Executive Condos Still Relevant In Meeting Private Housing Aspirations But Affordability Could Be Improved

Private home prices have risen consecutively for seven years since 2017. Amid the upward climb in private residential property prices, the executive condo (EC) housing type has become even more important for many households in the "sandwiched class" as a means to enter the private residential segment - in a bid to achieve their aspirations of owning and living in a private home.

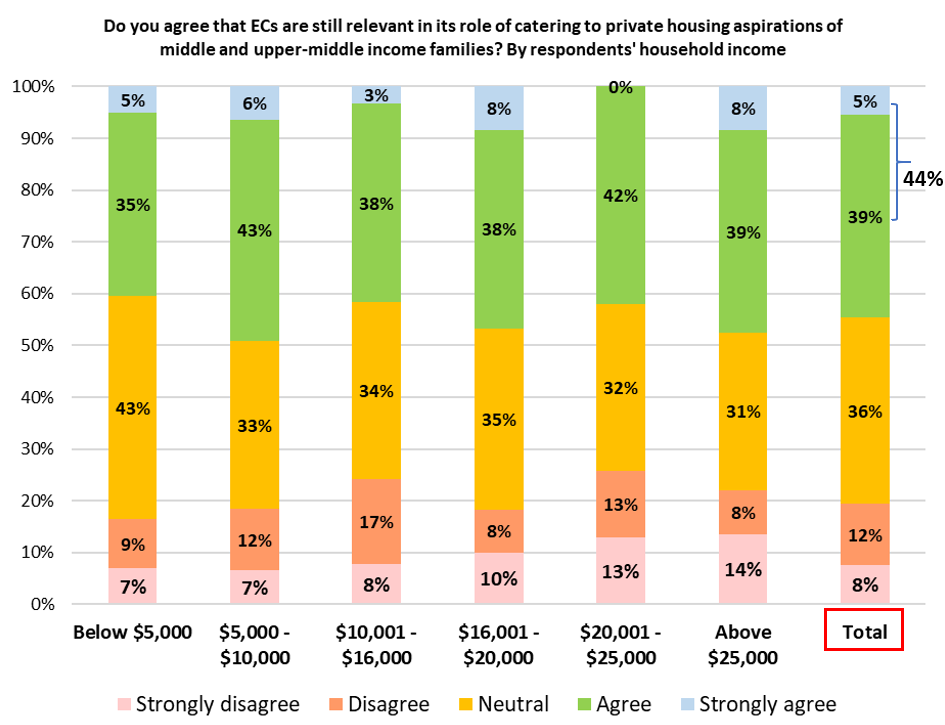

PropNex conducted a survey of some 1,250 HDB flat owners to find out if they feel that ECs are still relevant in meeting their housing aspirations as EC prices continued to inch upwards. Findings showed that a good portion of respondents (44%) either agree or strongly agree that ECs are still relevant in catering to the private housing aspirations of households (see Chart 1, Total column).

Chart 1: Are ECs still relevant in catering to the private housing aspirations of middle and upper-middle income families; by respondents' household income

By and large, ECs continue to be popular with homebuyers in Singapore, as they are usually more affordable than new private condo launches. However, many respondents indicated that they are concerned about rising prices of new EC launches.

According to URA Realis caveat data, the median transacted unit price of new EC units has risen substantially in the last few years from $798 psf in 2017 to $1,417 psf in 2023. In the first half of 2024, the median unit price of new ECs has tipped over the $1,500-psf mark (see Table 1).

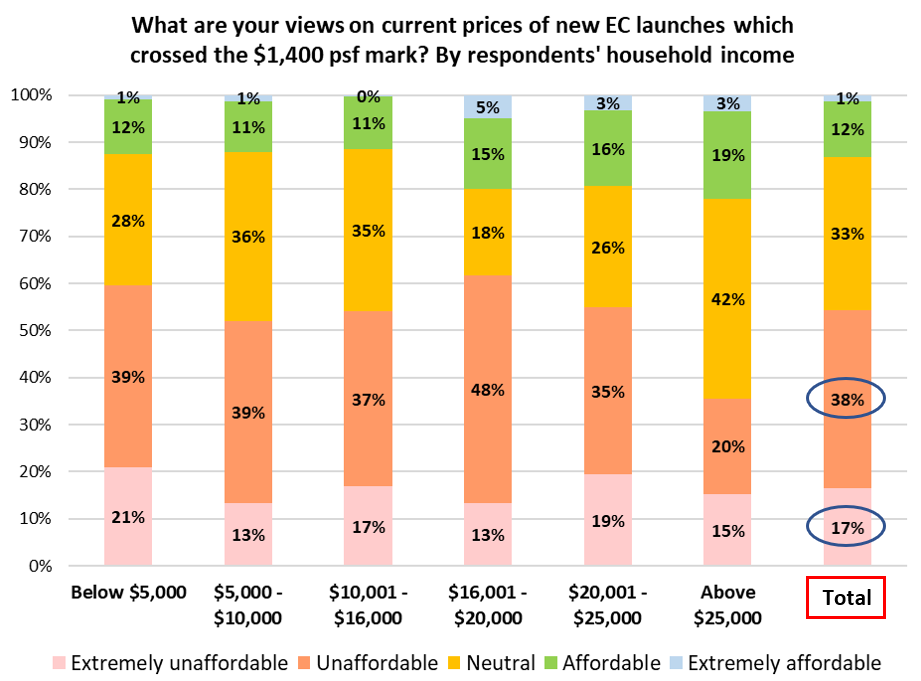

With the gradual climb in prices, PropNex's survey findings showed that 38% of the respondents felt that prices of new ECs are unaffordable, while 17% of them said that new ECs are extremely unaffordable (see Chart 2, Total column).

Table 1: Median unit price ($PSF) of ECs (new sales and resales)

| Median $PSF price of EC homes | Year-on-Year % change in median price | ||

Year | EC new sales | EC resale | EC new sales | EC resale |

2016 | $782 | $687 |

|

|

2017 | $798 | $681 | 2.0% | -0.9% |

2018 | $944 | $752 | 18.3% | 10.4% |

2019 | $1,101 | $856 | 16.6% | 13.8% |

2020 | $1,114 | $885 | 1.2% | 3.4% |

2021 | $1,175 | $963 | 5.5% | 8.8% |

2022 | $1,337 | $1,130 | 13.8% | 17.3% |

2023 | $1,417 | $1,275 | 6.0% | 12.8% |

1H 2024 | $1,507 | $1,319 | 6.4% | 3.5% |

Source: PropNex Research, URA Realis (2024 data up till 30 June 2024)

Chart 2: What are your views on current prices of new EC launches which crossed the $1,400 psf mark? By respondents' household income

Among some of the suggestions to improve the affordability include releasing more EC sites for sale on the Confirmed List of the government land sales programme - which garnered most vote among respondents (see Table 2) - and revising the $16,000 monthly household income ceiling eligibility criteria, as well as raising the mortgage servicing ratio (currently at 30%) which is applicable for bank financing for new EC purchase.

Table 2: Number of responses on various suggestions to improve EC affordability

| Suggestions | Number of respondents who agreed with this suggestion* | Proportion of respondents (%) |

| Release more EC government land sales sites for tender | 721 | 58% |

| Raise household income ceiling beyond the current $16,000 for new EC purchase | 593 | 48% |

| Raise MSR beyond the current 30% for new EC purchase | 482 | 39% |

Source: PropNex Research, *respondents were able to select multiple options

Revising the MSR

The MSR refers to the portion of a borrower's gross monthly income that goes towards repaying all property loans. Presently, the MSR is capped at 30% of a borrower's gross monthly income and only applies to home loans for the purchase of an HDB flat or an EC (where the minimum occupation period of the EC has not expired). The MSR was first set at 40% during its inception, and was eventually brought down to 30% in 2013 for housing loans granted to HDB flat and new EC buyers.

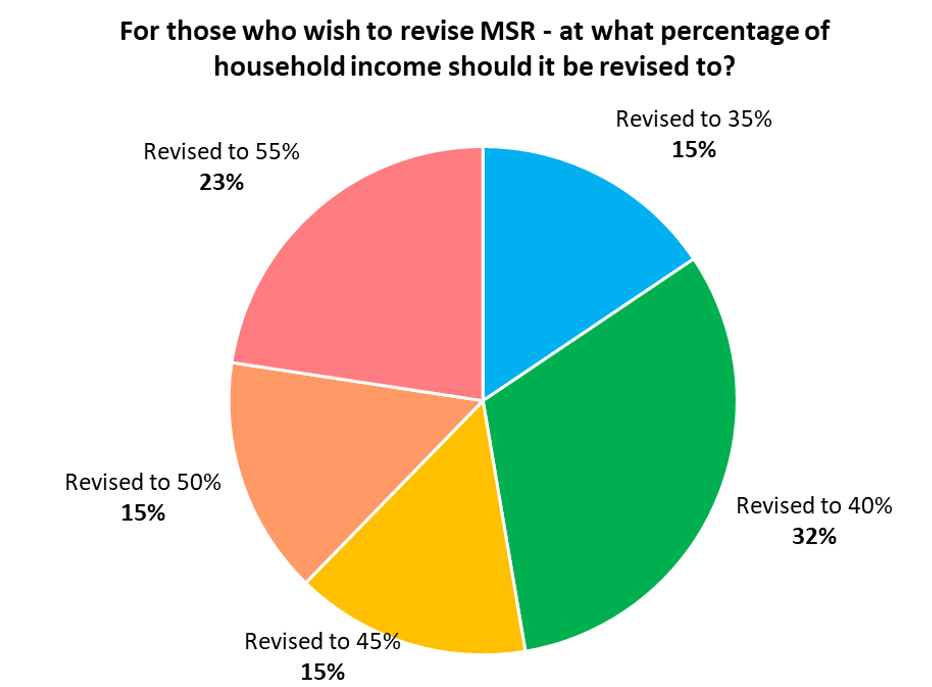

PropNex's survey findings showed that half (52%) of the respondents felt that the MSR should be revised for EC purchase, while 48% of those polled said it should remain at 30%. Among the respondents who indicated that the MSR should be revised, about one-third of them said it should be raised to 40%, while under a quarter of them felt that it would be apt for the MSR to be set at 55%. The remaining respondents are fairly evenly split at 15% each for MSR to be at levels of either 35%, 45%, or 50% (see Chart 3).

Chart 3: If it is to be revised, which is the appropriate MSR level for EC purchase?

Increase the monthly household income ceiling

Currently, the prevailing monthly household income ceiling for buyers of new ECs is set at $16,000, having been adjusted up from $14,000 in 2019. Survey findings showed that about 55 per cent of all respondents agreed that the income ceiling should be adjusted, with those in the higher income brackets feeling most strongly about this - unsurprising, given that a raise in the income ceiling could make them eligible to purchase new ECs.

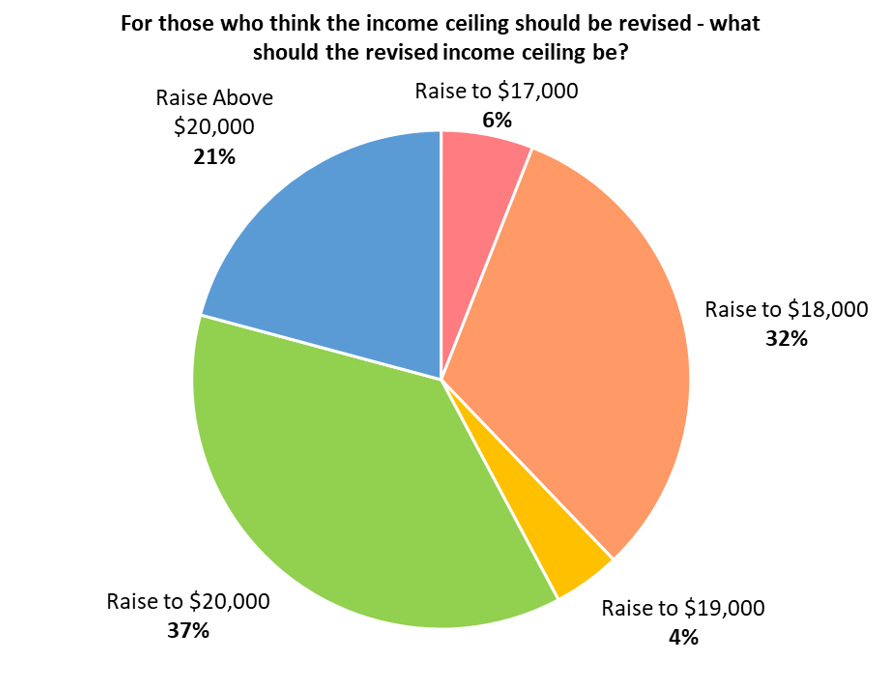

Among the respondents who indicated that the monthly household income ceiling for new EC purchase should be revised, 37% of the respondents said it should be raised to $20,000, 32% of those polled indicated that an appropriate level would be $18,000, while 21% thought that it should be increased to above $20,000 (see Chart 4).

Chart 4: If it is to be revised, which is the appropriate monthly household income ceiling for new EC purchase?

Bump up EC land supply on Confirmed List

The option that resonated most among respondents was for the government to bump up the supply of EC sites on the GLS programme. In the last few years, the government has tended to release two Confirmed List EC sites for tender each year, leading to stiffer competition for such sites among developers which contributed to higher land bids. By increasing the supply of EC sites - possibly to four Confirmed List plots per year - it could potentially help to rein in land bid prices by developers.

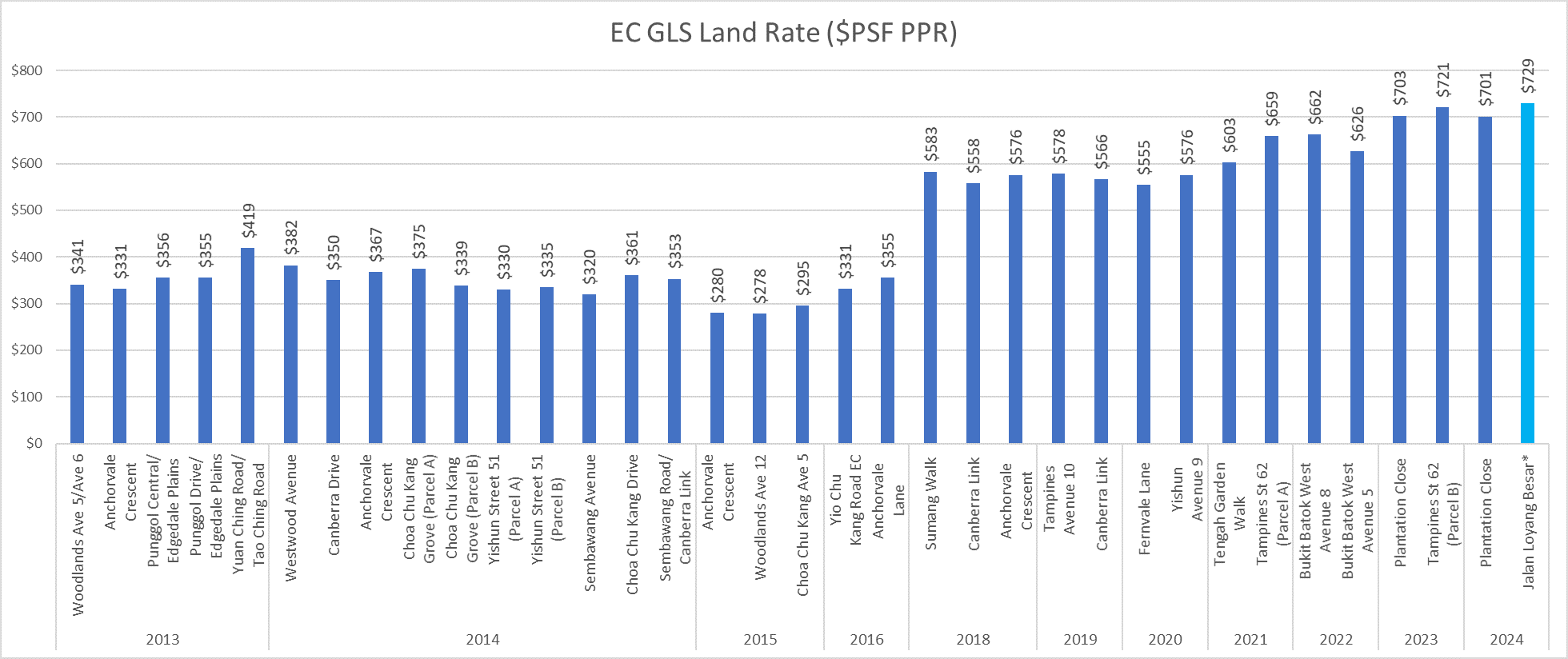

Between 2012 and 2018, multiple EC sites were sold each year - averaging about six sites per year - compared with two sites per year from 2019 to 2023, The GLS EC land rate breached the $500-psf per plot ratio (psf ppr) mark in 2018 when the Sumang Walk EC site was awarded for $583 psf ppr. Since then, the record land rate has been rewritten several times, the EC plot in Tampines Street 62 (Parcel B) achieved a land rate at $721 psf ppr, which could be leapfrogged by that of Jalan Loyang Besar at $729 psf ppr (see Chart 5). The tender for the Jalan Loyang Besar site is yet to be awarded at the time of writing.

Chart 5: Land rate ($psf ppr) of EC GLS sites since 2013

The other solutions that were suggested by respondents include setting a selling price cap on new EC units launched for sale, having a cap on the land bid price for EC sites sold via the GLS programme, further tightening the eligibility criteria for EC buyers, and raising government subsidies or grants to eligible buyers of new ECs.

Click here to download the PropNex HDB flat owners' sentiment survey on the EC market