60% ABSD: Should Chinese Buyers Still Invest In A Home In Singapore?

Foreign buyer participation in Singapore's property market had fallen over the past year since the revision in Additional Buyer's Stamp Duty (ABSD) rates for foreigners. To curb demand from overseas buyers and cool the real estate market, ABSD rates for foreigners (non-permanent residents, NPR) was increased to 60% in April 2023, a record high since the introduction of the ABSD in December 2011. Our writer speaks to Mr. Kevin Feng, Associate Branch District Director at PropNex Realty and leader of the PropNex China Elite Team, to find out how the increase in ABSD rates has affected the mainland Chinese investors and how these buyers could navigate the Singapore property market for the rest of 2024.

1) What are some of your current observations on the behaviour/sentiment of mainland Chinese buyers of Singapore properties? How has the current global situation influenced the buying and/or immigration decision among the Chinese investors?

Based on our observation, immigration demands from the mainland Chinese have increased significantly, even when Singapore is at the top of the list of popular immigration destinations with some of the highest barriers when it comes to migration. Generally viewed as a safe haven for wealth accumulation and legacy planning even in times of uncertainty, Singapore is a robust global financial hub with stable fundamentals and great infrastructure. Being a cosmopolitan city-state with a majority ethnic Chinese population possessing a bilingual education system with reputable schools and tertiary institutions, it is unsurprising that Singapore is still popular with the Chinese buyers in terms of immigration and property investing.

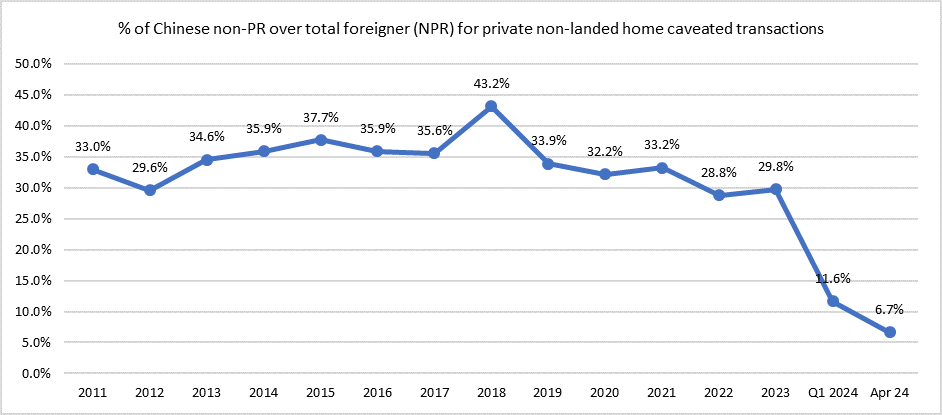

However, despite the increase in immigration demand, property buying demand for mainland Chinese foreigners have dropped due to the increase in foreign buyer ABSD to 60% in April 2023. Chinese non-PR made up 29.8% of foreign buyers of non-landed private homes for the whole of 2023, declining to 11.6% at the end of Q1 2024 (see Chart 1).

Source: PropNex Research, URA Realis (as at 16 May 2024)

Uncertainty in the global economy, geopolitical tensions, inflation, and stricter due diligence checks due to last year's anti-money laundering bust are also some of the factors causing the relatively tentative sentiment in the market as potential buyers and investors take the time to assess their options.

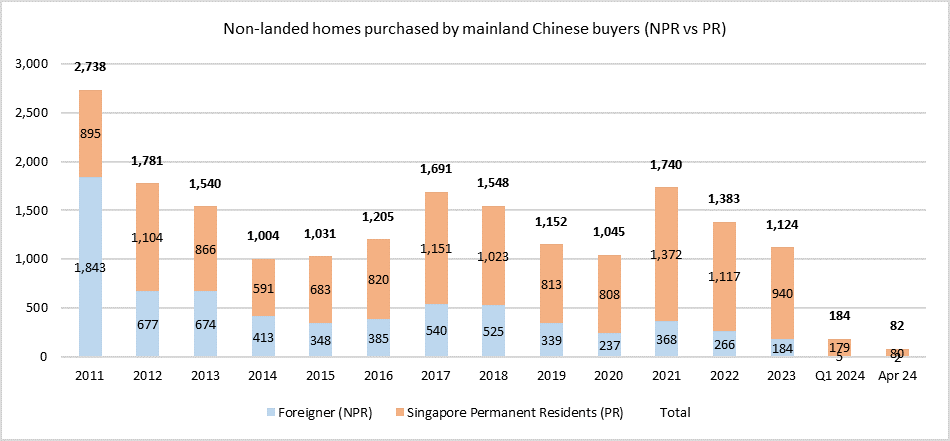

For the whole of 2023, 1,124 non-landed new sale and resale private homes were sold to Chinese buyers, of which 184 transactions were done by non-PR mainland Chinese, while the first four months of 2024 saw 7 of such transactions (see Chart 2). Both PR and non-PR transaction volumes would likely increase over the rest of 2024, as more new launches are expected to come on especially after the June holidays seasonal lull, with the possible launch of larger developments such as Sora in Jurong East, Emerald of Katong in Jalan Tembusu, and The Chuan Park in Q3 2024.

Source: PropNex Research, URA Realis (as at 16 May 2024)

2) What is the primary channel through which these buyers come to know of investment opportunities in Singapore, and subsequently purchase a home here? (e.g. long-term relationships with property agents, online listings, etc.)

I believe it is important for these buyers to approach a reputable and reliable property salesperson to learn about property investment opportunities in Singapore. These buyers usually take the recommendations of their family and friends to find a salesperson who can provide the necessary advice and information, and guide them through the process.

For us, trust is of the essence. The Chinese buyers who approach us for investment opportunities in Singapore are mostly our regular clients and the referrals they brought in, where the trust is built through word of mouth recommendations. Our team focuses on high end homes and commercial properties, and we place strong emphasis on long-term value-added services with our clients, which helps us forge strong, lasting working relationships with them.

3) Based on your experience, which region (CCR, RCR or OCR) is a hot favourite among Chinese buyers and why?

The CCR region is the most popular of the three among Chinese buyers. Singapore is an attractive destination for top talent around the world including China. These talent and professionals have the buying and holding power needed to own prime assets in Singapore, which are typically located in the CCR.

Chinese elites who had taken up citizenship or permanent residency and acquired prime assets in Singapore include Alibaba co-founder James Sheng and Haidilao founder Zhang Yong. James Sheng is said to have bought a GCB in Leedon Park for $50million back in 2018, while Zhang Yong had acquired two GCBs in Gallop Road in 2016 and 2020.

A mainland Chinese couple holding permanent residency in Singapore was also reported to have purchased two adjacent 4-bedroom apartments in luxury development The Ritz-Carlton Residences earlier this year. Located in CCR along Cairnhill Road in Orchard, the two units have the same floor area of 3,057 sq ft, and had changed hands for 16.5 million each, according to URA Realis caveats.

4) With the current 60% ABSD rate for non-PR foreigners in place, how has this measure affected the Chinese buyers' buying interest in Singapore property?

The 60% ABSD has significantly reduced foreign buyer interest in residential properties. For Chinese buyers looking to reside in Singapore, most of them would choose to rent a home first. Investment wise, some buyers turn to commercial properties. It was observed that the higher property tax for investment residential property and ABSD rates on residential property purchase by investors and foreigners may have potentially directed some investment demand to commercial properties, which are not subjected to ABSD.

5) What would be your advice for potential Chinese buyers looking to invest in a residential property in Singapore in 2024?

I would advise potential Chinese buyers interested in long-term residence and property investment in Singapore to start by renting a home, and purchase their first residential property only after securing their PR (Permanent Residency). PRs are subjected to 5% ABSD on their first home and 30% for their second residential property, while foreigners have to pay 60% ABSD for every residential property they purchase. Interested buyers can make use of the 30-day visa-free arrangement between Singapore and China to view potential properties and make informed decisions face-to-face with their agent.

Table 1: Prevailing ABSD rates for PRs and Foreigners (NPR)

| Buyer Profile | ABSD Rates on or before 26 April 2023 | ABSD Rates on or after 27 April 2023 |

| Singapore Permanent Residents (SPR) buying first residential property | 5% | 5% |

| SPR buying second residential property | 25% | 30% |

| SPR buying third and subsequent residential property | 30% | 35% |

| Foreigners (NPR) buying any residential property | 30% | 60% |