Early 2026 in Lentor: Permanence or Flexibility for Buyers?

As the early-2026 launch window continues to unfold, attention naturally shifts from high-activity districts to quieter neighbourhoods where fewer launches carry greater weight. Lentor (District 26) is one such area.

Unlike other launch hotspots, Lentor's early-2026 moment is not about volume or competition. It is about a clear fork in the road.

With just two new launches arriving within months of each other, buyers here are not choosing between "better" projects - they are choosing between permanence and flexibility, and what kind of life stage they are committing to next.

In our earlier analysis of the early-2026 launch pipeline (Part 1 and Part 2), we highlighted how compressed launch windows make clarity more important than speed. We explored this more narrowly in Tampines (District 18), where buyers faced an EC versus private condominium decision.

Lentor presents a similar contrast - but in a very different form. Instead of EC versus private condo, its early-2026 pipeline is also defined by two launches that represent fundamentally different ways of living. For buyers here, the question is not which project is "better", but which path fits where they are headed next.

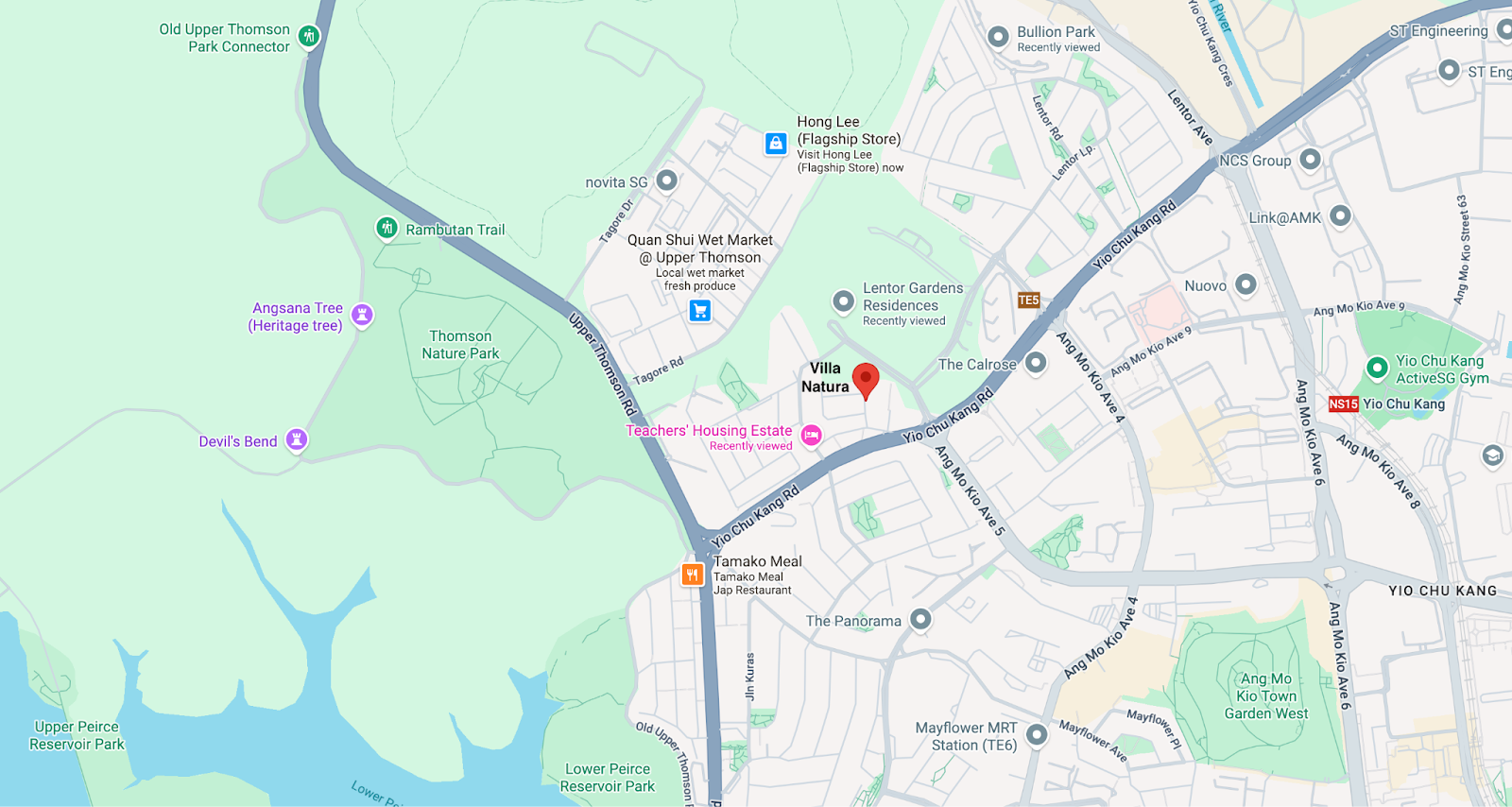

Lentor's transformation over the past few years has been steady rather than loud - but it has been deliberate. Once characterised by low-rise industrial uses and underutilised land, the Lentor Hills area has been progressively reshaped through a carefully released sequence of private residential sites, reflecting long-term planning rather than short-term market reaction.

Rather than a single wave of development, Lentor's growth has unfolded in phases. This has allowed infrastructure, transport connectivity, and residential density to evolve in tandem, giving the area time to mature organically. The result is a neighbourhood that is increasingly cohesive, rather than one still finding its footing.

Source: LTA

The introduction of the Thomson-East Coast Line has been a critical anchor in this transformation. With Lentor now directly linked to key city and employment nodes, accessibility has shifted from a future promise to a lived reality, supporting everyday commuting patterns rather than speculative appeal.

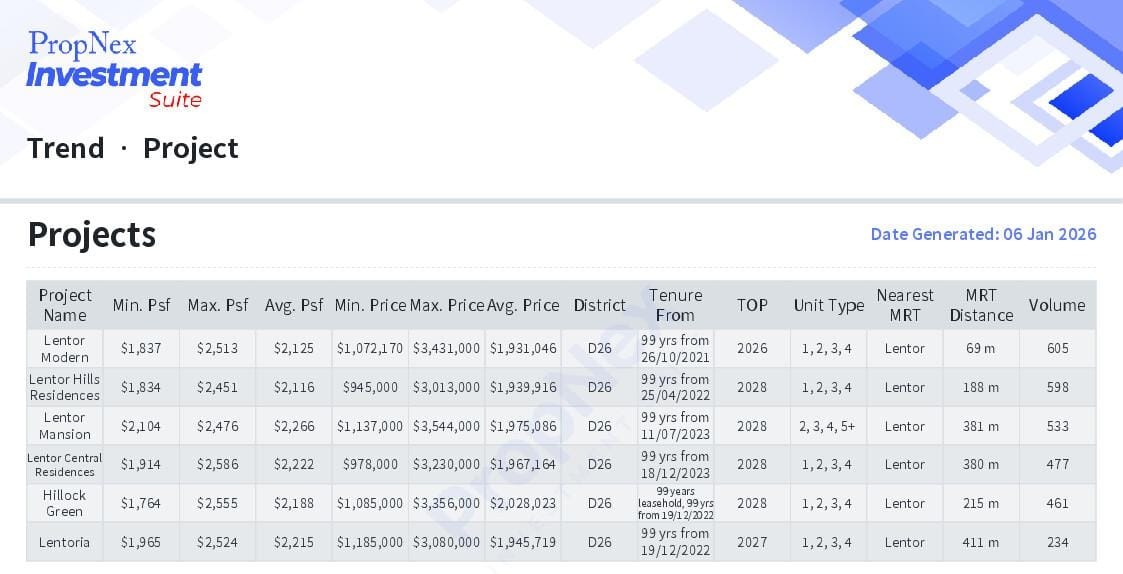

By early 2026, Lentor is already very much a functioning private residential estate. Several projects have been launched and sold over the past few years, creating an established base of homeowners and visible price benchmarks across different phases of development. The upcoming launches therefore enter a market that is no longer being defined, but one that already has transaction history, buyer expectations, and clearer signals around how Lentor is valued.

What makes this moment especially relevant for buyers is not volume, but contrast. Two new projects will enter the market almost back-to-back, forcing buyers to confront a decision they do not often face within the same neighbourhood: landed living versus private condominium living.

Although both projects sit within Lentor, they serve very different roles in a buyer's housing journey.

One path leans towards permanence. It is shaped around long-term space needs, lifestyle stability, and the intention to stay put. Buyers drawn here are typically comfortable committing capital for longer periods, with fewer expectations of repositioning in the near term.

The other path prioritises flexibility. It is designed to keep options open - whether that means upgrading again, monetising the home through rental, or reallocating capital as circumstances change. Liquidity, accessibility, and exit optionality matter more here than maximising space.

For first-timers, this distinction helps clarify whether the next home is meant to be a stepping stone or a settling point. For upgraders, it reframes the decision as one of alignment rather than escalation.

Source: Aurum Gravis

Landed homes often carry a certain emotional pull. More space, greater privacy, and a sense of having "arrived" are powerful ideas - but they also come with heavier commitments - including higher absolute price points, greater upfront cash outlay, ongoing maintenance responsibilities, and a longer holding mindset due to a smaller buyer pool and lower liquidity compared to condominiums. At the same time, landed living is no longer limited to a narrow, ultra-wealthy profile, as buyer demographics and development formats have evolved. In Singapore's context, landed homes - particularly freehold ones - are also tightly controlled assets that cannot be purchased by foreigners, giving them an inherent scarcity that tends to make this segment more resilient across market cycles.

Villa Natura sits outside the typical image of landed housing most buyers are familiar with. Developed and curated by Aurum Gravis, a boutique developer with a focused track record in landed residential projects, Villa Natura is a landed project that shows a clear emphasis on contemporary tropical design, efficient spatial planning, and a cohesive architectural language.

Unlike traditional landed homes that are built, sold, and altered individually over time, developer-led landed projects are planned and released as a single, low-density estate. In Villa Natura's case this means a freehold landed development in Lentor where layout planning, design standards, and overall positioning are aligned from the outset.

For buyers, the result is landed-style living - private space, multiple storeys, and greater autonomy - paired with a higher level of design certainty and estate coherence.

That said, landed living in Lentor is not ideal for buyers who expect near-term job mobility, uncertain family expansion, or who rely on frequent capital recycling. The smaller buyer pool and longer holding horizons mean this route rewards clarity and stability more than optionality.

It remains a commitment to permanence, best suited for buyers who are ready to stay the course rather than pivot repeatedly.

Private condominiums remain the default upgrade path for a reason. They offer structure, predictability, and flexibility - especially in evolving neighbourhoods like Lentor.

Project Name | Developer(s) | Number of Bids | Land Cost ($ psf ppr) |

Lentor Gardens Residences | Kingsford Group | 2 | $920 |

Lentor Central Residences | Hong Leong Holdings, GuocoLand, and CSC Land Group | 2 | $982 |

Lentor Mansion | GuocoLand and Hong Leong Holdings | 1 | $985 |

Lentor Hills Residences | Hong Leong Holdings and GuocoLand | 4 | $1,060 |

Hillock Green | China Communications Constructions Co., Soilbuild Group and United Engineers | 3 | $1,108 |

Lentoria | TID (a joint venture between Hong Leong Group and Mitsui Fudosan) | 2 | $1,130 |

Lentor Modern | GuocoLand | 9 | $1,204 |

In the case of Lentor Gardens Residences, this flexibility is reinforced by how the site itself was acquired. The strong top bid for the Lentor Gardens GLS plot reflects developers' continued confidence in the area, while also setting a clear land cost benchmark that shapes pricing expectations from the outset.

For buyers, this matters because such projects tend to enter the market with:

Clearer pricing logic anchored to recent land tenders

Strong MRT-led appeal that support both owner-occupation and rental demand

A broader resale and tenant pool compared to landed housing

Looking at Lentor's recent GLS outcomes and surrounding launches, Lentor Gardens Residences is entering a market where land costs have generally ranged from the $900s to above $1,100 psf ppr, depending on site attributes and bidding intensity. With its land costs at the lower end of this spectrum, the project is expected to be competitively positioned relative to earlier Lentor launches.

Based on existing Lentor benchmarks and typical developer pricing strategies, buyers can reasonably expect launch prices to sit within the broader Lentor private condo range, likely starting from the low-$2,0xx psf region for smaller units, with larger layouts scaling upwards accordingly. While final pricing will depend on unit mix, positioning, and market conditions closer to launch, the land cost suggests room for measured pricing rather than aggressive escalation.

In terms of product mix, Lentor Gardens Residences is likely to follow the established Lentor template, offering a broad spread of unit types from one-bedroom to four-bedroom layouts. This caters to a wide buyer base - from first timers seeking entry into private property, to upgraders prioritising family-sized units with MRT convenience.

For many first-timers, a condominium like Lentor Gardens Residences serves as a transition home - a platform that keeps future moves open.

Beyond avoiding overcommitment, this flexibility enables buyers to upgrade again, generate rental income if plans change, or reallocate capital as their wealth position evolves. For upgraders, it provides a way to improve lifestyle today without fully locking in tomorrow, making optionality a feature rather than a compromise.

Before choosing between landed and condominium living in Lentor, buyers should pause and understand what these two ideas actually mean in practical,everyday terms. This is not about labels, but about how your home will support - or constraint - your next phase of life.

In simple terms, permanence refers to homes that are designed for long stays and fewer moves. They tend to suit buyers who have clearer visibility on their family size, career stability, and lifestyle preferences, and who are comfortable committing significant capital to one capital for an extended period.

Permanence often comes with:

Larger space and greater control over how you use and modify your home

Higher financial and lifestyle commitment, including maintenance and upkeep

A longer holding mindset, as these homes are not typically meant to be traded frequently

On the other hand, flexibility refers to homes that make it easier to adjust as life changes. These are often more liquid, easier to rent or resell, and better suited for buyers who expect their circumstances to evolve over time.

Flexibility usually offers:

Easier resale and rental exit options

Lower commitment to a single life configuration

Greater ability to adapt as careers, family size, or priorities change

Understanding which of these matters more to you today is often more important than predicting where prices may move next.

At its core, Lentor's early-2026 launches force a simple but important question:

Are you buying for permanence, or for flexibility?

Permanence favours space, control, and long-term certainty. Flexibility prioritises mobility, adaptability, and financial optionality. Neither is inherently better. The right answer depends on how stable your life stage truly is today - and how much room you want to leave for change.

For many first-time buyers, Lentor may represent the first chance to enter private property or even landed living. That makes clarity around intent - rather than caution alone - especially important.

From a Property Wealth System (PWS) perspective, blind spots tend to arise not because buyers choose permanence, but because they do so without fully understanding what that commitment entails.

Common blind spots include:

Underestimating commitment: Moving into a high-permanence home without fully accounting for the longer holding horizon, cash buffers, and lifestyle stability required

Treating permanence and flexibility as opposites: Assuming one is always superior, instead of recognising that each suits different life stages

Misreading stability: Overestimating how settled income, family structure, or long-term plans really are

Ignoring sequencing: Choosing permanence when a stepping-stone approach may still serve the same long-term outcome

Within the PWS framework, permanence is not discouraged - it is contextual. For buyers whose careers, households, and priorities are already well-defined, committing earlier to a higher-permanence home can be a deliberate and confident choice.

Lentor presents a rare chance to assess that readiness honestly, and to choose permanence or flexibility with intention - rather than by default.

Upgraders approach Lentor from a different position - with experience, equity, and clearer preferences. However, experience can also create assumptions that deserve revisiting.

Rather than asking whether the next step is affordable, the more important question is whether it still aligns with how you want to live now.

Key questions worth reassessing include:

Whether your household size and lifestyle have truly stabilised

Whether you are prioritising daily comfort, long-term optionality, or a balance of both

How important future exit flexibility remains at this stage

Whether you are ready to settle decisively, or prefer to retain room to adjust again

An upgrade should reflect who you are today - not simply extend the path you were previously on. Past success should inform decisions, but not dictate them.

Unlike districts defined by launch volume and urgency, Lentor's early-2026 moment is quieter - and that is precisely what makes it valuable.

With just two launches offering fundamentally different paths, buyers are encouraged to slow down, reflect, and decide with intent. Whether you are a first-timer stepping into private property, or an upgrader weighing your next long-term move, Lentor offers a rare opportunity: the chance to choose deliberately, based on lifestyle fit rather than market noise.

In Lentor, the right decision is not about timing the market.

It is about alignment.

The costliest mistake here is not price or timing - it is choosing a home structure that does not match how you actually live, or expect to live next. Lentor rewards clarity more than speed.