Don't Buy Overseas Until You Read This

There is no better time than now if you are considering procuring or investing in overseas properties.

In 2022, CNA Luxury published an article, "Home and away: What's fuelling the rise of Singaporeans investing in property abroad?"

The article stated that many Singaporeans were exploring the overseas market in recent years, and for a variety of reasons, such as homeschooling, remote working, and the need for outdoor spaces. The increased ABSD rate also is probably the main factor for Singaporeans looking to invest globally.

The current top three countries that Singaporeans are investing in are Australia, United States of America, and United Kingdom, with the popular cities being Melbourne, Perth, Sydney, Los Angeles, New York, and London. It is not surprising seeing that many of these locations are popular destinations for studying as well as relocation and holiday homes. However, there is also a rising interest in non-city holiday destinations, such as Hokkaido and Hobart.

In fact, many countries, such as Thailand, have recognised the increasing need for foreign properties.

That being said, buying an overseas property is no doubt an interest among Singaporeans, even way before the limitation caused by the increased ABSD. Now before you jump the gun and purchase an overseas property, read to the end of this article before making that decision.

You might be purchasing an international property for a myriad of reasons, such as work and children's education. However, if you are purchasing an international property for your own living, there are several vital factors to consider even before making the purchase.

#1 Research on the necessary visas, laws, and taxes

There's no point purchasing a property in said country if you are not able to live there. For example, if you are looking to purchase a property in New York, it would only make sense to conduct adequate research on the obtainability of the right visa to allow you to live in the States.

That is why countries offering golden visa programmes, such as Australia, Canada, Hong Kong, Italy, Malaysia, New Zealand, Spain, and Thailand, are popular investment destinations. Golden visas offer investors, their families, and their future generations new lifestyle, market, healthcare, and educational opportunities. In fact, these programmes allow for citizenship applications after a couple of years living in the country.

Apart from visas, there is also a need to familiarise yourself with their local property laws and taxes. For example, foreign buyers looking at the Australian property market will have to seek approval from their foreign investment review board (FIRB) even before considering a property. Also, if you are going to be purchasing the property under another person's name, let's say your child, that is another possible law you need to consider.

The best advice is to consider visiting the country at least once before making the decision. There is more than just buying a property at an attractive location. You need to be familiar with how things work there as well as the culture. The last thing you want is to buy a property only to find out you do not like it there.

#2 Valuation and yield of the property's immediate surroundings

Just like purchasing a property in Singapore, you might eventually consider upgrading your overseas property or selling it to realise the profit. Depending on the neighbourhood, your property's valuation and yield can be higher or lower than expected.

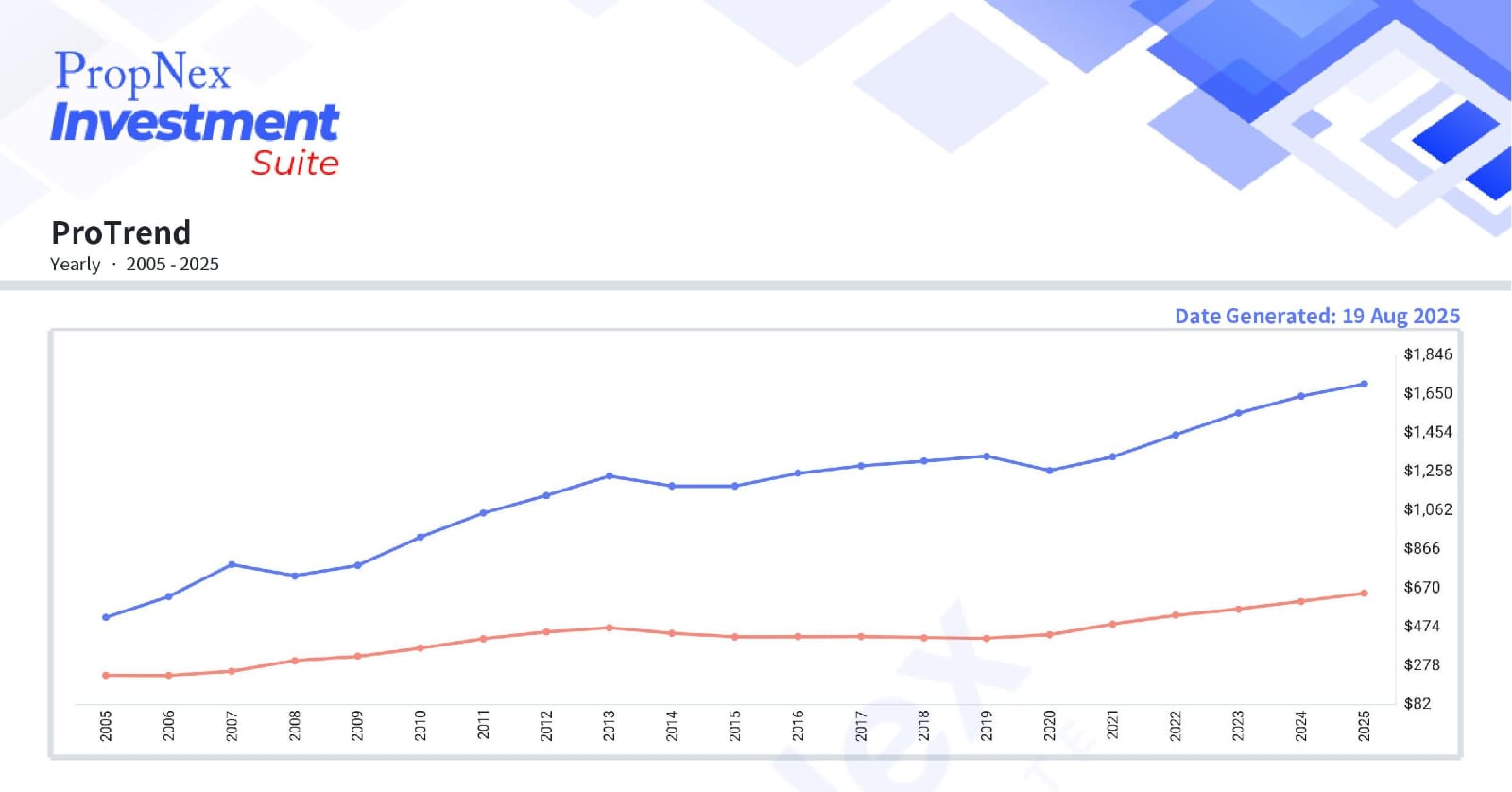

The general property market in Singapore is predictable, well-established, and closely-watched by the government. As such, it is extremely stable and resilient.

As you can see, the average value of HDBs (red line) and private condos (blue line) has maintained a steady increase without much significant fluctuations over the past 20 years. However, in countries, such as Malaysia, where many regions are still developing, the resale market is less predictable.

This could mean a potential goldmine if the value rises, a loss if an oversupply results in a plummet in value, or the value remaining stagnant. Unlike Singapore, property may not be profitable. As such, you can consider yourself lucky as long as the property value does not depreciate.

#3 Safety

Singapore is one of the safest nations in the world. It might not seem natural to factor it when purchasing a property here. As such, many Singaporeans do take it for granted, especially when in a foreign land. That should not be the case when looking at foreign markets. And unlike Singapore, you are also not able to generalise safety to the entire nation. Different cities and even streets can be distinctly different. You could be walking from one street to another, and find yourself in a potentially dangerous neighbourhood.

This brings us back to the first point on conducting adequate research and ensuring that you have visited the targeted location at least once before making your decision. Being at the location physically will give you a sense of how safe the neighbourhood is.

If you are purchasing an international property as an investment, some of the things you might consider important when making a decision are desired capital appreciation and expected cash flow as income. However, there are other aspects that you have to consider.

#1 Set realistic rental goals and know the market's stability

You must remember that nowhere is like Singapore, and many Singaporeans often forget about that when considering overseas investment. If we look at some of the popular countries for foreign investments, UK's average gross rental yield is at 7.03 per cent, Malaysia's average gross rental yield is at 5.16 per cent, Canada's average gross rental yield is at 5.10 per cent, and Thailand's average gross rental yield is at 6.27 per cent. Singapore's average gross rental yield is at 4.35 per cent.

Now before you jump into conclusion, it is vital to note that overseas markets are not as stable as Singapore's. UK's gross rental yield can drop to as low as 2.90 per cent, Malaysia's can drop to as low as 2.84 per cent, and Thailand's can drop to as low as 2.87 per cent. Being aware of the market's stability and conducting adequate research on it will help you to set realistic rental goals.

#2 Research on the rental taxes and laws for non-residents

Non-resident property owners are typically subjected to higher taxes and tighter laws in a majority of countries. For example, if you are considering investing in a UK property, there are tax considerations that you need to understand, such as rental income tax, capital gains tax, and stamp duty land tax.

Generated income from rental is subjected to income tax, depending on the property owner's tax residency status and total income. Additionally, foreign property owners are subjected to capital gains tax. However, they may get certain tax exemptions and reliefs when they pay their capital gains tax. Lastly, non-resident property owners must be prepared to pay stamp duty land tax which can range up to 12 per cent depending on the price of your property. Non-resident property owners are also subjected to an additional two per cent surcharge if the property is valued at 40,000 pounds or more.

#3 Be patient and plan your exit strategy

Do not rush to invest in an overseas property just because it sounds promising. It helps to constantly look out for potential properties in the market. However, it also helps to wait for the right time. One thing to note is that the more buyers there are in the market, the higher the competition. Buyers with more purchasing power will have the edge over their competitors, leaving behind "undesirable" properties.

Apart from making a profit through rental, you can also benefit from selling the property. This is where your exit strategy comes into play. There are several factors that affect your property value, such as how popular the location is, the property's condition, and the immediate surroundings.

Purchasing overseas properties can be a lucrative investment, whether you end up living there or renting it out. Often, when the offer sounds too good to be true, think twice.

Do not be swayed by "cheap" offers, especially in locations that you are unfamiliar with. Foreign property investment comes with its own set of challenges and considerations. Here are some final thoughts to consider:

Pros:

Diversification: Investing in foreign real estate can diversify your investment portfolio and reduce risk.

Potential for high returns: Popular tourist destinations or emerging markets can offer high returns of investment.

Personal use: You can use the property for retirement or as a vacation home.

Favourable exchange rates: A favourable exchange rate can make properties in certain countries even more affordable.

Cons:

Regulatory and legal issues: Understanding and complying with the local regulations and laws can sometimes be complex.

Currency risk: Exchange rate fluctuations can impact the value of your property investment.

Management challenges: Managing a property from afar can be difficult and may require engaging local property managers to help.

Market knowledge: Lack of knowledge about the local property market and its surroundings can lead to poor investment decisions.

Cultural differences: Different business practices and cultural norms may pose potential challenges.

As such, it is vital that you conduct thorough research on the local real estate market and the country's political and economic stability. You would also want to get legal and tax advice on the country's legal implications. Explore the available financing options as a non-resident yet be aware that securing a mortgage in a foreign land may be challenging. And as always, plan ahead and have a solid exit strategy in case you need to sell the property quickly.

Buying overseas properties can be a rewarding venture if you approach it with careful consideration and planning. At the upcoming PropNex International Property Expo, you'll gain first-hand insights into safe and proven strategies for investing abroad, discover exciting new launches, and learn how to build long-term wealth with confidence.

Don't miss this chance to explore opportunities and hear directly from industry experts.

Register today to secure your spot!

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.