Lowered Interest Rates: Is It A Right Time For Homeownership?

If you have been keeping up-to-date with the headlines, you have probably heard that the US Federal Reserve has just announced a significant interest rate cut, marking a pivotal moment in the global financial landscape. The Fed lowered its benchmark interest rate by 50 basis points (0.5%), its largest cut in recent years, in an effort to stimulate growth and counter the effects of high inflation and slowing economic momentum in the US.

While that might sound like a story for Wall Street, it is one that could affect all of us here in Singapore - especially when it comes to mortgages, loans, and savings. So, what does this mean for Singapore borrowers, savers, and the property market? Let us break it down!

In response to mounting concerns about economic growth, inflationary pressures, and financial stability, the US Federal Reserve slashed its federal funds rate by 50 basis points, bringing the rate down from 5.5% to 5.0%. The decision aims to make borrowing cheaper and to inject liquidity into the US economy to stave off a potential downturn. Even more significant for the future, the Fed signalled its intention to further lower rates in the coming years, potentially by another 0.5% by the end of 2024, 1% through 2025, and another 0.5% in 2026, making it a total of a possible 2.5% cut.

This sets the stage for a prolonged period of low interest rates, not just in the US but globally - including here in Singapore.

First things first - why does a cut in US interest rate matter in Singapore? Singapore's financial system is deeply connected to global trends, especially those set by the US. Unlike in the US, where the central bank directly controls interest rates, the Monetary Authority of Singapore (MAS) uses exchange rate policy to manage the economy. However, our local interest rates, such as the Singapore Interbank Offered Rate (SIBOR) and the Singapore Overnight Rate Average (SORA) - are influenced by global market conditions, including the US Federal Reserve's actions. When the US Fed Reserve lowers their rates, it puts pressure on Singapore's banks to reduce borrowing costs as well.

In fact, we have seen SIBOR rate climb over the past year, moving from around 1.5% in early 2022 to nearly 4% in 2023. This has directly impacted home loan rates, making mortgages more expensive for property buyers.

Currently, mortgage rates in Singapore have been hovering around 3.5% to 4%, depending whether the loan is pegged to SIBOR, SORA, or a bank's internal board rate. Fixed home loan packages are similarly priced, with many banks offering rates between 3.8% and 4.2%. The rising cost of home loans have pushed many buyers and homeowners to reconsider their financing strategies.

With the Fed slashing their interest rates - and their plans for future cuts - these rates could start to ease. We think that Singapore's mortgage rates could drop to as low as 3% over the next two years if the Fed continues its rate-cutting trajectory. This would significantly reduce borrowing costs for property buyers and homeowners.

For borrowers with existing floating-rate home loans tied to SIBOR or SORA, the Fed's rate cuts may provide some relief. Let us take a look at some numbers:

- A S$1 million home loan over 25 years at 4% interest results in monthly repayments of around S$5,280.

- If interest rates drop to 3.5%, those repayments would fall to about S$5,010, saving the borrower S$270 each month, or S$3,240 annually.

- If rates continue to drop and hit 3%, monthly repayments would decrease to approximately S$4,740, saving S$540 per month, or S$6,480 annually.

This is also a good time to advise your clients to look into refinancing their home loans to secure these lower rates. With banks potentially offering more competitive rates, refinancing their home loans could help them lock in lower rates and save thousands over the life of their mortgage. So, encourage your clients to shop around for the best refinancing deals.

Where this announcement might benefit one group, it might not be the case for another - savers. While lower interest rates are great news for borrowers, savers may feel the squeeze. If the Fed's rate cut prompts local banks to lower savings interest rates, clients with fixed deposits and savings accounts could see their returns diminish. Many banks in Singapore are currently offering around 2.5% to 3.5% on fixed deposits. If these rates fall by 0.5% in line with the Fed's decision, savers could lose hundreds of dollars in potential interest over time.

Real estate investment, on the other hand, offers the potential for both long-term capital appreciation and rental income, making it a more attractive alternative in a low-interest-rate environment. Singapore's property market has shown resilience, and with borrowing costs set to decline further, this could be a great time for clients to consider expanding their property portfolios.

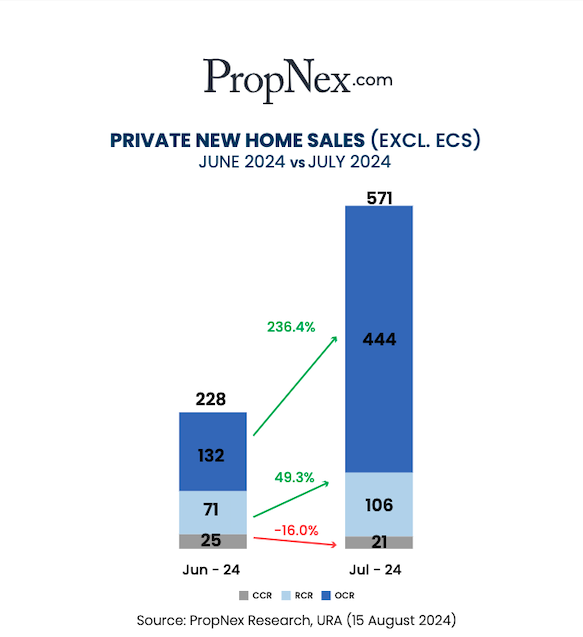

From a real estate perspective, the Fed's current and future rate cuts could drive more activity in the property market. As borrowing becomes cheaper, more potential buyers - especially first-time homeowners and investors - may be encouraged to take action. We have already seen positive momentum in the market: In July 2024, private home sales (571 units) exceeded June's sales by approximately 150%, driven largely by demand for new launches.

With the possibility of lower mortgage rates over the next couple of years, demand for properties priced between S$1.5 million and S$2 million could increase. Clients who have been hesitant to enter the market due to rising borrowing costs may find the environment more favourable, especially as banks adjust to a prolonged period of lower rates.

While the Fed's rate cuts provide immediate opportunities for borrowers and property investors, especially for young Singaporeans like myself, it is important to keep a long-term perspective. While borrowing costs may fall, you should still consider your financial stability, future income, and job security before making major financial commitments. Over-leveraging in a period of low interest rates can lead to risks, especially if the global economy faces further challenges.

For you as a property salesperson, staying on top of these developments will allow you to guide your clients through refinancing, purchasing, or investing in real estate. The next few years could present significant opportunities for growth, but the key is being proactive and helping clients make informed decisions based on their financial goals.

The US Federal Reserve's recent 50 basis point rate cut, along with its plans for further cuts over the next couple of years, signals a favourable environment for borrowers and property investors in Singapore. Borrows stand to benefit from lower mortgage rates and refinancing opportunities, while property investors can take advantage of cheaper financing options to grow their portfolios.

Whether you're a borrower, saver, or property investor, these interest rate shifts could affect you. So, it's important to stay informed and weigh your financial decisions carefully.

To gain deeper insights into how these changes may impact your financial and property strategies, consider joining us at our upcoming seminar, where our CEO and Deputy CEO will break down this topic even further. Sign up here to hear their opinions and advice on making the most of these developments.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.