Two-Speed Housing Market As Private Home Prices Saw Slower Growth, While HDB Resale Flat Prices Climbed At A Faster Clip In Q2 2024

26 July 2024, Singapore - A two-speed housing market persisted in Q2 2024 as the growth momentum in private home prices continued to slow, while HDB resale flat prices climbed at a faster clip over the previous quarter. The limited number of new launches, and prevailing cooling measures have combined to put a drag on the private residential segment, particularly in the new private home sales market. Meanwhile, the healthy demand for HDB resale flats has helped to prop up prices in the public housing resale market during the quarter.

Private home sales

In the private homes market, the resale segment shone in Q2 2024, posting 3,802 transactions - the highest in eight quarters, since 4,236 units were resold in Q2 2022. Of note, resale private homes made up 77.4% of the overall private residential transactions (including new sales, resale, and sub-sales) during the quarter, which is the largest proportion on record since 1996. The pick-up in the resale volume can be attributed to several factors, including limited suitable new project launches, and the sizable price gap between new and resale private homes which had steered more buyers to the secondary market. All in, 6,491 resale private homes were sold in 1H 2024, marking a recovery from the two halves of 2023, where 5,598 units (1H) and 5,731 (2H) units were resold.

Meanwhile, new private home sales (ex. EC) came in at 725 units in Q2 2024, representing the lowest developers' sales on a quarterly basis since 690 units were shifted in Q4 2022. This took new private home sales to 1,889 units in 1H 2024 - which is a record low half-yearly sales tally, lower than the 1,977 units sold in 2H 2008 amid the global financial crisis. The pullback in new home sales was largely due to fewer launches, with developers placing 634 new units for sale in Q2 2024, compared with 1,304 units (ex. EC) in Q1 2024.

As at end of Q2 2024, there were 20,566 uncompleted unsold units (ex. EC) in the supply pipeline, compared with 19,936 units (ex. EC) in the previous quarter. The Urban Redevelopment Authority (URA) noted that 3,339 private homes (including EC) were completed in Q2 2024.

Q2 2024 URA Private Residential Property Index

Figures from the URA showed that overall private home prices rose by 0.9% QOQ in Q2 2024 - slowing from the 1.4% QOQ increase in Q1 2024 (see Table 1). This final print is lower than the flash estimates of a 1.1% growth announced earlier this month. Factoring in Q2's price increase, overall private home prices have risen by 2.3% cumulatively in the first half of 2024. For the full-year 2024, PropNex expects private home prices to grow by 4% to 5% - slowing from the 6.8% growth in 2023.

Table 1: URA Private Property Price Index (PPI)

Price Indices | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q4 2023 | Q1 2024

| Q2 2024

|

(QOQ % Change) | (YOY % Change) | (QOQ % Change) | |||||

Overall PPI | 3.3 | -0.2 | 0.8 | 2.8 | 6.8 | 1.4 | 0.9 |

Landed | 5.9 | 1.1 | -3.6 | 4.6 | 8.0 | 2.6 | 1.9 |

Non-Landed | 2.6 | -0.6 | 2.2 | 2.3 | 6.6 | 1.0 | 0.6 |

| 0.8 | -0.1 | -2.7 | 3.9 | 1.9 | 3.4 | -0.3 |

| 4.4 | -2.5 | 2.1 | -0.8 | 3.1 | 0.3 | 1.6 |

| 1.9 | 1.2 | 5.5 | 4.5 | 13.7 | 0.2 | 0.2 |

Both landed private homes and non-landed private homes segments posted QOQ price growth, with the former reflecting a higher rate of increase at 1.9% QOQ, while non-landed residential properties achieved a slender 0.6% QOQ growth in Q2 2024. Over 1H 2024, landed private home prices have risen by 4.5%, while that of non-landed homes climbed by 1.6% QOQ cumulatively in the same period.

Within the non-landed homes segment, prices in the Core Central Region (CCR) dipped by 0.3% QOQ in Q2 2024, after the CCR PPI rose by 3.4% QOQ, and had reached a peak in then. In contrast, private home prices climbed in the Rest of Central Region (RCR) and the Outside Central Region (OCR) by 1.6% QOQ and 0.2% QOQ in Q2 2024 - extending the price increase from the previous quarter.

Meanwhile, landed private homes enjoyed increased sales across all segments - detached, semi-detached, and terrace house - which have helped to prop up prices. As per caveats lodged, there were 494 landed home transactions in Q2 2024, up by nearly 31% from 378 deals in Q1 2024.

Private home leasing

Over in the private home leasing market, rentals continued to moderate for the third straight quarter, despite a slight increase in the number of rental contracts lodged. Based on URA Realis data, there were 20,326 residential (private landed and non-landed) rental contracts in Q2 2024 - up by 1.7% from 19,981 contracts in the previous quarter. However, this has not stemmed the rental decline. In Q2 2024, private home rentals dipped by 0.8% QOQ in Q2 2024, following a decline of 1.9% in Q1 2024. In the first half of 2024, private home rentals have fallen by a cumulative 2.7%, as the influx of rental stock from strong completions in 2023 exerted downward pressure on rents.

Mr Ismail Gafoor, CEO of PropNex Realty:

"The pace of growth of private home prices has been flattening in the recent quarters, partly due to the lack of new launches and weaker new home sales - a segment that tended to pull up overall prices. Outside of new home sales, the private resale segment is actually performing well. In Q2, the resale segment accounted for a record high of 77.4% of the overall private housing transactions. We expect the resale market to drive private home sales this year, and project that about 12,000 to 13,000 resale private homes could be transacted in the whole of 2024.

A dearth of suitable new units due to limited project launches, and the price gap between new and resale private homes have channeled buyers to the secondary market, contributing to a strong 41% QOQ gain in resale transactions from 2,689 units resold in Q1 2024 to 3,802 units in Q2 2024. Generally, the still sizable price gap between new and resale private homes has helped to put the wind in the sails of the resale market, amidst the cautious sentiment and buyers remaining very price sensitive. For instance, the median transacted price gap between non-landed new private homes (ex. EC) and non-landed private resale grew to 39.7% in Q2 2024 compared with 22.5% in Q1 2024 (see Table 2). Therefore, prospective buyers with a less generous housing budget will likely seek buying options in the resale market.

Table 2: Median transacted price of non-landed private homes (ex. EC) by type of sale, by quarter, and price gap (%)

Quarter | Non-landed New Sale (ex. EC) | Non-landed Resale (ex. EC) | Price gap |

2023Q1 | $2,029,000 | $1,480,000 | 37.1% |

2023Q2 | $1,964,479 | $1,480,000 | 32.7% |

2023Q3 | $1,894,000 | $1,500,000 | 26.3% |

2023Q4 | $2,157,500 | $1,525,000 | 41.5% |

2024Q1 | $1,960,000 | $1,600,000 | 22.5% |

2024Q2 | $2,221,300 | $1,590,000 | 39.7% |

We expect price quantum and value proposition of the property to remain front and centre of buyers' decision-making process, including in the primary market. For example, freehold development Kassia - which was launched in July - garnered a healthy 52% take-up rate at launch, helped by its attractive pricing where the bulk of the units were sold at a price range of just over $880,000 to around $1.6 million.

In Q2 2024, developers sold 725 new private homes (ex. EC), and a combined 1,889 units in 1H 2024. We expect new home sales could pick up in the second half of 2024 as more new projects are expected to be launched. For the full-year 2024, we project that developers' sales could come in at around 5,500 to 6,000 units (ex. EC), while overall private home prices could climb by 4% to 5% in 2024.

A number of factors could be supportive of the private residential market in the second half of the year. They include stablising home prices, more new launches, potential pent-up demand due to the softer sales we have witnessed of late, as well as the prospect of rate cuts - at least one, possibly two, according to some economists - by the US Federal Reserve, which will have an impact on borrowing costs and help to improve affordability."

Q2 2024 HDB Resale Price Index

Meanwhile, data released by the Housing and Development Board (HDB) showed that prices of resale flats grew at a faster pace in Q2 2024, rising by 2.3% QOQ following the 1.8% QOQ growth in the previous quarter (See Table 3). The final print is higher than the flash estimates of a 2.1% QOQ increase.

Table 3: HDB Resale Price Index

Quarter | QOQ % change | YOY % change |

Q1 2021 | 3.0% | 8.1% |

Q2 2021 | 3.0% | 11.0% |

Q3 2021 | 2.9% | 12.5% |

Q4 2021 | 3.4% | 12.7% |

Q1 2022 | 2.4% | 12.2% |

Q2 2022 | 2.8% | 12.0% |

Q3 2022 | 2.6% | 11.6% |

Q4 2022 | 2.3% | 10.4% |

Q1 2023 | 1.0% | 8.8% |

Q2 2023 | 1.5% | 7.5% |

Q3 2023 | 1.3% | 6.2% |

Q4 2023 | 1.1% | 4.9% |

Q1 2024 | 1.8% | 5.8% |

Q2 2024 | 2.3% | 6.6% |

At a growth of 2.3% QOQ in Q2 2024, this represents the fastest pace of quarterly increase in six quarters, since resale flat prices climbed by 2.3% QOQ in Q4 2022. Cumulatively, the HDB resale price index has risen by 4.2% in 1H 2024.

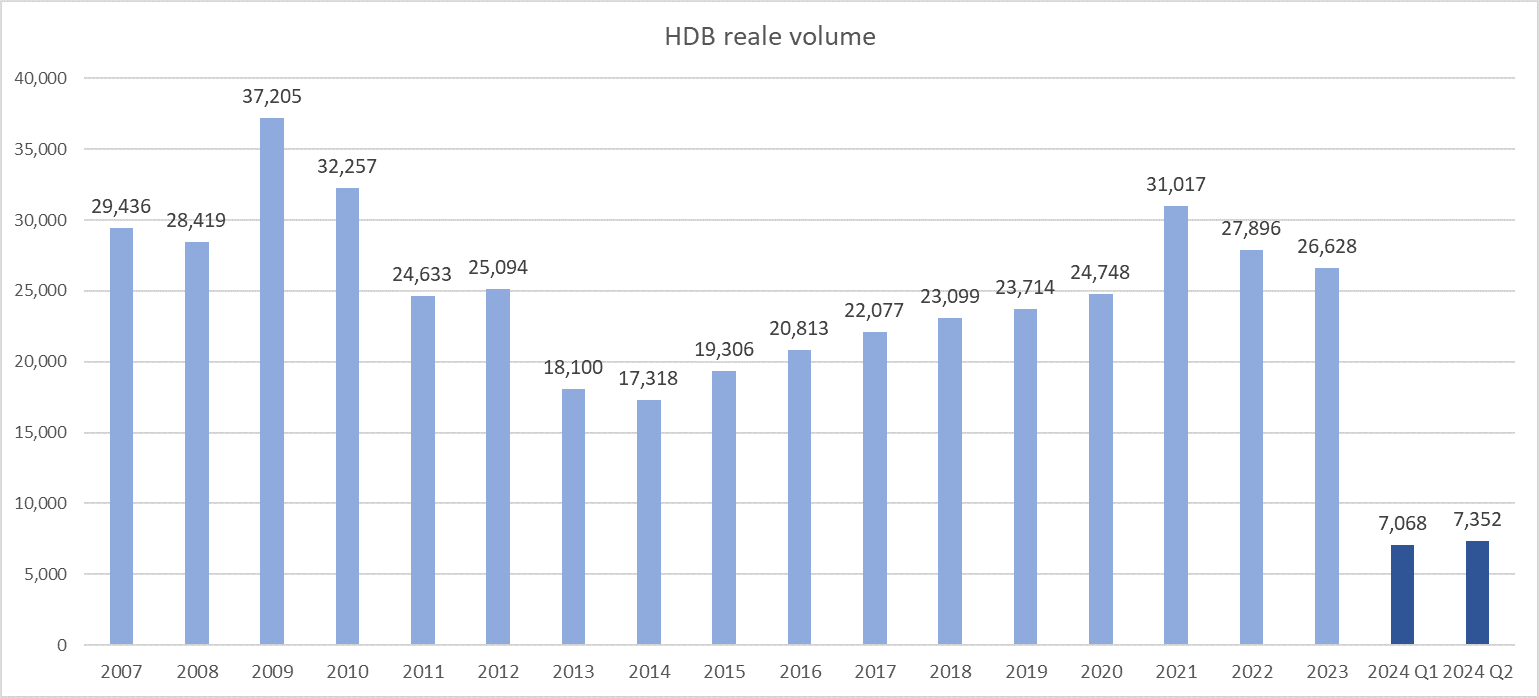

The HDB said that 7,352 resale flats were transacted in Q2 2024, marking a 4% increase from the 7,068 units resold in Q1 2024 (see Chart 1). On a year-on-year basis, the resale volume was 12.9% more than the 6,514 resale flats sold in Q2 2023. This takes the HDB resale flat volume to 14,420 units in 1H 2024 - which PropNex believes is on track in meeting its sales projection of around 27,000 to 28,000 units for the whole of 2024.

Chart 1: HDB resale flat volume by year

Ms Wong Siew Ying, Head of Research and Content, PropNex Realty:

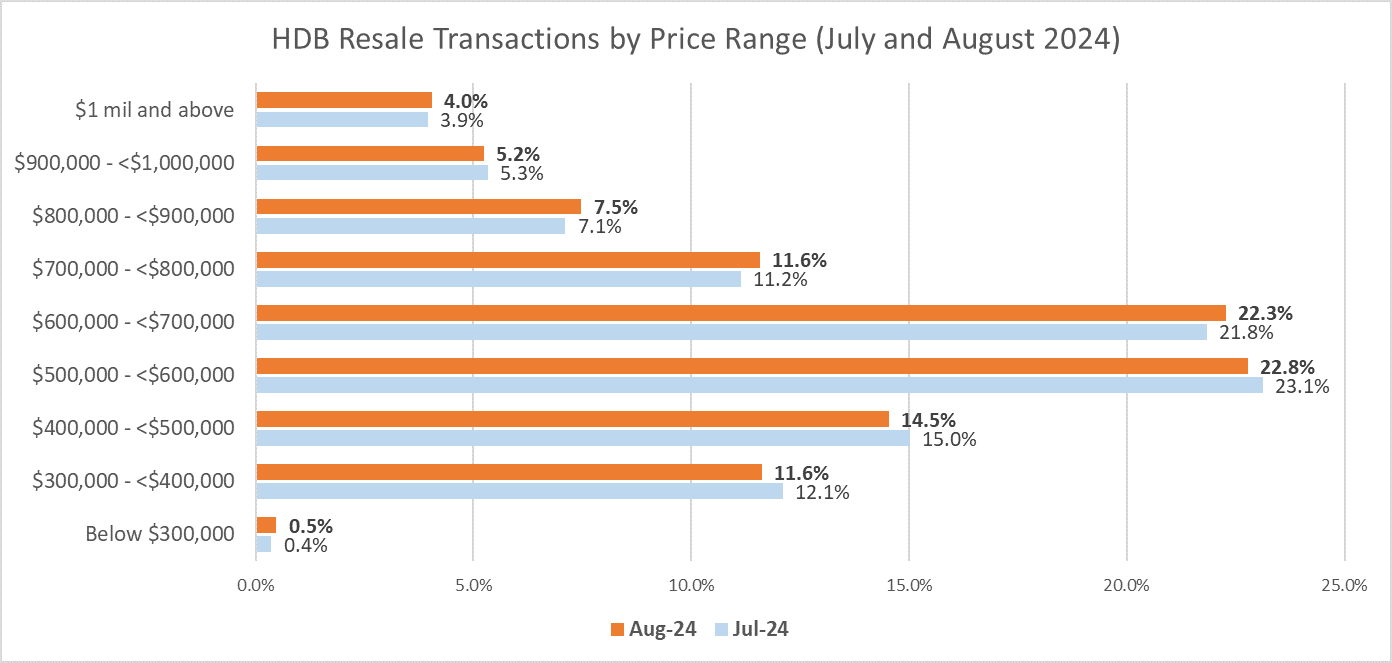

"The increase in the HDB resale flat prices on Q2 2024 marks the 17th consecutive quarter of price growth, amid healthy demand for resale flats and a slightly larger proportion of flats being resold at higher prices. Based on transaction data, we observed that the proportion of flats transacted at price bands of over $600,000 has risen in Q2 from Q1 2024 (see Chart 2).

In addition, there have also been a near 29% jump in the number of resale flats sold for at least $1 million in Q2 2024, at 236 units compared with 183 such flats in the previous quarter. In Q2 2024, the million-dollar flats accounted for about 3% of the total resale transactions in the quarter.

Chart 2: Proportion of HDB resale transactions by price range

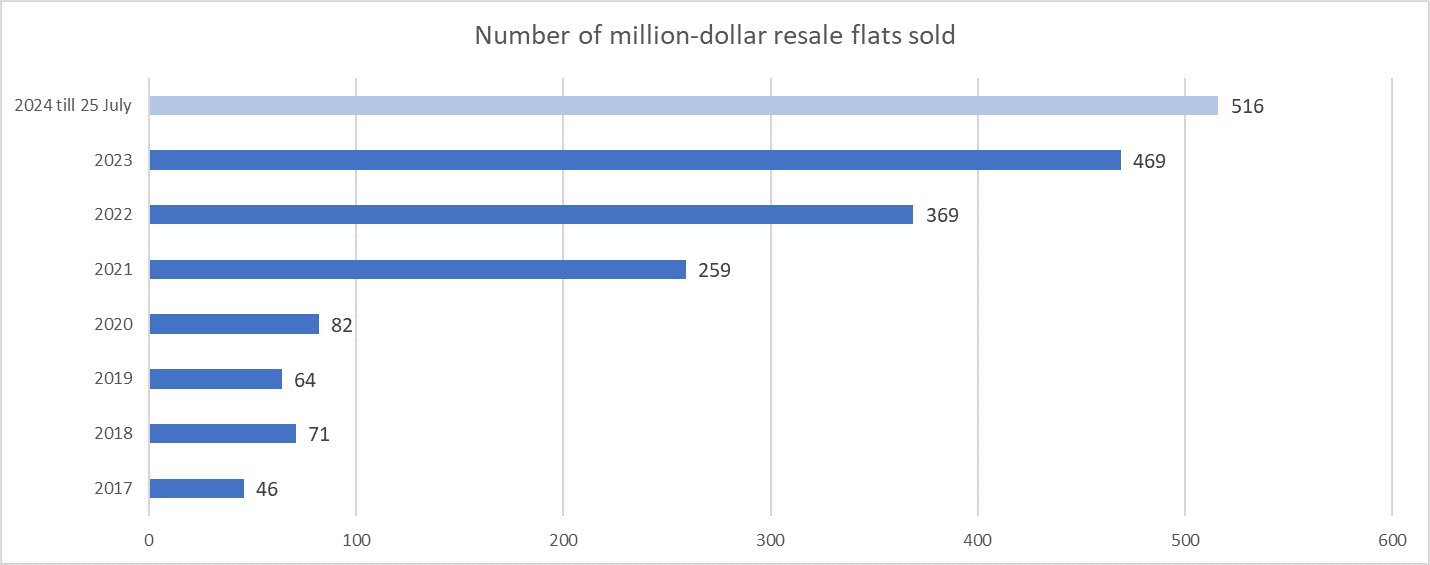

Factoring in the 97 units of million-dollar resale flats sold in July (till 25 July), there were 516 flats that were resold for at least $1 million in the year-to-25 July 2024 period thus far - already surpassing the 469 units that changed hands in the entire 2023.

Overall, million-dollar resale flats still accounted for a small portion of the HDB resale flat transactions, and we think such transactions, while rising will likely remain outliers as such resale flats tend to have very unique attributes. That being said, one area to watch is whether their growing numbers and new record prices being set could potentially inject more enthusiasm into the market - resulting in unrealistic price expectations or push up asking prices of homes in various neighbourhoods.

Chart 3: Number of million-dollar HDB resale flat sold by year

Another factor that has been supportive of the HDB resale prices has been the fewer number of flats exiting the 5-year minimum occupation period (MOP) this year, which would have made them eligible to be sold on the resale market. Based on completion status of HDB flats, the estimated number of flats reaching MOP in 2024 is around 13,000 units, down from about 15,700 units in 2023, and a bumper crop of more than 31,300 units in 2022. This will impact resale stock available for sale, and in turn put some upward pressure on resale flat prices amid healthy demand.

In October, the HDB is expected to offer about 8,500 Build-To-Order (BTO) flats across 15 projects. The upcoming BTO flats will be offered under the new flat classification framework, as Standard, Plus, or Prime flats based on their specific locational attributes. Several BTO projects are in attractive locations and they will likely draw keen interest among applicants.

Still, we do not expect that the upcoming BTO exercise would siphon too much buying demand from the HDB resale flat market. Those who are unsuccessful in their flat application, as well as buyers who prefer a more centrally-located flat but are not willing to be subjected to the stricter conditions that come with Plus and Prime flats will still tap the resale market for options. In addition, families with more pressing housing needs will also prefer resale homes.

For the whole of 2024, we project that HDB resale prices could rise by around 7% to 8%, and the total HDB resale flat volume may hover at 27,000 to 28,000 units."

Suggested Reads

Upcoming Events

View moreYou may like

Developers' Sales Plunged By 87% MOM In November Amid Limited New Launches; City Fringe Projects Dominate Sales

December 15, 2025

Sustained Private Housing Supply Planned For 1H 2026, Amid Stabilisation In The Property Market

December 02, 2025

A Rare Bukit Timah Freehold Hilltop Estate Enters the Market for the First Time in 70 Years

November 21, 2025

Developers' Sales Surged To 11-month High In October, Propelled By Robust Demand For New Launches; Monthly Sales In The Core Central Region Are Highest In Over 18 Years

November 17, 2025