PropNex Picks

October 30, 2024

Resale Market Watch: Holland Bungalow Nets $7.1 Million In Resale Gains In September 2024

Jean Choo

Senior Research Analyst

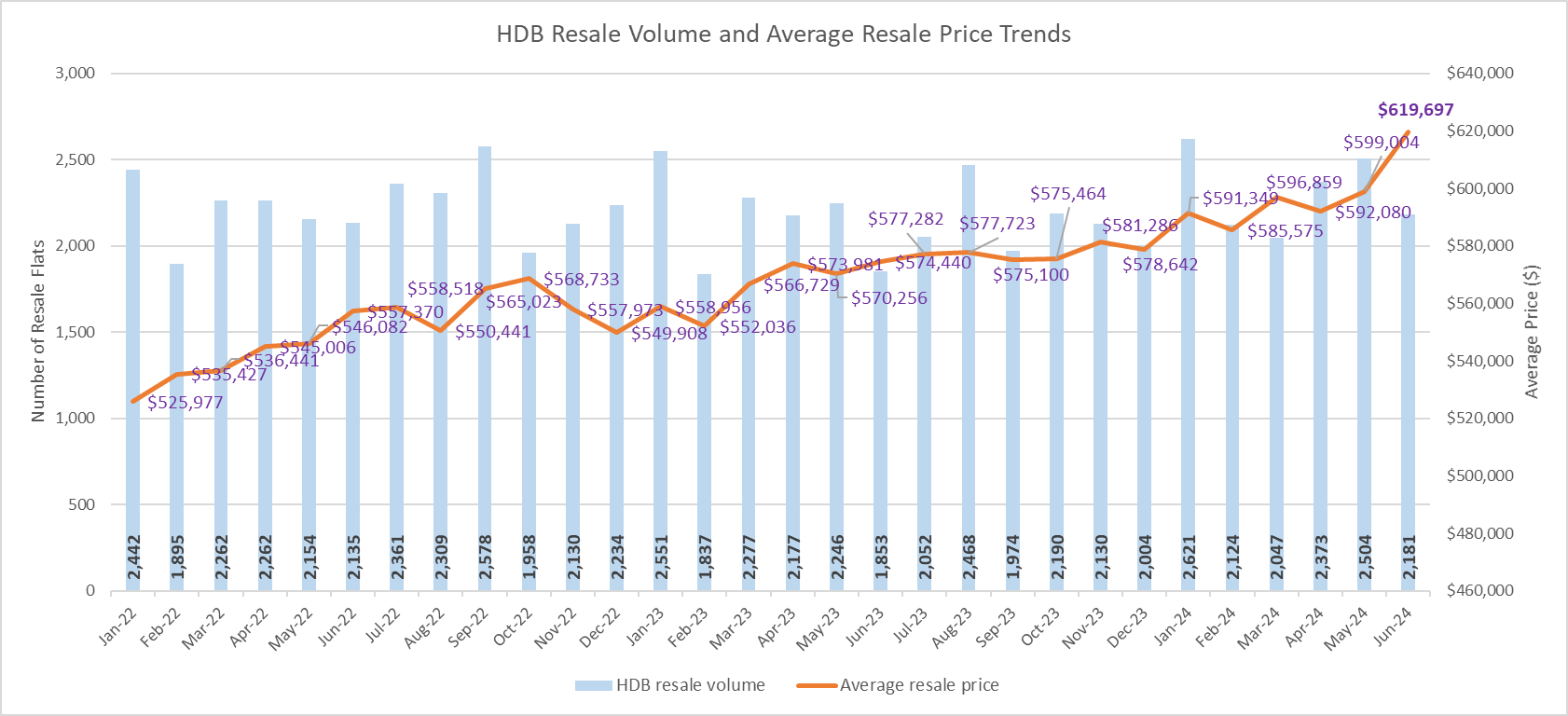

Resale landed activity buffers in September due to hungry ghost month

Based on URA Realis caveat data, about 131 landed homes were transacted on the resale market in September 2024; the combined transaction value came up to $677 million - down from August (163 deals valued at $804.6 million). Upon an analysis of each transaction and their respective gains, most landed deals were profitable. With the exception of the top gainer, the remaining top 10 landed home transactions in September booked gains ranging from about $4.1 million to $6.2 million. The top gainers were scattered across the island with a majority located in the suburbs; five out of the top 10 landed transactions are located in the Outside Central Region (OCR); another three each in the Core Central Region (CCR) and two transactions in the Rest of Central Region (RCR) during the month.

Landed home resale activity in September slowed down further following a lull in August owing to the Hungry Ghost Month. Amidst the muted sales in September, there was a higher proportion of higher priced landed homes being sold compared with the previous month. Based on URA Realis caveat data, about 35.9% of resale landed homes sold in September were priced at $5 million and above, compared with about 27.6% in August. Meanwhile, 64.1% of the resale landed transactions were priced at below $5 million in September - higher than the 72.4% proportion in the previous month.

Chart 1: Price range of private resale landed transactions in August 2024 vs September 2024

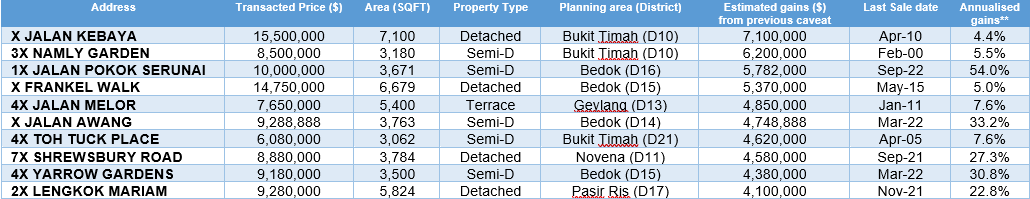

Top 10 resale landed transactions in terms of estimated gains*

*Gains are derived from the resale transaction for each unit against the unit's last caveated transaction. The gains reflected is gross - it has not accounted for the applicable seller's stamp duties, interest payable, taxes and other relevant divestment costs.

**Annualised gain is the compounded annual rate of return which shows the rate of return over the time period between the point of resale and the property's last caveated transaction, expressed in annual percentage terms. The formula for determining this is simply: [(current resale price) / (purchase price)] time period in years-1

Top landed transaction with highest gains (overall)

The top landed transaction in the month was for a detached property in the CCR, along Jalan Kebaya in District 10. The property is situated at a quieter corner of Jalan Kebaya estate in Holland, Bukit Timah. The bungalow was sold for $15.5 million in September and achieved a gross profit of $7.1 million from the last caveated price lodged in April 2010 - booking an annualised gain of 4.4% over 14 years. This freehold bungalow sits on a plot with a land area of 7,100 sq ft; reflecting a unit price of $2,183 psf on land area.

Top landed transaction with highest gains (Core Central Region)

The second performing transaction in the city was for a semi-detached house in Bukit Timah (District 11) along Namly Garden. It was sold for $8.5 million in September, with its last caveat being lodged in February 2000. The sale price is up by about $6.2 million from the previous caveated price, marking an annualised profit of 5.5% over 24 years. Based on a land area of 3,180 sq ft, the sale price reflects a unit price of $2,673 psf on land area. The property is about a 10 minutes' walk to the Sixth Avenue MRT station on the downtown line. The property is also a short drive from nearby amenities at Sixth Avenue and the Coronation Road neighbourhood, including Crown Centre, King's Arcade, and Coronation Plaza. It is also near the hwa Chong Instituition, Raffles Girls' School, and Nanyang Girls' School.

The third best-performing landed transaction in the city was for a bungalow along Shrewsbury Road in Novena (District 11). The property was sold for $8.88 million in September and achieved a gross profit of $4.58 million from the last caveated price lodged in September 2021- booking a whooping annualised gain of 27.3% within a 3-year holding period. This freehold property sits on a plot with a land area of more than 3,700 sq ft, with the sale price reflecting a unit price of $2,347 psf on land area. The property is within walking distance to the Novena MRT station on the North South line. The property is located close to several amenities in the vicinity, including Velocity Mall, Novena Square 2 Mall, United Square mall, Tan Tock Seng Hospital and Pek Kio Market and Food Centre.

Top landed transaction with highest gains (Rest of Central Region)

The best performing landed home transaction in the RCR was for a terrace house along Jalan Melor in Macpherson, within the Geylang planning area (District 13). The property was sold for $7.65 million, reflecting an estimated gain of $4.85 million, representing an annualised gain of 7.6% per year from its last caveat lodged in January 2011 - with a holding period of 13 years. The property is situated close to two MRT stations - Tai Seng MRT station on the circle line and the Mattar MRT station on the Downtown Line, which take residents to the city centre within 30 minutes.

The second-best performing transaction in the city fringe was for the sale of a semi-detached house in Toh Tuck Place in Bukit Timah (District 21). It was sold for nearly $6.08 million in September, with its last caveat being lodged in April 2005. The sale price is up by $4.62 million from the previous caveated price, representing an annualised gain of 7.6% per year over nearly 20 years. The property is located near the Beauty World commercial node and within walking distance to the cluster of amenities at Beauty World Centre, Bukit Timah Plaza, Bukit Timah Food centre and more.

Top landed transaction with highest gains (Outside Central Region)

The best performing landed home transaction in the OCR was for a Jalan Pokok Serunai freehold semi-detached home in District 16 (Bedok) was sold for $10 million, up by about nearly $5.8 million from the last caveat lodged in September 2022 - this reflects an eye-watering annualised profit of 54% after a short holding period of 2 years. The semi-detached house is situated within a short 10-minute walk to Siglap MRT station on the Thomson-East Coast Line (TEL), which takes commuters to the city within 45 minutes. It is also a short drive to other regional work hubs in the east such as Tampines, Changi Airport and Expo.

The second best-performing landed home transaction in the OCR was for a bungalow along Frankel Walk in the Bedok planning area (District 15). The property was sold for about $14.75 million, reflecting an estimated gain of some $5.37 million, representing an annualised gain of 5% per year from its last caveat lodged in May 2015, with a holding period of nearly 10 years. The property is located just a short walk to Kembangan MRT station on the East-West Line, which takes commuters to the city centre in less than 45 minutes.

If you are looking for high-end homes or good class bungalows in Singapore, contact PropNex's GCB and Prestige Landed department for buying opportunities and insights on the landed residential property market.

For more property research insights, join PropNex Friends today.

Read the latest PropNex Research report on the GCB and Prestige Landed homes market.