What You Need to Know About Buying Properties via Trusts

Last updated 5th Dec 2024

Contributed by Anthony Law Corporation

For most people, a residential property is first and foremost a home - a roof over the head. Many buyers also acquire houses as a form of investment, with some parents purchasing properties for their children under trusts. This article explores the objectives behind buying in trusts and the implication of the new ABSD (Trust) rule that was first introduced in May 2022.

1. Why should one buy properties in Trust?

While a child (i.e. a person below 21 years old) does not have the legal capacity to own a property in his/her own name yet, his/her parents may nevertheless buy a property for the child and hold it in trust for the child's benefit, which allows the child to beneficially own the property.

Some parents purchase homes for their children using a trust structure for a variety of reasons, mainly driven by inheritance and succession planning or other legitimate tax arrangement as advised by legal professionals.

These trust structures are also used by parents who, during their lifetimes, want to give an advanced inheritance of residential property to their children, especially if these are minor children, instead of waiting to transfer these assets upon their demise.

2. Who can buy a property in Trust?

Bearing in mind that purchases of residential property using a trust structure have to be paid fully in cash, it would follow that prudent financial planning as well as having a large coffer are vital considerations when planning to purchase property using a trust structure for the benefit of one's child or children. In other words, those who buy properties in trust tend to be cash-rich.

Once these have been considered, buying a property using a trust structure is an available option or tool for anyone who wishes to make a gift of advanced inheritance or for succession planning, or other legitimate tax arrangement.

3. How can one go about buying a property in Trust? What are the steps and requirements?

Generally, a trust is set up by the trustee doing the following:

Executing the trust instrument trust or trust deed; and

Transferring of assets into the trust.

In executing the trust instrument, the settlor or trustee must clearly decide the key terms of the trust which would include:

Who the beneficiary is;

Who will be appointed as trustee of the trust;

The powers of the trustee; and

The vesting of the beneficial interest.

Properties purchased using a trust structure will have to be fully paid for in cash. CPF monies cannot be used for the purchase. Banks are also unable to extend a loan for the purchasing of property using a trust structure.

4. The government introduced ABSD (Trust) in 2022. What is this about and how will it impact buying in Trust?

The Ministry of Finance (MOF) announced that with effect from May 9, 2022, that additional buyer's stamp duty (ABSD) of 35% will apply to any transfer of residential property into a living trust. This ABSD is to be paid upfront (i.e., within 14 days of executing the sale and purchase agreement or exercising the option to purchase).

More recently, since 27 April 2023, the ABSD (Trust) has been revised upwards to 65% from 35%, as part of the latest series of property market cooling measures implemented by the government to cool property demand. The new ABSD (Trust) rate of 65% will apply to any transfer of residential property into a living trust on or after 27 April 2023.

Previously, ABSD did not apply to living trust where there is no identifiable beneficial owner at the time of asset transfer into the trust. One could say that this policy change plugs a potential loophole used by some to avoid paying ABSD.

However, a trustee may apply to the Inland Revenue Authority of Singapore (IRAS) for a refund of the ABSD (Trust), subject to fulfilling various conditions - namely, that all beneficial owners are identifiable, that the beneficial ownership has been vested in the beneficiary or beneficiaries and that the trust cannot be revoked, varied or subject to any subsequent conditions.

According to IRAS, the remission of ABSD (Trust) may be provided via a refund where the conveyance, assignment or transfer on sale of residential property to a person i.e., trustee, is held on trust for one or more identifiable individual beneficiaries only.

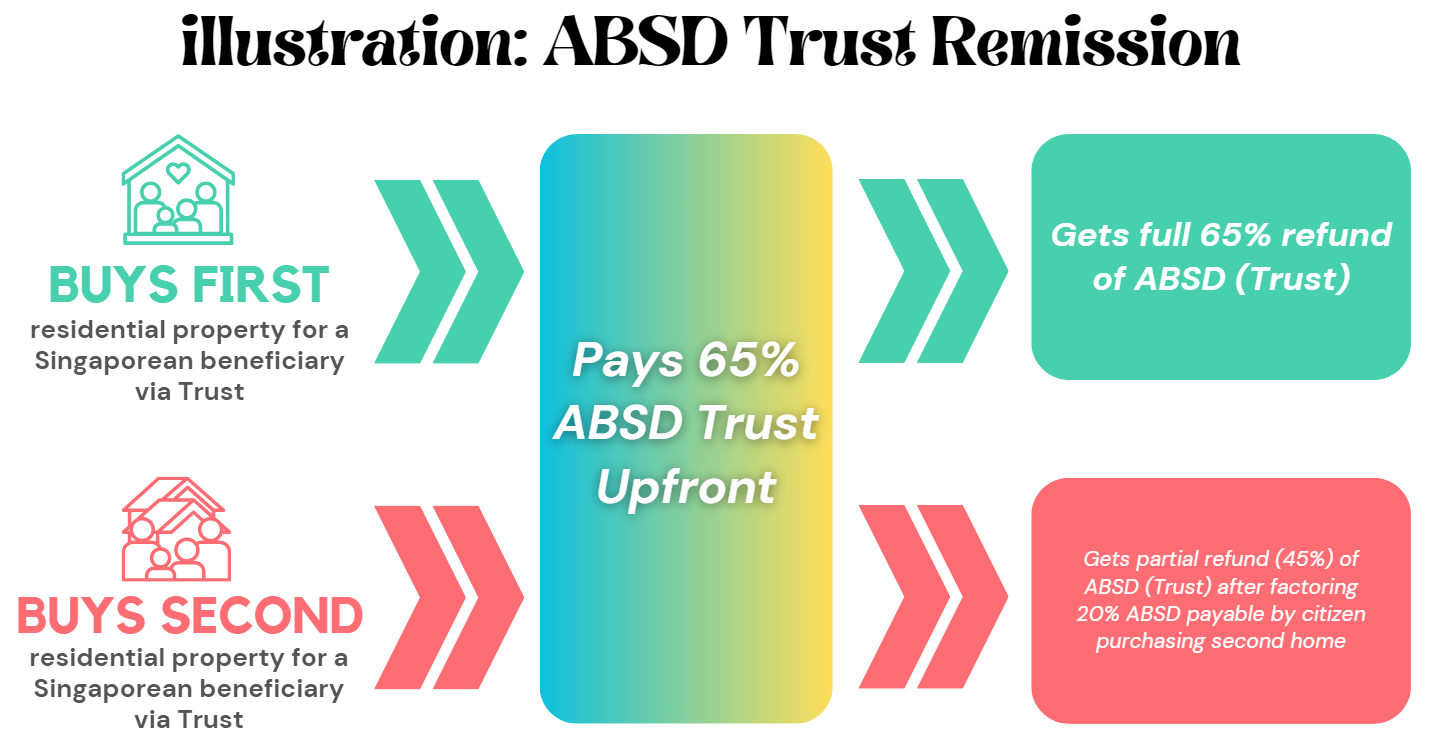

If the conditions are met, the amount remitted will be based on the difference between the ABSD (Trust) rate of 65% and ABSD rate corresponding to the profile of the beneficial owner with the highest applicable ABSD rate.

ABSD (Trust) of 65% is to be paid up front, and an application for the refund must be made to IRAS within six months after the date of execution of the instrument. Most applications will be processed within 2 months from the date of complete information being submitted. Where the application has been approved, the refund will be made within 1 month after approval.

The government's introduction of ABSD (Trust) is to prevent a situation where people avoid paying ABSD by buying the property in others' names instead of their own names. Therefore, the beneficial ownership of the property must belong to the beneficiary. This would ensure that the beneficiary will become the real owner of the property and that the property is not in fact controlled by the person who created the trust, and who is trying to avoid paying ABSD by not buying it in his own name.

5. With the new rules, does it still make sense to buy a residential property in Trust, why?

The ABSD (Trust) is not expected to have much of an impact on the wider residential market.

Properties purchased using a trust structure account for a small minority among the large number of private housing units transacted each year. An estimate of about 10% or less of private homebuyers purchase property using a trust structure for the benefit of their children.

Most of the people who buy properties using a trust structure for the benefit of their children would put their Singaporean child or family member as the beneficiary of the trust. Since the net impact on these trust structures is neutral because they can apply to IRAS for a refund of ABSD (Trust), it is likely that purchase of residential property using a trust structure will continue.

Besides, people who purchase properties using a trust structure tend to be the ultra-wealthy. The upfront payment of 65% (which they may eventually get back) may not be too much of a deterrent in lieu of the tax savings of ABSD which may be significant.

Therefore, this imposition of ABSD (Trust) has little effect. Purchasing property using a trust structure would still be attractive for those who have the means. With the imposition of ABSD (Trust) this means that they will have to have an additional hefty 65% of the purchase price upfront.

If they meet certain conditions, for instance, if the beneficiary is identifiable as a Singapore citizen with no prior Singapore residential properties, the ABSD refund will be in full anyway.

Essentially, trusts are set up as vehicles for genuine gifts and estate/succession planning and the imposition of the new ABSD (Trust) does not change that.

If you are thinking of setting up a trust for your loved ones, don't forget to consult a professional law firm for legal advice tailored to your needs.

Editorial note: This article has been updated on 5 Dec 2024 to reflect changes in the ABSD (Trust) policy