The Implications of Remote Work on OCR Properties

In late 2019, a pneumonia-like disease broke out in Wuhan, China. It only took a few months for it to spread globally, and by March 2020, the World Health Organization (WHO) declared COVID-19 as a pandemic. It's been over 5 years since then, and if there's one thing that came out of this whole thing, it's remote work.

Well, technically, remote work predates the infamous pandemic. But the lockdowns, stay-at-home orders, and introduction of online meeting apps like Zoom certainly contributed to its rising popularity. Thanks to that, many workplaces and companies still offer remote work today, over a year after the public health emergency was declared over. Forbes even regarded remote work as COVID-19's biggest legacy.

In Singapore particularly, workers showed a strong preference for a hybrid work model. A 2022 report by PwC also revealed that both employees and employers in Singapore showed a stronger preference for remote work compared to most other countries worldwide.

As hybrid and remote work became the new norm, there's a noticeable demand for residential properties in the Outside Central Region (OCR). Prior to the pandemic, many homebuyers preferred properties closer to the city centre for easier commuting. However, since flexible working arrangements reduce the need for daily office trips, it only makes sense that homebuyers are now prioritising space, comfort, and affordability over proximity to work. This has led to an increase in interest in OCR properties, which typically offer larger homes at lower prices compared to those in the Central Region.

Also read: District Diary: Mapping Out Regions in Singapore

This rise in demand for OCR properties hasn't gone unnoticed by developers either. While Singapore homes are not traditionally designed for Work-From-Home (WFH), especially with such limited space, recent project launches boast flexible configurations to make it more comfortable. For example, The Florence Residences in Hougang and Treasure at Tampines offer units that come with a study. Other developments like the Woodleigh Residences have units with flexi rooms that can easily be turned into a home office. These projects also have facilities like communal study rooms, multi-purpose rooms and function rooms that could support remote work setups.

Moreover, the OCR infrastructure has been growing. The establishment of new cafes, eateries and co-working spaces caters to the growing trend of remote work, giving workers comfortable and convenient spaces to be productive.

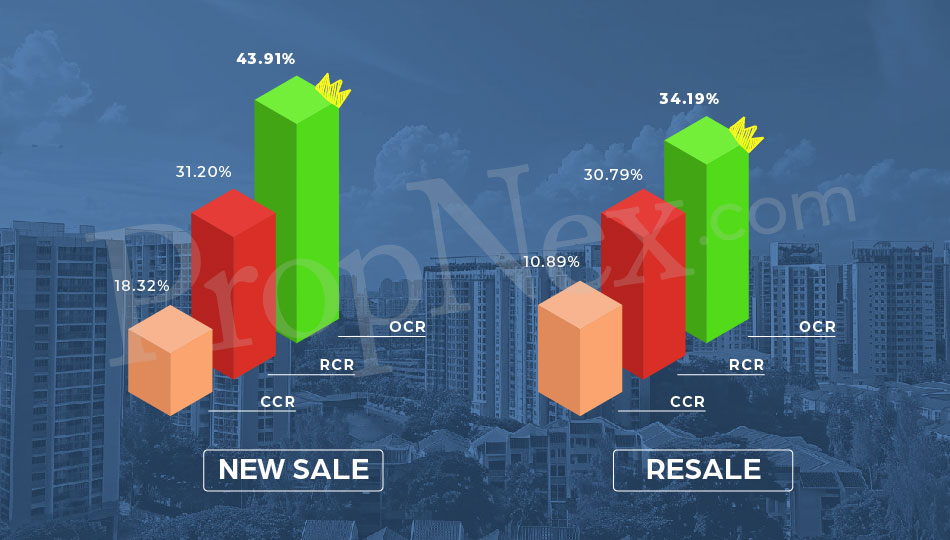

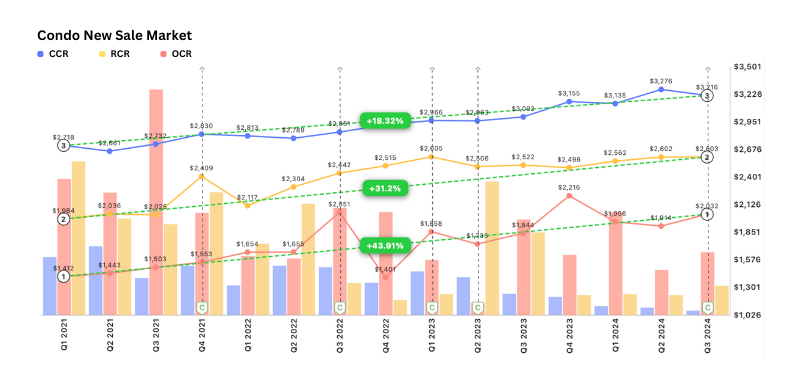

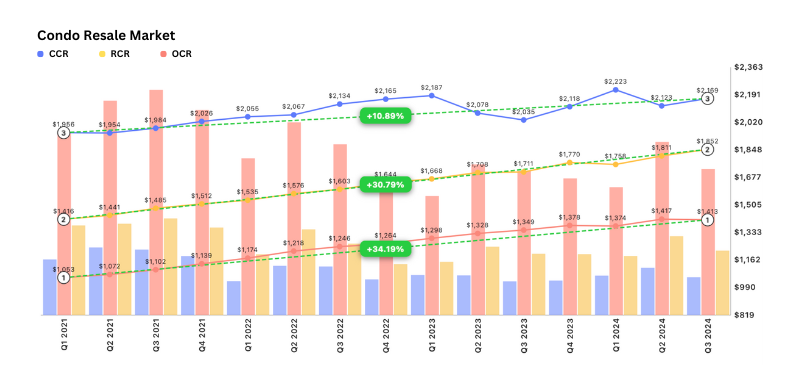

Looking at the data for the condo market, OCR properties indeed showed the largest growth in recent years, with a 43.91% increase in new sale and a 34.19% rise in resale since 2021. While remote work isn't the only factor driving this trend, it certainly plays a significant role. RCR properties follow closely with a 31.2% increase in new sales and a 30.79% rise in resale. In contrast, CCR properties have seen more modest growth, with an 18.32% rise in new sales and 10.89% in resale.

I do want to note that there were more fluctuations in the OCR new sale market, largely due to cooling measures, which seem to impact this segment more than RCR and CCR. However, in the resale market, CCR is the one to show slight fluctuations compared to the steady growth we see in its RCR and OCR counterparts.

Source: PropNex Investment Suite

Source: PropNex Investment Suite

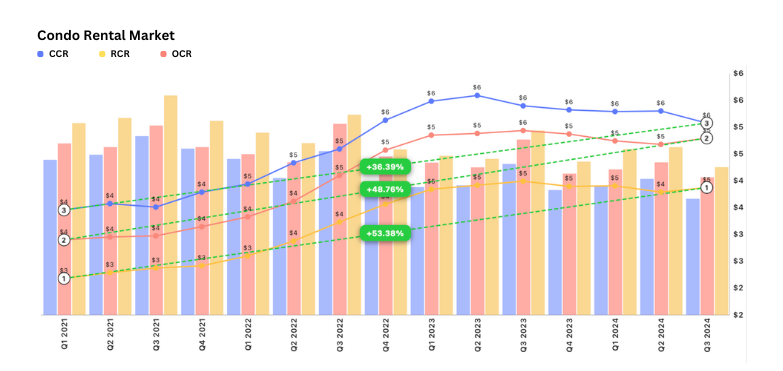

The rental market in OCR has also seen impressive growth over the past five years, with a substantial increase of 53.38%. This outpaces both the RCR and CCR, which experienced a 48.76% and 36.39% rise respectively.

Source: PropNex Investment Suite

For investors, OCR's strong performance presents an opportunity to tap into a market that has seen sustained interest due to the changing work landscape. While Central Region properties will always be in demand due to their prestige and proximity to the city, OCR properties offer a compelling alternative for both homebuyers and investors looking for long-term growth potential. The combination of affordability, larger living spaces, and the shift towards more flexible working arrangements continues to make OCR homes a more attractive option.

If I had to guess, the remote work trend is unlikely to reverse back to what it was pre-COVID era. Many businesses have realised the cost-saving benefits of offering flexible work options, and employees appreciate the improved work-life balance that comes with hybrid and remote work. So we can expect OCR properties to remain strong in the coming years, especially as more people seek homes that offer affordability, space, and better value for money.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.