How Did Resale Condos Fare In 1H 2024?

The resale residential property market appears to have defied the weight of the cautious sentiment and uncertainties that have so far put a drag on the new home sales segment. In 1H 2024, more than 5,300 condo units changed hands in the resale market - comparatively higher than in 2H 2023 and 1H 2023, which saw 5,055 condo units and 5,178 condo units being resold, respectively. Meanwhile, resale prices in 1H 2024 also climbed, with the average price of resale non-landed private homes coming in at $1,698 psf in 1H 2024, up from $1,626 psf in 2023 and $1,514 psf in 2022.

PropNex looked at the most profitable condominium projects and districts in the resale market in 1H 2024, ranking the top 10 best-performing projects and districts according to their gross profits. First, some details about the methodology which entails a comparison of resales caveats. The gains garnered for the units were derived by matching the condo resale transactions in 2024 with their previous purchase prices according to caveats lodged. The average profit was then computed on a project basis or district basis.

Suburban condo projects dominate top 10 gainers list

In a ranking of the average profit, the top 10 projects in 1H 2024 comprised mostly Outside Central Region (OCR) projects (7 projects), followed by the Rest of Central Region (RCR) (2 projects); there was only one Core Central Region (CCR) project in the top 10 list (see Table 1).

The top 10 most profitable projects had average profits ranging from $347,000 to $526,000. These are mostly newer projects, with the oldest on the list being The Bayshore which was completed in 1996. Unsurprisingly, most of the projects that made the top 10 list are developments that have desirable location or physical attributes, such as being in the city or city fringe (D'Leedon, Eight Riversuites, Parc Esta), near a waterbody (Q Bay Residences, Lakeville, The Bayshore) or close to an MRT station (Botanique at Bartley, D'nest).

Table 1: Top 10 resale condo projects^ in terms of average gross profit* in 1H 2024

| Project Name | Year Completed | Region | Resale Volume | Average Profit gained per resale transaction^ | Average Annualised Profit* |

| D'LEEDON | 2014 | CCR | 38 | $526,447 | 2.90% |

| THE MINTON | 2013 | OCR | 36 | $521,396 | 5.39% |

| BOTANIQUE AT BARTLEY | 2019 | OCR | 21 | $485,152 | 5.15% |

| THE PALETTE | 2015 | OCR | 27 | $482,412 | 4.79% |

| THE BAYSHORE | 1996 | OCR | 20 | $446,826 | 3.77% |

| PARC ESTA | 2022 | RCR | 43 | $413,438 | 6.14% |

| LAKEVILLE | 2017 | OCR | 21 | $368,754 | 3.62% |

| D'NEST | 2017 | OCR | 20 | $355,941 | 4.18% |

| EIGHT RIVERSUITES | 2016 | RCR | 23 | $349,016 | 3.51% |

| Q BAY RESIDENCES | 2016 | OCR | 20 | $347,322 | 3.88% |

^projects with fewer than 20 transactions in the month are excluded from this analysis*Gains are derived from the resale transaction for each unit against the unit's last caveated transaction; the average profit is determined on the profits of all resale transactions in the development which occurred during the month. The profit reflected is gross - it has not accounted for the applicable seller's stamp duties, interest payable, taxes and other relevant divestment costs. #Annualised gains is the compounded annual rate of return which shows the rate of return over the time period between the point of resale and the property's last caveated transaction, expressed in annual percentage terms. The formula for determining this is simply: [(current resale price) / (purchase price)] time period in years-1 Analysis was done based on available data from URA Realis

The most profitable project, D'Leedon, a city centre condominium project in District 10, recorded 38 resale transactions in 1H 2024, achieving gains of $526,000 on average for each transaction. The project is known for its contemporary wavy silhouette designed by internationally-renowned architect Zaha Hadid. At over 36-storeys high, D'Leedon is one of the tallest developments in the surrounding low-rise estate, giving residents panoramic views over the nearby Botanic Gardens.

Newer condo projects most popular amongst resale buyers in 1H 2024

With rising prices of new suburban homes in 2024, buyers continued to dip into the resale market to purchase homes at more affordable price points. In 1H 2024, by ranking the projects in terms of resale volume, the top 10 transacted projects comprised a number of OCR projects (see Table 2). Many of these projects are almost brand-new and are mostly in good physical condition - a plus for owner occupiers looking to move in quickly.

In terms of gains, the popular projects pale in comparison to the top 10 most profitable projects (in Table 1 above), since many of them were recently-built and have been purchased at higher entry prices compared with the older projects. Furthermore, most of them likely had shorter holding periods, which offered a shorter runway for values to appreciate.

Table 2: Top 10 resale condo projects^ in terms of number of units transacted in 1H 2024

| Project Name | Year Completed | Region | Resale Volume | Average Profit gained per resale transaction^ | Average Annualized Profit* |

| TREASURE AT TAMPINES | 2023 | OCR | 80 | $275,038 | 5.7% |

| STIRLING RESIDENCES | 2022 | CCR | 45 | $285,528 | 4.6% |

| PARC ESTA | 2022 | RCR | 43 | $413,438 | 6.1% |

| D'LEEDON | 2014 | CCR | 38 | $526,447 | 2.9% |

| THE MINTON | 2013 | OCR | 36 | $521,396 | 5.4% |

| JADESCAPE | 2022 | RCR | 33 | $318,420 | 5.7% |

| SIMS URBAN OASIS | 2017 | RCR | 32 | $249,005 | 3.8% |

| HIGH PARK RESIDENCES | 2019 | OCR | 31 | $345,783 | 5.4% |

| THE GARDEN RESIDENCES | 2021 | OCR | 29 | $178,771 | 3.4% |

| THE PALETTE | 2015 | OCR | 27 | $482,412 | 4.8% |

^projects with fewer than 20 transactions in the month are excluded from this analysis*Gains are derived from the resale transaction for each unit against the unit's last caveated transaction; the average profit is determined on the profits of all resale transactions in the development which occurred during the month. The profit reflected is gross - it has not accounted for the applicable seller's stamp duties, interest payable, taxes and other relevant divestment costs. #Annualised gains is the compounded annual rate of return which shows the rate of return over the time period between the point of resale and the property's last caveated transaction, expressed in annual percentage terms. The formula for determining this is simply: [(current resale price) / (purchase price)] time period in years-1 Analysis was done based on available data from URA Realis

The top-selling resale project in 1H 2024 was Treasure at Tampines - in the OCR - which shifted 80 units on the resale market. The resale units that were sold during the period enjoyed average gains of $275,000 per transaction and average gains of 5.7% per year.

The second top selling project in 1H 2024 was Stirling Residences, a fairly new project that was completed in 2022. The development in District 3 sold 45 units on the resale market, with average gains of nearly $286,000 or average annualised gains at 4.6% per year.

Meanwhile, the third most popular project was another development that was completed recently in 2022; Parc Esta located in District 14 sold 43 units in 1H 2024. The average gains in the project had amounted to more than $410,000 per transaction or average annualised gains of 6.1% per year.

Central districts posted most gains in 1H 2024

On a district level, the Central Region pulled in bigger gains in terms of profit quantum. By PropNex's ranking of the gross profit, the top 10 districts were mostly in the city centre or city fringe - only two districts in the suburbs, D26 (Upper Thomson) and D22 (Jurong) made the top 10 rankings (see Table 3).

Table 3: Top 10 districts for resale condo transactions in 1H 2024 by gross gains*

| District | Number of Units | Average Gains | Average Annualised Gains (%)# |

| D10 / Ardmore, Bukit Timah, Holland Road, Tanglin | 263 | $839,914 | 3.20% |

| D11 / Watten Estate, Novena, Thomson | 130 | $811,808 | 3.24% |

| D15 / Katong, Joo Chiat, Amber Road | 419 | $778,563 | 4.62% |

| D26 / Upper Thomson, Springleaf | 46 | $752,132 | 5.35% |

| D21 / Upper Bukit Timah, Clementi Park, Ulu Pandan | 149 | $743,503 | 4.42% |

| D20 / Bishan, Ang Mo Kio | 186 | $591,222 | 4.69% |

| D16 / Bedok, Upper East Coast, Eastwood, Kew Drive | 244 | $525,325 | 3.83% |

| D22 / Boon Lay, Jurong | 112 | $519,670 | 4.12% |

| D5 / Pasir Panjang, Clementi | 244 | $511,656 | 3.70% |

| D9 / Orchard, Cairnhill, River Valley | 228 | $510,001 | 2.03% |

*Gains are derived from the resale transaction for each unit against the unit's last caveated transaction; the average profit is determined on the profits of all resale transactions in the development which occurred during the month. The profit reflected is gross - it has not accounted for the applicable seller's stamp duties, interest payable, taxes and other relevant divestment costs. #Annualised gains is the compounded annual rate of return which shows the rate of return over the time period between the point of resale and the property's last caveated transaction, expressed in annual percentage terms. The formula for determining this is simply: [(current resale price) / (purchase price)] time period in years-1 Analysis was done based on available data from URA Realis

District 10 was the most profitable district in 1H 2024, where a number of transactions fetched enviable profits. Projects located in prestigious neighbourhoods such as Ardmore Park and Balmoral had helped to boost the average profit in the district. In 1H 2024, 263 homes in District 10 were sold on the resale market, with an average profit of nearly $840,000 per transaction.

Meanwhile, the second most profitable district was District 11 (Novena, Thomson), where 130 homes were transacted for an average profit of more than $810,000 per transaction. A number of condominium projects in the Newton and Thomson neighbourhoods have garnered decent gains - finding favour with buyers who like the prime location, and proximity to good schools.

Coming in at third place, District 15 (Katong, Joo Chiat) achieved over 419 resale condo transactions, with an average gross profit of more than $778,000 per transaction. Owners of homes along the eastern coast of Singapore have been enjoying decent gains with the gradual gentrification of the area, and the improvement in transport infrastructure, such as the recently opened Thomson-East Coast Line (TEL) stations under Phase 4 in end-June 2024.

District 26 is another area which has benefited from the TEL which commenced its Phase 3 operations in November 2022 - linking commuters in the North to Orchard Road, and the central business district. Slightly fewer than 50 homes in the Upper Thomson area were resold at an average gross profit of more than $750,000 per transaction. Also, the launch of several new condo projects in the Lentor Hill estate - some at benchmark prices of above $2,100 psf - have helped to boost prices of resale projects in the vicinity.

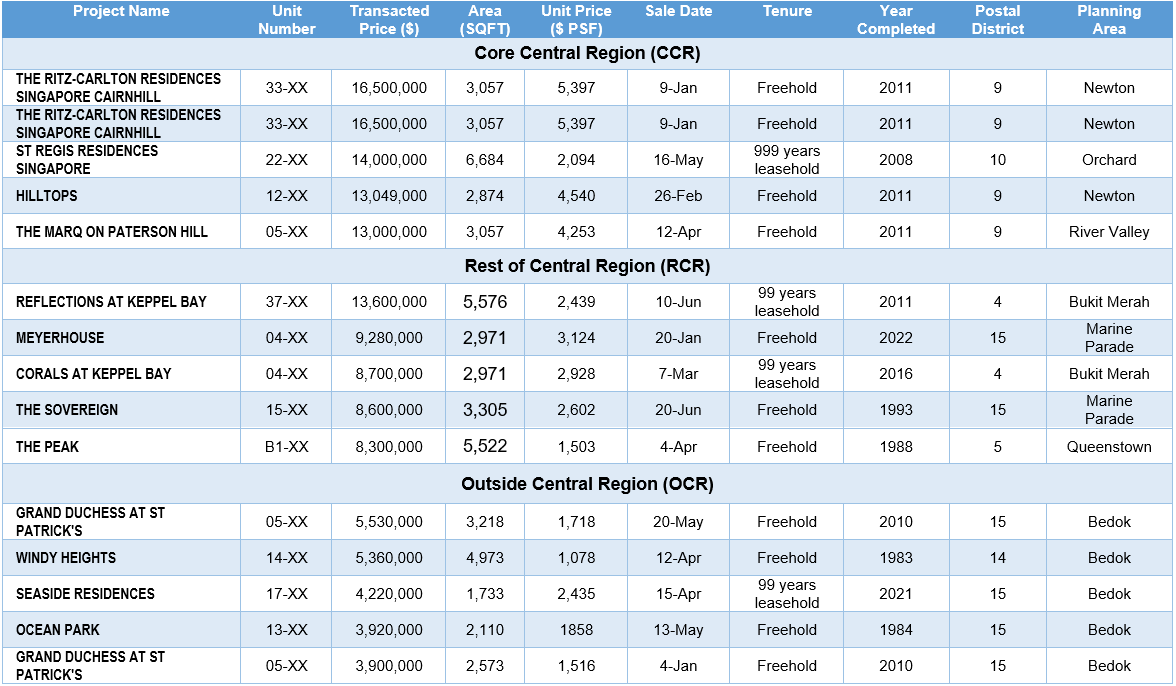

City centre and waterfront developments had the most expensive resale condos

Expectedly, the priciest resale condos were transacted in the city centre and waterfront areas.

Table 4: Top 5 priciest transactions by price quantum by region in 1H 2024

In 1H 2024, the most expensive resale condo transactions were for two adjacent 33th floor units at The Ritz Carlton Residences Singapore Cairnhill which went for $16.5 million each in January. These transactions are the top deals for the CCR (see Table 4) in 1H 2024. Their purchase price reflects an eye-watering unit price of $5,397 psf.

Over at the city fringe, the most expensive resale unit sold in 1H 2024 was a 37th storey unit at Reflections at Keppel Bay, which fetched $13.6 million in June 2024. The project's popularity stems from its proximity to the future Greater Southern Waterfront (GSW), earmarked as an iconic waterfront precinct in Singapore.

In the suburbs, the most expensive resale condo unit was found at Grand Duchess at Saint Patrick's, a development in Bedok that was built in 2010. The 5th floor unit was sold for about $5.5 million, reflecting a unit price of $3,218 psf. The development features two conserved colonial-style black and white houses, one of which has been converted into the project's clubhouse.

In 2024, the Singapore real estate market is poised to gradually recover with the projected economic recovery and potential interest rate cuts in the second half of the year. The resale condo segment is expected to stage a modest rebound - with new supply completions in 2024 set to help inject more resale units into the market. More than 9,000 private homes (ex. ECs) could be completed in 2024, and some owners could put their property up for resale, which could likely support resale home prices. Speak to PropNex's experienced property agents to find out the best buys in the resale market today.

Join PropNex Friends to stay in the know of all the key trends in the property market!