媒体新闻稿

June 25, 2024

Government Maintains Ample GLS Housing Supply In 2H 2024; Total Supply Of Private Homes In 2024 Will Be Highest In A Year Since 2013

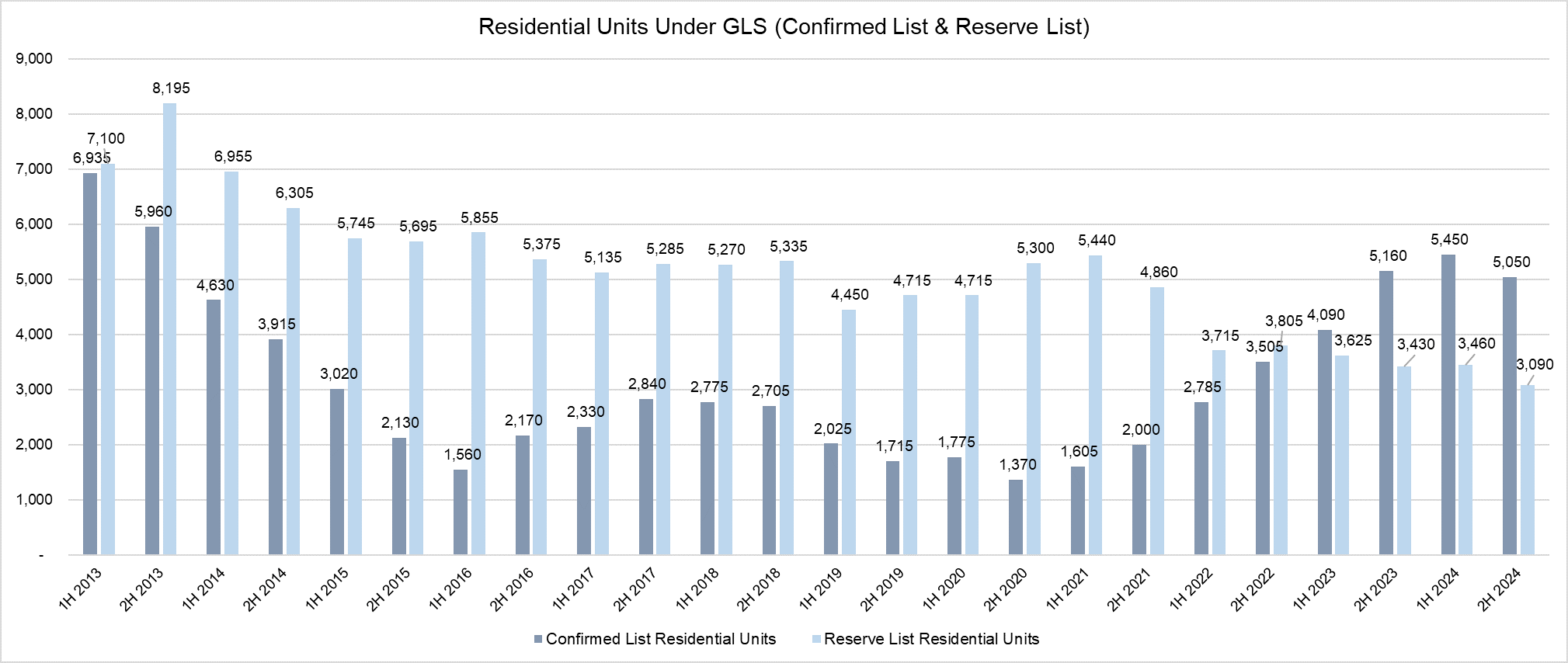

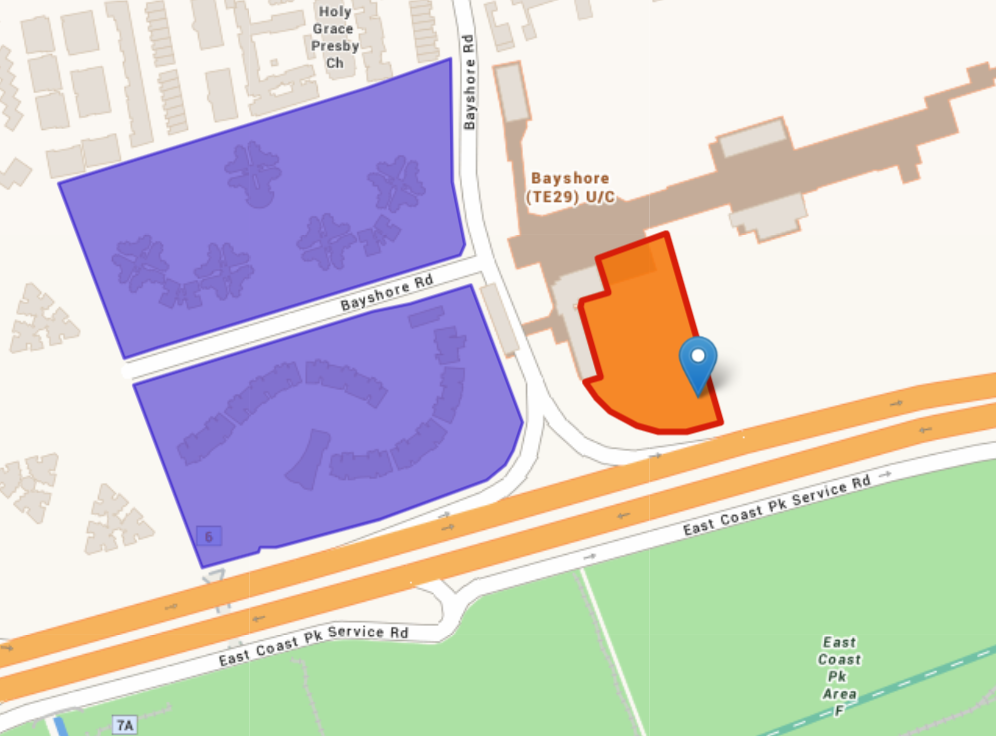

25 June 2024, Singapore - The government has maintained its supply of land for private housing development for the second half of 2024 (2H 2024) under its Government Land Sales (GLS) programme. For 2H 2024, the government will be offering 10 sites on the Confirmed List, comprising nine residential sites including an executive condo plot, and one residential and commercial plot. All in, the 10 Confirmed List sites can yield an estimated 5,050 residential units (including 560 EC units) - relatively on par with the 5,450 units offered in the Confirmed List of the 1H 2024 GLS programme (see Chart 1).

Chart 1: Residential units offered under the GLS programme (Confirmed List and Reserve List)

Source: PropNex Research, MND

Meanwhile, the government has placed another nine sites on the Reserve List of the 2H 2024 GLS slate which can be triggered for sale by developers should there be market demand for them. The Reserve List sites comprise five residential plots, one commercial site, two white site, and one hotel site which can collectively offer 3,090 residential units (including 730 EC units), 99,350 sq m gross floor area of commercial space, and 530 hotel rooms.

Taken together, the government will be offering a total supply of 11,110 private residential units (including 610 units from the activated Reserve List site at Zion Road (Parcel B)) for the entire 2024 - the highest yearly supply since 2013.

Mr Ismail Gafoor, CEO of PropNex:

"After raising the Confirmed List supply for seven consecutive GLS programmes previously, the government has maintained its GLS supply for 2H 2024. The 5,050 units to be offered represent a substantial private housing stock, following the 5,450 units offered in 1H 2024. The government is signaling its resolute intention in bringing about a more sustainable residential property market. We expect the injection of an ample land supply for housing, coupled with the three rounds of cooling measures since December 2021, as well as the cautious sentiment in the market will aid the stabilisation of the private housing sector.

We note that private home prices have grown at a slower pace in Q1 2024, and the transaction volume has also been softer in the past months. This follows the 15-year low new private home sales volume in 2023. With the tentative buying sentiment and some uncertainty as to the depth of the private housing demand, developers have been careful in their land acquisition activity, which has been demonstrated in the recent GLS land tenders.

For GLS tenders which have closed so far in 2024, the nine sites (ex. EC) attracted a median of two bids, compared with three bids (nine sites ex. EC) in 2023, and four bids (nine sites ex. EC) in 2022. The land bid prices have also been more conservative these days, as developers seek to mitigate and manage risks amidst market uncertainties.

We think developers will have ample opportunities to further shore up their land inventory, and prospective home buyers will have plenty to be excited about, in view of several attractive sites to be released. Notably, out of the 10 Confirmed List sites, we observe that six plots are within walking distance to an MRT station, which is increasingly becoming a key priority among buyers, including owner-occupiers and investors."

Ms Wong Siew Ying, Head of Research and Content, PropNex:

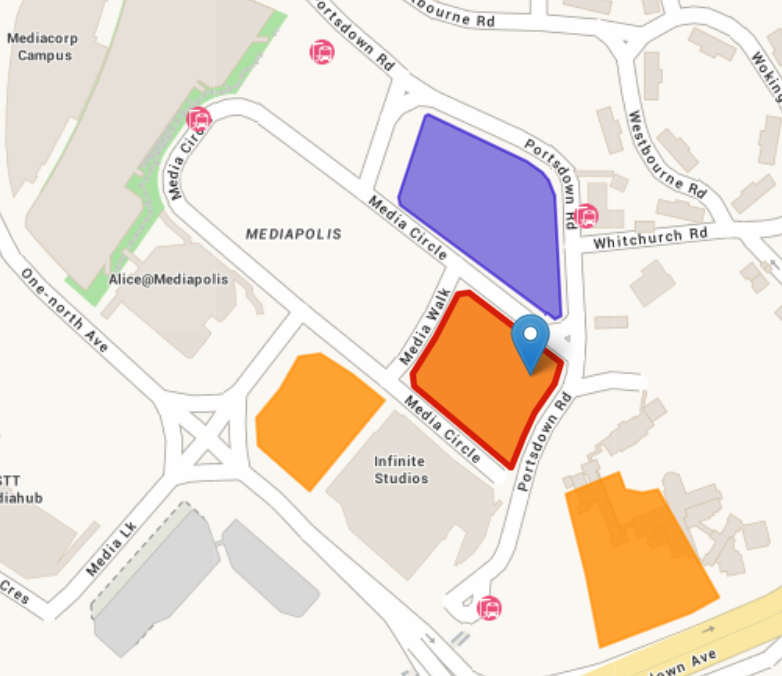

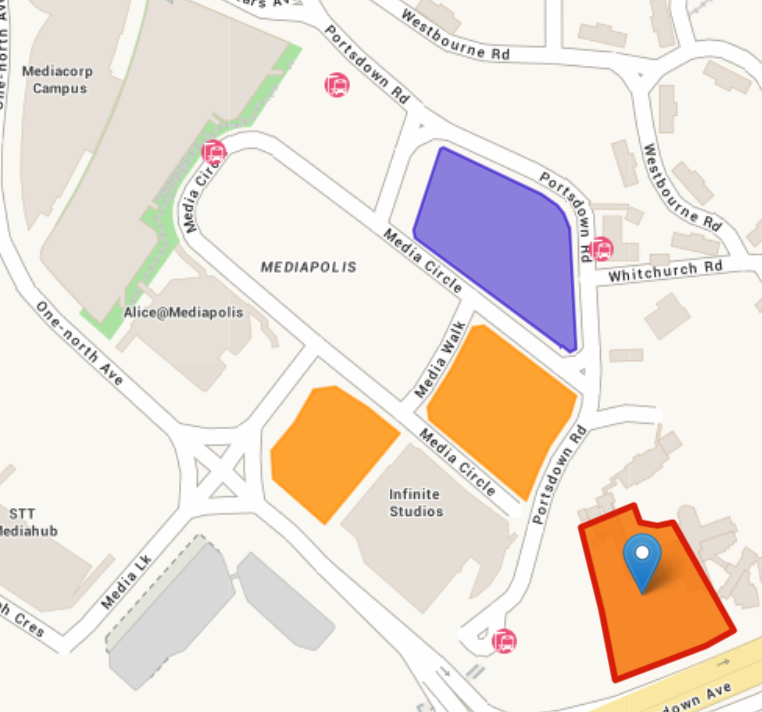

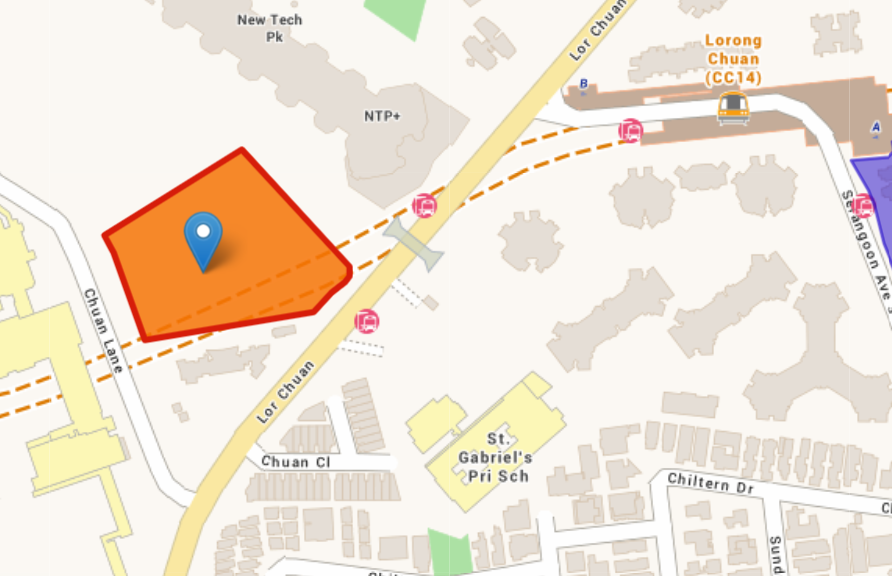

"The latest GLS slate in 2H 2024 presents a good selection of sites in a variety of locations, including 10 plots which are newly-added. The newly-added Confirmed List sites are in Faber Walk, Media Circle Parcels A and B, Chuan Grove, Holland Link, and Chencharu Close. Meanwhile, new on the Reserve List are sites in Marina Gardens Lane, Woodlands Drive 17 (EC), Holland Plain, and River Valley Green (Parcel C).

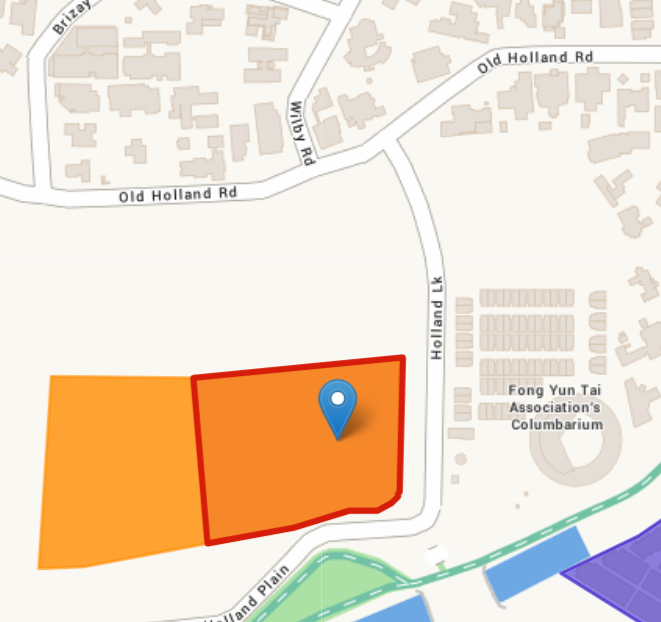

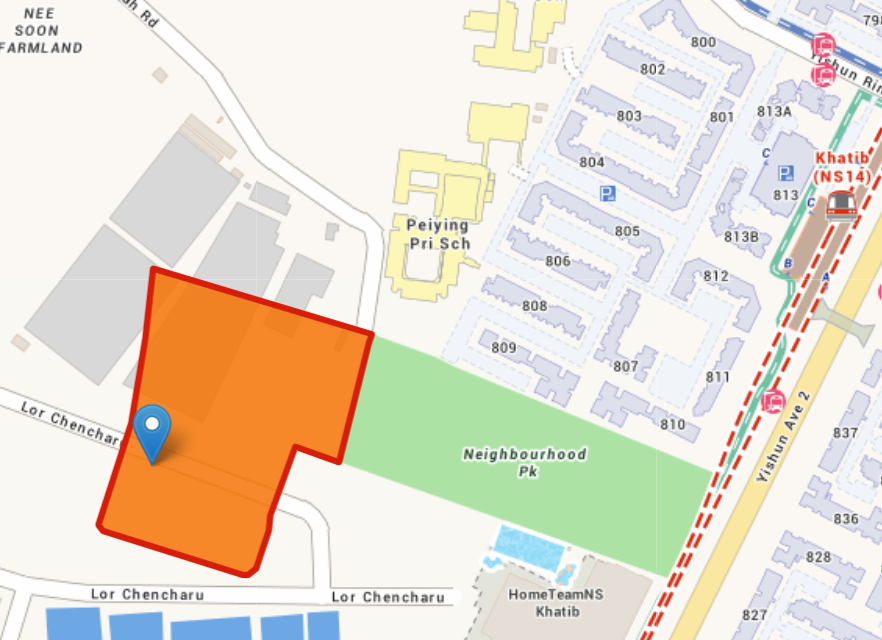

In our view, the more attractive plots on the Confirmed List are the Tampines Street 95 EC site, the Bayshore Road site, the Chuan Grove plot, River Valley Green (Parcel B), and the Chencharu Close mixed-use site. In particular, the Bayshore Road site and the Chencharu Close plot are the first private housing site in their respective new housing precincts (see Table 1 on site summary). On the other hand, we think the plot in Holland Link - near the Brizay Park good class bungalow area - could potentially face some challenges owing to its less accessible location further away from the MRT station, as well as being near a columbarium which may not appeal to some buyers.

We note that the Marina Gardens Crescent white site has been injected into the Reserve List for 2H 2024. The URA had in February 2024 rejected the sole bid for the white site, deeming it to be too low ($984 psf ppr, submitted by GuocoLand (Singapore), Intrepid Investments and TID Residential). Elsewhere in Marina South, the government has put a new residential plot in Marina Gardens Lane on the Reserve List; this plot is relatively attractive being opposition Gardens by the Bay and within walking distance to the upcoming Marina South MRT station on the Thomson-East Coast Line. However, the lack schools in the Marina area, and prevailing additional buyer's stamp duty measure may weigh on demand for downtown homes.

Given the ample supply of housing units on the Confirmed List, we do not anticipate developers to trigger the Reserve List sites for tender launch in the coming months."

Table 1: Brief summary of Confirmed List sites 2H 2024

| Site | Remarks |

Tampines Street 95 (EC) - 560 units  |

|

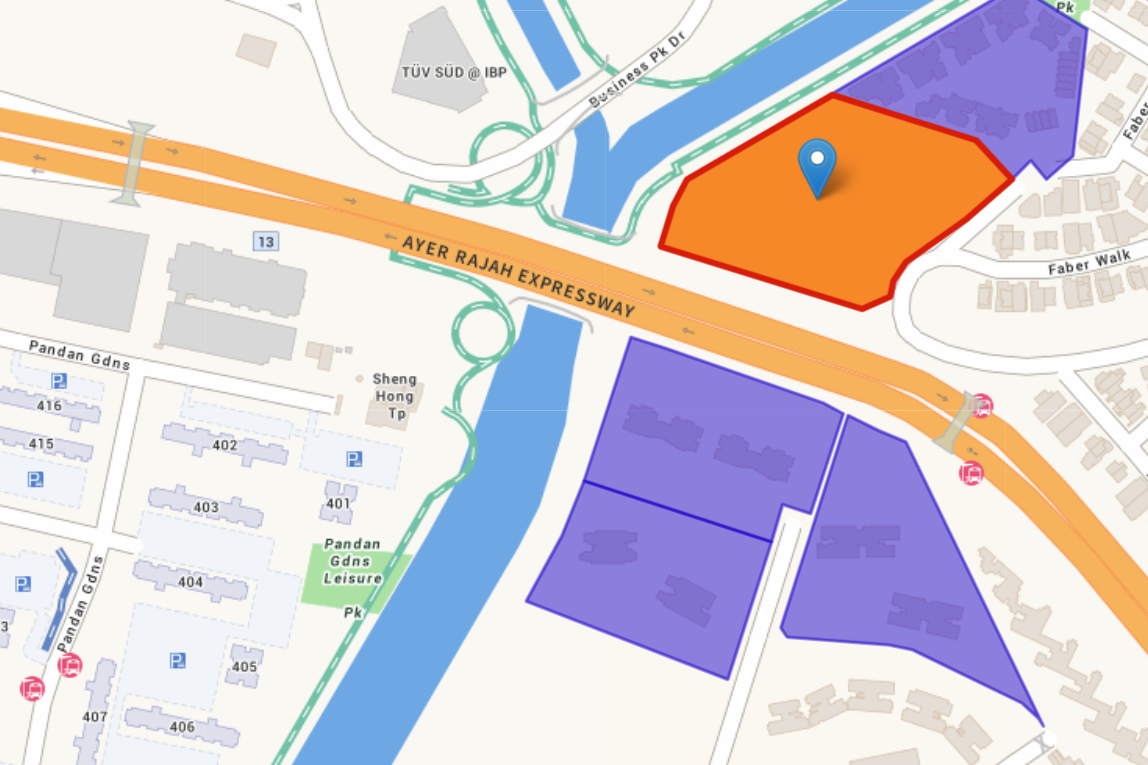

Faber Walk - 400 units  |

|

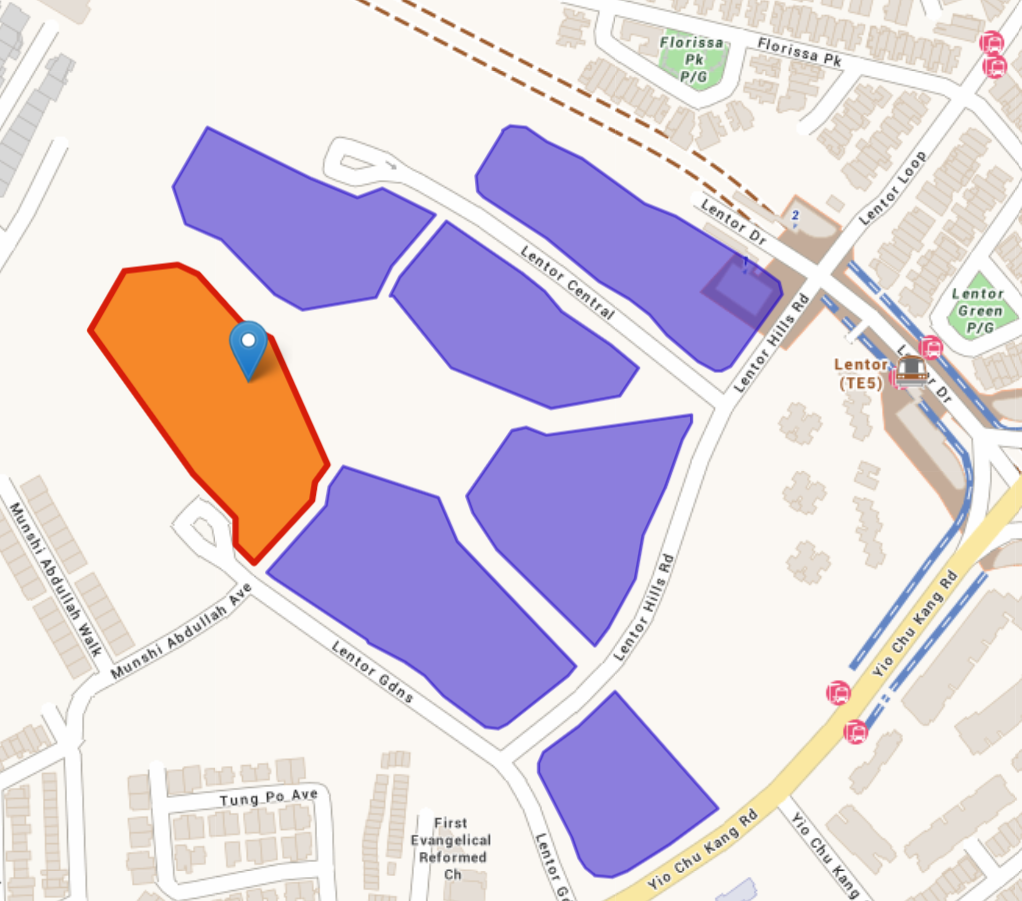

Lentor Gardens - 500 units  |

|

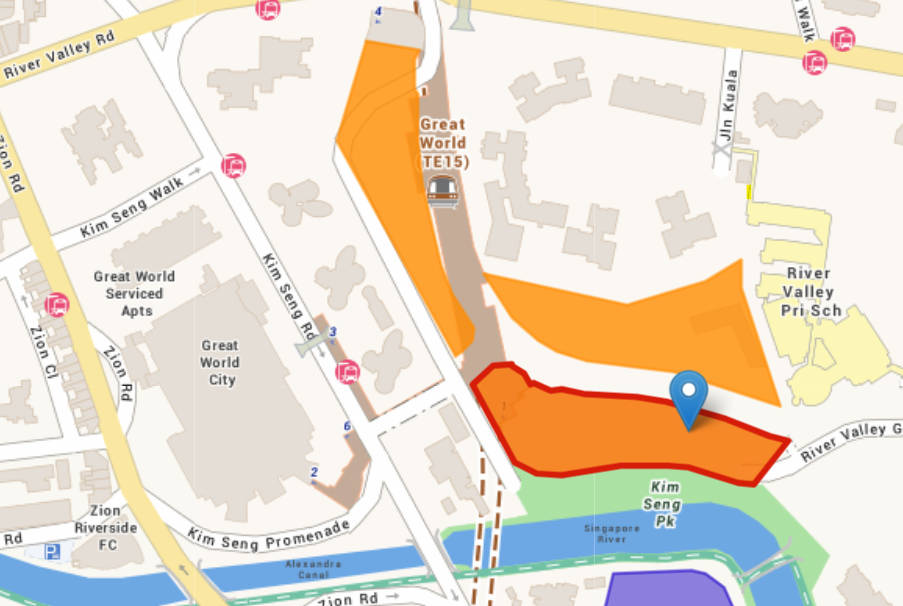

River Valley Green (Parcel B) - 580 units, including 220 long-stay serviced apartments  |

|

Bayshore Road - 515 units  |

|

Media Circle (Parcel A) - 345 units  Media Circle (Parcel B) - 485 units  |

|

Chuan Grove - 550 units  |

|

Holland Link - 240 units  |

|

Chencharu Close - 875 units  |

|

Source: PropNex Research, URA Space