Developers' Sales Tepid in August, As Absence Of New Launches and The Lunar Ghost Month Led to a 64% Decline in Sales From July

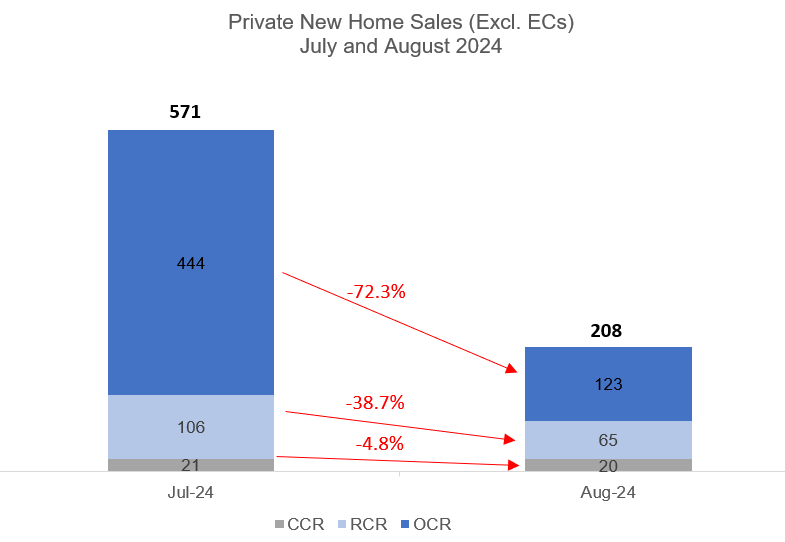

16 September 2024, Singapore - Private new home sales declined in August following a strong rebound in the previous month. Developers sold 208 new units (ex. executive condos) in August, representing a 64% month-on-month fall from 571 units shifted in July. On a year-on-year basis, developers' sales were down by about 47% from the 394 units transacted in August 2023. Taken together, 2,668 units of new private homes (ex. EC) have been sold in the first eight months of 2024.

There were no fresh projects launched in August, which coincided with the lunar Ghost Month, a period that typically sees a lower property sales volume, as people refrain from transacting and as developers hold back on putting new projects on the market. Developers put out 272 new units (ex. EC) from previously-launched projects for sale in August, down from 616 new units launched in July.

In August, the Outside Central Region (OCR) led sales, with several OCR projects among the best-sellers in the month. New homes sales in the OCR made up about 59% of the total transactions in August.

Developers sold 123 new units (ex. EC) in the OCR in August - down by about 72% from July. The OCR accounted for majority of the top-selling private residential projects during the month (see Table 3). The most popular OCR projects included: Hillock Green which transacted 17 units at a median price of $2,108 psf; Lentoria which shifted 15 units at a median price of $2,217 psf; and Hillhaven which sold 14 units at a median price of $2,153 psf. Meanwhile, The Botany At Dairy Farm moved 12 units in August, taking the take-up rate to 97% since the project was launched in March 2023. The 533-unit Lentor Mansion continued to pare down on its stock following a successful launch in March this year; the project transacted 8 units in August and is now 86% sold.

In the Rest of Central Region (RCR), there were 65 new homes sold in August, about 39% lower than the 106 units transacted in the previous month. The best-selling RCR project and also the top seller in August overall was Tembusu Grand, which sold 30 units at a median price of $2,455 psf. Based on URA data, Tembusu Grand has transacted 470 out of its 638 units (or 74%) since the project was launched in April 2023. It is likely that the upcoming new launch - the 846-unit Emerald of Katong - across from Tembusu Grand could have created more buzz in that area, which had helped to boost interest for Tembusu Grand. The other two RCR projects that made it to the top 10 best-sellers' list in August were The Continuum and The Reserve Residences which sold 10 and 9 units respectively (see Table 3).

Meanwhile, developers sold 20 new units in the Core Central Region (CCR) in August - down marginally from the 21 units transacted in July. Three CCR projects accounted for the bulk of the sales in this sub-market. One Bernam shifted 6 units at median price of $2,799 psf, 19 Nassim and Watten House each sold 5 units at median prices of $3,477 psf and $3,233 psf respectively in August. The priciest new unit sold in August is located in the CCR, namely the 4,198-sq ft freehold property at 32 Gilstead which was purchased by a Singapore permanent resident for $14.7 million (unit price of $3,505 psf) - reflecting the highest price quantum and unit price achieved among the four transactions at 32 Gilstead, since the project was launched in April 2024.

In the EC segment, developers sold 36 new units in August, down by 2.7% from the 37 new EC units transacted in July. North Gaia EC in Yishun made up a lion's share of the sales, with 24 units sold at a median price of $1,306 psf. Amid the paring down of EC stock, there are now around 200 units of unsold new EC on the market, and the tight supply should bode well for the next EC project that may come on later this year, being the 504-unit Novo Place EC in Plantation Close in Tengah.

Ms Wong Siew Ying, Head of Research & Content, PropNex Realty said:

"New homes sales were once again sluggish in August, after transactions rebounded in July. The weaker sales volume was mainly due to a lack of new projects being launched, as well as the seasonal lull owing to the lunar Ghost Month. We anticipate that developers' sales in September could see some slight improvement with the upcoming launch of the 158-unit 8@BT, which is within walking distance to the Beauty World MRT station. Beyond September, other launches that could potentially come on include Meyer Blue, Union Square Residences, Bagnall Haus, Emerald of Katong, Nava Grove in Pine Grove, Norwood Grand in Champions Way, the Chuan Park, Aurea in Beach Road, and the mixed-use project to be built on the Marina View white site.

Despite the decline in developers' sales in August, we note that the overall median transacted price of new non-landed private homes increased by 42% to nearly $2.4 million in August from about $1.7 million in the previous month (see Table 1), according to caveats lodged. The lower transaction volume could have affected prices in August. Meanwhile, there was also a higher proportion of units sold at higher price levels during the month, which had helped to boost overall prices in August.

Table 1: Median transacted price of new non-landed private homes sold by Month (ex, EC)

Core Central Region | Outside Central Region | Rest of Central Region | Overall | |

Jan-24 | $3,503,400 | $1,927,415 | $2,011,956 | $2,005,000 |

Feb-24 | $2,663,808 | $1,987,000 | $2,412,000 | $2,332,500 |

Mar-24 | $3,124,000 | $1,746,000 | $2,869,500 | $1,851,895 |

Apr-24 | $3,118,000 | $2,114,000 | $2,386,000 | $2,249,000 |

May-24 | $2,814,000 | $2,109,500 | $2,092,500 | $2,162,031 |

Jun-24 | $3,635,800 | $2,088,000 | $2,288,000 | $2,222,310 |

Jul-24 | $2,453,000 | $1,497,500 | $2,750,000 | $1,682,000 |

Aug-24 | $3,668,000 | $2,169,430 | $2,920,000 | $2,390,000 |

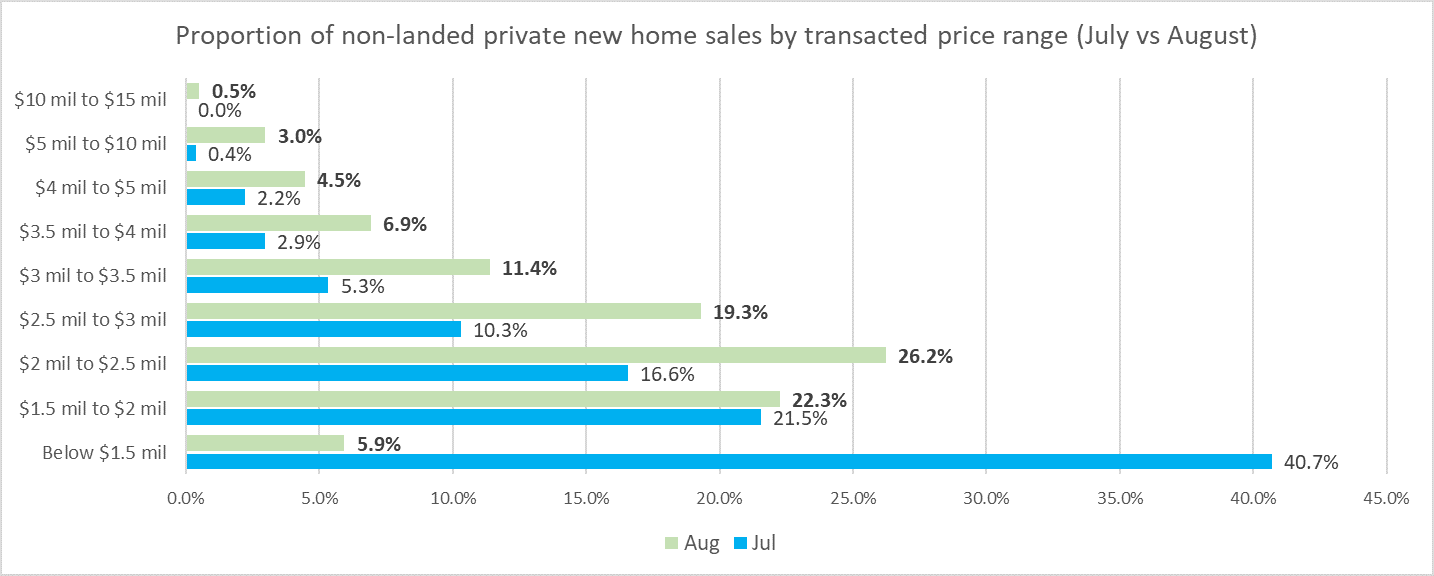

Notably, about 41% of the new non-landed private homes sold in July 2024 were priced at below $1.5 million - largely contributed by new launches Sora and Kassia - compared with the 5.9% proportion in August (see Chart 1). We note that transacted prices were higher across the other price bands in August, based on our analysis of the URA Realis caveat data.

This could be due to a dearth of new projects in August which had influenced the price trend during the month. Meanwhile, the new projects that came on in July would have affected pricing, as fresh launches tend to have a wider availability of smaller units which are transacted at a lower price quantum. For instance, caveat data showed that about 59% of the non-landed new private homes sold in July have a unit size of 800 sq ft or below, while about 24% of August's sales were similarly sized.

Chart 1: Proportion of non-landed private new home sales (ex. EC) by transacted price range

Meanwhile, the proportion of new non-landed private homes (ex. EC) purchased by foreigners (non-PR) made up 2.5% of August's transactions - marking an increase from the 0.9% in July. However, in absolute terms the number of transactions by foreigners (NPR) is similar in July and August, at 5 transactions each month. Singapore PRs accounted for 8.9% of the transactions, while the proportion of non-landed private new home sales to Singaporean buyers rose to 88.1% in August from about 87.1% in the previous month (see Table 2).

Table 2: Proportion of non-landed new private home sales (ex. EC) by nationality by residential status by month

Nationality by Residential Status | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Jan-24 | Feb-24 | Mar-24 | Apr-24 | May-24 | Jun-24 | Jul-24 | Aug-24 |

Company | - | - | - | - | - | - | - | - | - | - | - | 0.2% | 0.5% |

Foreigner (NPR) | 2.8% | 5.4% | 6.2% | 1.9% | 3.6% | 0.7% | 2.0% | 1.6% | 3.3% | 2.4% | 5.2% | 0.9% | 2.5% |

Singapore Permanent Residents (PR) | 16.8% | 11.9% | 10.3% | 12.4% | 9.4% | 10.2% | 14.2% | 6.2% | 13.8% | 14.6% | 13.2% | 11.8% | 8.9% |

Singaporean | 80.4% | 82.7% | 83.5% | 85.7% | 87.0% | 89.1% | 83.8% | 92.3% | 82.9% | 83.0% | 81.6% | 87.1% | 88.1% |

Overall, new private home sales year-to-date have been relatively modest amid limited major launches. Homebuyers have become more discerning and are drawn to projects with a lower price quantum. With a steady pipeline of launches still to come - including projects with a sizable number of units - there will be buying opportunities. In addition, the keenly awaited US Federal Reserve policy rate cut, which could happen as early as this week (FOMC meeting on 17-18 September) may help to lighten debt burden and make borrowing more affordable if it comes to pass.

A rate cut should help to lift sentiment somewhat, and could also potentially encourage some property buyers on the sidelines to return to the market. Meanwhile, the improved economic prospects and the still tight labour market are also supportive of the property segment. All things considered, we remain relatively optimistic about new home sales in the last few months of 2024."

Table 3: Top-Selling Private Residential Projects (ex. EC) in August 2024

S/N | Project | Region | Units sold in Aug 2024 | Median price in Aug 2024 ($PSF) |

1 | TEMBUSU GRAND | RCR | 30 | $2,455 |

2 | HILLOCK GREEN | OCR | 17 | $2,108 |

3 | LENTORIA | OCR | 15 | $2,217 |

4 | HILLHAVEN | OCR | 14 | $2,153 |

5 | LENTOR HILLS RESIDENCES | OCR | 13 | $2,148 |

6 | THE BOTANY AT DAIRY FARM | OCR | 12 | $2,078 |

7 | THE CONTINUUM | RCR | 10 | $2,868 |

8 | THE RESERVE RESIDENCES | RCR | 9 | $2,566 |

9 | THE MYST | OCR | 8 | $2,004 |

| LENTOR MANSION | OCR | 8 | $2,185 |

10 | SCENECA RESIDENCE | OCR | 7 | $2,079 |

| POLLEN COLLECTION | OCR | 7 | $2,261 |

Suggested Reads

Upcoming Events

View moreYou may like

Developers' Sales Plunged By 87% MOM In November Amid Limited New Launches; City Fringe Projects Dominate Sales

December 15, 2025

Sustained Private Housing Supply Planned For 1H 2026, Amid Stabilisation In The Property Market

December 02, 2025

A Rare Bukit Timah Freehold Hilltop Estate Enters the Market for the First Time in 70 Years

November 21, 2025

Developers' Sales Surged To 11-month High In October, Propelled By Robust Demand For New Launches; Monthly Sales In The Core Central Region Are Highest In Over 18 Years

November 17, 2025