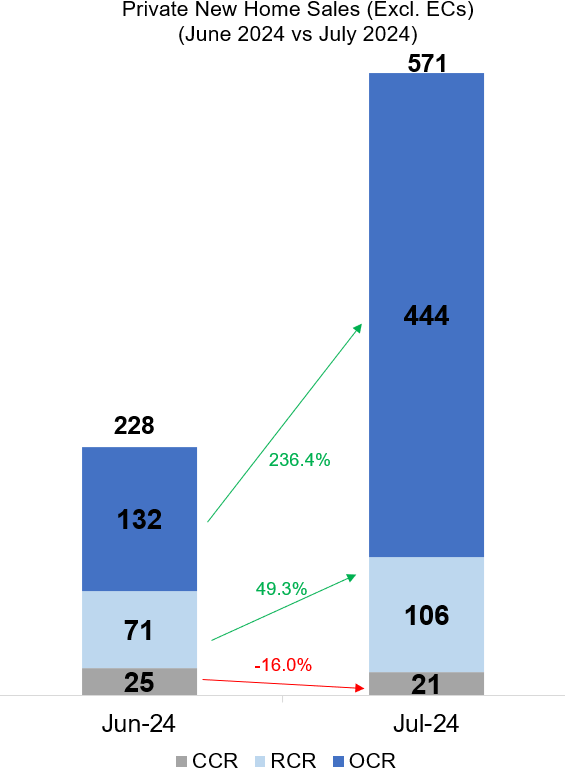

New Private Home Sales More Than Doubled In July 2024 As Fresh Launches In The OCR Boosted Transactions

15 August 2024, Singapore - Developers' sales rebounded in July, supported by fresh project launches in the mass market segment. There were 571 units of new private homes sold (ex. executive condos) in July - more than doubling the 228 units shifted in the previous month. Of note, July's sales figure is also the highest monthly tally in four months, and the second highest monthly sales this year (only surpassed by the 718 units sold in March). On a year-on-year basis, developers' sales were down by nearly 60% from 1,413 new units transacted in July 2023.

Two projects in the Outside Central Region (OCR) - the 440-unit Sora in Yuan Ching Road and 276-unit Kassia in Flora Drive - were launched for sale in July; collectively, they accounted for about 45% of the month's new home sales. Developers placed 616 new units on the market in July (up from 118 new units in June) with Sora and Kassia making up most of the units launched. The boost in the number of new units launched during the month had helped to spur sales.

Including the 1,889 units (ex. EC) of new private homes sold in the first half of 2024, developers transacted a total of 2,460 new units (ex. EC) in the first seven months of the year. New home sales in 2024 look odds-on to underperform the 6,421 units shifted in the whole of 2023. PropNex projects that developers' sales could potentially come in at 5,500 to 6,000 units (ex. EC) this year.

Buoyed by sales at Sora and Kassia, the OCR was the top performing region in July, selling 444 new units (ex. EC) during the month - more than three times higher than the 132 units sold in the previous month. Kassia led sales in July with 154 units sold at a median price of $2,049 psf, followed by Sora which moved 103 units at a median price of $2,152 psf (see Table 2). Meanwhile, sales at The Lakegarden Residences remained steady, benefiting from the buzz generated by Sora's launch. There were 41 units transacted at a median price of $2,212 psf at The Lakegarden Residences, making it the third best-selling project in July.

Over in the Rest of Central Region (RCR), developers sold 106 new units in July, marking a 49% increase from the 71 units transacted in June. The most popular RCR projects during the month were Grand Dunman which moved 24 units at a median price of $2,583 psf, and Tembusu Grand which shifted 23 units at a median price of $2,445 psf. As at the end of July, Tembusu Grand has sold about 69% out of its 638 units. Later in the year, a new project nearby, the 846-unit Emerald of Katong is expected to be launched, offering more options to prospective buyers in the Jalan Tembusu area.

Meanwhile, 21 new private homes were transacted in the Core Central Region (CCR) in July, representing the lowest monthly sales since 16 units were sold in December 2018. The top-selling CCR project was Hill House in Institution Hill which sold 7 units at a median price of $3,066 psf in July. CCR new home sales have been relatively muted due to limited launches following the tightening of the additional buyer's stamp duty (ABSD), which had crimped investment demand from foreigners and property investors.

In the EC segment, developers sold 37 new units in July, down by 26% from the 50 new EC units transacted in June amid the paring down of unsold EC stock in the market. In July, North Gaia EC sold 26 units at a median price of $1,319 psf, while Lumina Grand sold 11 units at a median price of $1,492 psf. As at end-July, there were 232 new EC units that are still unsold, based on URA's figures.

Ms Wong Siew Ying, Head of Research & Content, PropNex Realty said:

"The pick-up in new home sales in July was not unexpected, in view of the two OCR launches, Sora and Kassia that hit the market during the month. The two projects collectively made up 45% of July's sales and enjoyed positive interest from buyers, due in part to some pent-up demand since there have been very few sizable launches since the 533-unit Lentor Mansion came on in March 2024. In particular, the freehold development Kassia had sold 52% of its 276 units on its launch weekend - achieving one of the best take-up rates for a new private residential project launch this year. Kassia has moved a total of 154 units as at the end of July.

With peaking home prices and the cautious market sentiment, homebuyers are selective and price conscious, seeking out buying opportunities that could offer the best value proposition. Given the ample pipeline of new launches to come, many prospective buyers are also in no hurry to commit, preferring to wait for new projects. However, some buyers may be motivated to act if they come across a property that is supported by factors such as right pricing, good location attributes, efficient unit layout, compelling urban transformation story, and strong track record of the developer.

Freehold development Kassia's performance is perhaps reflective of this, with its attractive price quantum that sat within the pricing sweet-spot of many mass market homebuyers. Based on caveat lodged (up till 4 August), about 86.5% of the 155 units sold at Kassia were priced at below $1.5 million. Meanwhile, over at another project that did well this year - Lentor Mansion - we note that about 66.3% of the 457 units sold so far (till 4 August) were transacted at a price range of between $1.1 million and just under $2 million, according to URA Realis caveat data.

We expect realistic pricing to rule the day when it comes to driving primary market sales, and quantum play will remain a key pricing strategy for developers in achieving a good take-up rate at project launch. Meanwhile, developers will also be mindful of the upcoming supply of new private residential projects.

Following the rebound in July, developers' sales will likely moderate in August, owing to the Ghost Month which typically sees lower property transactions. In addition, there will not be any major new projects to be launched for sale in August. Meanwhile, in September, we expect the 226-unit Meyer Blue and the 158-unit 8 @ BT in Bukit Timah Link to hit the market. We could potentially see more new projects come on in Q4 2024, including Nava Grove in Pine Grove, Chuan Park, Emerald of Katong, Bagnall Haus, and Aurea, amongst others.

Table 1: Proportion of non-landed new private home sales (ex. EC) by nationality by residential status by month

Nationality by Residential Status | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Jan-24 | Feb-24 | Mar-24 | Apr-24 | May-24 | Jun-24 | Jul-24 |

Company | - | - | - | - | - | - | - | - | - | - | - | - | - |

Foreigner (NPR) | 1.3% | 2.5% | 5.4% | 6.2% | 1.9% | 3.6% | 0.7% | 2.0% | 1.6% | 3.2% | 2.4% | 5.2% | 1.1% |

Singapore Permanent Residents (PR) | 9.8% | 16.8% | 11.9% | 10.3% | 12.5% | 9.4% | 10.2% | 14.0% | 6.1% | 14.0% | 14.6% | 13.2% | 12.2% |

Singaporean | 88.8% | 80.7% | 82.7% | 83.5% | 85.7% | 87.0% | 89.1% | 84.0% | 92.3% | 82.8% | 83.0% | 81.6% | 86.6% |

The proportion of new non-landed private homes (ex. EC) purchased by foreigners (non-PR) fell to 1.1% in July, from 5.2% in the previous month. In absolute terms, there were six transactions by foreigners in July and they are for units at 19 Nassim, One Bernam, Sora, The Hill @ One North, The Lakegarden Residences, and The Landmark. Singapore PRs accounted for 12% of the transactions, while the proportion of non-landed private new home sales to Singaporean buyers rose to 87% in July from about 82% in June (see Table 1)."

Table 2: Top-Selling Private Residential Projects (ex. EC) in July 2024

S/N | Project | Region | Units Sold in July 2024 | Median Price in July 2024 ($PSF) |

1 | KASSIA | OCR | 154 | $2,049 |

2 | SORA | OCR | 103 | $2,152 |

3 | THE LAKEGARDEN RESIDENCES | OCR | 41 | $2,212 |

4 | HILLHAVEN | OCR | 29 | $2,088 |

5 | GRAND DUNMAN | RCR | 24 | $2,583 |

6 | TEMBUSU GRAND | RCR | 23 | $2,445 |

7 | HILLOCK GREEN | OCR | 21 | $2,183 |

8 | LENTORIA | OCR | 20 | $2,171 |

| LENTOR MANSION | OCR | 20 | $2,237 |

9 | THE CONTINUUM | RCR | 14 | $2,828 |

| PINETREE HILL | RCR | 14 | $2,520 |

10 | THE BOTANY AT DAIRY FARM | OCR | 13 | $2,055 |

Suggested Reads

Upcoming Events

View moreYou may like

Developers' Sales Plunged By 87% MOM In November Amid Limited New Launches; City Fringe Projects Dominate Sales

December 15, 2025

Sustained Private Housing Supply Planned For 1H 2026, Amid Stabilisation In The Property Market

December 02, 2025

A Rare Bukit Timah Freehold Hilltop Estate Enters the Market for the First Time in 70 Years

November 21, 2025

Developers' Sales Surged To 11-month High In October, Propelled By Robust Demand For New Launches; Monthly Sales In The Core Central Region Are Highest In Over 18 Years

November 17, 2025