PropNex Survey 2024: Upgrading Desire Stronger Among Younger Flat Owners, But High Home Prices Seen As A Deterrent

It is no secret that one of the aspirations of many Singapore households is to own and live in a private home. For many, the journey could look something like this - purchase a new build-to-order (BTO) flat from the HDB or a resale flat on the open market, live in the flat for 5 to 10 years or more, and subsequently upgrade to a private residential property, which could be an executive condominium (EC) unit.

In March-April 2024, PropNex embarked on an online survey of about 1,250 HDB flat owners to find out about their housing aspirations, their views regarding public and private home prices in Singapore, and an indication on how they would frame their asking price should they put their flat up for sale.

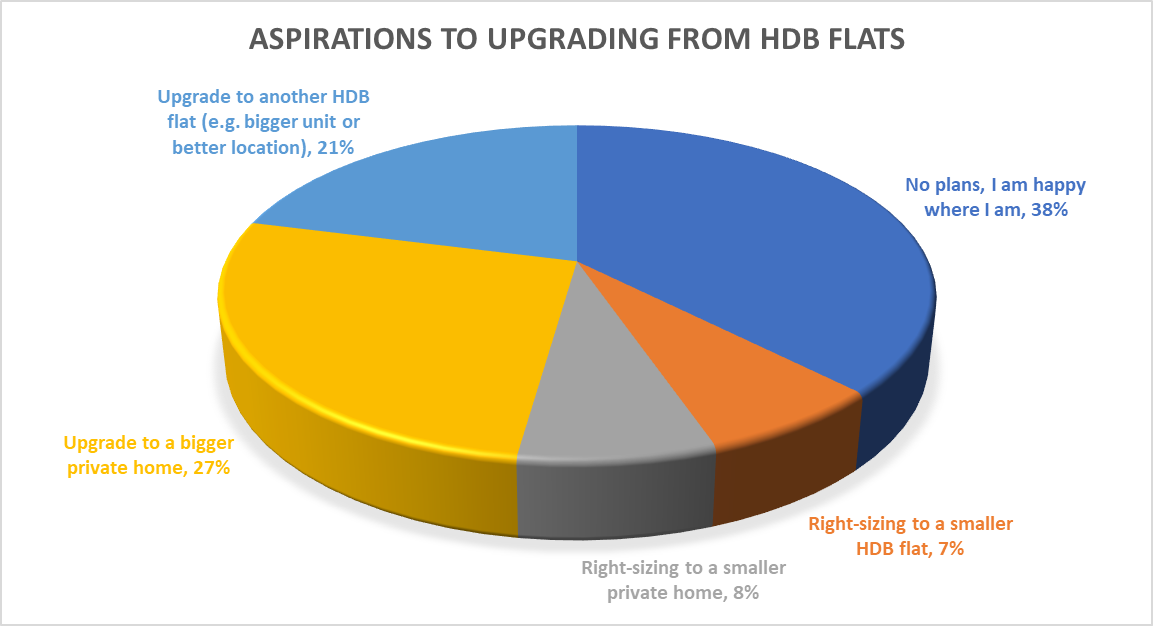

The survey found that about half (48 per cent) of the respondents collectively aspire to upgrade from their HDB flat - 27 per cent to a larger private home, and 21 per cent to a bigger HDB flat. Meanwhile, 15 per cent of them indicated that they intend to right-size to either a smaller HDB flat or a smaller private home. Notably, over one-third of the respondents said they have no plans to right-size or upgrade (see Chart 1).

Chart 1: Proportion of respondents and aspirations to upgrading from HDB flat

Within the group that has upgrading plans - to either a larger private home or larger HDB flat - it was observed that the inclination to do so was the strongest among respondents aged between 30 and 40 years (see Table 1). It is possible that these respondents could have accumulated savings over the years and are looking to trade up from their existing HDB flat. They may also be seeking a larger home to accommodate a bigger family or lifestyle changes.

Similarly, survey findings showed that a greater proportion (38 per cent) of those who plan to right-size to a smaller private home are aged 40 to 50 years. It is likely that high home prices could have dissuade some of these respondents from opting for a larger property. Meanwhile, a substantial proportion (73 per cent in total) of flat owners who are 50 years or older indicated that they plan to right-size to a smaller HDB flat, including single-person households who may no longer need a large home.

Table 1: Proportion of respondents by housing aspirations by age group

Age group | Intend to upgrade from HDB flat to: | Intend to right-size from HDB flat to: | No plans | ||

| Larger private home | Larger HDB flat | Smaller private home | Smaller HDB flat | ||

21 - 30 years old | 9% | 8% | 1% | 3% | 4% |

30 - 40 years old | 44% | 33% | 27% | 8% | 16% |

40 - 50 years old | 30% | 33% | 38% | 16% | 25% |

50 - 60 years old | 11% | 21% | 23% | 34% | 30% |

60 years old and above | 6% | 5% | 11% | 39% | 26% |

While the PropNex survey findings generally indicate a desire to own and live in a private home among more than one-third of the nearly 1,250 respondents, many of the HDB flat owners polled felt that they are being priced out of the private housing market. In addition, the prevailing additional buyer's stamp duty (ABSD) measure also made it challenging for them to upgrade to a private home. (see Table 2). Singapore citizens who are looking to purchase their second residential property in Singapore will face an ABSD rate of 20 per cent, up from 17 per cent prior to the April 2023 revision.

Table 2: Main reasons or challenges in not upgrading to a private home

Reason for not upgrading | Number of responses* |

High home prices | 793 |

ABSD measure | 396 |

Have other financial commitments | 335 |

Still serving the 5-year MOP | 286 |

Family circumstances | 259 |

Have not seen a property I like | 203 |

Waiting for an attractive BTO project | 168 |

Other | 68 |

In particular, the largest proportion of respondents - at 42 per cent and 26 per cent - felt that private new launches are unaffordable or extremely unaffordable, respectively (see Table 3). This is followed by private resale homes where 38 per cent of those polled thought prices are unaffordable, and 23% of the respondents said private resale prices are extremely unaffordable.

Table 3: Perceptions on affordability of homes in various property segments

Affordability | BTO flats | HDB resale flats | Private new launches | Private resale |

Extremely unaffordable | 5% | 12% | 26% | 23% |

Unaffordable | 18% | 33% | 42% | 38% |

Neutral | 39% | 37% | 25% | 28% |

Affordable | 32% | 16% | 7% | 10% |

Extremely affordable | 5% | 1% | 0.4% | 0.5% |

It is little wonder that high home prices were cited as a key challenge to upgrading. Among the HDB flat owners polled, 62 per cent said that their housing budget for the next home is below $1 million, 31 per cent cited a budget of $1 million to $2 million, and the remaining 7 per cent with a budget of more than $2 million. To this end, it is perhaps unsurprising that 23 per cent of the respondents said their next preferred home will be a resale HDB flat, while 21 per cent will opt for a new BTO flat sold by the HDB (see Chart 2).

Chart 2: Proportion of respondents based on preferred housing type for next home

In view of the cost of buying a replacement home, 87 per cent of the respondents said they will expect a certain level of price premium over market rate should they resell their flat. Drawing from these findings, it is perhaps safe to say that the asking price for HDB resale flats are generally going to hold firm in the near-term.

Click here to download the full PropNex HDB Flat Owners' Survey 2024.