PropNex Picks

July 03, 2024

Records Are Tumbling In The Million-Dollar HDB Resale Flats Segment In June, With All-Time High Monthly Sales And New Record Price

Wong Siew Ying

Head of Research and Content

Some new records were set in June in the HDB resale flats segment, as the number of million-dollar resale flats transacted hit a fresh monthly high at 95 units (see Chart 1). This was about 30% higher than the 73 units of million-dollar resale flats sold in May, and 28% higher than the previous record of 74 such flats that changed hands in January. Meanwhile, two flats in Bukit Merah were resold for an all-time high price of $1.588 million each - making them the joint most expensive resale HDB flats ever sold.

The increase in the number of such flats sold in recent months could be due to a combination of various reasons - perhaps more former private home owners returning to the market after serving out the 15-month wait-out period, and the demand for newer resale flats that have become eligible for resale.

Chart 1: Number of "Million-dollar" HDB Resale Flats sold By Month

Based on transaction data, the Kallang Whampoa town led the sales of such flats in June with 18 HDB resale flats fetching at least $1 million. Among the 18 units, eight flats are located at St. George's Towers, where owners have recently met the 5-year minimum occupation period (MOP). These eight million-dollar 4-room flats resold at 25A, 26A and 26B St. George's Lane still have a balance lease of 95 years. They have a unit size of 92 sq m and are located on floors ranging from 16th storey to 30th storey. In the first six months of 2024, there have been 30 units of million-dollar resale flats at St. George's Towers.

Following Kallang Whampoa, two towns had 11 units of million-dollar resale flats each, in Geylang and Bukit Merah, while 10 flats were resold for at least $1 million in Toa Payoh. In Geylang, seven of the 11 units are at MacPherson Spring in Circuit Road - also a recently-MOPed project. The remaining million-dollar flats resold in June are in Bishan, Clementi, Ang Mo Kio, Queenstown, Yishun, Serangoon, Central Area, Bukit Timah, Marine Parade, Hougang, Pasir Ris, Woodlands, Tampines, and Bedok.

By flat type, there were 35 units of 4-room flats and 42-units of 5-room flats transacted for at least $1 million in June - the highest number of million-dollar flats resold in each segment on a monthly basis. The other million-dollar resale flats sold in June were 17 executive flats and one multi-generation flat.

Yet another record that was sent tumbling - two 5-room HDB resale flats became the joint most expensive flats resold when they were transacted for $1.588 million each (see Table 1). Both units are in Bukit Merah, with one in Boon Tiong Road, and the other in Henderson Road. The previous record price was $1.569 million for a DBSS (design, build, and sell scheme) 5-room resale flat at Lorong 1A Toa Payoh that was transacted in January 2024.

Table 1: Top 10 HDB resale flats sold in June 2024 by Transacted Price

| Town | Type | Street | Storey range | Floor area SQM | Lease start date | Price | PSF ($) |

| BUKIT MERAH | 5 ROOM | HENDERSON RD | 46 TO 48 | 113 | 2019 | $1,588,000 | $1,306 |

| BUKIT MERAH | 5 ROOM | BOON TIONG RD | 34 TO 36 | 112 | 2016 | $1,588,000 | $1,317 |

| TOA PAYOH | 5 ROOM | LOR 1A TOA PAYOH | 31 TO 33 | 117 | 2012 | $1,540,000 | $1,223 |

| BISHAN | 5 ROOM | BISHAN ST 24 | 28 TO 30 | 120 | 2011 | $1,538,000 | $1,191 |

| TOA PAYOH | 5 ROOM | LOR 1A TOA PAYOH | 34 TO 36 | 114 | 2012 | $1,503,888 | $1,226 |

| BUKIT MERAH | 5 ROOM | HENDERSON RD | 40 TO 42 | 113 | 2019 | $1,500,000 | $1,233 |

| BISHAN | EXECUTIVE | BRIGHT HILL DR | 22 TO 24 | 174 | 1990 | $1,480,000 | $790 |

| TOA PAYOH | 5 ROOM | LOR 1A TOA PAYOH | 19 TO 21 | 117 | 2012 | $1,420,000 | $1,128 |

| MARINE PARADE | 5 ROOM | MARINE DR | 10 TO 12 | 157 | 1976 | $1,380,000 | $817 |

| CENTRAL AREA | 4 ROOM | CANTONMENT RD | 43 TO 45 | 94 | 2011 | $1,365,000 | $1,349 |

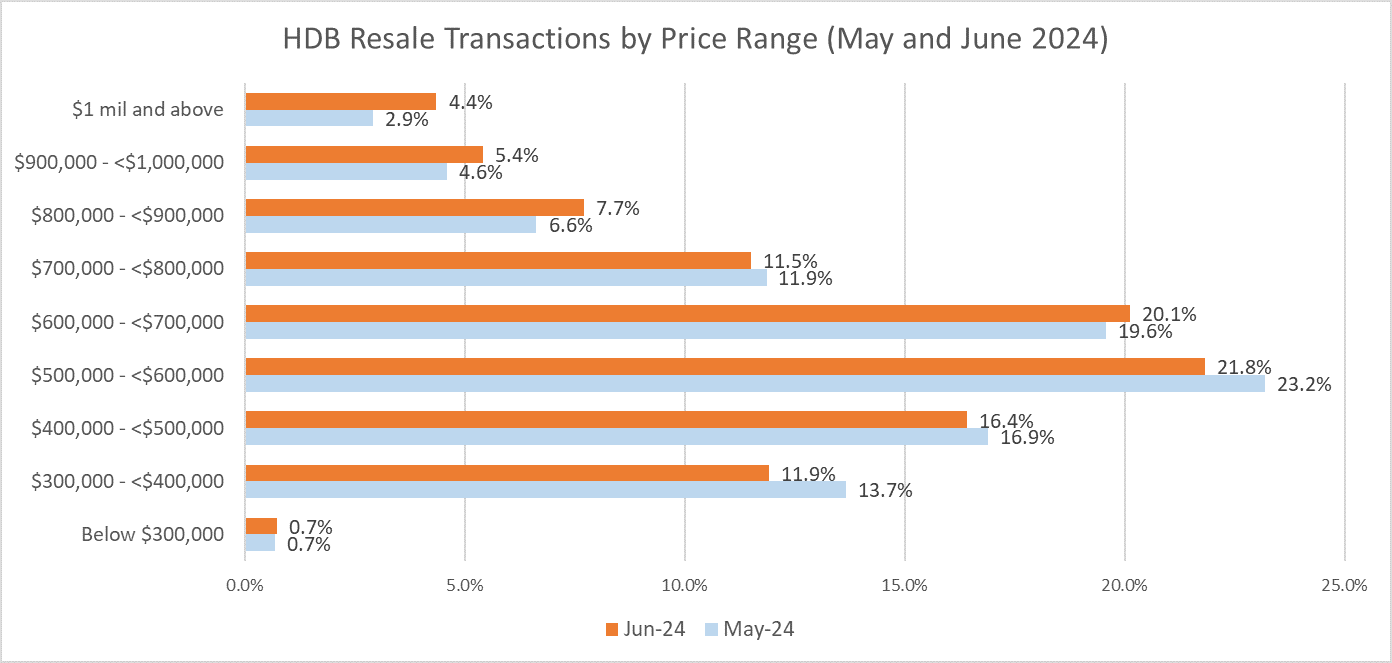

Chart 2: Proportion of HDB Resale Transactions by Price Range

The record number of million-dollar flats sold in June, coupled with a dip in overall resale volume from May to June has pushed the proportion of flats resold for at least $1 million to 4.4% of the month's resale volume in June - up from 2.9% in May (see Chart 2). Taking in June's million-dollar flat sales, there were 419 such flats transacted in the first half of 2024 - on track to trump last year's record of 469 million-dollar resale flats sold. In fact, that record could be breached as early as July 2024 - considering there have been an average of about 70 such sales per month this year.

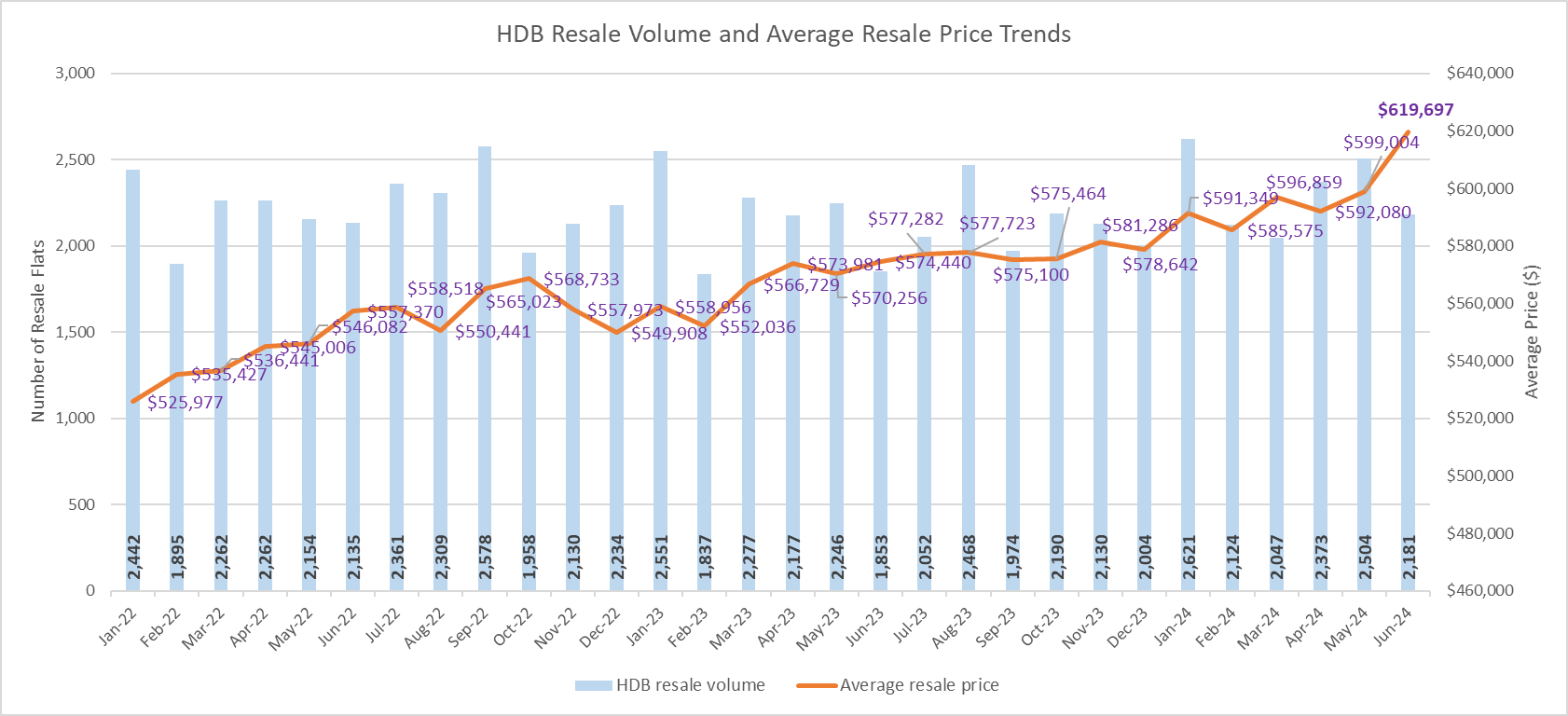

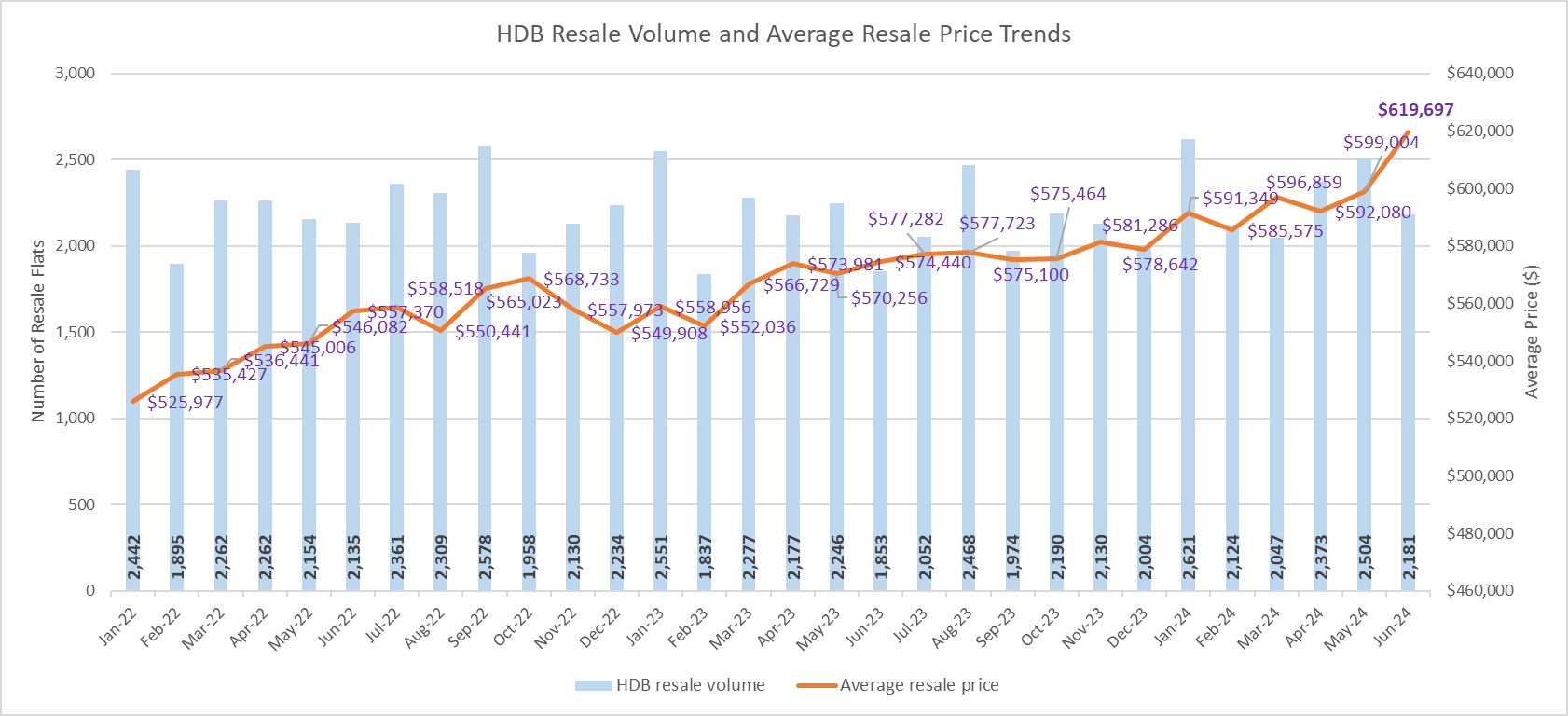

Zooming out to the overall HDB resale flat market, the transaction volume in June fell by nearly 13% to 2,181 units from 2,504 units in the previous month (see Chart 3) - possibly due to the lull in market activities amid the June school holidays. When compared with June 2023, the resale volume rose by 17.7% year-on-year. Non-mature towns accounted for about 58% of the monthly resale volume in June, with Sengkang, Yishun and Punggol being the most popular. Mature town Tampines led the month's sales with 161 resale flats sold, including a good number of transactions at the recently-MOPed Tampines GreenRidges.

Despite the decline in sales volume, the average resale price rose by 3.5% month-on-month in June to $619,697, touching a new high (see Chart 3). Meanwhile, the average resale price was up by 7.9% from June 2023.

Chart 3: HDB resale volume and average transacted price by month

The average resale prices of 3- to 5-room, and executive flats all rose from May to June (see Table 2), with 5-room and 4-room resale flats posting a stronger increase of 3.5% MOM and 3.6% MOM growth in June, respectively - partly helped by the higher number of million-dollar flats resold in these segments. Meanwhile, the average resale price of 3-room flats climbed by 2.3% MOM, while that of executive flats rose by 2.2% MOM in June.

Table 2: Average transacted HDB resale flat prices by Flat Type in last six months

| Flat Type | Jan-24 | Feb-24 | Mar-24 | Apr-24 | May-24 | Jun-24 | MOM % change |

| 3-ROOM | $420,369 | $425,098 | $423,526 | $430,532 | $431,768 | $441,815 | 2.3% |

| 4-ROOM | $597,705 | $599,264 | $610,176 | $605,043 | $612,840 | $634,427 | 3.5% |

| 5-ROOM | $712,135 | $691,993 | $706,353 | $710,615 | $717,828 | $743,679 | 3.6% |

| EXECUTIVE | $865,608 | $843,499 | $851,162 | $871,600 | $857,144 | $876,113 | 2.2% |

Table 3: Average transacted HDB resale flat prices in Mature and Non-mature towns

| Mature towns | Non-mature towns | |||||||

| May-24 | Jun-24 | % change MOM | May-24 | Jun-24 | % change MOM | |||

| 3 ROOM | $442,167 | $451,905 | 2.2% | $415,929 | $424,756 | 2.1% | ||

| 4 ROOM | $698,543 | $736,411 | 5.4% | $564,449 | $572,457 | 1.4% | ||

| 5 ROOM | $837,528 | $883,023 | 5.4% | $665,246 | $677,036 | 1.8% | ||

| EXECUTIVE | $950,869 | $955,187 | 0.5% | $804,891 | $833,211 | 3.5% | ||

Assessing the data by towns and flat types, it was observed that 4-room and 5-room flats in mature towns booked the steepest increase in the average resale price, climbing by 5.4% MOM each in June (see Table 3). Meanwhile, the segment that saw the fastest pace of price growth in non-mature towns in June was executive flats, where the average resale price climbed by 3.5% MOM to over $833,000.

PropNex expects the HDB resale market to remain lively amid healthy buying interest, which should continue to lend support to resale flat prices. Looking ahead, the HDB resale volume could pick up in July, and possibly dial down a notch during the traditional Hungry Ghost month which starts on 4 August.