HDB Resale Market Rebounded In July; Record Number Of Flats Resold For At Least $1 Million During The Month

Following a dip in sales in June, HDB resale flat transactions rebounded in July 2024 - posting the highest monthly sales in nearly 14 years. The uptick came after transactions fell in June, where market activity tended to slow owing to the school holidays.

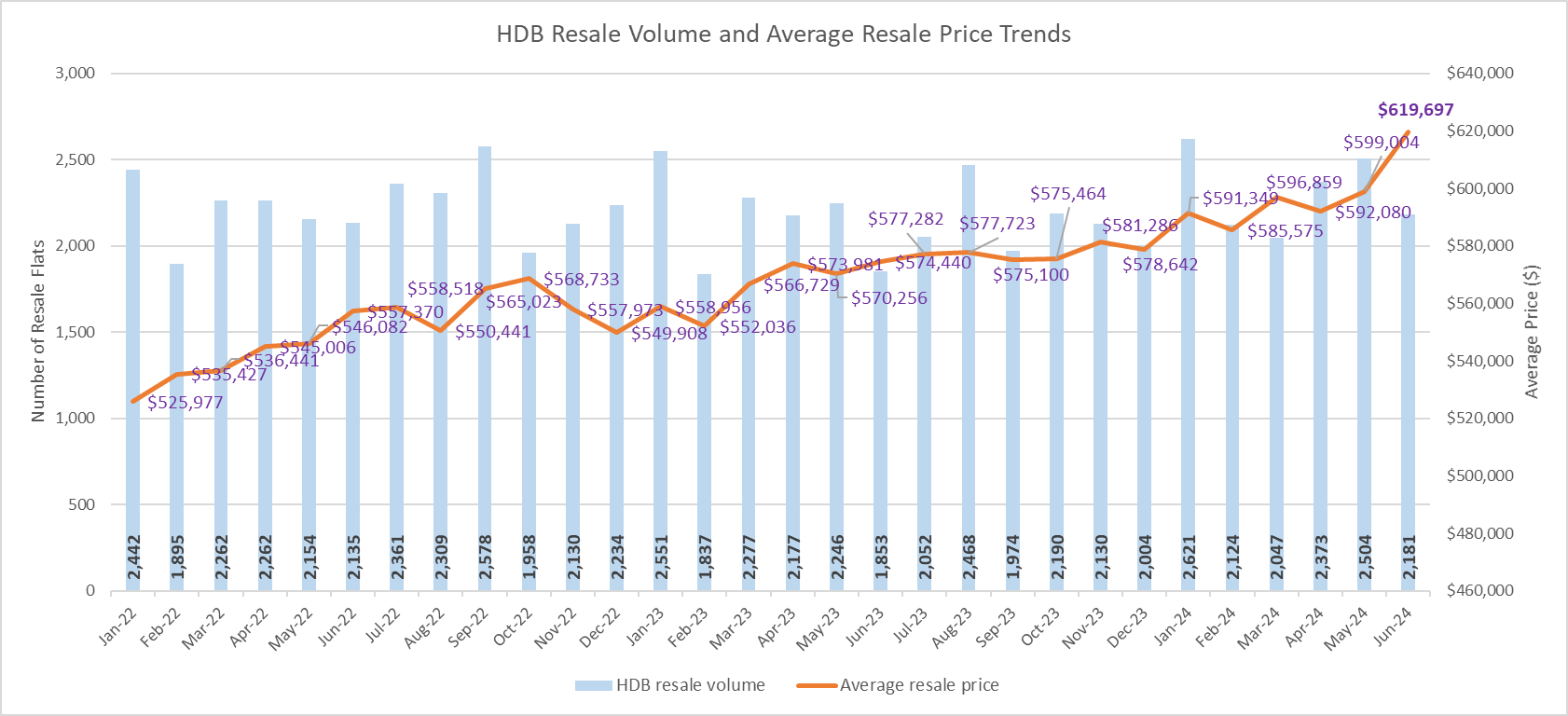

According to sales data, 3,047 resale flats changed hands in July, marking a 40% increase from the 2,179 flats resold in the previous month. When compared with July 2023, the resale volume was up by about 49% year-on-year (see Chart 1). Notably, the 3,047 units transacted in July 2024 is the highest monthly tally since 3,298 flats were sold in August 2010.

Despite the stronger sales, the average resale price moderated in July from June, dipping by 0.5% month-on-month to around $616,400. The slight decline in the average price may be an indication of some price resistance setting in among buyers, amid firmer prices in the first half of 2024 as reflected by the HDB resale price index. On a YOY basis, the average HDB resale price rose by 6.8% from July 2023, according to the transaction data (see Chart 1).

By locations, non-mature towns made up nearly 60% of the resale flats transacted in July. The top five most popular towns during the month were all non-mature estates, namely Sengkang, Woodlands, Punggol and Jurong West.

Chart 1: HDB resale volume and average transacted price by month

Table 1: Average transacted HDB resale flat prices in Mature and Non-mature towns

| Mature towns | Non-mature towns | |||||

Jun-24 | Jul-24 | % change MOM | Jun-24 | Jul-24 | % change MOM | |

3 ROOM | $451,905 | $449,786 | -0.5% | $424,756 | $433,036 | 1.9% |

4 ROOM | $736,837 | $749,056 | 1.7% | $572,457 | $576,190 | 0.7% |

5 ROOM | $883,023 | $849,889 | -3.8% | $677,274 | $676,388 | -0.1% |

EXECUTIVE | $955,187 | $972,738 | 1.8% | $833,211 | $835,068 | 0.2% |

In July, various flat types in mature and non-mature towns saw divergent price trends. In mature estates, executive flats posted a 1.8% MOM increase in the average resale price, followed by a 1.7% growth in the 4-room flats segment. Meanwhile, the average price of 3-room and 5-room flats in mature estates declined by 0.5% and 3.8% MOM, respectively (see Table 1). Over in non-mature towns, the average resale price of 3-room flats rose by 1.9% MOM, while that of 4-room and executive flats inched up by 0.7% and 0.2%, respectively.

After booking stronger gains in June, transaction data showed that the growth in the average resale prices of 3- and 4-room, and executive flats rose by 0.4% to 0.7% MOM in July (see Table 2), while 5-room flats saw the average resale price fall by 2.1% MOM.

Table 2: Average transacted HDB resale flat prices by Flat Type in last six months

Flat Type | Feb-24 | Mar-24 | Apr-24 | May-24 | Jun-24 | Jul-24 | MOM % change |

3-ROOM | $425,037 | $423,526 | $430,802 | $432,155 | $441,815 | $443,482 | 0.4% |

4-ROOM | $599,264 | $610,176 | $605,043 | $612,983 | $634,477 | $638,762 | 0.7% |

5-ROOM | $691,993 | $706,353 | $710,615 | $718,076 | $743,971 | $728,213 | -2.1% |

EXECUTIVE | $843,499 | $851,162 | $871,600 | $857,144 | $876,113 | $881,511 | 0.6% |

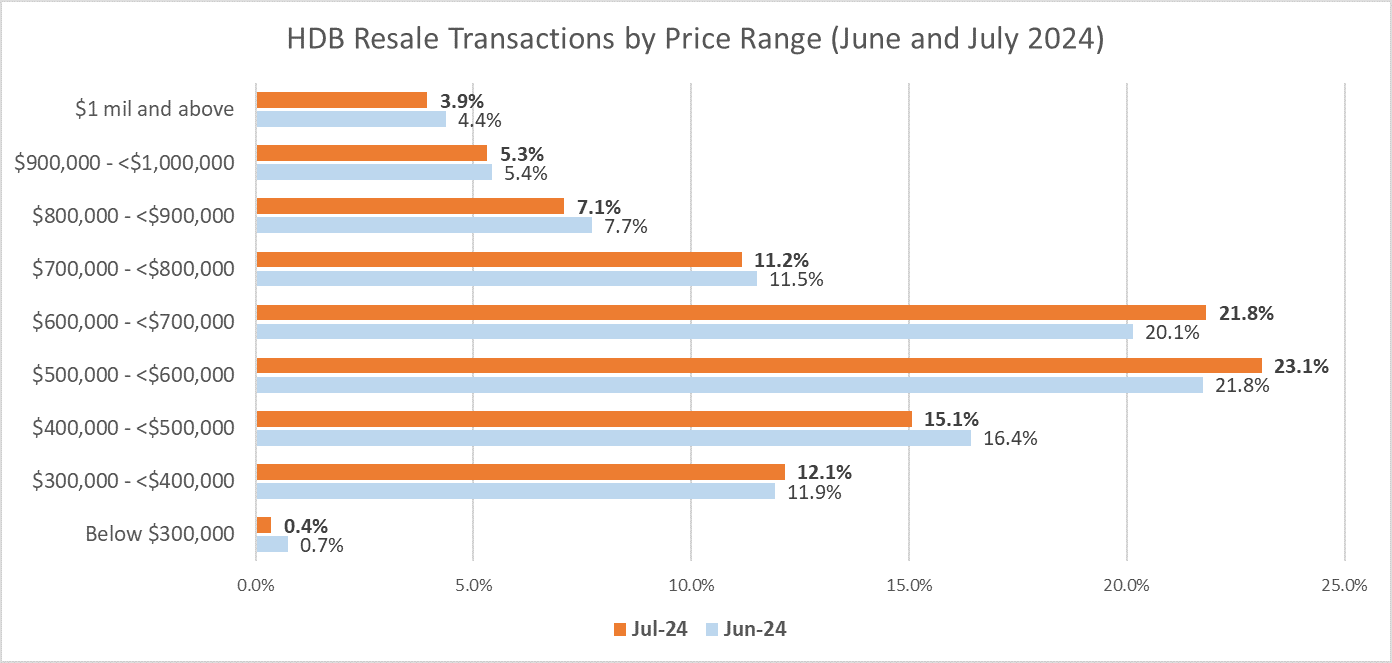

Chart 2: Proportion of HDB Resale Transactions by Price Range

By price range, 27.6% of the flats resold in July were priced at below $500,000 compared with 29.1% in the previous month. Meanwhile, the proportion of flats sold for between $500,000 and under $1 million was 68.5% in July - slightly higher than 66.5% in June. At the top end of the market, the proportion of flats resold for at least $1 million came in at 3.9% in July, lower than the 4.4% in the previous month - this is despite July posting a record-high monthly sales tally of such million-dollar resale flats.

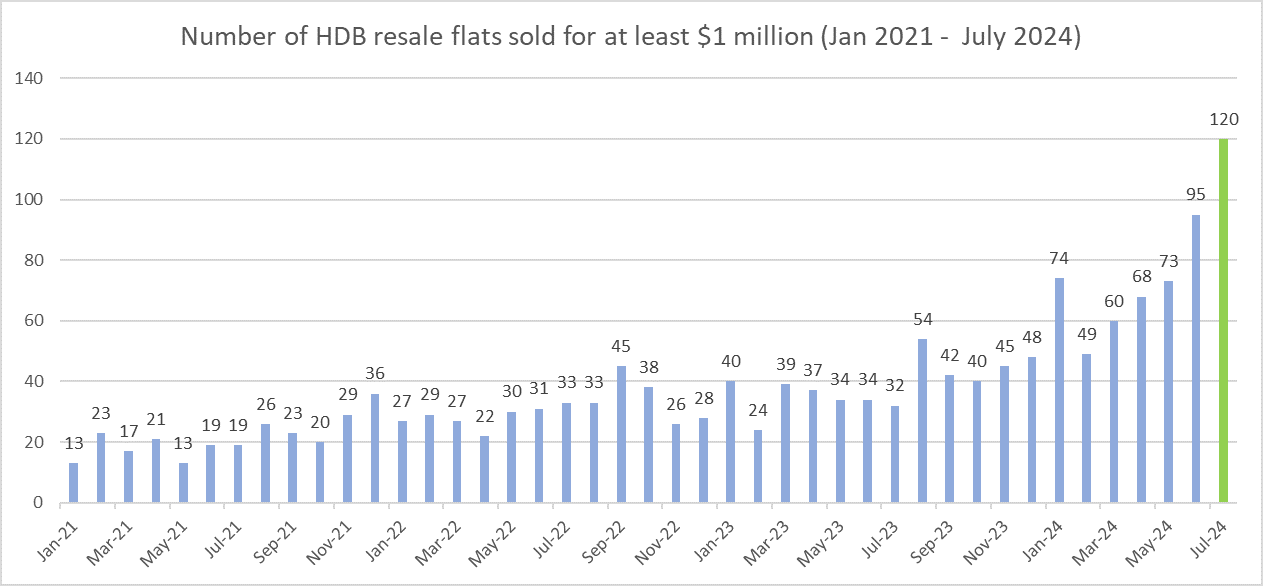

Transaction data showed that there were 120 flats resold for at least $1 million in July, up by 26% from the 95 units sold in June (see Chart 3). Taken together, there have been 539 units of million-dollar resale flats in the first seven months of 2024.

Of the 120 units transacted in July, 4-room resale flats accounted for 56 units or about 47% of the million-dollar flats resold during the month; this is the highest number of 4-room million-dollar flats resold on a monthly basis. The other million-dollar resale flats comprised 40 units of 5-room flats, 23 units of executive flats, and a 3-room terrace flat.

By town, there were nine resale flats sold for at least $1 million that are located in non-mature estates. There are three units in Hougang, two each in Woodlands and Bukit Batok, and one unit each in Punggol and Sengkang. The rest of the million-dollar resale flats are in mature estates, led by Kallang Whampoa with 23 units. Other mature towns that saw such transactions in July were Bukit Merah, Queenstown, Toa Payoh, Bishan, Ang Mo Kio, Clementi, Bukit Timah, Serangoon, Central Area, Bedok, Tampines, Geylang, and Marine Parade.

Chart 3: Number of "Million-dollar" HDB Resale Flats sold By Month

Table 3: Top 10 HDB resale flats sold in July 2024 by Transacted Price

Town | Type | Street | Storey range | Floor area SQM | Lease start date | Price | PSF ($) |

KALLANG/WHAMPOA | 3 ROOM | JLN MA'MOR | 01 TO 03 | 366.7 | 1972 | $1,568,000 | $397 |

BISHAN | 5 ROOM | BISHAN ST 24 | 37 TO 39 | 120 | 2011 | $1,568,000 | $1,214 |

TOA PAYOH | 5 ROOM | LOR 1A TOA PAYOH | 25 TO 27 | 114 | 2012 | $1,428,000 | $1,164 |

CENTRAL AREA | 4 ROOM | CANTONMENT RD | 37 TO 39 | 95 | 2011 | $1,400,000 | $1,369 |

BUKIT MERAH | 5 ROOM | HENDERSON RD | 22 TO 24 | 113 | 2019 | $1,400,000 | $1,151 |

BUKIT MERAH | 5 ROOM | HAVELOCK RD | 37 TO 39 | 114 | 2013 | $1,378,888 | $1,124 |

QUEENSTOWN | 4 ROOM | DAWSON RD | 40 TO 42 | 97 | 2016 | $1,300,000 | $1,245 |

ANG MO KIO | EXECUTIVE | ANG MO KIO AVE 5 | 10 TO 12 | 178 | 1980 | $1,300,000 | $679 |

BUKIT TIMAH | EXECUTIVE | TOH YI DR | 04 TO 06 | 146 | 1988 | $1,280,000 | $814 |

BISHAN | EXECUTIVE | BISHAN ST 13 | 01 TO 03 | 146 | 1987 | $1,277,000 | $813 |

The top transactions in July were for the sale of a large 367-sq m terrace flat in Jalan Ma'mor with a balance lease of 47 years, and a 5-room DBSS (design, build, and sell scheme) flat in Bishan. Both flats fetched $1.568 million each (see Table 3).

Following the rebound in July, the HDB resale market could see a dial-down in sales volume in August, as transactions are typically slower during the Ghost Month, where some prospective buyers and sellers may refrain from transacting.