The HDB resale volume was relatively stable in November, dipping just 2.5% month-on-month to 2,137 units from 2,192 units in the previous month, according to the latest transaction data. When compared with the previous year, HDB resale transactions last month were up slightly by 0.3% year-on-year. Non-mature towns made up about 61% of the transactions in November, with Punggol leading sales during the month.

Looking at 2023, it is clear that the HDB resale market is showing signs of slowing growth, as the combined impact of price resistance among buyers, a larger Build-to-Order (BTO) supply, and the effects of the September 2022 cooling measures weigh on sales. In the first 11 months of 2023, an average of 2,161 resale flats were transacted per month – down from an average of 2,227 units in 2022 and 2,424 units in 2021, where demand was more buoyant.

PropNex expects the resale volume in December to trend close to the 2,000-unit level, in view of the year-end seasonal lull, as well as the HDB’s December BTO sales launch possibly drawing some prospective buyers from the resale market. Some 6,000 BTO flats will be offered for application, spanning seven towns – Bukit Panjang, Jurong West, Woodlands, Bedok, Bishan, Bukit Merah, and Queenstown.

Despite the more measured general buying sentiment, the average HDB resale prices inched up for the second straight month in November, rising by 0.9% MOM to more than $580,930 following the marginal 0.1% MOM increase in October. On a year-on-year basis, HDB resale prices were up by 4.1% YOY from November 2022 (see Chart 1).

Chart 1: HDB resale volume and average transacted price by month

Source: PropNex Research, Data.gov.sg

By flat type, the average of resale prices of larger flat types saw a slight decline from October to November. The overall average resale price of executive flats slipped by 1.9% MOM to $839,811, while that of 5-room resale flats dipped by 0.2% to $690,780 (see Table 1) – the slower growth and occasional dip in prices reflect price resistance in the market, where buyers are reluctant to pay more for resale flats as overall prices have run up substantially in recent years. Meanwhile, the average resale price for 4-room flats was flat in November, and that of 3-room flats rose by 1.6% MOM.

Table 1: Average transacted HDB resale flat prices by Flat Type in last six months

Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | MOM % change | |

3-ROOM | $414,189 | $413,667 | $411,399 | $415,016 | $413,524 | $420,172 | 1.6% |

4-ROOM | $581,585 | $582,175 | $597,592 | $589,426 | $592,461 | $592,688 | 0.0% |

5-ROOM | $686,300 | $684,851 | $690,447 | $694,687 | $692,186 | $690,780 | -0.2% |

EXECUTIVE | $820,123 | $831,930 | $844,183 | $833,436 | $855,699 | $839,811 | -1.9% |

Source: PropNex Research, Data.gov.sg

Assessing the data by towns and flat types, it was found that the average resale prices of several flat types posted MOM declines in November – across both mature and non-mature estates. The segment that saw the steepest drop was executive flats in mature towns where the average resale price fell by 1.4% MOM to more than $911,000; this was followed by 5-room resale flats in mature estates where average price decreased by 1% MOM to about $800,000 (see Table 2). At the other end, 3-room resale flats in non-mature towns garnered the largest price increase, rising by 1.9% MOM to $409,439 in November.

Table 2: Average transacted HDB resale flat prices in Mature and Non-mature towns

Mature towns | Non-mature towns | |||||||

| Oct-23 | Nov-23 | % change MOM | Oct-23 | Nov-23 | % change MOM | ||

3 ROOM | $422,601 | $427,418 | 1.1% | $401,719 | $409,439 | 1.9% | ||

4 ROOM | $684,534 | $680,457 | -0.6% | $549,315 | $547,533 | -0.3% | ||

5 ROOM | $808,687 | $800,776 | -1.0% | $644,319 | $643,735 | -0.1% | ||

EXECUTIVE | $924,029 | $911,036 | -1.4% | $806,461 | $801,167 | -0.7% | ||

Source: PropNex Research, Data.gov.sg

In November 2023, mature towns made up the top 3 lists of estates in PropNex’s ranking of average transacted resale prices on a per square foot basis ($PSF) by flat types (see Table 3). The highest average PSF price for 4-room flats in November was $897 psf in Queenstown, while Bukit Merah and Bishan achieved the highest average unit resale price for 5-room flats and executive flats in November at $845 psf and $684 psf, respectively.

Table 3: Top 3 towns by Average $PSF transacted price by flat type in November 2023 (and corresponding price in previous month)

4-Room | |||||

Top 3 | Oct-23 | Nov-23 | |||

QUEENSTOWN | $921 | $897 | |||

CENTRAL AREA | $862 | $813 | |||

KALLANG/WHAMPOA | $793 | $803 | |||

5-Room | Executive | ||||

Top 3 | Oct-23 | Nov-23 | Top 3 | Oct-23 | Nov-23 |

BUKIT MERAH | $729 | $845 | BISHAN | $707 | $684 |

QUEENSTOWN | $603 | $744 | ANG MO KIO | $577 | $653 |

KALLANG/WHAMPOA | $711 | $704 | SERANGOON | $601 | $647 |

Source: PropNex Research, data.gov.sg

Based on resale transaction data, about 33.6% of resale flats sold in November were priced at below $500,000, compared to 34.8% in the previous month. Meanwhile, about 64.3% of the flats resold in November were priced at between $500,000 and just under $1 mil – up from 63.4% in September. The proportion of resale flats sold for at least $1 million made up 2.1% of November’s sales – rising slightly from 1.9% in the previous month (See Chart 2).

Chart 2: Proportion of HDB Resale Transactions by Price Range

Source: PropNex Research, Data.gov.sg

The number of HDB flats resold for at least $1 million climbed by 9.8% MOM to 45 units in November from 41 units transacted in October (see Chart 3). This takes the total number of such flats resold to 422 in the first 11 months of 2023 – already more than 14% higher than the record 369 units resold in the whole of 2022.

Chart 3: Number of “Million-dollar” HDB Resale Flats sold By Month

Source: PropNex Research, Data.gov.sg

Of the 45 units of million-dollar resale flats, four of them are located in non-mature estates Bukit Batok (2 units), Woodlands (1), and Hougang (1). The remaining units are in Bukit Merah (9), Kallang Whampoa (6), Ang Mo Kio (5), Bishan, Queenstown, and Toa Payoh (4 in each), Clementi (3), Serangoon and Central Area (2 in each), and Bedok and Geylang (1 in each).

By flat type, 17 of the million-dollar resale flats are 5-room units, followed by 15 units of executive flats, 12 units of 4-room flats, and a 3-room terrace flat spanning 141 sq m in Jalan Bahagia, which fetched $1.2 million.

The most expensive HDB resale flat sold in November was a 5-room flat at Henderson Road (see Table 4). The 113 sq m (1,216 sq ft) flat at City Vue @ Henderson which is located between the 31st and 33rd floor fetched $1.46 million. This latest transaction is the highest resale price achieved at City Vue @ Henderson – a SERS replacement site - so far. In November, City Vue @ Henderson witnessed four flats resold for at least $1 million.

Overall, City Vue @ Henderson has seen a number of resale transactions in recent months. There were 16 deals done in the last three months (September to November) compared with 19 deals in the first eight months of 2023. It is possible that the August announcement of the new “Standard, Plus, and Prime” classification framework - effective from the second half of 2024 – could have heightened the appeal of existing choice resale flats, such as those at City Vue @ Henderson.

The government has said that the new Plus and Prime flats which are in attractive locations will come with stricter resale/rental conditions and a longer 10-year minimum occupation period. Existing resale flats will not be affected by the new classification framework, and some buyers who are unwilling to be subjected to stricter conditions for the upcoming Plus and Prime flats may decide to purchase choice resale units now. In addition, most of the HDB BTO launches in the city fringe do not offer 5-room flats, thereby increasing the appeal of such units in the resale market.

Table 4: Top 10 HDB resale flats transacted in November 2023 by Transacted Price

Town | Type | Street | Storey range | Floor area SQM | Lease start date | Price | PSF ($) |

BUKIT MERAH | 5 ROOM | HENDERSON RD | 31 TO 33 | 113 | 2019 | $1,460,000 | $1,200 |

BUKIT MERAH | 5 ROOM | HENDERSON RD | 43 TO 45 | 113 | 2019 | $1,450,000 | $1,192 |

CENTRAL AREA | 4 ROOM | CANTONMENT RD | 46 TO 48 | 95 | 2011 | $1,330,888 | $1,302 |

BUKIT MERAH | 5 ROOM | HENDERSON RD | 04 TO 06 | 113 | 2019 | $1,305,000 | $1,073 |

KALLANG/WHAMPOA | 3 ROOM | JLN BAHAGIA | 01 TO 03 | 141 | 1972 | $1,200,000 | $791 |

BUKIT MERAH | 5 ROOM | HENDERSON RD | 04 TO 06 | 113 | 2019 | $1,180,000 | $970 |

BISHAN | EXECUTIVE | BISHAN ST 13 | 10 TO 12 | 146 | 1987 | $1,170,000 | $744 |

BUKIT MERAH | 4 ROOM | TELOK BLANGAH ST 31 | 34 TO 36 | 95 | 2013 | $1,150,000 | $1,125 |

KALLANG/WHAMPOA | 5 ROOM | BOON KENG RD | 28 TO 30 | 107 | 2011 | $1,140,000 | $990 |

CLEMENTI | 5 ROOM | CLEMENTI AVE 4 | 25 TO 27 | 105 | 2014 | $1,120,000 | $991 |

Source: PropNex Research, Data.gov.sg

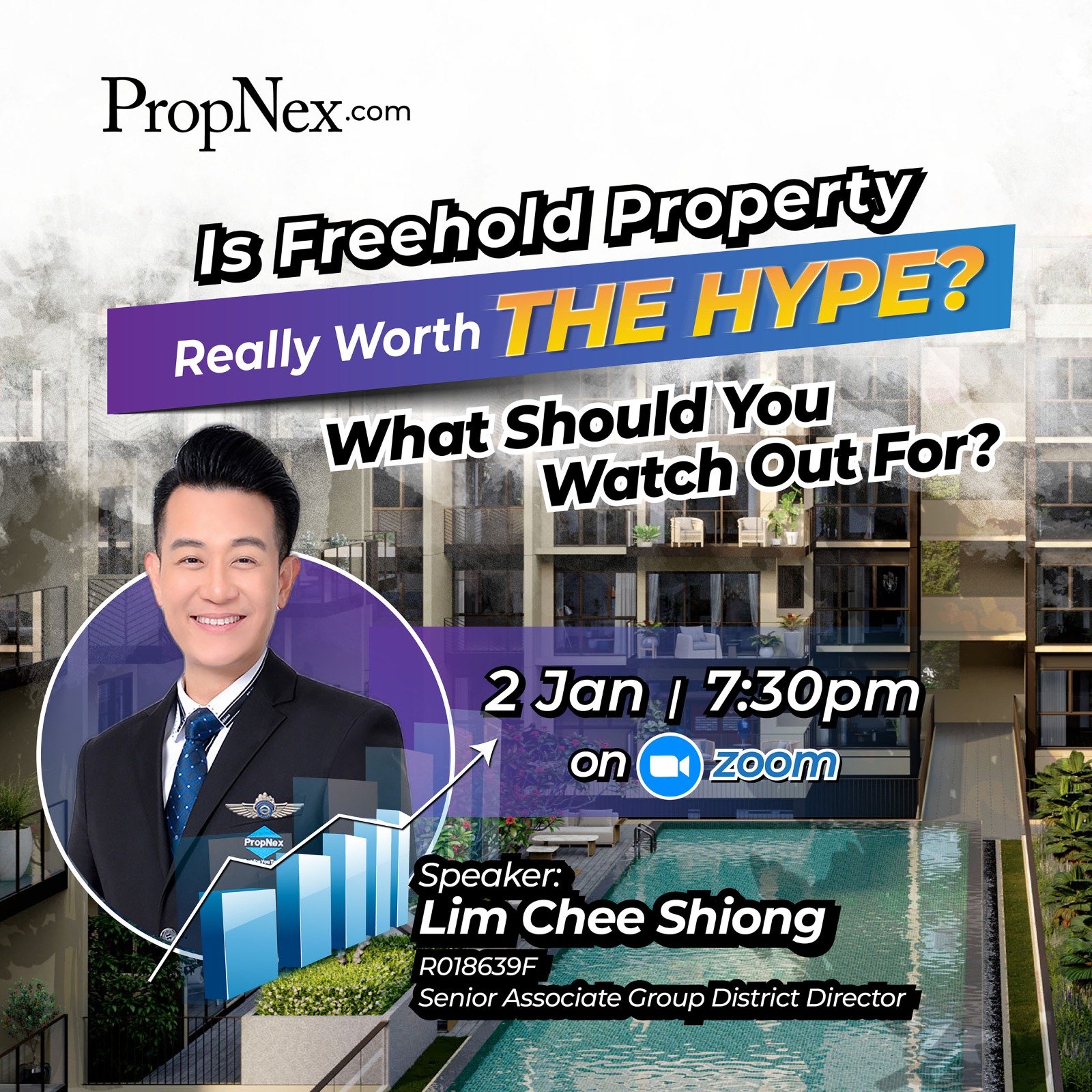

Hear what previous attendees have to say about their experiences at the Property Wealth System Masterclass. We invite you to join us in 2024 and embark on a journey to stretch your dollars and make them work for you: