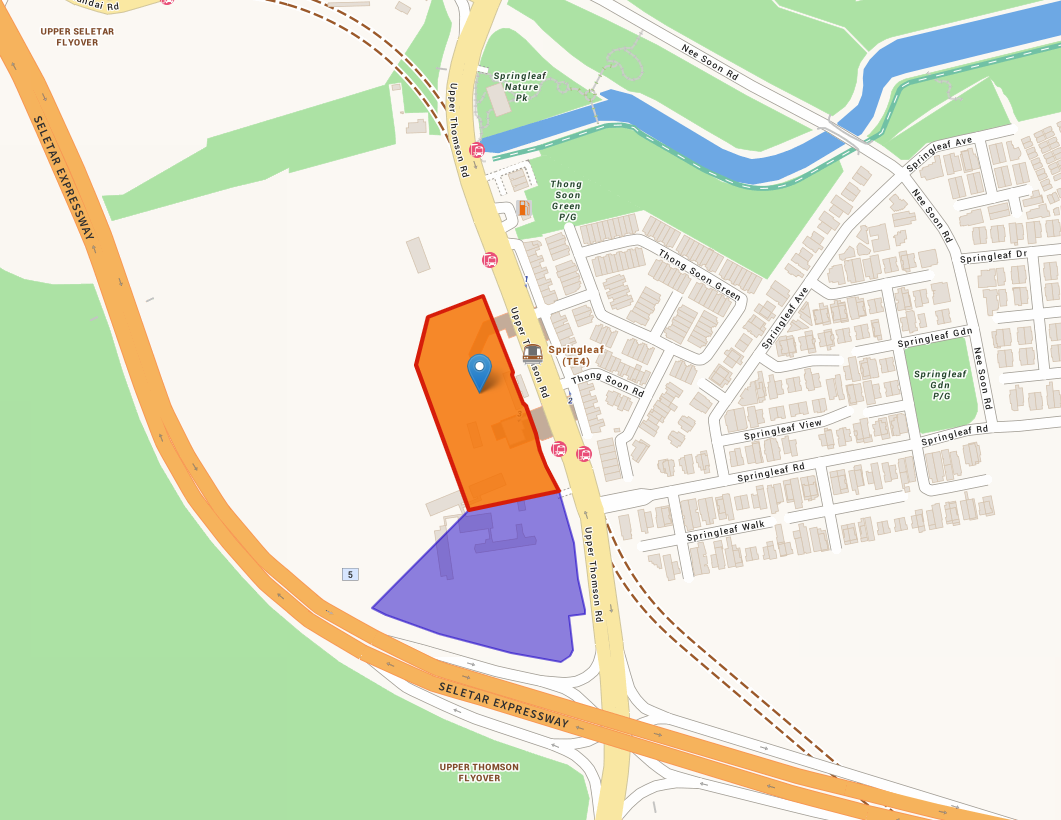

Also on the Confirmed List, is the residential plot in Upper Thomson Road (Parcel A) which saw no bids when its tender closed in June this year. Previously, the plot was to offer a mix of residential units and long-stay serviced apartments. Of note, the URA has provided more flexibility this time; it said that serviced apartment/long-stay serviced apartment use will not be mandated for the site but can be allowed subject to approval from technical agencies.

Several sites for which tender bids were rejected by the URA for being too low earlier this year have been listed on the Reserve List - they are the Jurong Lake District master developer site, and plots in Media Circle (for long-stay serviced apartment use) and Marina Gardens Crescent.

Mr Ismail Gafoor, CEO of PropNex said:

"In our view, the 1H 2025 land supply offers a good mix of sites both in the suburbs and also nearer to the city. Looking at the array of sites on the Confirmed List, it is clear that the government has its finger on the pulse of the market.

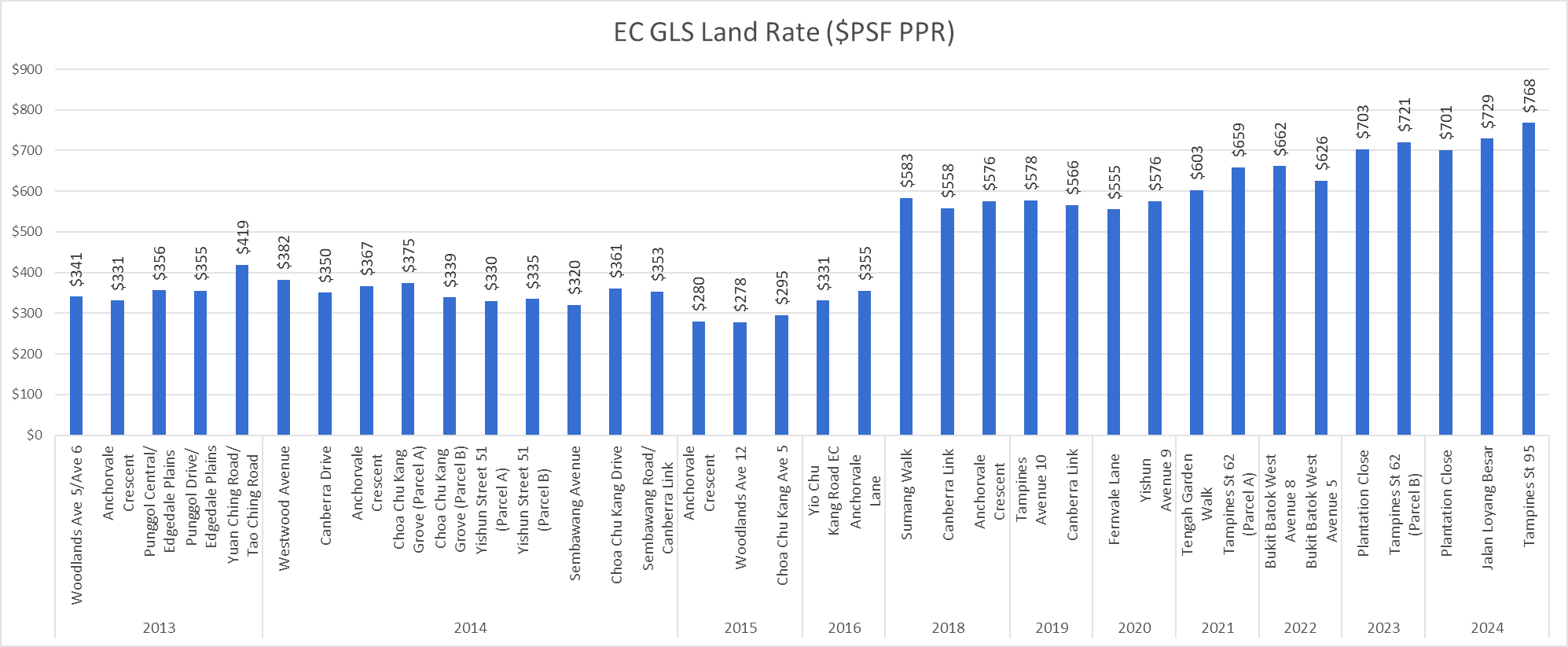

For instance, there has been strong demand for EC sites among developers, and PropNex has also advocated for the government to put out more EC land for tender, and we are heartened that three such plots are on the Confirmed List in 1H 2025. With ECs being a popular choice among eligible homebuyers, and EC projects generally enjoying healthy take-up, developers have been attracted to bid for such plots. A recent EC site in Tampines St. 95 was awarded for a record land rate of $768 psf ppr (see Chart 2). As EC land prices go up, the selling price to end-users will inevitably rise as well. Hence, by increase the EC land supply in 1H 2025, we hope that it will go some way to soothe the competition among developers in land tenders, and help to moderate EC land cost and prices accordingly.

The upcoming GLS offers many attractive sites and we think they will excite developers, who may be looking at replenishing their land inventory and development pipeline, in view of a positive turn in sentiment and uptick in home sales of late. In addition, the optimism around rate cuts and an improving economic outlook could support housing demand, and enhance developers' appetite for residential sites.

Chart 2: Land rates ($psf per plot ratio) for EC sites sold via GLS from 2013

Source: PropNex Research, HDB

It has been an unprecedented year where GLS tenders are concerned. For the first time, the URA had decided not to award the tender for three plots - Marina Gardens Crescent, Jurong Lake District master developer site, and Media Circle (SA2) - as the respective top bids were assessed to be too low. Meanwhile, a site in Upper Thomson Road (Parcel A) which has a long-stay serviced apartment (SA2) component drew no bids.

Given the revival in home buying sentiment, prospect of easing interest rates, and the paring down of unsold stock, we expect public land tenders could see more active participation in 1H 2025, particularly with a slate of exciting sites over a fairly good geographical spread, including in two new housing precincts in Bukit Timah Turf City and the former Keppel Golf Course site.

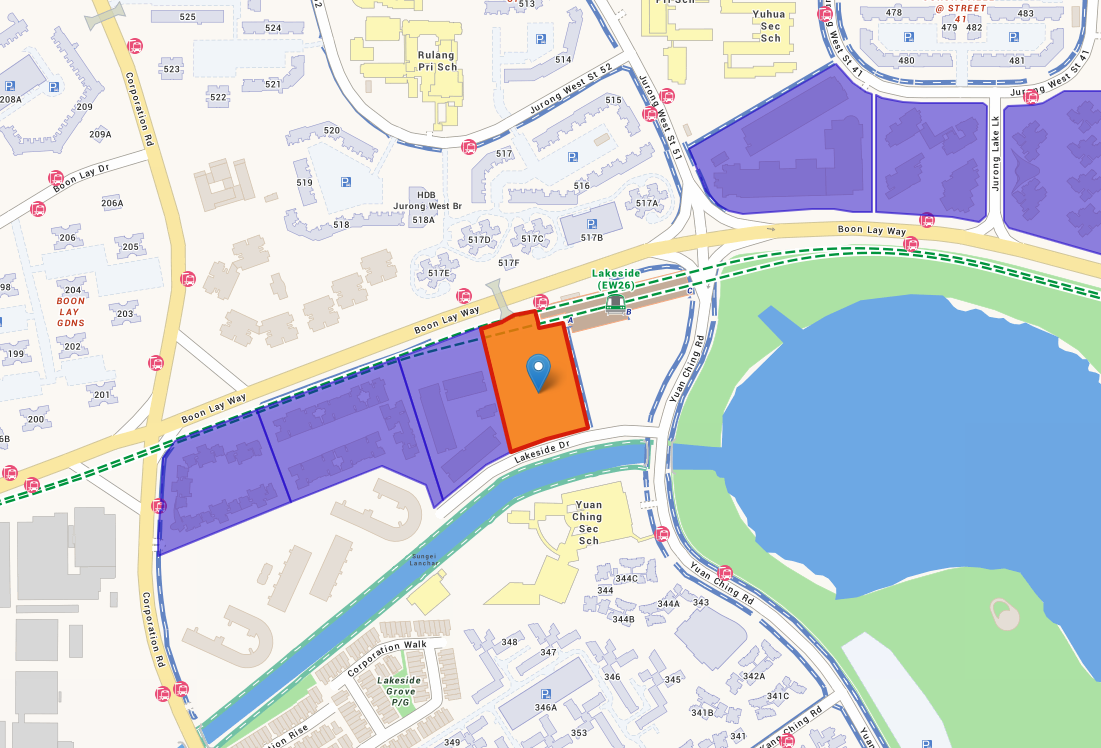

There are numerous well-located sites on the Confirmed List, with majority of them close to an MRT station, which would appeal to both developers and homebuyers alike. In our view, the most attractive ones are the mixed-use site in Hougang Central (835 units) that will be connected to the Hougang MRT station, the Telok Blangah Road plot (740 units) and Dunearn Road (370 units) site in new housing precincts, and within minutes' walk to the MRT station, as well as the Lakeside Drive site (575 units) which is right next to the Lakeside MRT station, and is near to Jurong Lake Gardens and the Jurong East commercial hub."

Table 1: Brief summary of Confirmed List sites 1H 2025

Site | Remarks |

Senja Close (EC) - 295 units |

|

Woodlands Drive 17 (EC) - 420 units |

|

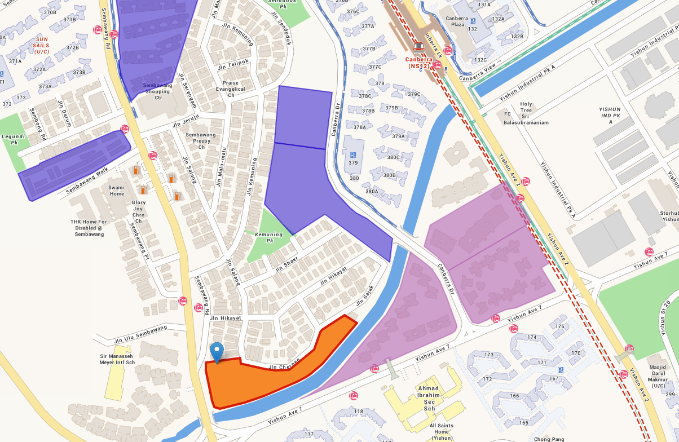

Sembawang Road (EC) - 265 units |

|

Lakeside Drive - 575 units |

|

Dunearn Road - 370 units |

|

Chuan Grove - 505 units |

|

Upper Thomson Road (Parcel A) - 595 units |

|

Dorset Road - 430 units |

|

Telok Blangah Road - 740 units |

|

Hougang Central - 835 units |

|

Suggested Reads

Upcoming Events

View moreYou may like

January's New Private Home Sales Signal Steady Start to 2026; Demand for New Executive Condominiums Holds Up

February 16, 2026

Growth In Private Home And HDB Resale Flat Prices Touched Multi-Year Low In 2025, While Housing Demand Stayed Resilient, Settling Into A Goldilocks Market

January 23, 2026

Propnex's Singapore Budget 2026 Wish List: Targeted Policy Recalibration To Further Promote Market Stability, Improve Affordability, And to Encourage Urban Renewal

January 06, 2026