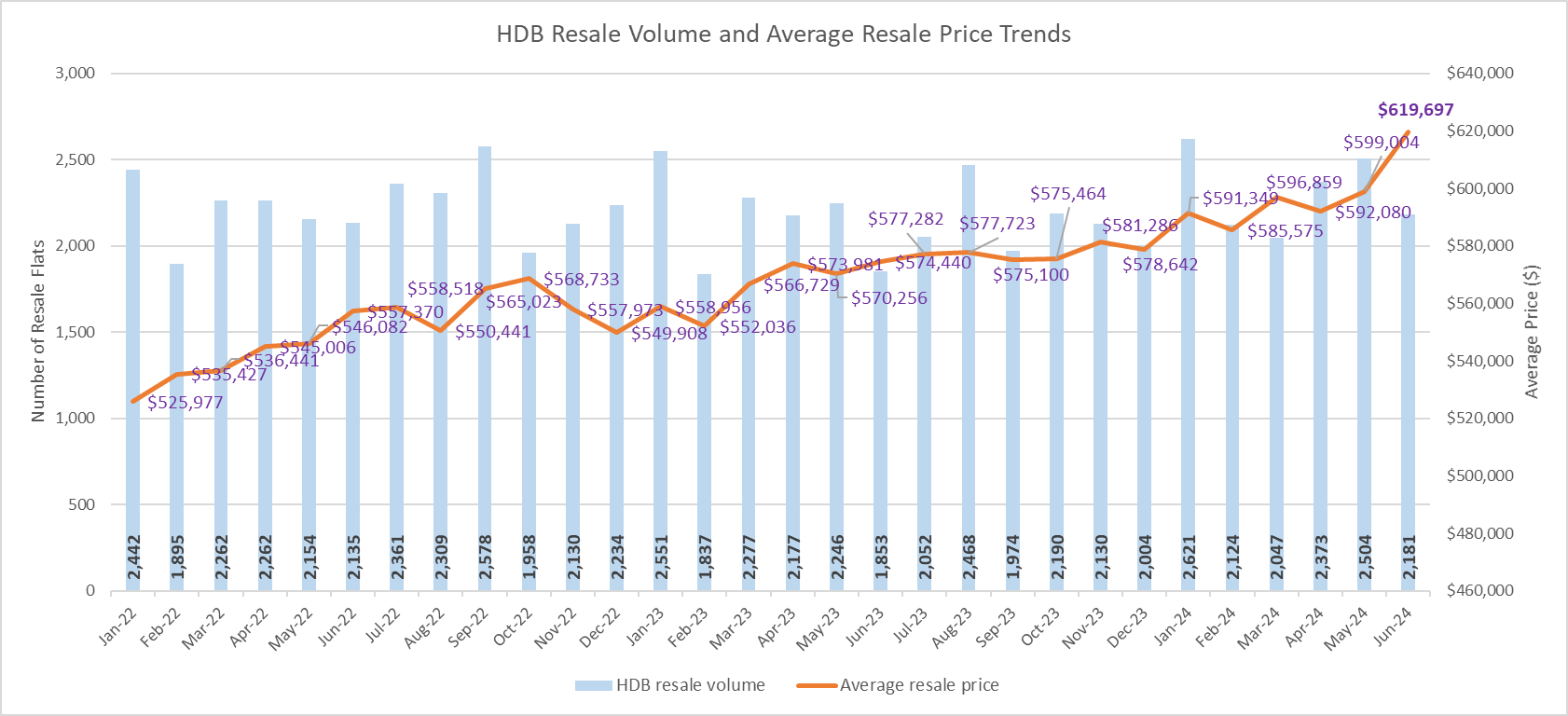

2024年6月18日,新加坡——2024 年 5 月,新私宅销售连续第二个月下滑,新项目数量匮乏压低了市场活动。开发商 5 月份共售出 221 套新房(不包括执行共管公寓EC),较 4 月份所售的 301 套下跌 26.6%。此前,开发商从3 月到 4 月份的销售额环比下降了 58.1%。2024年5月的销售额是自 2008 年以来,5 月单月份最低的销售业绩。

与去年同期相比,新私宅销量较 2023 年 5 月的 1,039 个单位大跌 78.7%,当时双悦园(The Continuum)和青麓尚居(The Reserve Residences)的开盘带动了销售。4 月和 5 月份新私宅总销量达 522 套(不包括 EC)。2024 年 6 月预计不会有大型项目开盘,2024 年第二季开发商销售可能会走软,极大可能比2024 年第一季售出的 1,164 套新房和 2023 年第二季售出的 2,127 套新房来的逊色。

2024 年 5 月,开发商推出了 248 套新单位,较上个月投放市场的 278 套下滑 11%。5 月份一共有三个新项目开盘,分别是核心中央区建有190 个单位的豪华项目天澜云邸(Skywaters Residences),以及中央区外两个精品开发项目 Jansen House(21个单位)和 Straits at Joo Chiat(16 个单位)。

Source: PropNex Research, URA

中央区外(OCR)占 5 月份销售额的 64%,销量达 141 个单位(不包括 EC)。这比上个月成交的 150 个单位下滑了 6%。5 月份最畅销的 OCR 项目包括 以中位数尺价每平方英尺 2,164 元售出25个单位的Lentor Hills Residences;中位数尺价每平方英尺 2,099 元售出23个单位的顶林佳苑(Hillhaven);中位数尺价每平方英尺 2,128 元售出21个单位的Hillock Green(见表 2)。与此同时,OCR 精品新项目 Jansen House 售出 3个单位,中位数尺价为每平方英尺 2,098 元;Straits at Joo Chiat 则卖出2 个单位,中位数尺价为每平方英尺 2,091 元。

其他中央区(RCR)方面,开发商在 5 月份卖出 53 套新房,较 4 月份的 119 套滑落近 56%。这是自 2023 年 1 月成交 48 套新房以来,RCR新私宅单月销量最少的一次。5 月份最畅销RCR 项目是鼎瑞苑(The Landmark),14 套单位以中位数每平方英尺 2,883 元售出。紧随其后的是双悦园(The Continuum),以中位数尺价每平方英尺 2,844 元售出10个单位。

与此同时,核心中央区 (CCR) 开发商销量在 5 月份环比下降约 16% 至 27 个单位。本月两个受欢迎的 CCR 项目是 19 Nassim 和康邻豪庭(Klimt Cairnhill),分别以每平方英尺 3,373 元和每平方英尺 3,317 元的中位数尺价各自卖出6 个单位。值得注意的是,丹戎巴葛(Tanjong Pagar)天澜云邸 57 楼的一套面积7,761 平方英尺的公寓单位,以 4,730 万元或每平方英尺 6,100 元的价格售出,创下99 年地契非有地新私宅项目最高尺价的纪录。

EC 市场中,新私宅销量从 4 月份的 51 套下跌至 5 月份的 40 套,跌幅约22%。North Gaia 是5月份最畅销的 EC 项目,以每平方英尺 1,338 元的中位数尺价售出 20 个单位。市区重建局数据显示,截至 5 月底,市场上有 299 套未售出的新 EC 单位。

博纳产业市场研究与产业内容主管黄秀瑩(Wong Siew Ying):

“5 月份新私宅销售低迷,成了开发商销售三个月来的最低水平。新开盘的项目数量有限,因此销售疲软并不令人意外。5 月份推出的新项目中,有两个是单位数量较少的精品开发项目,而天澜云邸作为市中心的高端项目,可能超出了本地大多数购房者的预算。

除了 3 月份推出建有 533 个单位的悦府伦庭外,迄今为止推出的新项目规模相对小得多。许多潜在购房者可能正在等待更多项目开盘,才能在买房前货比三家。

新盘项目数量匮乏,以及多数家庭会趁学校假期出国旅行进而形成交易淡季,开发商销售在来临的 2024 年 6 月可能会保持疲软。因此,我们认为2024 年第二季新私宅销售预计将表现平淡,可能低于 2024 年第一季(1,164 套)以及 2023 年第二季(2,127 套)。

2024 年第三季市场可能会更活跃,尽管开发商可能会避免农历鬼月(8 月 4 日至 9 月 2 日)期间推出项目。两个OCR项目,裕廊东(Jurong East)建有440个单位的水岸华庭(Sora)和弗洛拉通道(Flora Drive)建有 276 个单位的 Kassia,预计将于 7 月份开盘。其他中大型项目也可能在 2024 年第三季上市,包括嘉乐轩(Emerald of Katong)(847 个单位)、Meyer Blue(226 个单位)、鑫丰瑞府(The Chuan Park)(916 个单位)、武吉知马连路(Bukit Timah Link)项目(160 套)。

近期开盘的新项目数量有限,市场上现有项目的未售库存继续减少。Lentor Hills Residences 于 2023 年 7 月推出,是 2024 年 5 月最畅销的项目。值得注意的是,伦多(Lentor)地区另外三个项目Hillock Green、悦府伦庭 和 Lentoria都得以上榜5月份畅销项目前十名。市建局房地产资讯系统买卖禁令数据显示(截至 6 月 9 日),这四个伦多项目以及综合开发项目曲水伦庭(Lentor Modern)(2022 年 9 月开盘)共售出单位总数的约 75%(2,477 个单位中的 1,855 个)。这或许在一定程度上缓解了人们最初的担忧,认为伦多地区可能出现供应过剩的情况。伦多中路(Lentor Central)的第六个项目或将建有约 475 个单位,目前尚未开售。这个地段于 2023 年 9 月由开发商标得。

表 1: 每月非有地新私宅销售(不包括EC)的买家居民身份国籍占比

买家居民 | 2023年5月 | 2023年6月 | 2023年7月 | 2023年8月 | 2023年9月 | 2023年10月 | 2023年11月 | 2023年12月 | 2024年1月 | 2024年2月 | 2024年3月 | 2024年4月 | 2024年5月 |

公司机构 | - | - | - | - | - | - | - | - | - | - | - | - | - |

外籍人士(NPR) | 3.0% | 4.7% | 1.3% | 2.5% | 5.4% | 6.4% | 1.7% | 3.6% | 1.1% | 2.0% | 1.6% | 3.5% | 2.8% |

新加坡 永久居民 | 10.4% | 12.2% | 9.9% | 16.8% | 11.9% | 9.6% | 12.5% | 9.4% | 10.2% | 14.3% | 6.2% | 14.1% | 14.7% |

新加坡公民 | 86.6% | 83.1% | 88.8% | 80.7% | 82.7% | 84.0% | 85.8% | 87.0% | 88.8% | 83.7% | 92.2% | 82.4% | 82.5% |

来源: 博纳研究、市区重建局房地产资讯系统(数据于2024年6月18日截取)

买卖禁令数据显示,5 月份外国买家(非永久居民)所占新私宅销售的比例,从上个月的 3.5% 下滑至 2.8%。以绝对数量来看,外国买家提交的买卖禁令有六个,而上个月的外国买家买卖禁令则有10笔。2024 年 5 月份由外籍买家(NPR)买下的6个单位来自10 Evelyn、19 Nassim、Atlassia、康邻豪庭、天澜云邸以及万景轩(The Botany at Dairy Farm)。与此同时,4月到5月,本地买家和永久居民买家购买新私宅的销售比例微升,分别占5月份销售的82.6% 和 14.7%(见图 1)。”

表2:2024年5月畅销私宅项目龙虎榜(不包括EC)

| 项目 | 区域 | 2024年5月 售出单位 | 2024年5月 中位数价格($PSF) | |

1 | LENTOR HILLS RESIDENCES | OCR | 25 | $2,164 |

2 | 顶林佳苑HILLHAVEN | OCR | 23 | $2,099 |

3 | HILLOCK GREEN | OCR | 21 | $2,128 |

4 | 万景轩THE BOTANY AT DAIRY FARM | OCR | 18 | $1,968 |

5 | 秘林嘉园THE MYST | OCR | 17 | $2,152 |

6 | 鼎瑞苑THE LANDMARK | RCR | 14 | $2,883 |

7 | 悦府伦庭LENTOR MANSION | OCR | 11 | $2,229 |

8 | LENTORIA | OCR | 10 | $2,149 |

双悦园THE CONTINUUM | RCR | 10 | $2,844 | |

9 | 名门世家GRAND DUNMAN | RCR | 8 | $2,552 |

10 | 19 NASSIM | CCR | 6 | $3,373 |

康邻豪庭KLIMT CAIRNHILL | CCR | 6 | $3,317 |

来源: 博纳研究、市区重建局(2024年6月18日)