Press Release

July 15, 2024

Monthly Developers Sales Inched Up Slightly In June 2024, Despite A Lack Of Project Launches And Market Lull During School Holidays

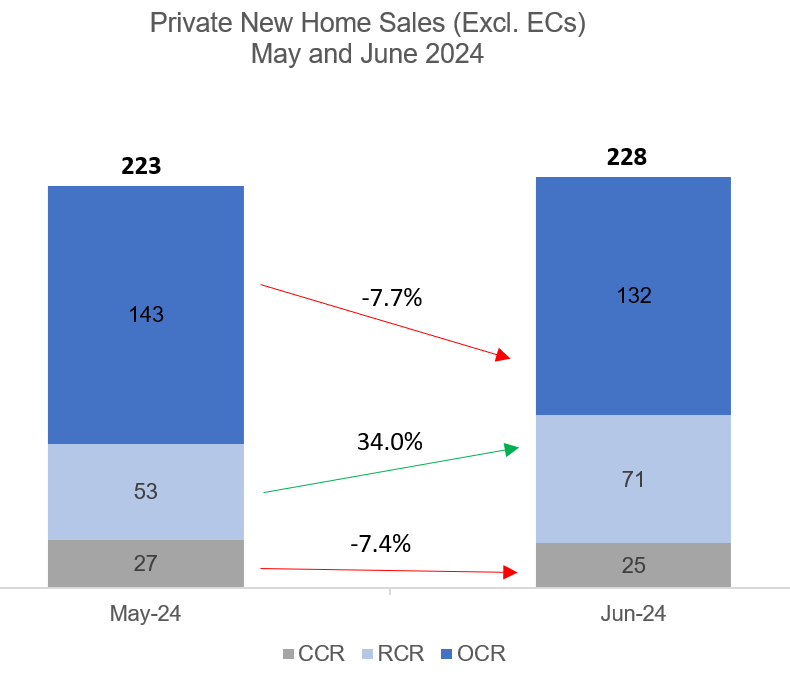

15 July 2024, Singapore - New private home sales held up in June despite a lack of new project launches and during a period that is typically marked by slower sales activity owing to the June school holidays. Developers sold 228 new units (ex. EC) in June, up slightly by 2.2% month-on-month (MOM) from the admittedly low-base of 223 units shifted in the previous month. On a year-on-year basis, developers' sales were down by 18% from 278 new homes sold in June 2023.

Factoring June's sales, there were 752 new units (ex. EC) transacted in Q2 2024. Including the sales tally in Q1 2024, developers sold 1,916 new private homes (ex. EC) in the first half of 2024. This is substantially lower than the 3,383 new units (ex. EC) transacted in the first half of 2023.

In June, there were no fresh projects put on the market. Developers launched 118 units from existing projects for sale during the month - lower than the 238 units launched in May 2024. The new units launched in June were from Tembusu Grand, The Lakegarden Residences, Pollen Collection, and Watten House.

The Outside Central Region (OCR) led sales in June, accounting for 58% of the month's sales. Developers sold 132 new units (ex. EC) in June, marking a 7.7% decline from the 143 units that changed hands in the previous month. Some of the top-selling OCR projects in June included The Lakegarden Residences which sold 23 units at a median price of $2,119 psf, and The Botany at Dairy Farm which moved 21 units at a median price of $1,979 psf (see Table 2). With two fresh OCR projects debuting in July - Sora and Kassia - new home sales in this sub-market are expected to pick up this month. Sora in Jurong East sold 102 units during its launch weekend (on 6-7 July).

Over in the Rest of Central Region (RCR), there were 71 new units transacted in June - picking up by 34% from the 53 units sold in the previous month. The most popular RCR projects during the month included Tembusu Grand which sold 20 units at a median price of $2,542 psf, Pinetree Hill which transacted 15 unit at a median price of $2,548 psf, and The Continuum where 11 units were sold at a median price of $2,859 psf.

Meanwhile, developers' sales in the Core Central Region (CCR) remained relatively flat, with 25 units transacted in June - marginally down from 27 units sold in the previous month. Klimt Cairnhill was the best-selling CCR project, with eight units sold at a median price of $3,335 psf. Based on the monthly sales data, developers sold a total of 84 new units in the CCR in Q2 2024 - the lowest quarterly tally since Q4 2015 where 64 new units were sold. The limited new launches in this sub-market, and the tightening of the additional buyer's stamp duty measure to curb foreign investment demand have weighed on the CCR segment.

In the EC segment, developers sold 50 new EC units in June, rising by 25% from the 40 units shifted in the previous month. The top-sellers among the EC projects in June were North Gaia which moved 29 units at a median price of $1,311 psf, and Lumina Grand which sold 16 units at a median price of $1,508 psf. As at end-June, there are 266 new EC units that are still unsold, according to URA's figures.

Ms Wong Siew Ying, Head of Research & Content, PropNex Realty:

"Developers' sales remained relatively flat in June, with 228 transactions (ex. EC) - a shade higher than that of May. This is despite the lack of fresh project launches during the month, and June being typically a period of slower market activity due to the school holidays, where many families may be on vacation abroad.

In particular, we note the sharper pick-up in sales at The Lakegarden Residences and Tembusu Grand in June compared with the earlier months of 2024. The Lakegarden Residences shifted 23 units in June alone, which is higher than a combined 22 units sold in the first five months of 2024, based on caveats lodged. Meanwhile, Tembusu Grand moved 20 units in June, which equals the 20 units transacted collectively from January to May this year. The prospects of upcoming launches nearby - namely Sora and Emerald of Katong - could have helped to drive buyers' attention to The Lakegarden Residences and Tembusu Grand. We anticipate that The Lakegarden Residences should be among the best-sellers again this month, seeing that the project has already transacted 27 units in the first week of July, based on URA Realis caveat data.

In July 2024, we expect new private home sales to potentially see a slight rebound from June, in view of the launch of Sora in Yuan Ching Road earlier this month, and the upcoming launch of freehold development, Kassia in Flora Drive on 20 July. The 440-unit Sora sold 102 of the 320 units released for sale at an average price of $2,160 psf at its launch weekend (6-7 July).

Thereafter, new home sales are likely to be soft in August with the Ghost Month (4 August - 2 September) kicking in - a period which tends to see slower property transactions, and developers refraining from launching new projects.

Table 1: Proportion of non-landed new private home sales (ex. EC) by nationality by residential status by month

| Nationality by Residential Status | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Jan-24 | Feb-24 | Mar-24 | Apr-24 | May-24 | Jun-24 |

| Company | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Foreigner (NPR) | 4.7% | 1.3% | 2.5% | 5.4% | 6.2% | 1.9% | 3.6% | 0.7% | 2.0% | 1.6% | 3.2% | 2.3% | 5.0% |

| Singapore Permanent Residents (PR) | 12.2% | 9.8% | 16.8% | 11.9% | 10.3% | 12.5% | 9.4% | 10.2% | 13.9% | 6.3% | 13.8% | 15.9% | 13.6% |

| Singaporean | 83.1% | 88.8% | 80.7% | 82.7% | 83.5% | 85.7% | 87.0% | 89.1% | 84.1% | 92.2% | 83.0% | 81.8% | 81.4% |

Source: PropNex Research, URA Realis (retrieved on 15 July 2024)

In June 2024, the proportion of new non-landed private homes (ex. EC) purchased by foreigners (non-PR) rose to 5% - or 11 caveats in absolute terms - of the month's sales. This is up from the 2.3% proportion (5 caveats) in May 2024. By projects, there were four transactions by foreigners (NPR) at Klimt Cairnhill, three at Midtown Modern, and one each at Grand Dunman, The Continuum, The Landmark, and Watten House in June. Meanwhile, the proportion of non-landed private new home sales to Singaporean buyers and Singapore PR dipped slightly in June from May, accounting for 81.4% and 13.6% of the June's non-landed private new home sales, respectively (see Table 1)."

Table 2: Top-Selling Private Residential Projects (ex. EC) in June 2024

| S/N | Project | Region | Units Sold in June 2024 | Median Price in June 2024 ($PSF) |

| 1 | THE LAKEGARDEN RESIDENCES | OCR | 23 | $2,119 |

| 2 | THE BOTANY AT DAIRY FARM | OCR | 21 | $1,979 |

| 3 | TEMBUSU GRAND | RCR | 20 | $2,542 |

| 4 | HILLHAVEN | OCR | 18 | $2,124 |

| 5 | PINETREE HILL | RCR | 15 | $2,548 |

| 6 | LENTOR HILLS RESIDENCES | OCR | 14 | $2,104 |

| 7 | HILLOCK GREEN | OCR | 13 | $2,132 |

| 8 | THE CONTINUUM | RCR | 11 | $2,859 |

| LENTORIA | OCR | 11 | $2,096 | |

| 9 | THE LANDMARK | RCR | 9 | $2,866 |

| 10 | KLIMT CAIRNHILL | CCR | 8 | $3,335 |

Source: PropNex Research, URA (15 July 2024)