Bedok Semi-detached Home Fetched Nearly $8 Million in Resale Gains in April

Healthy momentum in the landed resale market in April

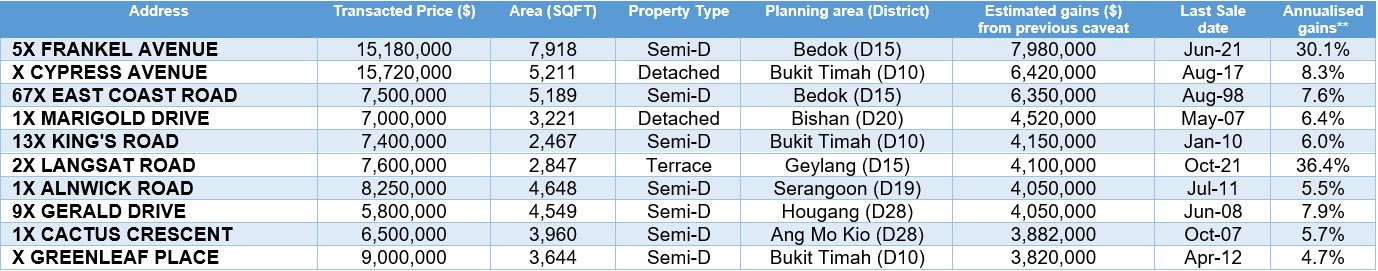

Based on URA Realis caveat data, about 153 landed homes were transacted on the resale market in April 2024; the combined transaction value came up to $849 million ? rising from March (139 deals valued at $736 million). Upon an analysis of each transaction and their respective gains, most landed deals were profitable. In a ranking by gross profit garnered, the list of top 10 transactions consisted of landed homes located across the island, including in Bukit Timah, Bedok and Geylang. The top 10 landed home transactions in April booked gains ranging from about $3.8 million to $8 million. The top gainers were in varied locations; five out of the top 10 landed transactions are located in the Outside Central Region (OCR), another three in the Core Central Region (CCR), while the remaining two are in the Rest of Central Region (RCR).

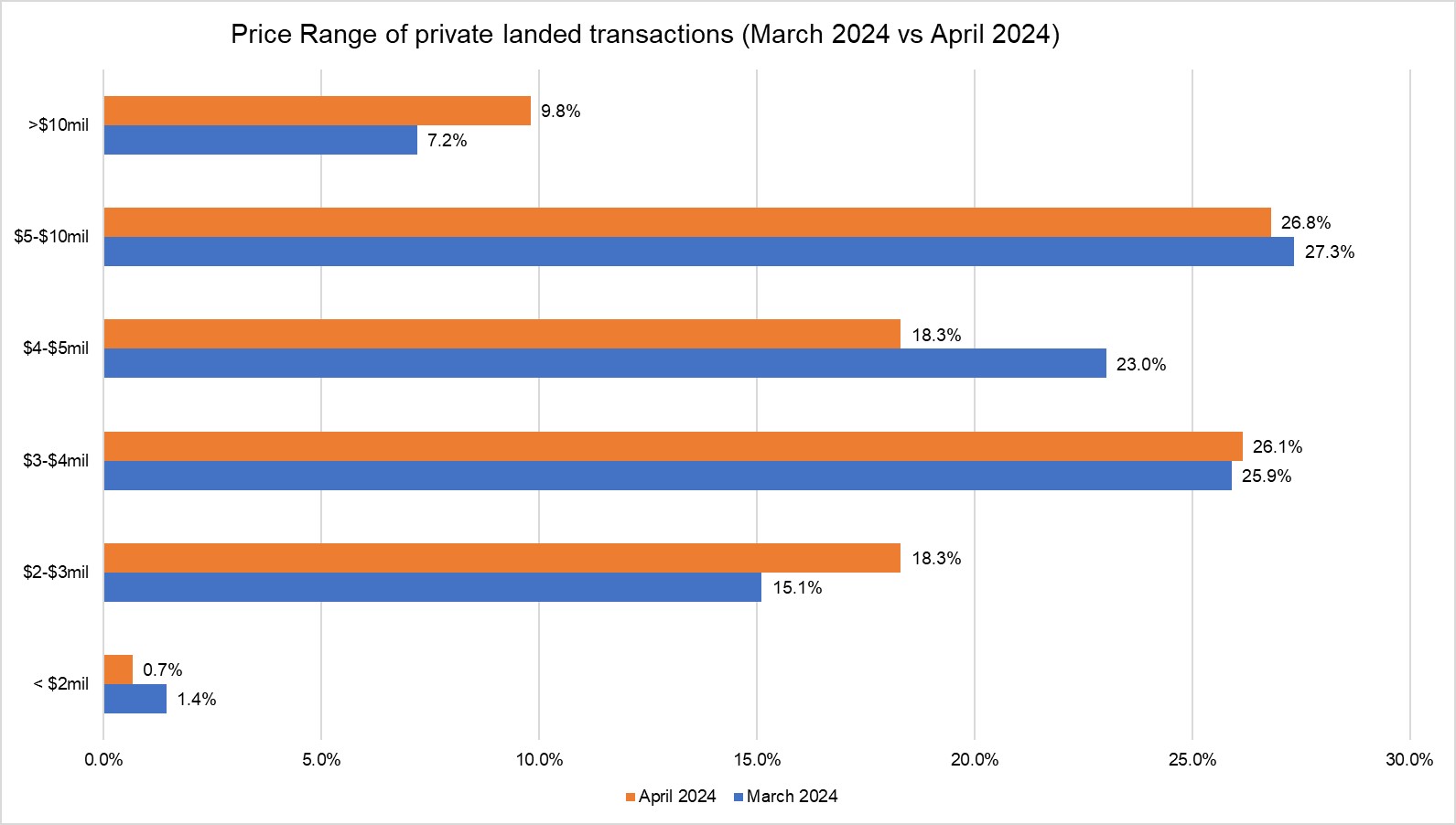

Landed home resale activity in April continued to gain traction after picking up in March. In April, there was a larger proportion of higher priced landed homes being sold compared with the previous month. Based on URA Realis caveat data, about 36.6% of resale landed homes sold in April were priced at $5 million and above, compared with about 34.5% in March. Meanwhile, 63.4% of the resale landed transactions were priced at below $5 million in April ? lower than the 65.5% proportion in the previous month.

Chart 1: Price range of private resale landed transactions in March 2024 vs April 2024

Source: PropNex Research, URA Realis

Top 10 resale landed transactions in terms of estimated gains*

Source: PropNex Research, URA Realis

*Gains are derived from the resale transaction for each unit against the unit?s last caveated transaction. The gains reflected is gross ? it has not accounted for the applicable seller?s stamp duties, interest payable, taxes and other relevant divestment costs.

**Annualised gain is the compounded annual rate of return which shows the rate of return over the time period between the point of resale and the property?s last caveated transaction, expressed in annual percentage terms. The formula for determining this is simply: [(current resale price) / (purchase price)] time period in years-1

Top landed transaction with highest gains (overall)

The top landed transaction in the month was for a semi-detached house in the OCR, in Frankel Avenue (District 15). The property was sold for $15.18 million in April and achieved a gross profit of $7.98 million from the last caveated price lodged in June 2021 - booking an annualised gain of 30.1%. This freehold property sits on a plot with a land area of 7,918 sq ft, with the sale price reflecting a unit price of $1,912 psf on land area. A The 2-storey semi-detached house is situated within the Frankel landed housing estate. It is located within 10 minutes? walk to the Kembangan MRT station on the East-West Line, and a short drive from the amenities in Bedok town.

Top landed transaction with highest gains (Core Central Region)

The top landed transaction in the month in the CCR was for a bungalow along Cypress Road (District 10). The newly built property was sold for $15.72 million in April and achieved a gross profit of $6.42 million from the last caveated price lodged in August 2017 - booking an annualised gain of 8.3%. This freehold property sits on a plot with a land area of more than 5,200 sq ft, with the sale price reflecting a unit price of $3,017 psf on land area. The property is a short walk to the Sixth Avenue MRT station on the Downtown Line, which take residents to the city in less than 30 minutes. It is also near the Nanyang Girls High School, Hwa Chong Institution, and Raffles Girls Primary School.

The second best-performing landed transaction in the CCR was for a freehold semi-detached house along King?s Road in the Bukit Timah planning area (District 10). The property was sold for about $7.4 million, reflecting an estimated gain of more than $4.15 million, which represents an annualised gain of 6% per year from its last caveat lodged in January 2010 ? with a holding period of 14 years. The property is a short walk from the Farrer Road MRT station, on the Circle Line, which takes residents to the city in about 20 minutes. The property is also near amenities along Empress Road and near the St. Margaret Girls? School and Nanyang Primary School.

Top landed transaction with highest gains (Rest of Central Region)

The best performing landed home transaction in the RCR was for a detached house along Marigold Drive in the Bishan planning area (District 20). The property was sold for about $7 million, reflecting an estimated gain of $4.52 million, representing an annualised gain of 6.4% per year from its last caveat lodged in May 2007 - with a holding period of nearly 17 years. The property is located a short walk from the Upper Thomson MRT station on the Thomson East-Coast Line.

The second-best performing transaction in the city fringe was for the sale of a corner terrace house in Langsat Road in Geylang (District 15). The property is located near the heritage enclave at Joo Chiat and within walking distance to amenities at Geylang Serai. It was sold for $7.6 million in April, with its last caveat being lodged in October 2021. The sale price is up by about $4.1 million from the previous caveated price, marking a whooping annualised profit of 36.4% over less than 3 years. Based on a land area of 2,847 sq ft, the sale price reflects a unit price of $2,669 psf on land area, a record high in terms of unit price for terrace houses sold in the neighbourhood.

Top landed transaction with highest gains (Outside Central Region)

The second most profitable deal in the suburbs in April was the sale of another semi-detached home in East Coast Road in the Frankel landed Estate in Bedok (District 15). The property was sold for $7.5 million, up by $6.35 million from the last caveat lodged in August 1998. This reflects an annualised profit of 7.6% over a holding period of nearly 26 years.

The third best-performing suburban landed home transaction in the top 10 rankings was the sale of a semi-detached house on Alnwick Road, in District 19 (Serangoon). The 999-year leasehold property was sold for $8.25 million, up by $4.05 million from the last caveat lodged in July 2011 ? this reflects an annualised profit of 5.5% after a holding period of nearly 13 years. The two-storey detached house is situated in the heart of the Serangoon Gardens landed housing area. Residents enjoy convenient access to heartland amenities nearby, such as the Serangoon Garden market, Chomp Chomp Food Centre, and MyVillage at Serangoon Gardens.

If you are looking for high-end homes or good class bungalows in Singapore, contact PropNex?s GCB and Prestige Landed department for buying opportunities and insights on the landed residential property market.

For more property research insights, join PropNex Friends today.

Read the latest PropNex Research report on the GCB and Prestige Landed