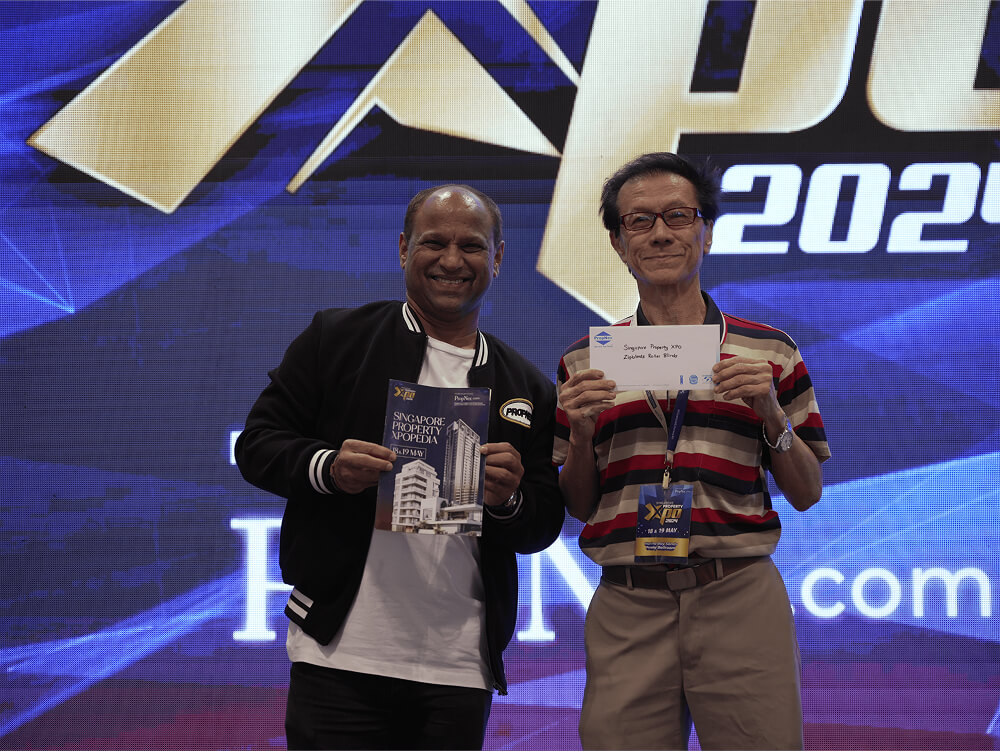

Largest

Real Estate

Event In Singapore

17 & 18 MAY

10AM to 6PM

Marina Bay Sands, PEONY BALLROOM

Stay Informed, Stay Updated, Stay Discerning

Event In Singapore

Marina Bay Sands, PEONY BALLROOM

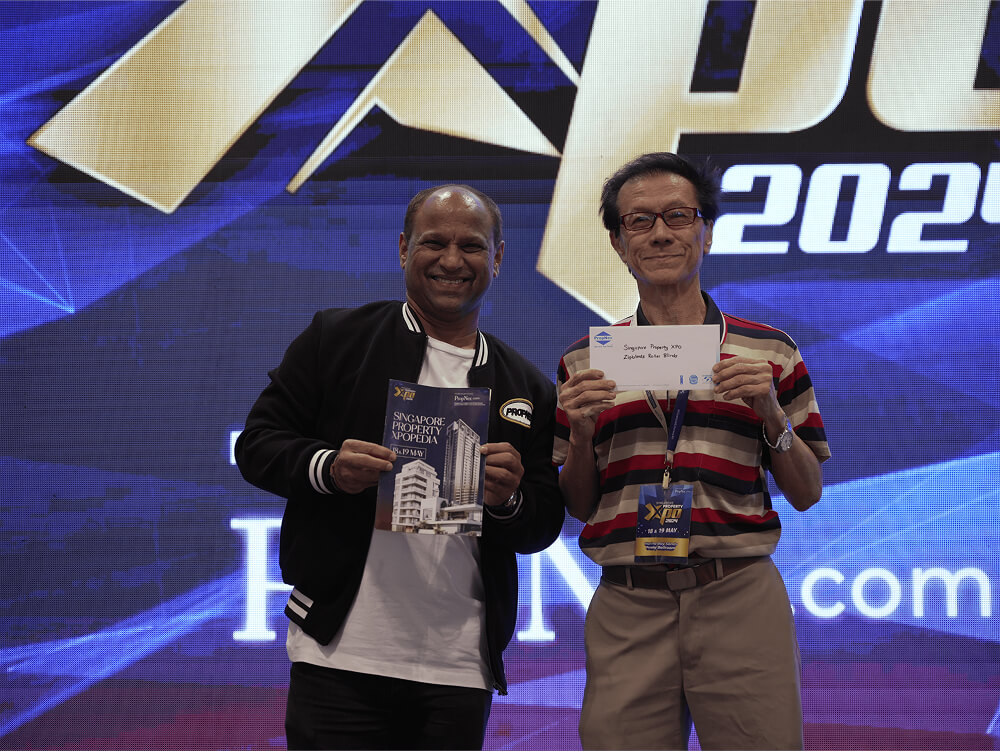

Advisory Associate Branch District Director, PropNex

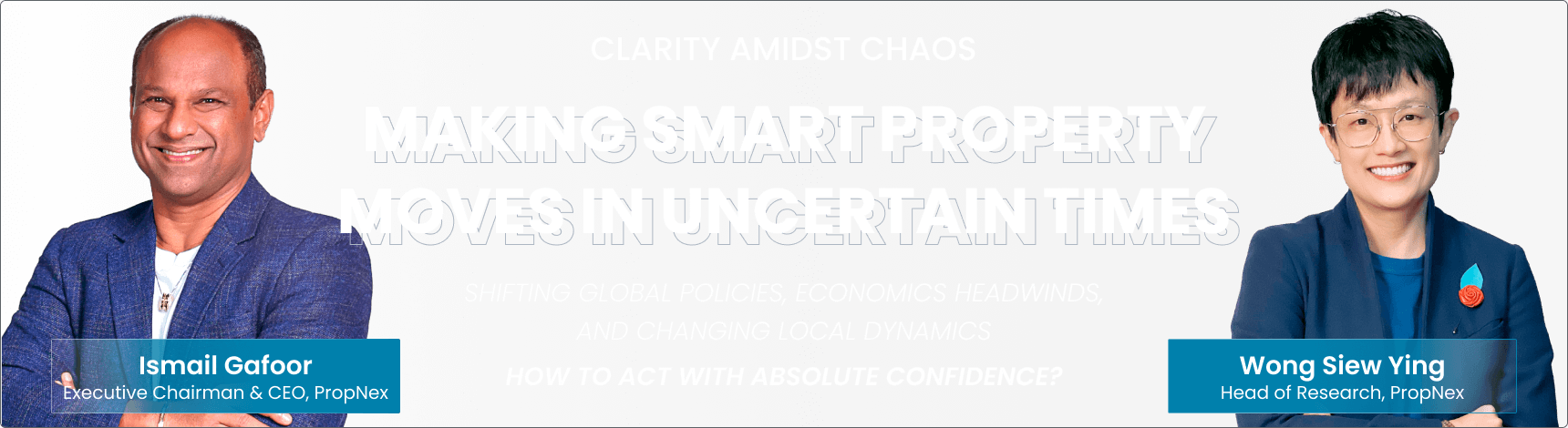

Executive Chairman & CEO, PropNex

Advisory Associate Branch District Director, PropNex

Associate Branch District Director, PropNex

Executive Chairman & CEO, PropNex

Head of Research, PropNex

Chief Agency Officer, PropNex

Head of International Sales, PropNex

Key Executive Officer, PropNex

LOCAL

OVERSEAS