Investing in Paradise: Bali Properties

Property prices and ABSD rates are rising like the sea levels, making it challenging for Singaporeans to invest in a second property... unless it's overseas!

Many people are already eyeing Malaysian properties due to its proximity to Singapore. But there are also attractive opportunities in other countries. Take Bali, Indonesia for example. Though it's a bit further from Singapore, it has compelling potential. So you might want to read through this article before you bet the rest of your money on Malaysian homes.

Rich in culture, breathtaking views, and delicious food, Bali attracts millions of visitors annually. In fact, the number of tourist arrivals has only gone up since COVID restrictions were lifted, and it has now surpassed pre-pandemic levels. In 2023 alone, Bali welcomed over 14.6 million tourists, 5.2 million of which are foreign. This is a significant increase from the previous year, and the numbers are expected to continue growing.

In recent years, the island of the Gods has also become a land of digital nomads. With plenty of workshops, boot camps, and networking opportunities, Bali has become the go-to destination for remote workers who want to have a good work-life balance and enjoy a laid-back island lifestyle. The visa-on-arrival policy combined with the relatively low cost of living have also made Bali particularly attractive to Russian expats. This has actually become a key factor fuelling the recent property growth in Bali.

The influx of visitors not only kickstarted new businesses but also drove up the demand for properties, especially vacation rentals. So much so that Bali's real estate market has become the most popular in the country.

Source: Beyond Bayou

Property demands by foreigners in Badung and Denpasar, two of the most visited regions, have skyrocketed by 92.1% and 81.3% respectively since 2022. Literally thousands of new villas have been built in the past two years. This increase in housing supply and demand can directly be attributed to the war between Russia and Ukraine, which is why Russians have become the main target demographic for many new developments.

Accordingly, property prices in Bali have been on the rise. The Residential Property Price Index (IHPR) went up from 1.48% in the first quarter to 1.86% in the second quarter, indicating a positive outlook for Bali properties in the coming years.

With current conditions, locals have also shown interest in Bali properties. Even one of my friends is building a villa now! It seems that everyone wants to get in on this amazing deal, and let's be real, who wouldn't?

Even though the market is moving in an upward trajectory, property prices remain affordable for the most part. Now I'm not going to pretend that everyone can simply afford to buy a property. But frankly speaking, property prices in Bali are only a small fraction of what you'd need to pay in Singapore.

For instance, this 2,206 sqft (205 sqm) 2-bedroom 2-bathroom villa with a swimming pool in Canggu is priced at only S$311,000. The initial leasehold is 25 years, but it can be extended further depending on the type of ownership (more on that later).

Source: Kibaber Property

Meanwhile, this 473 sqft (44 sqm) 1-bedroom 1-bathroom HDB flat in Ang Mo Kio with 53 years left on the lease costs $312,000.

Source: PropNex.com

All this is not to say that you should just ditch your dream of owning a home in Singapore. But if you're looking to invest in a second property, which one would you rather buy? I'll let you be the judge of that.

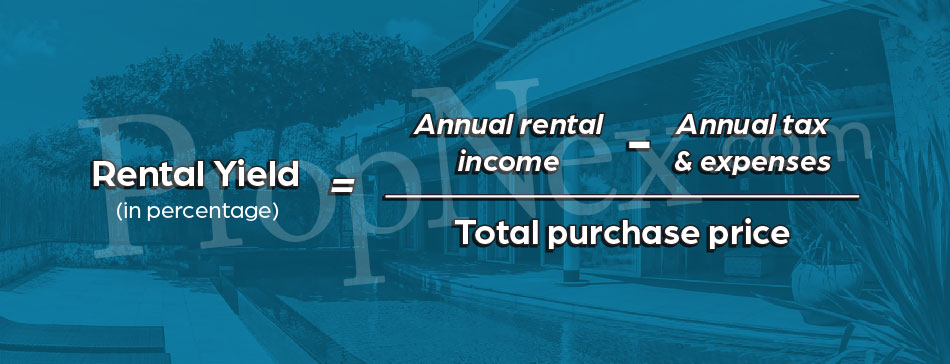

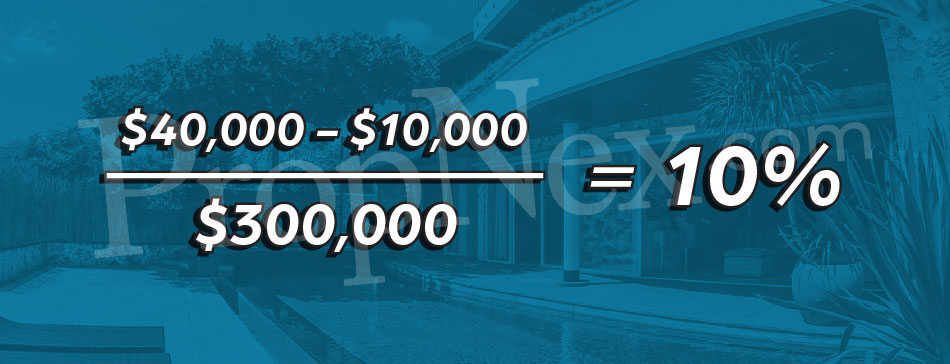

Beyond the value of the property itself, investors are attracted to the rental yield that vacation homes can offer. To be clear, rental yield refers to how much rental income a property generates annually (minus any expenses) compared to the total purchase price.

To illustrate, let's say you purchased a property for $300,000. Every year, you pay $10,000 for tax and maintenance fees, but you get $40,000 in rental income. Then your rental yield would be 10%.

Generally speaking, a rental yield over 5% is already considered good. It's enough to indicate a strong return on investment. In Bali, the average rental yield for vacation properties can reach up to 15%, which is significantly higher than the typical yields in Singapore or anywhere in the world for that matter. This is especially true for popular regions like Canggu, which is everyone's favourite vacation spot at the moment. You can expect great rental yields from vacation homes in this area regardless of whether it's a budget villa or a luxury stay. Other places like Denpasar, Uluwatu, and Ubud can also generate decent rental yields. This brings us to the next point.

When talking about property, one thing that always comes up is location. So here are some of the best performing areas in Bali that you should look into before investing.

Canggu

Source: Finns Beach Club

This bule hub is THE hottest place in Bali right now, swarming with tourists and digital nomads. There are plenty of cafes, restaurants, bars, and beach clubs in this area. The Gu' is also a popular destination for surfers since there are many beaches like Pererenan, Berawa, and Batu Bolong. Interestingly, despite being surrounded by the coast, the region also features scenic rice fields.

Source: ??Omnivagant

Seminyak/Kuta

Source: Goway Travel

Just south of Canggu, Seminyak is famous for its beautiful beaches, shopping, and nightlife experience.

Uluwatu

Known for its clifftops and beaches, Uluwatu is popular amongst those who want to have a taste of Bali's nature and culture. Aside from breathtaking views, plenty of tourists also visit this area to witness Kecak, a Balinese traditional dance.

Ubud

Two things Ubud is known for: the monkey forest and rice terrace. Personally, I prefer the latter since Bali monkeys are not the friendliest (they are, in fact, little thieves!). Regardless, many people visit this region to get a cultural experience, much like Uluwatu.

Thanks to the booming tourism, Bali is transforming. Rural areas like Canggu are now filled with new villas, cafes, eateries, and co-working spaces, reshaping the island. And as Bali becomes a popular hub for remote work and leisure, more people are relocating to the island, both short- and long-term. And it's not just the Russian expats and digital nomads, even Indonesian citizens are moving to Bali to seek better work opportunities. This growing population is boosting demand for housing, which often leads to capital appreciation in property values. On top of that, rental demand is also going up as newcomers look for rental options.

However, despite being so popular, Bali's infrastructure is actually lagging behind. Streets are narrow and not properly maintained. Now add the growing population to that mix and you get bad traffic. There are also no pavements for pedestrians and public transport is very limited. But thankfully, things will get better soon. Just last September, two companies kicked off an ambitious MRT project that will cost USD 20 billion. This initiative is set to tackle traffic congestion in Bali and is expected to be completed by 2031. With better accessibility and connectivity, demand for residential and commercial properties can potentially rise even more, further driving up property values.

That being said, because Bali properties rely heavily on tourism, anything that affects it will directly affect your investment. When the market is at its peak, it presents exceptional opportunities for investors, especially if you can enter at a low price. Alas, this is a double-edged sword- because when tourism declines, so does the demand for rental and real estate in general, which obviously will affect your property values and rental yields. The pandemic of Covid-19, for example, has shown how quickly things can go awry. Of course, things picked up after some time has passed. But then again, these things can happen unpredictably, so you definitely want to keep that in mind.

Generally speaking there are two types of property that foreigners can buy in Indonesia.

- Rumah tapak (landed house)

Source: BaliRealty

It's pretty straightforward, rumah tapak or landed house is a house built on a plot of land. According to current regulations, foreigners can only buy a rumah tapak with a minimum value of Rp 5,000,000,000 (roughly S$415,000 at the time of writing) and the plot size should not surpass 2,000 sqm (equivalent to 21,527 sq ft).

- Rumah susun (stacked house/apartment)

Source: Bali Home Immo

Rumah susun, abbreviated as rusun, can be regarded as an apartment. But to be precise, it is a development consisting of multiple units that can be structured horizontally or vertically. According to current regulations, foreigners can only buy a rusun with a minimum value of Rp 2,000,000,000 (roughly S$167,000 at the time of writing).

You might be thinking, "If Bali properties are so profitable, why isn't everyone investing there?" There's a reason why foreigners make up only 1.4% of buyers. Foreigners who want to buy a property in Indonesia face certain challenges and restrictions on property ownership such as having to be an Indonesian resident. This means they have to reside in Indonesia for at least half of the year (183 days). If not, their property will be auctioned by the state or returned to the owner of the land after one year.

However, the government has been relaxing some of these regulations to attract more foreign investors. For instance, in the past, foreigners who want to buy a property in Indonesia must hold a Kartu Identitas Tinggal Sementata (KITAS), which is a limited stay permit, or a Kartu Identitas Tinggal Tetap (KITAP), which is a permanent stay permit. Today, with just a passport or a visa, foreigners can easily get a limited leasehold. Here's another example, back then, foreigners could only obtain the right to use (hak pakai). But now, they can get limited leasehold properties and the right to build (hak guna bangunan/HGB) as well.

In the coming future, the government also plans to establish golden visas. These special visas for investors should make property investing more accessible for foreigners, improving market conditions not only in Bali, but across various regions of Indonesia.

Perhaps the most complicated part of owning a property in Indonesia as a foreigner is the type of ownership you can have. So here's a breakdown.

- Limited leasehold (hak sewa)

Like the name suggests, limited leasehold grants one control over a property for a specified amount of time, typically 25 years in Bali. However, it does not give you the right to collect revenue from the property, so this type of ownership is more suitable for those who just need a place to live. Foreigners can get a limited leasehold property with any kind of visa, including Visa on Arrival (VoA), making it the most straightforward and accessible way for them to buy a property in Indonesia.

- Right to build (hak guna bangunan/HGB)

The right to build can give a foreigner the legal right to construct and own buildings on state-owned land (tanah milik negara) or land under a management right (hak pengelolaan or HPL). If you have the right to build, you can sell, gift, exchange, pass on through inheritance, or use the land as collateral for a mortgage. The right to build is initially valid for up to 30 years but it can be extended for another 20 years.

For foreigners, obtaining the right to build requires setting up a foreign-owned company in Indonesia, called a Penanaman Modal Asing (PMA). First, you need to establish the PMA by getting the company's Articles of Association approved and securing a tax card. Next, you must obtain a KITAS visa, a temporary residence permit. After completing these steps, your PMA can acquire property in Indonesia and hold an HGB title, allowing you to build and use the land for up to 50 years through your company.

- Right to use (hak pakai)

The right to use gives one the legal right to use state-owned land or other people's land. However, unlike limited leasehold, the right to use also gives you the right to collect revenue, making it ideal for those who want to make rental income on their properties. Foreigners can also obtain this right without owning a PMA, so it's more accessible to individuals, though you still need a KITAS visa.

The validity of this type of ownership can reach up to 80 years, consisting of an initial 30 years, a 20-year extension, and a further 30-year renewal. Family members can inherit the rights, and it can be sold to Indonesian citizens, who can then convert it to the right to own (hak milik).

- Freehold or the right to own (hak milik)

The right to own is permanent and valid for a lifetime. It is the strongest title that one can have over a plot of land. However, this is exclusively reserved for Indonesian citizens and legal entities that have met requirements. Foreigners cannot own freehold land (even through HGB).

| Type of property ownership | Obtainable by foreigner | Requirements |

| Limited leasehold | Yes, but can't collect revenue | Passport and any type of visa |

| Right to build (hak guna bangunan/HGB) | Yes, except on freehold | PMA and KITAS |

| Right to use (hak pakai) | Yes, but limited to a single property | KITAS |

| Freehold or the right to own (hak milik) | No | Must be Indonesian citizen |

Foreigners who want to buy or sell properties in Indonesia are still subject to tax, but not more than locals. Below is the breakdown.

- Acquisition Tax (Bea Perolehan Hak atas Tanah dan Bangunan - BPHTB):

When acquiring property, foreigners must pay an acquisition tax, which is 5% of the property's sale value or market value, whichever is higher, after deducting a non-taxable threshold (varying by region).

- Annual Property Tax (Pajak Bumi dan Bangunan - PBB):

This is an annual tax on land and buildings. The tax rate varies, generally ranging from 0.1% to 0.3% of the property's taxable sale value, with the exact percentage depending on the property's value and location.

- Income Tax (Pajak Penghasilan - PPh):

Rental Income: If the foreign owner rents out the property, they must pay annual income tax on the rental income. The tax rate is 10% of the gross rental income.

Capital Gains Tax: If the foreigner sells the property, they are subject to a capital gains tax of 2.5% of the gross transaction value. This will be considered as an additional income in your annual tax report.

- Luxury Goods Sales Tax (PPnBM):

If the property is categorised as a luxury property, a Luxury Goods Sales Tax may apply. This can cost up to 20% of the property value.

All in all, Bali presents an enticing opportunity for real estate investment, especially now when rental yields and capital appreciation are on the rise. Bali's tourism initiatives and economic growth also adds a sense of reassurance. Given this current market condition, the risk of property values dropping appears quite low.

As alluring as it is, investing in Bali properties comes with a set of challenges. Navigating the complex regulations can be daunting. Overseas investors, in particular, may find property management difficult. You might have to fly back and forth, or, you might need to link up with agencies that specialise in handling properties for foreign investors. In any case, the costs can add up.

In terms of an exit strategy, options are fairly straightforward: you can sell to an Indonesian citizen, which tends to be simpler, or to another foreign investor with the correct ownership rights. Apart from taxes, there are typically no additional fees when selling a property (unless you choose to hire a professional to manage the process).

Ultimately, Bali properties are not for everyone because it does demand quite a lot of effort. It's up to you to decide whether or not it's worth it. Regardless, I encourage you to explore the possibilities and make your own informed decision. So the next time you visit Bali, go look into the properties there. Research the market, explore different locations, and learn more about the regulations. And if you are interested in investing, make sure you get connected with trusted professionals to help you navigate the process and avoid getting scammed. Our PropNex Indonesia agents based in Indonesia can offer their local expertise and are fully prepared to guide you every step of the way. Feel free to reach out to us if you need further clarity for property sales and purchases in Indonesia.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.