Sixth Avenue GCB Rakes In $14 Million In Resale Gains In May

Quieter activity in the landed resale market in May

Based on URA Realis caveat data, about 128 landed homes were transacted on the resale market in May 2024; the combined transaction value came up to $767 million - down from April (172 deals valued at $937 million). Upon an analysis of each transaction and their respective gains, most landed deals were profitable. The top 10 landed home transactions in May booked gains ranging from about $3.9 million to $14.4 million. The top gainers were scattered across the island; five out of the top 10 landed transactions are located in the Outside Central Region (OCR), another three in the Core Central Region (CCR), while the remaining two are in the Rest of Central Region (RCR).

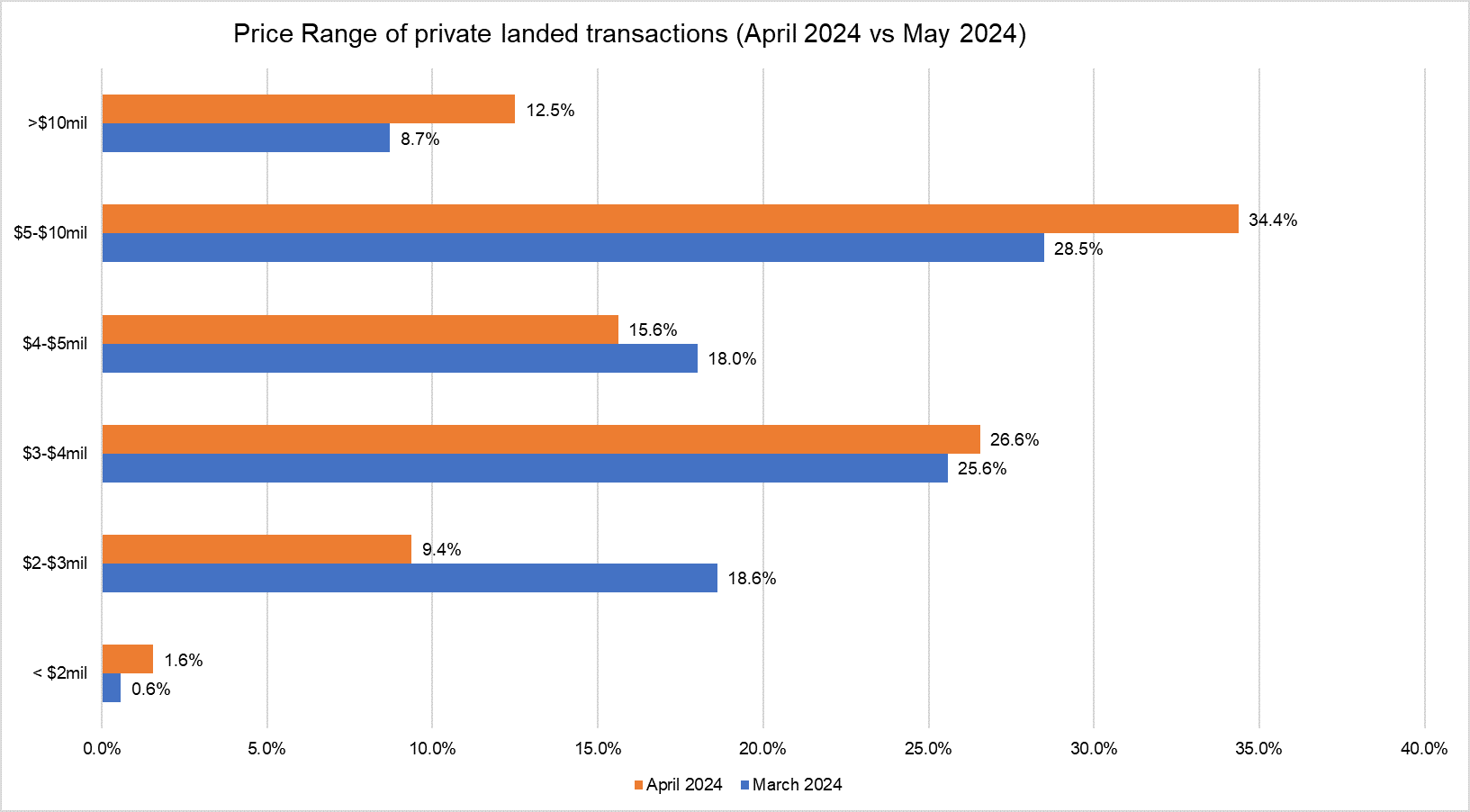

The landed home resale activity in May dialled down slightly after picking up in April. Despite the slower sales in May, there was a larger proportion of higher priced landed homes being sold compared with the previous month. Based on URA Realis caveat data, about 46.9% of resale landed homes sold in May were priced at $5 million and above, compared with about 37.2% in April. Meanwhile, 53.1% of the resale landed transactions were priced at below $5 million in May - lower than the 62.8% proportion in the previous month.

Chart 1: Price range of private resale landed transactions in April 2024 vs May 2024

Source: PropNex Research, URA Realis

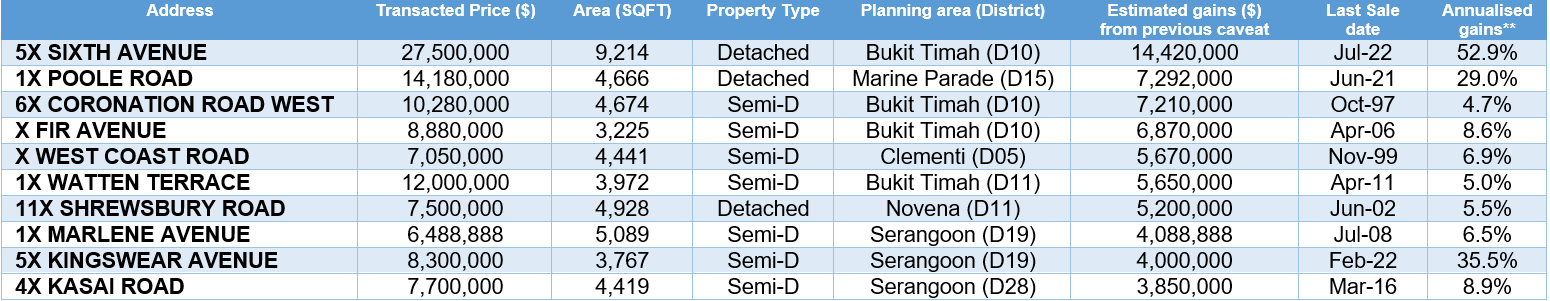

Top 10 resale landed transactions in terms of estimated gains*

Source: PropNex Research, URA Realis

*Gains are derived from the resale transaction for each unit against the unit's last caveated transaction. The gains reflected is gross - it has not accounted for the applicable seller's stamp duties, interest payable, taxes and other relevant divestment costs.

**Annualised gain is the compounded annual rate of return which shows the rate of return over the time period between the point of resale and the property's last caveated transaction, expressed in annual percentage terms. The formula for determining this is simply: [(current resale price) / (purchase price)] time period in years-1

Top landed transaction with highest gains (overall)

The top landed transaction in the month was for a Good Class Bungalow (GCB) in the CCR, along Sixth Avenue (District 10). The GCB was sold for $27.5 million in May and achieved a gross profit of $14.4 million from the last caveated price lodged in July 2022 - booking an eye-watering annualised gain of 52.9%. This freehold property sits on a vast plot with a land area of over 9,200 sq ft; the sale price reflects a unit price of $2,985 psf on land area. The recently rebuilt property is situated within the Sixth Avenue GCB area, one of Singapore's most prestigious landed housing enclaves. The property is a 10 to 15-minute walk to the Sixth Avenue MRT station on the Downtown Line, which take residents to the city in less than 30 minutes.

Top landed transaction with highest gains (Core Central Region)

The second top landed transaction in the month in the CCR was for a semi-detached house along Coronation Road West (District 10). The property was sold for nearly $10.3 million in May and achieved a gross profit of $7.2 million from the last caveated price lodged in October 1997 - booking an annualised gain of 4.7%. This freehold property sits on a plot with a land area of more than 4,600 sq ft, with the sale price reflecting a unit price of $2,200 psf on land area. The property is situated close to the cluster of GCB estates in the Bukit Timah planning area, including Bin Tong Park, Queen Astrid Park, and Oei Tiong Ham GCB areas.

The third-best performing transaction in the city was for another semi-detached house in Bukit Timah (District 10) along Fir Avenue, within Eden Park. The freehold property is a stone's throw from the Sixth Avenue MRT station on the Downtown Line, which take residents to the city in less than 30 minutes. It was sold for nearly $8.9 million in May, with its last caveat being lodged in April 2006. The sale price is up by about $6.9 million from the previous caveated price, marking an annualised profit of 8.6% over 18 years. Based on a land area of 3,225 sq ft, the sale price reflects a unit price of $2,754 psf on land area.

Top landed transaction with highest gains (Rest of Central Region)

The best performing landed home transaction in the RCR was for a 2-storey bungalow along Poole Road in the Marine Parade planning area (District 15). It is the only RCR landed transaction which made the top 10 rankings in the month. The property was sold for about $14.2 million, reflecting an estimated gain of some $7.3 million, representing an annualised gain of 29% per year from its last caveat lodged in June 2021 - with a holding period of less than 3 years. The property is located across the Geylang River, from the Dakota MRT station on the Circle Line, which takes commuters to the city centre in less than 30 minutes. The property is also just a short walk to the stretch of shophouses lining Tanjong Katong Road, which houses some popular eateries include Ponggol Nasi Lemak and Nan Xiang Chicken Rice.

Top landed transaction with highest gains (Outside Central Region)

The most profitable deal in the suburbs in May was the sale of a corner semi-detached home in West Coast Road in Clementi (District 5). The property was sold for about $7.1 million, up by nearly $5.7 million from the last caveat lodged in November 1999. This reflects an annualised profit of 6.9% over a holding period of nearly 25 years. The property is close to the National University of Singapore, one of Singapore's most prestigious local universities. It is also just a short drive away from other amenities in the vicinity, including the West Coast Park, West Coast Plaza, and Haw Par Villa. It is also a quick bus ride to the Haw Par Villa MRT station on the Circle Line which takes commuters to other employment nodes in Kent Ridge, Buona Vista, Labrador Park, and Harbourfront in less than 15 minutes.

The second best-performing suburban landed home transaction in the top 10 rankings was the sale of a semi-detached house in Marlene Avenue, in District 19 (Serangoon). The freehold property was sold for nearly $6.5 million, up by about $4.1 million from the last caveat lodged in July 2008 - this reflects an annualised profit of 6.5% after a holding period of nearly 16 years. The two-storey semi-detached house is situated in within the Serangoon Gardens landed housing area. Residents can enjoy convenient access to heartland amenities nearby, such as the Serangoon Garden market, Chomp Chomp Food Centre, and MyVillage at Serangoon Gardens.

If you are looking for high-end homes or good class bungalows in Singapore, contact PropNex's GCB and Prestige Landed department for buying opportunities and insights on the landed residential property market.

For more property research insights, join PropNex Friends today.

Read the latest PropNex Research report on the GCB and Prestige Landed homes market.