Getting in on the Red Hot Manchester

Manchester Manchester Manchester. Have you been hearing or seeing a lot more people talking about homes in Manchester? The last time we spoke about Manchester, I showed you why the city is becoming all the rage of late, but for those of you who didn't see that article, I suggest you head over there first. With many newly implemented transformations and also ones in the pipeline, Manchester is set to be a place of growth and ingenuity. Today let's explore the cost of actually buying a property in Manchester and what are some of these costs involved that you should know fully well before taking the plunge. Even if Manchester doesn't interest you, it wouldn't harm you to take a look to understand a little better about properties in the UK.

Affordability

Price Comparison: The average property price in Manchester is significantly lower than in London, making it easier for individuals and families to purchase homes without stretching their finances.

Rental Yields: Investors often find higher rental yields in Manchester due to the lower purchase prices combined with a strong rental demand, especially among students, young professionals and new migrants who are flocking into the country.

Economic Growth

Job Opportunities: Manchester has become a hub for various industries, particularly technology, media, and finance, with big names like Amazon, Deloitte, IBM, Unilever and many others creating a wealth of job opportunities.

(Credit: Deloitte, Business Live)

Business Investment: Major corporations are setting up offices or moving their headquarters to the city, attracted by lower operational costs compared to London, which boosts the local economy and job market. Manchester is now home to 80 of the FTSE 100 companies.

Quality of Life

Cultural Scene: Manchester is known for its vibrant music scene, art galleries, museums, and sporting events. The city has a rich cultural heritage and a dynamic atmosphere.

(Credit: Manchester Museum)

Green Spaces: The city boasts numerous parks and nearby natural areas, offering residents a balance of urban living and access to nature.

(Credit: Manchester Evening News)

Transport Links

Connectivity: Manchester's transport infrastructure, including the Metrolink tram system and connections to major cities via trains, makes commuting convenient.

Midlands-North West Rail Link: Mayors of Greater Manchester and West Midlands have recently revealed plans for a railway line connecting the two regions. More details will be out in due course.

Investment Opportunities

Regeneration Projects: Areas within Manchester are undergoing significant regeneration, leading to new developments that attract buyers and renters.

(Credit: NOMA, Media City)

Diverse Property Types: From modern apartments to Victorian terraced houses, the variety of property types available caters to different tastes and budgets, appealing to a broad audience.

(Credit: Unlock Manchester)

Education and Employment

Universities: Manchester is home to several respected universities, attracting students from around the world, which increases demand for rental properties.

(Credit: University of Manchester)

Skilled Workforce: The presence of universities and a growing job market creates a skilled workforce, benefiting local businesses and contributing to the city's economic vitality.

Perhaps before we start on the calculations and numbers, it is important for us to understand what kind of taxes are involved when we purchase a property in the UK. For example, the Buyer's Stamp Duty (BSD) and Additional Buyer's Stamp Duty (ABSD) should already be very familiar to you. Well if it isn't then maybe you read this.

If you are a foreigner buying a property in the UK, you have to first know about the Stamp Duty Land Tax (SDLT). It essentially applies to any property purchase you make. Here's how the rates go:

| Purchase price bands () | Standard rate (%) | Additional property surcharge (%) | Including 2% non-resident surcharge (%) |

| Up to 250,000 | 0 | 5 | 7 |

| Above 250,000 and up to 925,000 | 5 | 10 | 12 |

| Above 925,000 and up to 1,500,000 | 10 | 15 | 17 |

| Above 1,500,000+ | 12 | 17 | 19 |

However, as long as you are purchasing in the UK for the purpose of renting out, it will be considered an additional property. In that case, the standard SLRT rates do not apply to you. An easier way to see the total tax you'll need to pay you can see the final column to the right for reference.

A better way to put things into perspective for you is to do a little comparison of the properties in Singapore and Manchester. The scenario will be that you already own a home here in Singapore, and you are looking for that second property for investment. We took a look at a 1-bedroom new launch in Singapore, a 1-bedroom new launch in Manchester, and another 2-bedroom new launch in Manchester for reference.

| 1br New Launch (Singapore) | 1br New Launch (Manchester) | 2br New Launch (Manchester) | |

| Purchase Price | S$1,000,000 | 250,000 | 400,000 |

| Downpayment (25%) | S$250,000 | 62,500 | 98,000 |

| Stamp Duties | S$224,600 (BSD + ABSD) | 17,500 | 35,500 |

| Capital Overlay | S$474,600 | 80,000 (S$137,600) | 133,500 (S$229,670) |

As you can clearly see from the table above, because of the need to pay for higher ABSD rates in Singapore, the stamp duties portion is significantly higher than the ones you'll need to pay in the UK. EVEN THOUGH, the stamp duties you are paying for a UK property is slightly higher due to aforementioned NR Surcharge which is taxed to non-residents of the UK.

Hence, with the money you are intending to use as capital for your second 1-bedroom property in Singapore, you can easily buy two 2-bedroom units in Manchester. Wow? I know right. But certainly, apart from the initial capital overlay or the monthly mortgages, one of the most important things, if not the most important thing, is the rental that you can collect from the investment property right?

Summing up 2023 the Manchester region actually outperformed the UK in general. Having strong demands for housing in Manchester, both Manchester and Central Manchester outperformed the UK by two and three times respectively.

2023 | UK | London | Central London | Manchester | Central Manchester |

House Growth | -6% | -4% | -3% | 1.6% | 6% |

Rental Growth | 6% | 7% | 6.5% | 12.2% | 18% |

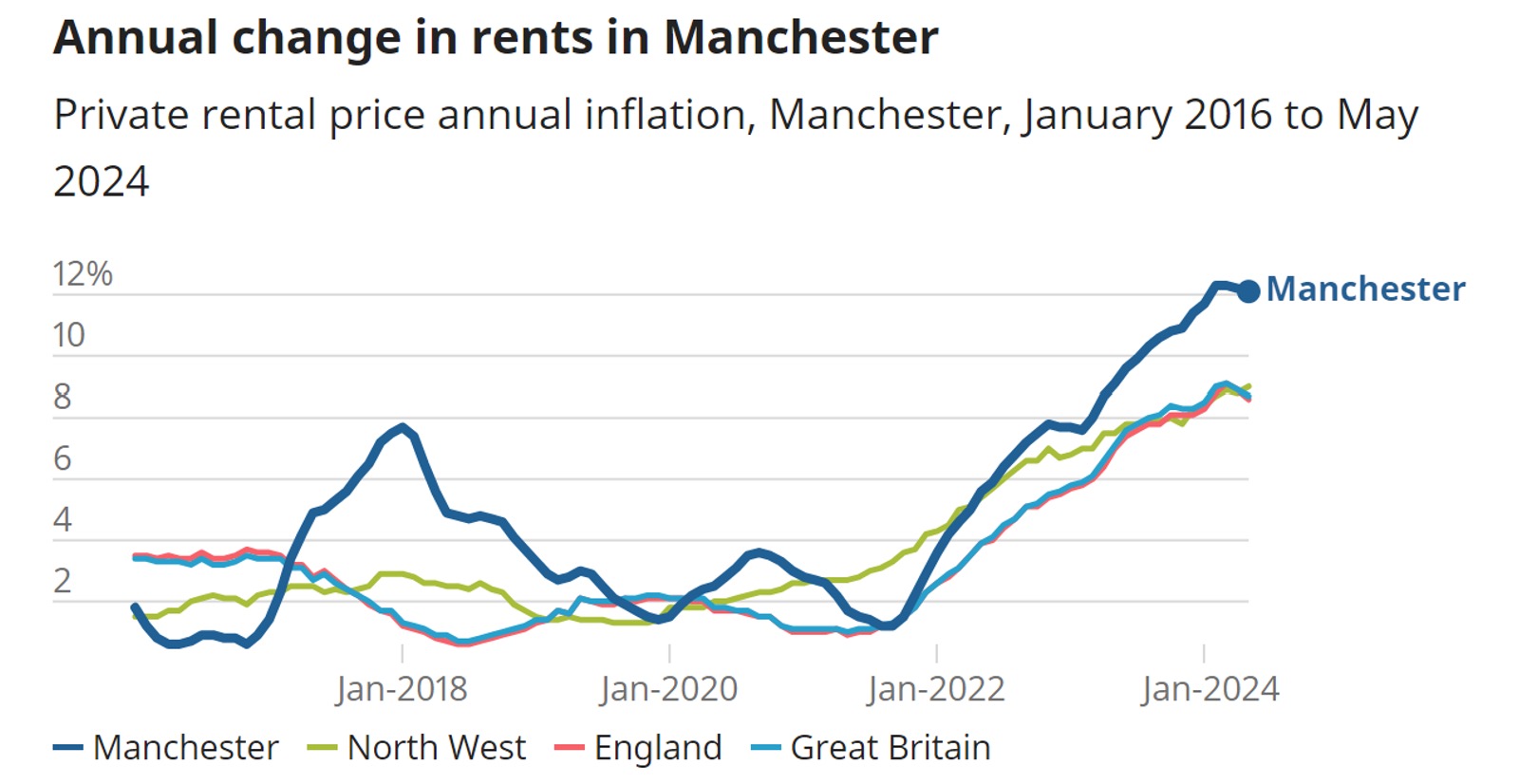

In fact, when we look at the annual change in rents, we can see Manchester outpacing out of Great Britain and England.

When it comes to property investment, it is important to look at the rental yield more than the rental growth. What is rental yield? It is the rental income your property generates as a percentage of property's purchase price.

London: Average rental yields are around 3% to 5%, depending on the borough.

Manchester: Average rental yields often range from 6% to 8%, with some areas exceeding 9%.

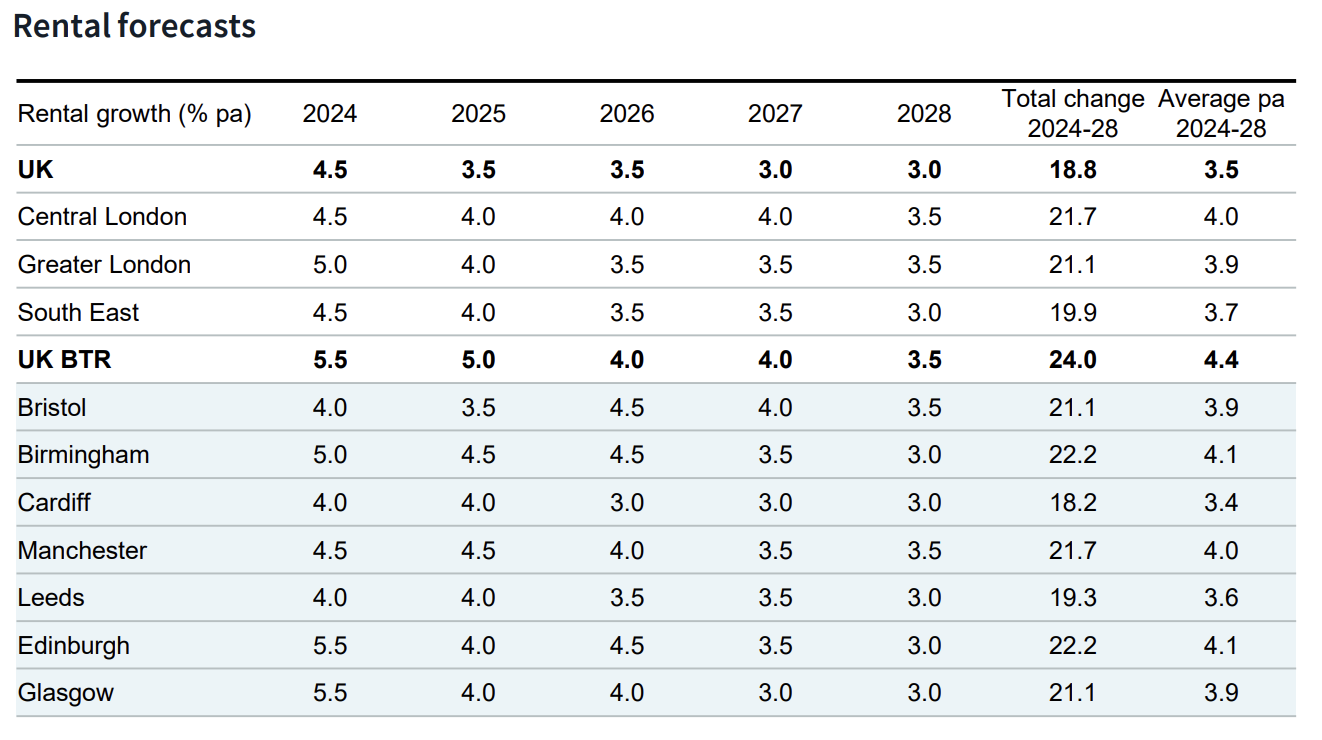

And when we look at forecasted rental growth between Manchester and London, we can see that the growth between the two cities are relatively on par, with Manchester outpacing London in some years. It also goes to show that Manchester is competitive in terms of their rental growth with its capital.

(Source: JLL)

After buying a property in Manchester, you probably would need a caretaker of sorts to look after your property while you are all the way here in Singapore. Let's throw in all the management related fees and also look at the income tax you would have to incur while renting out the unit. And yes, your rents are subject to income tax but you'll definitely get a pleasant surprise after understanding this part of the finances so please continue reading.

Before looking at an example, let us further understand what are some key taxes involved.

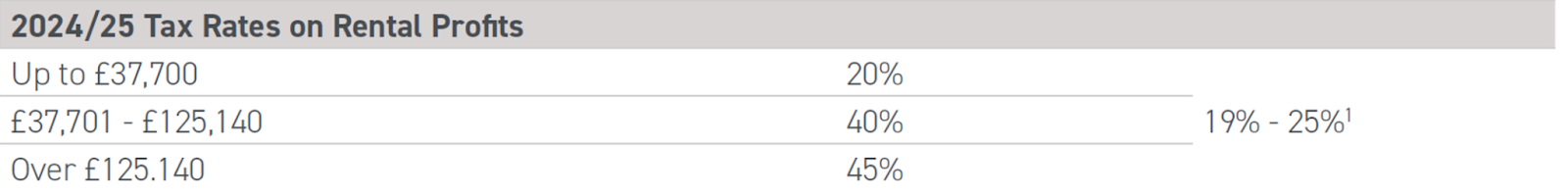

Income Tax

When you collect rental in the UK, it is seen as a form of income, hence you would need to pay yearly income tax. The tax rates on rental profits are also tiered, starting from 20 per cent.

Landlord Mortgage Interest Tax Relief

Good news though! To keep your income tax even lower, there is a tax-credit relief based on 20 per cent of your mortgage interest payments.

Example

You bought a 400,000 2-bedroom unit in Manchester, and rented it out for 2,250 every month.

In a year for rental:

| Gross Rent | 27,000 | $45,900 | Rent you charge for the year |

| Lettings & Management Fee | 2,430 | $4,131 | Property manager fee |

| Management Fee | 3,785 | $6,434 | MSCT |

| Mortgage Repayment | 18,037 | $30,663 | Yearly Loans |

| Gross Profit Before Tax | 2,748.29 | $4,672 |

In a year for income tax:

| Gross Income Tax Payable | 4,157 | $7,067 | 20 % of chargeable amount = Gross Rent - Lettings - Management Fee |

| Mortgage Interest Tax Relief | 2,781.24 | Relief of 20% of the interest for the year's mortgage | |

| Effective Income Tax Payable | 1,376 | $2,339 | |

| YEARLY PASSIVE INCOME | 1,372 | $2,333 |

Passive Income

You might be thinking to yourself, $2,333 for passive income in a year? Are you even kidding me? I might as well invest in stocks or cryptocurrency. But it is literally the best deal ever. Your monthly mortgages are serviced by the rental income you are receiving and after minusing all the expenses and tax, you are still able to see green. Isn't it such a good deal?

When you take a loan with a UK bank, they will base the loan amount on your income and the potential rent your property is able to generate. What does this mean for you? It means that identifying the right property to purchase is very important. Does buying a cheaper unit in the suburbs better or choosing a slightly higher priced unit in the city centre better? What do you think? It is best to consult a professional when making a decision on which project to enter!

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.